Illegal loans

입력 2019.03.08 (14:59)

수정 2019.03.08 (15:20)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

Under the current law, users of private lending services can only receive back the interest exceeding the legal ceiling on interest rates set by the Interest Limitation Act. The government is pushing for amending the law so that the entire interest amount of illegal loans becomes invalid.

[Pkg]

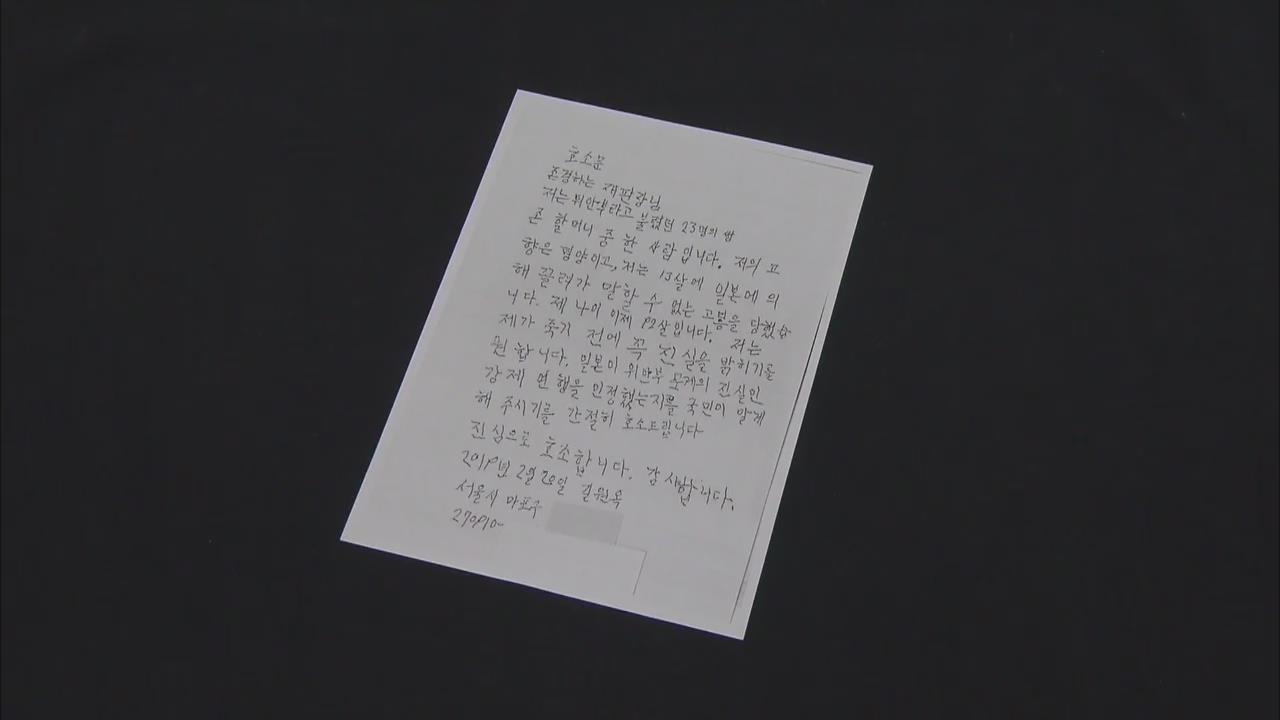

An estimated 520,000 people in Korea are suspected of making use of illegal private loan services in 2017. That's one in every 100 people. The combined amount of their loans reached 6.8 trillion won. Two percent of the loan recipients have been found to be paying an annual interest rate of over 66 percent, while six percent said they have fallen victim to illegal debt-collecting practices. As damage from illegal lending practices continues to rise, the government has come up with countermeasures. The new regulation seeks to invalidate interest rates that exceed the legal ceiling of 24 percent a year. Under the current law, only the interest that exceeds the legal ceiling is considered invalid and can be returned to debtors. However, under the new regulation, loans with interest rates that exceed the legal ceiling will be considered illegal and their interest will be invalidated entirely. The government will also introduce prompt damage redress measures. Currently, victims of illegal lending services can seek judicial relief only via their attorneys. However, when the new law goes into effect, financial authorities will also be allowed to act as proxies for the victims.

[Soundbite] Park Joo-young(Financial Services Commission) : "We will devise measures to strengthen regulations on illegal credit services and consult with legal experts on how to help victims."

Last year the Financial Supervisory Service received about 125,000 reports of damage from illegal credit services, up 24 percent from the previous year.

Under the current law, users of private lending services can only receive back the interest exceeding the legal ceiling on interest rates set by the Interest Limitation Act. The government is pushing for amending the law so that the entire interest amount of illegal loans becomes invalid.

[Pkg]

An estimated 520,000 people in Korea are suspected of making use of illegal private loan services in 2017. That's one in every 100 people. The combined amount of their loans reached 6.8 trillion won. Two percent of the loan recipients have been found to be paying an annual interest rate of over 66 percent, while six percent said they have fallen victim to illegal debt-collecting practices. As damage from illegal lending practices continues to rise, the government has come up with countermeasures. The new regulation seeks to invalidate interest rates that exceed the legal ceiling of 24 percent a year. Under the current law, only the interest that exceeds the legal ceiling is considered invalid and can be returned to debtors. However, under the new regulation, loans with interest rates that exceed the legal ceiling will be considered illegal and their interest will be invalidated entirely. The government will also introduce prompt damage redress measures. Currently, victims of illegal lending services can seek judicial relief only via their attorneys. However, when the new law goes into effect, financial authorities will also be allowed to act as proxies for the victims.

[Soundbite] Park Joo-young(Financial Services Commission) : "We will devise measures to strengthen regulations on illegal credit services and consult with legal experts on how to help victims."

Last year the Financial Supervisory Service received about 125,000 reports of damage from illegal credit services, up 24 percent from the previous year.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Illegal loans

-

- 입력 2019-03-08 15:07:17

- 수정2019-03-08 15:20:33

[Anchor Lead]

Under the current law, users of private lending services can only receive back the interest exceeding the legal ceiling on interest rates set by the Interest Limitation Act. The government is pushing for amending the law so that the entire interest amount of illegal loans becomes invalid.

[Pkg]

An estimated 520,000 people in Korea are suspected of making use of illegal private loan services in 2017. That's one in every 100 people. The combined amount of their loans reached 6.8 trillion won. Two percent of the loan recipients have been found to be paying an annual interest rate of over 66 percent, while six percent said they have fallen victim to illegal debt-collecting practices. As damage from illegal lending practices continues to rise, the government has come up with countermeasures. The new regulation seeks to invalidate interest rates that exceed the legal ceiling of 24 percent a year. Under the current law, only the interest that exceeds the legal ceiling is considered invalid and can be returned to debtors. However, under the new regulation, loans with interest rates that exceed the legal ceiling will be considered illegal and their interest will be invalidated entirely. The government will also introduce prompt damage redress measures. Currently, victims of illegal lending services can seek judicial relief only via their attorneys. However, when the new law goes into effect, financial authorities will also be allowed to act as proxies for the victims.

[Soundbite] Park Joo-young(Financial Services Commission) : "We will devise measures to strengthen regulations on illegal credit services and consult with legal experts on how to help victims."

Last year the Financial Supervisory Service received about 125,000 reports of damage from illegal credit services, up 24 percent from the previous year.

Under the current law, users of private lending services can only receive back the interest exceeding the legal ceiling on interest rates set by the Interest Limitation Act. The government is pushing for amending the law so that the entire interest amount of illegal loans becomes invalid.

[Pkg]

An estimated 520,000 people in Korea are suspected of making use of illegal private loan services in 2017. That's one in every 100 people. The combined amount of their loans reached 6.8 trillion won. Two percent of the loan recipients have been found to be paying an annual interest rate of over 66 percent, while six percent said they have fallen victim to illegal debt-collecting practices. As damage from illegal lending practices continues to rise, the government has come up with countermeasures. The new regulation seeks to invalidate interest rates that exceed the legal ceiling of 24 percent a year. Under the current law, only the interest that exceeds the legal ceiling is considered invalid and can be returned to debtors. However, under the new regulation, loans with interest rates that exceed the legal ceiling will be considered illegal and their interest will be invalidated entirely. The government will also introduce prompt damage redress measures. Currently, victims of illegal lending services can seek judicial relief only via their attorneys. However, when the new law goes into effect, financial authorities will also be allowed to act as proxies for the victims.

[Soundbite] Park Joo-young(Financial Services Commission) : "We will devise measures to strengthen regulations on illegal credit services and consult with legal experts on how to help victims."

Last year the Financial Supervisory Service received about 125,000 reports of damage from illegal credit services, up 24 percent from the previous year.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.