SAMSUNG AFTER LEE'S DEATH

입력 2020.10.26 (15:10)

수정 2020.10.26 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

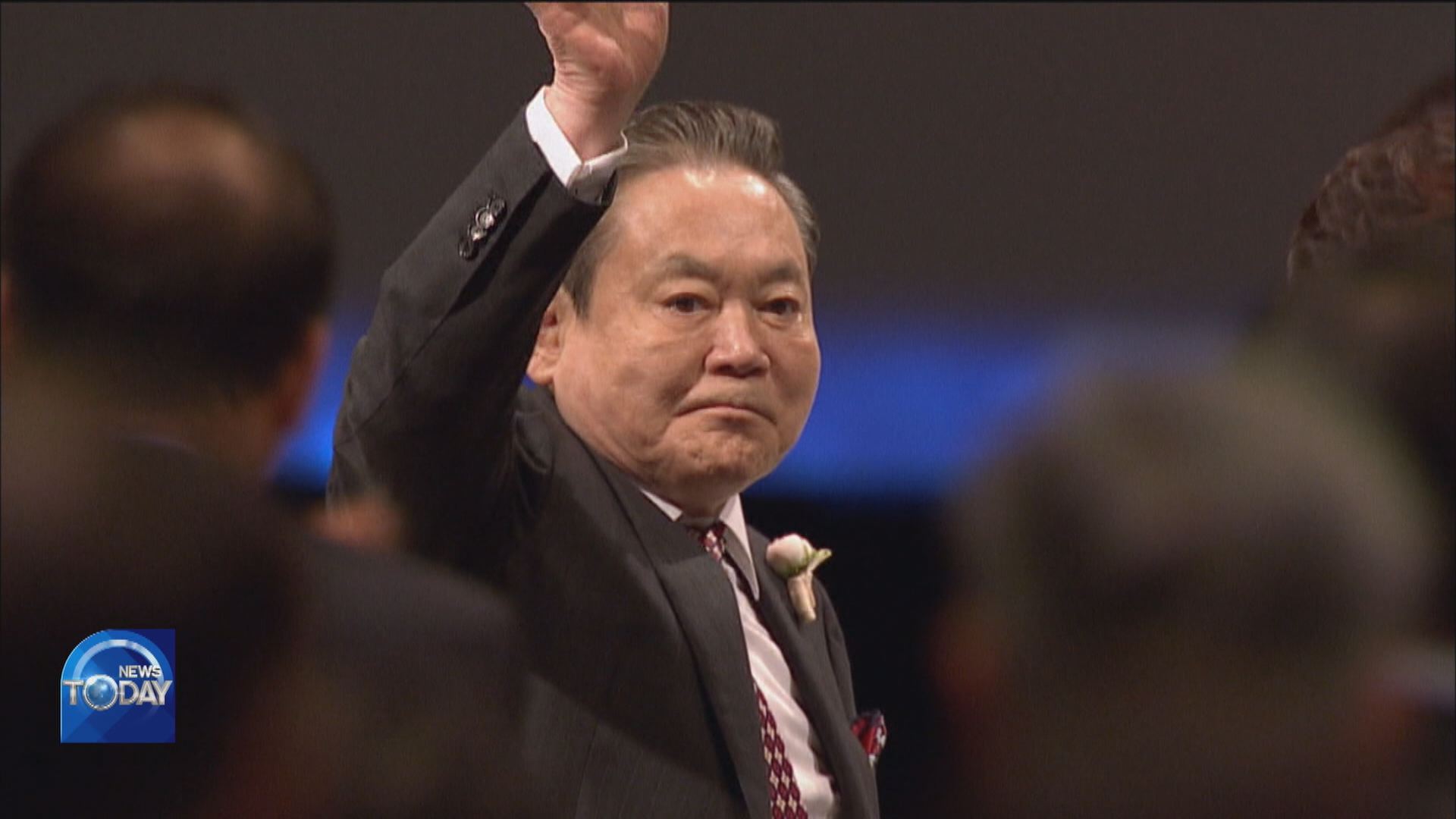

Lee Kun-hee left 18 trillion won in stocks alone, which means his children will have to pay 10 trillion won of inheritance tax. Eyes will also be on how the Samsung leadership will change under his son, Lee Jae-yong, who is being tried for engaging in shady dealings to obtain control of the conglomerate.

[Pkg]

The succession process of Samsung Group Vice Chairman Lee Jae-yong is almost over. Two years ago, the Korea Fair Trade Commission named Lee as the de facto leader of the group. At the heart of the conglomerate is amsung Electronics, in which Lee only holds 0.7% of shares. But he still exercises control over the group through Samsung C&T. He has 15.7% of the Samsung Electronics shares through Samsung C&T and Samsung Life Insurance, while other family members, including his late father, have only 5.1%. Even if his father's shares are divided among his children, Lee's corporate control would not be greatly impacted. But he will have to pay a hefty inheritance tax. Lee Kun-hee's inheritance amounts to 18.2 trillion won in stocks alone. The inheritance tax will total 10 trillion won given the 60% incremental tax rate. Adjustment in share structure is inevitable even if the taxes are paid in five-year installments or paid with loans borrowed with stocks as collateral.

[Soundbite] AHN SANG-HEE (DAISHIN CORPORATE GOVERNANCE INSTITUTE) : "Given the current equity structure, it wouldn't be easy for Lee Jae-yong to pay the inheritance tax by selling his core shares. So, changes in the leadership structure are inevitable."

In the long run, the revision of the Insurance Business Act currently pushed by the ruling party will be the key variable. If the insurance business law is revised, Samsung Life Insurance and Samsung Fire & Marine Insurance will have to sell a lion's share of their Samsung Electronics stocks, likely changing the group's governance structure following the changes in stockholders' equity. But the immediate concern is Lee's court trial. The first hearing on the allegation of illegal succession of corporate management rights began recently. Lee is accused of gaining corporate control by illegally merging Samsung C&T and Cheil Industries. He also has to face an upper court trial on alleged bribery and interference of state affairs. He was summoned to the court on Monday, but did not attend the trial due to his father's funeral. Samsung Group has to deal with the death of Chairman Lee Kun-hee, the trial, and the revision of the Insurance Business Act. It is, therefore, projected that the current management system built on Lee Jae-yong and key executives will be maintained for the time being.

Lee Kun-hee left 18 trillion won in stocks alone, which means his children will have to pay 10 trillion won of inheritance tax. Eyes will also be on how the Samsung leadership will change under his son, Lee Jae-yong, who is being tried for engaging in shady dealings to obtain control of the conglomerate.

[Pkg]

The succession process of Samsung Group Vice Chairman Lee Jae-yong is almost over. Two years ago, the Korea Fair Trade Commission named Lee as the de facto leader of the group. At the heart of the conglomerate is amsung Electronics, in which Lee only holds 0.7% of shares. But he still exercises control over the group through Samsung C&T. He has 15.7% of the Samsung Electronics shares through Samsung C&T and Samsung Life Insurance, while other family members, including his late father, have only 5.1%. Even if his father's shares are divided among his children, Lee's corporate control would not be greatly impacted. But he will have to pay a hefty inheritance tax. Lee Kun-hee's inheritance amounts to 18.2 trillion won in stocks alone. The inheritance tax will total 10 trillion won given the 60% incremental tax rate. Adjustment in share structure is inevitable even if the taxes are paid in five-year installments or paid with loans borrowed with stocks as collateral.

[Soundbite] AHN SANG-HEE (DAISHIN CORPORATE GOVERNANCE INSTITUTE) : "Given the current equity structure, it wouldn't be easy for Lee Jae-yong to pay the inheritance tax by selling his core shares. So, changes in the leadership structure are inevitable."

In the long run, the revision of the Insurance Business Act currently pushed by the ruling party will be the key variable. If the insurance business law is revised, Samsung Life Insurance and Samsung Fire & Marine Insurance will have to sell a lion's share of their Samsung Electronics stocks, likely changing the group's governance structure following the changes in stockholders' equity. But the immediate concern is Lee's court trial. The first hearing on the allegation of illegal succession of corporate management rights began recently. Lee is accused of gaining corporate control by illegally merging Samsung C&T and Cheil Industries. He also has to face an upper court trial on alleged bribery and interference of state affairs. He was summoned to the court on Monday, but did not attend the trial due to his father's funeral. Samsung Group has to deal with the death of Chairman Lee Kun-hee, the trial, and the revision of the Insurance Business Act. It is, therefore, projected that the current management system built on Lee Jae-yong and key executives will be maintained for the time being.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- SAMSUNG AFTER LEE'S DEATH

-

- 입력 2020-10-26 15:10:21

- 수정2020-10-26 16:45:40

[Anchor Lead]

Lee Kun-hee left 18 trillion won in stocks alone, which means his children will have to pay 10 trillion won of inheritance tax. Eyes will also be on how the Samsung leadership will change under his son, Lee Jae-yong, who is being tried for engaging in shady dealings to obtain control of the conglomerate.

[Pkg]

The succession process of Samsung Group Vice Chairman Lee Jae-yong is almost over. Two years ago, the Korea Fair Trade Commission named Lee as the de facto leader of the group. At the heart of the conglomerate is amsung Electronics, in which Lee only holds 0.7% of shares. But he still exercises control over the group through Samsung C&T. He has 15.7% of the Samsung Electronics shares through Samsung C&T and Samsung Life Insurance, while other family members, including his late father, have only 5.1%. Even if his father's shares are divided among his children, Lee's corporate control would not be greatly impacted. But he will have to pay a hefty inheritance tax. Lee Kun-hee's inheritance amounts to 18.2 trillion won in stocks alone. The inheritance tax will total 10 trillion won given the 60% incremental tax rate. Adjustment in share structure is inevitable even if the taxes are paid in five-year installments or paid with loans borrowed with stocks as collateral.

[Soundbite] AHN SANG-HEE (DAISHIN CORPORATE GOVERNANCE INSTITUTE) : "Given the current equity structure, it wouldn't be easy for Lee Jae-yong to pay the inheritance tax by selling his core shares. So, changes in the leadership structure are inevitable."

In the long run, the revision of the Insurance Business Act currently pushed by the ruling party will be the key variable. If the insurance business law is revised, Samsung Life Insurance and Samsung Fire & Marine Insurance will have to sell a lion's share of their Samsung Electronics stocks, likely changing the group's governance structure following the changes in stockholders' equity. But the immediate concern is Lee's court trial. The first hearing on the allegation of illegal succession of corporate management rights began recently. Lee is accused of gaining corporate control by illegally merging Samsung C&T and Cheil Industries. He also has to face an upper court trial on alleged bribery and interference of state affairs. He was summoned to the court on Monday, but did not attend the trial due to his father's funeral. Samsung Group has to deal with the death of Chairman Lee Kun-hee, the trial, and the revision of the Insurance Business Act. It is, therefore, projected that the current management system built on Lee Jae-yong and key executives will be maintained for the time being.

Lee Kun-hee left 18 trillion won in stocks alone, which means his children will have to pay 10 trillion won of inheritance tax. Eyes will also be on how the Samsung leadership will change under his son, Lee Jae-yong, who is being tried for engaging in shady dealings to obtain control of the conglomerate.

[Pkg]

The succession process of Samsung Group Vice Chairman Lee Jae-yong is almost over. Two years ago, the Korea Fair Trade Commission named Lee as the de facto leader of the group. At the heart of the conglomerate is amsung Electronics, in which Lee only holds 0.7% of shares. But he still exercises control over the group through Samsung C&T. He has 15.7% of the Samsung Electronics shares through Samsung C&T and Samsung Life Insurance, while other family members, including his late father, have only 5.1%. Even if his father's shares are divided among his children, Lee's corporate control would not be greatly impacted. But he will have to pay a hefty inheritance tax. Lee Kun-hee's inheritance amounts to 18.2 trillion won in stocks alone. The inheritance tax will total 10 trillion won given the 60% incremental tax rate. Adjustment in share structure is inevitable even if the taxes are paid in five-year installments or paid with loans borrowed with stocks as collateral.

[Soundbite] AHN SANG-HEE (DAISHIN CORPORATE GOVERNANCE INSTITUTE) : "Given the current equity structure, it wouldn't be easy for Lee Jae-yong to pay the inheritance tax by selling his core shares. So, changes in the leadership structure are inevitable."

In the long run, the revision of the Insurance Business Act currently pushed by the ruling party will be the key variable. If the insurance business law is revised, Samsung Life Insurance and Samsung Fire & Marine Insurance will have to sell a lion's share of their Samsung Electronics stocks, likely changing the group's governance structure following the changes in stockholders' equity. But the immediate concern is Lee's court trial. The first hearing on the allegation of illegal succession of corporate management rights began recently. Lee is accused of gaining corporate control by illegally merging Samsung C&T and Cheil Industries. He also has to face an upper court trial on alleged bribery and interference of state affairs. He was summoned to the court on Monday, but did not attend the trial due to his father's funeral. Samsung Group has to deal with the death of Chairman Lee Kun-hee, the trial, and the revision of the Insurance Business Act. It is, therefore, projected that the current management system built on Lee Jae-yong and key executives will be maintained for the time being.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[속보] 김건희 특검팀, 이응근 전 삼부토건 대표 <br>소환조사](/data/layer/904/2025/07/20250704_TDFd6l.jpg)

![[속보] 내란특검 “윤 변호인 수사방해 의혹, 파견경찰이 자료수집 중”](/data/news/2025/07/04/20250704_zxJ5qZ.jpg)

![[단독] “이 대통령, 주요국에 특사파견 예정…미·일 특사 막판 조율”](/data/layer/904/2025/07/20250704_DNItCk.jpg)

이 기사에 대한 의견을 남겨주세요.