Borrowed Name Accounts

입력 2018.03.20 (15:07)

수정 2018.03.20 (16:40)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The National Tax Service has ordered Samsung Group Chairman Lee Kun-hee to pay roughly 100 billion won in taxes for his possession of bank accounts under borrowed names. The tax agency has imposed high, punitive taxes on Lee, following the financial authorities' decision to levy a fine as well.

[Pkg]

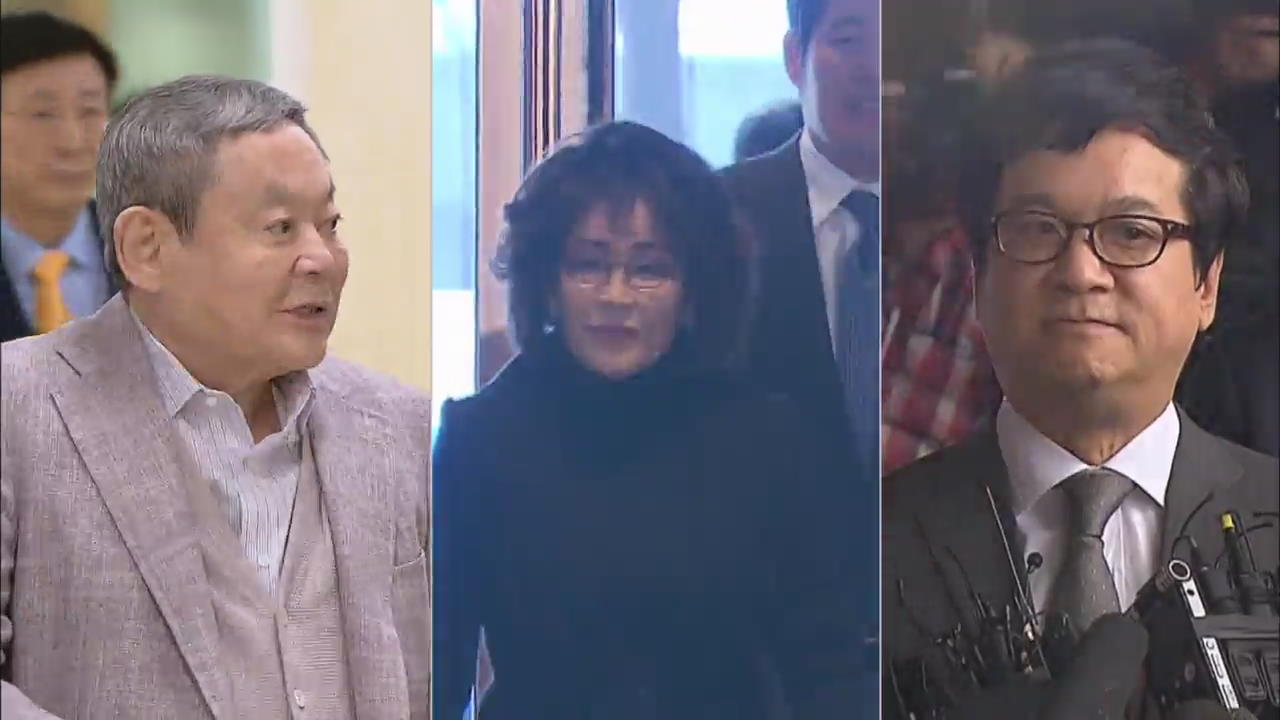

The National Tax Service has identified that Samsung Group Chairman Lee Kun-hee earned 130 billion won from bank accounts opened under borrowed names. The earnings are interest and dividends accrued from the borrowed-name accounts over the past ten years. The National Tax Service has recently levied 100 billion won in tax on the earnings. Under the real-name financial transaction law, 90 percent of earnings from borrowed-name accounts must be collected in tax if they are discovered by financial authorities It is a punitive tax, which is separate from a gift tax. The notices of the taxation were sent to the securities companies and banks with which Lee opened the borrowed-name accounts. The financial companies will most likely pay the taxes first and then demand that Lee reimburse the expenses. The taxes are applied to the earnings generated after 2008, because the imposition of taxes can be retroactive only for ten years. A special prosecutor team's investigation into Samsung discovered in 2008 that Lee held 4.5 trillion won in accounts opened under borrowed names. However, no punitive tax was imposed at the time. The National Tax Service plans to levy taxes on other conglomerate owners who have borrowed-name accounts, including Shinsegae Group Chairwoman Lee Myung-hee and CJ Group Chairman Lee Jae-hyun.

The National Tax Service has ordered Samsung Group Chairman Lee Kun-hee to pay roughly 100 billion won in taxes for his possession of bank accounts under borrowed names. The tax agency has imposed high, punitive taxes on Lee, following the financial authorities' decision to levy a fine as well.

[Pkg]

The National Tax Service has identified that Samsung Group Chairman Lee Kun-hee earned 130 billion won from bank accounts opened under borrowed names. The earnings are interest and dividends accrued from the borrowed-name accounts over the past ten years. The National Tax Service has recently levied 100 billion won in tax on the earnings. Under the real-name financial transaction law, 90 percent of earnings from borrowed-name accounts must be collected in tax if they are discovered by financial authorities It is a punitive tax, which is separate from a gift tax. The notices of the taxation were sent to the securities companies and banks with which Lee opened the borrowed-name accounts. The financial companies will most likely pay the taxes first and then demand that Lee reimburse the expenses. The taxes are applied to the earnings generated after 2008, because the imposition of taxes can be retroactive only for ten years. A special prosecutor team's investigation into Samsung discovered in 2008 that Lee held 4.5 trillion won in accounts opened under borrowed names. However, no punitive tax was imposed at the time. The National Tax Service plans to levy taxes on other conglomerate owners who have borrowed-name accounts, including Shinsegae Group Chairwoman Lee Myung-hee and CJ Group Chairman Lee Jae-hyun.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Borrowed Name Accounts

-

- 입력 2018-03-20 15:10:36

- 수정2018-03-20 16:40:01

[Anchor Lead]

The National Tax Service has ordered Samsung Group Chairman Lee Kun-hee to pay roughly 100 billion won in taxes for his possession of bank accounts under borrowed names. The tax agency has imposed high, punitive taxes on Lee, following the financial authorities' decision to levy a fine as well.

[Pkg]

The National Tax Service has identified that Samsung Group Chairman Lee Kun-hee earned 130 billion won from bank accounts opened under borrowed names. The earnings are interest and dividends accrued from the borrowed-name accounts over the past ten years. The National Tax Service has recently levied 100 billion won in tax on the earnings. Under the real-name financial transaction law, 90 percent of earnings from borrowed-name accounts must be collected in tax if they are discovered by financial authorities It is a punitive tax, which is separate from a gift tax. The notices of the taxation were sent to the securities companies and banks with which Lee opened the borrowed-name accounts. The financial companies will most likely pay the taxes first and then demand that Lee reimburse the expenses. The taxes are applied to the earnings generated after 2008, because the imposition of taxes can be retroactive only for ten years. A special prosecutor team's investigation into Samsung discovered in 2008 that Lee held 4.5 trillion won in accounts opened under borrowed names. However, no punitive tax was imposed at the time. The National Tax Service plans to levy taxes on other conglomerate owners who have borrowed-name accounts, including Shinsegae Group Chairwoman Lee Myung-hee and CJ Group Chairman Lee Jae-hyun.

The National Tax Service has ordered Samsung Group Chairman Lee Kun-hee to pay roughly 100 billion won in taxes for his possession of bank accounts under borrowed names. The tax agency has imposed high, punitive taxes on Lee, following the financial authorities' decision to levy a fine as well.

[Pkg]

The National Tax Service has identified that Samsung Group Chairman Lee Kun-hee earned 130 billion won from bank accounts opened under borrowed names. The earnings are interest and dividends accrued from the borrowed-name accounts over the past ten years. The National Tax Service has recently levied 100 billion won in tax on the earnings. Under the real-name financial transaction law, 90 percent of earnings from borrowed-name accounts must be collected in tax if they are discovered by financial authorities It is a punitive tax, which is separate from a gift tax. The notices of the taxation were sent to the securities companies and banks with which Lee opened the borrowed-name accounts. The financial companies will most likely pay the taxes first and then demand that Lee reimburse the expenses. The taxes are applied to the earnings generated after 2008, because the imposition of taxes can be retroactive only for ten years. A special prosecutor team's investigation into Samsung discovered in 2008 that Lee held 4.5 trillion won in accounts opened under borrowed names. However, no punitive tax was imposed at the time. The National Tax Service plans to levy taxes on other conglomerate owners who have borrowed-name accounts, including Shinsegae Group Chairwoman Lee Myung-hee and CJ Group Chairman Lee Jae-hyun.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.