IMPORTED JAPANESE MATERIALS

입력 2019.07.10 (15:04)

수정 2019.07.10 (17:04)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

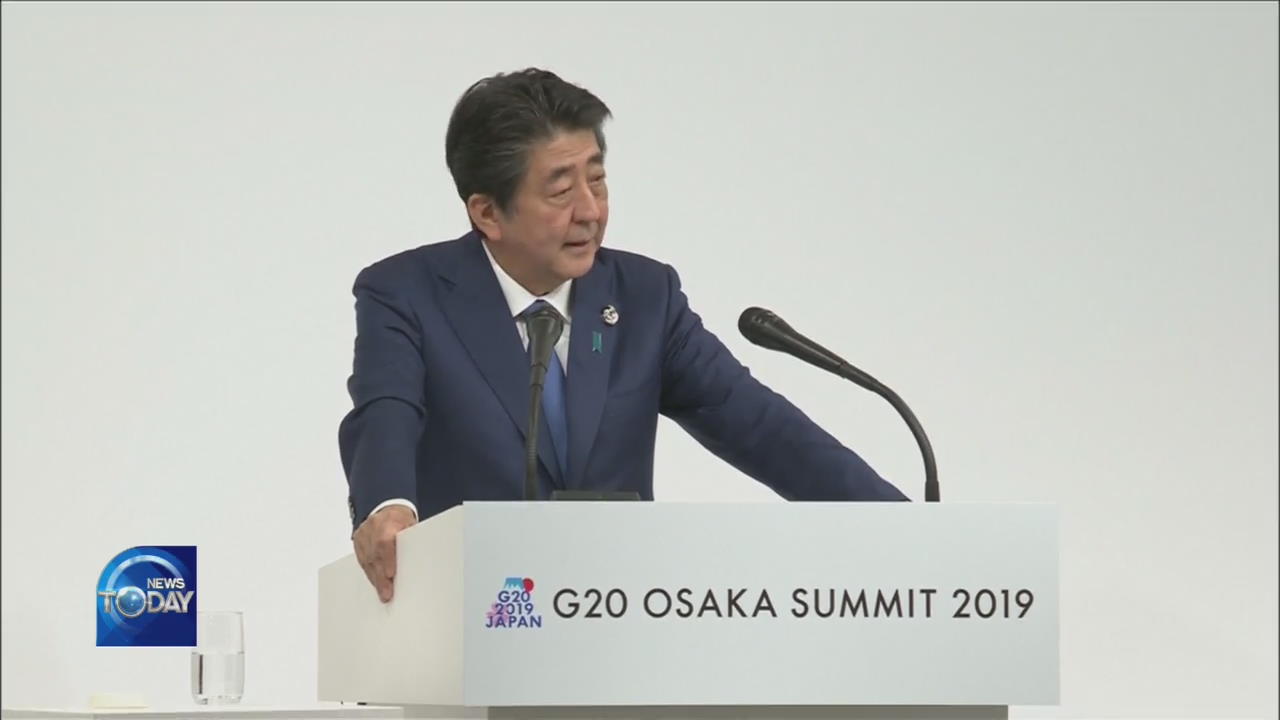

Meanwhile, regarding the issue of Japan's wartime forced labor, the Japanese government has asked South Korea to respond by July 18th, to its proposal to set up a mediation panel for discussions. As many predict Seoul will most not likely take up the offer, the Japanese media has been saying that additional retaliatory measures may be imposed by the Japanese government near the due date. Korean firms that import parts and materials from Japan are setting up contingency plans to find a way around Japanese imports.

[Pkg]

Batteries for electric vehicles have been Korea's staple export even during the overall sluggish export performance of recent days. Domestic producers LG Chem and Samsung SDI rank 4th and 6th in the global market, but key parts that go into making EV batteries such as separation film and anode materials are mostly from Japan. If Japan goes on to impose additional trade restrictions, increased cost and production setbacks are inevitable. LG Chem is therefore in emergency mode, trying to verify possible replacement volumes at home and those that can be imported from elsewhere such as China and Europe.

[Soundbite] SHIN HAK-CHEOL(CEO OF LG CHEM) : "We are making preparations assuming the scenario of more restrictions. Also, diversifying materials has always been a key goal."

Hydrogen fuel tanks, a key component in manufacturing hydrogen vehicles, also rely on Japanese-made carbon fiber. Carbon fiber is speculated to be on the list of Japan's next round of export curbs, if such an action does take place. Hyundai Motor is also devising emergency plans in search of alternative import channels. For tech giant Samsung Electronics, the most urgent matter is its depleting inventory of hydrogen fluoride, which can only be stored for a short period. Samsung has been looking into production facilities in other countries including Taiwan and also trying to check if domestic alternatives were possible.

[Soundbite] SUNG YUN-MO(MINISTER OF TRADE, INDUSTRY AND ENERGY) : "We are drafting countermeasures which will be announced when they are determined."

The situation at small- and medium-sized firms is even more serious. In a survey of around 260 small- and mid-sized semiconductor manufacturers, 59% said they will be unable to endure more than six months of Japan's export restrictions. Half of the surveyed firms said they had no countermeasures in place, signaling more grave conditions than their larger counterparts which are at least carrying out contingency planning.

Meanwhile, regarding the issue of Japan's wartime forced labor, the Japanese government has asked South Korea to respond by July 18th, to its proposal to set up a mediation panel for discussions. As many predict Seoul will most not likely take up the offer, the Japanese media has been saying that additional retaliatory measures may be imposed by the Japanese government near the due date. Korean firms that import parts and materials from Japan are setting up contingency plans to find a way around Japanese imports.

[Pkg]

Batteries for electric vehicles have been Korea's staple export even during the overall sluggish export performance of recent days. Domestic producers LG Chem and Samsung SDI rank 4th and 6th in the global market, but key parts that go into making EV batteries such as separation film and anode materials are mostly from Japan. If Japan goes on to impose additional trade restrictions, increased cost and production setbacks are inevitable. LG Chem is therefore in emergency mode, trying to verify possible replacement volumes at home and those that can be imported from elsewhere such as China and Europe.

[Soundbite] SHIN HAK-CHEOL(CEO OF LG CHEM) : "We are making preparations assuming the scenario of more restrictions. Also, diversifying materials has always been a key goal."

Hydrogen fuel tanks, a key component in manufacturing hydrogen vehicles, also rely on Japanese-made carbon fiber. Carbon fiber is speculated to be on the list of Japan's next round of export curbs, if such an action does take place. Hyundai Motor is also devising emergency plans in search of alternative import channels. For tech giant Samsung Electronics, the most urgent matter is its depleting inventory of hydrogen fluoride, which can only be stored for a short period. Samsung has been looking into production facilities in other countries including Taiwan and also trying to check if domestic alternatives were possible.

[Soundbite] SUNG YUN-MO(MINISTER OF TRADE, INDUSTRY AND ENERGY) : "We are drafting countermeasures which will be announced when they are determined."

The situation at small- and medium-sized firms is even more serious. In a survey of around 260 small- and mid-sized semiconductor manufacturers, 59% said they will be unable to endure more than six months of Japan's export restrictions. Half of the surveyed firms said they had no countermeasures in place, signaling more grave conditions than their larger counterparts which are at least carrying out contingency planning.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- IMPORTED JAPANESE MATERIALS

-

- 입력 2019-07-10 15:16:22

- 수정2019-07-10 17:04:18

[Anchor Lead]

Meanwhile, regarding the issue of Japan's wartime forced labor, the Japanese government has asked South Korea to respond by July 18th, to its proposal to set up a mediation panel for discussions. As many predict Seoul will most not likely take up the offer, the Japanese media has been saying that additional retaliatory measures may be imposed by the Japanese government near the due date. Korean firms that import parts and materials from Japan are setting up contingency plans to find a way around Japanese imports.

[Pkg]

Batteries for electric vehicles have been Korea's staple export even during the overall sluggish export performance of recent days. Domestic producers LG Chem and Samsung SDI rank 4th and 6th in the global market, but key parts that go into making EV batteries such as separation film and anode materials are mostly from Japan. If Japan goes on to impose additional trade restrictions, increased cost and production setbacks are inevitable. LG Chem is therefore in emergency mode, trying to verify possible replacement volumes at home and those that can be imported from elsewhere such as China and Europe.

[Soundbite] SHIN HAK-CHEOL(CEO OF LG CHEM) : "We are making preparations assuming the scenario of more restrictions. Also, diversifying materials has always been a key goal."

Hydrogen fuel tanks, a key component in manufacturing hydrogen vehicles, also rely on Japanese-made carbon fiber. Carbon fiber is speculated to be on the list of Japan's next round of export curbs, if such an action does take place. Hyundai Motor is also devising emergency plans in search of alternative import channels. For tech giant Samsung Electronics, the most urgent matter is its depleting inventory of hydrogen fluoride, which can only be stored for a short period. Samsung has been looking into production facilities in other countries including Taiwan and also trying to check if domestic alternatives were possible.

[Soundbite] SUNG YUN-MO(MINISTER OF TRADE, INDUSTRY AND ENERGY) : "We are drafting countermeasures which will be announced when they are determined."

The situation at small- and medium-sized firms is even more serious. In a survey of around 260 small- and mid-sized semiconductor manufacturers, 59% said they will be unable to endure more than six months of Japan's export restrictions. Half of the surveyed firms said they had no countermeasures in place, signaling more grave conditions than their larger counterparts which are at least carrying out contingency planning.

Meanwhile, regarding the issue of Japan's wartime forced labor, the Japanese government has asked South Korea to respond by July 18th, to its proposal to set up a mediation panel for discussions. As many predict Seoul will most not likely take up the offer, the Japanese media has been saying that additional retaliatory measures may be imposed by the Japanese government near the due date. Korean firms that import parts and materials from Japan are setting up contingency plans to find a way around Japanese imports.

[Pkg]

Batteries for electric vehicles have been Korea's staple export even during the overall sluggish export performance of recent days. Domestic producers LG Chem and Samsung SDI rank 4th and 6th in the global market, but key parts that go into making EV batteries such as separation film and anode materials are mostly from Japan. If Japan goes on to impose additional trade restrictions, increased cost and production setbacks are inevitable. LG Chem is therefore in emergency mode, trying to verify possible replacement volumes at home and those that can be imported from elsewhere such as China and Europe.

[Soundbite] SHIN HAK-CHEOL(CEO OF LG CHEM) : "We are making preparations assuming the scenario of more restrictions. Also, diversifying materials has always been a key goal."

Hydrogen fuel tanks, a key component in manufacturing hydrogen vehicles, also rely on Japanese-made carbon fiber. Carbon fiber is speculated to be on the list of Japan's next round of export curbs, if such an action does take place. Hyundai Motor is also devising emergency plans in search of alternative import channels. For tech giant Samsung Electronics, the most urgent matter is its depleting inventory of hydrogen fluoride, which can only be stored for a short period. Samsung has been looking into production facilities in other countries including Taiwan and also trying to check if domestic alternatives were possible.

[Soundbite] SUNG YUN-MO(MINISTER OF TRADE, INDUSTRY AND ENERGY) : "We are drafting countermeasures which will be announced when they are determined."

The situation at small- and medium-sized firms is even more serious. In a survey of around 260 small- and mid-sized semiconductor manufacturers, 59% said they will be unable to endure more than six months of Japan's export restrictions. Half of the surveyed firms said they had no countermeasures in place, signaling more grave conditions than their larger counterparts which are at least carrying out contingency planning.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.