ACQUISITION OF ASIANA AIRLINES

입력 2019.09.04 (15:03)

수정 2019.09.04 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The acquisition of Asiana Airlines, a deal worth trillions of won, has begun. At least three companies have expressed willingness to become the airline's new owner.

[Pkg]

The sell-off of Asiana Airlines has begun. Kumho Industrial is trying to keep the deal a secret, but already, three companies revealed they participated in the initial bidding. They are Aekyung Group, the parent-company of Jeju Air; the private equity fund KCGI, which is also the second largest shareholder at Korean Air. Also, Mirae Asset Daewoo and Hyundai Development Company, which filed a joint bid. Jeju Air stands a higher chance of winning the bid as a leading local low-budget carrier and an airline operator. KCGI has vowed to improve Asiana's financial structure as it did with Korean Air. Hyundai Development company is looking to diversify its business areas, and apparently joined hands with Mirae Asset in a bid to solve funding-related problems.

[Soundbite] (STAFF AT HYUNDAI DEVELOPMENT COMPANY(VOICE MODIFIED)) : "We have been considering various items in a bid to diversify our business."

Large conglomerates such as SK, Hanhwa and CJ did not take part. There is also a possibility that several private equity funds might have jumped on the bandwagon. The market reaction was mixed. Aekyung's shares rose slightly, whereas those of Mirae Asset declined. Shares of Hyundai Development Company plummeted nearly 10 percent.

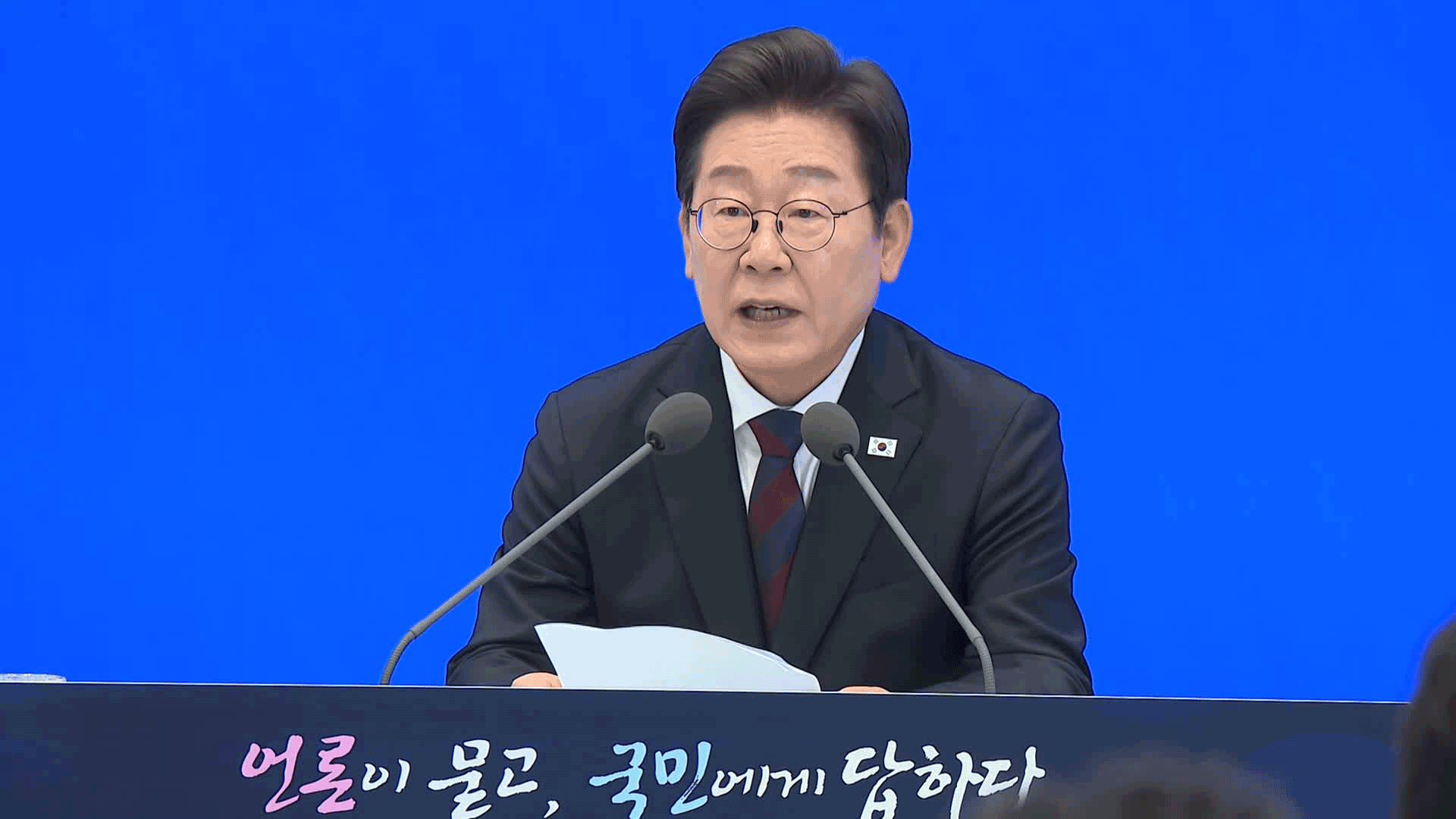

[Soundbite] LEE SANG-HEON(HI INVESTMENT AND SECURITIES) : "Hyundai Development Company specializes in construction. Many doubt that it will manage to produce a synergistic effect by delving into the airline business."

The acquisition of Asiana Airlines is expected to cost between one and two trillion won. Once the candidate is finalized, an examination will be conducted by the end of this month, and the sell-off will be complete by the year's end.

The acquisition of Asiana Airlines, a deal worth trillions of won, has begun. At least three companies have expressed willingness to become the airline's new owner.

[Pkg]

The sell-off of Asiana Airlines has begun. Kumho Industrial is trying to keep the deal a secret, but already, three companies revealed they participated in the initial bidding. They are Aekyung Group, the parent-company of Jeju Air; the private equity fund KCGI, which is also the second largest shareholder at Korean Air. Also, Mirae Asset Daewoo and Hyundai Development Company, which filed a joint bid. Jeju Air stands a higher chance of winning the bid as a leading local low-budget carrier and an airline operator. KCGI has vowed to improve Asiana's financial structure as it did with Korean Air. Hyundai Development company is looking to diversify its business areas, and apparently joined hands with Mirae Asset in a bid to solve funding-related problems.

[Soundbite] (STAFF AT HYUNDAI DEVELOPMENT COMPANY(VOICE MODIFIED)) : "We have been considering various items in a bid to diversify our business."

Large conglomerates such as SK, Hanhwa and CJ did not take part. There is also a possibility that several private equity funds might have jumped on the bandwagon. The market reaction was mixed. Aekyung's shares rose slightly, whereas those of Mirae Asset declined. Shares of Hyundai Development Company plummeted nearly 10 percent.

[Soundbite] LEE SANG-HEON(HI INVESTMENT AND SECURITIES) : "Hyundai Development Company specializes in construction. Many doubt that it will manage to produce a synergistic effect by delving into the airline business."

The acquisition of Asiana Airlines is expected to cost between one and two trillion won. Once the candidate is finalized, an examination will be conducted by the end of this month, and the sell-off will be complete by the year's end.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- ACQUISITION OF ASIANA AIRLINES

-

- 입력 2019-09-04 15:06:31

- 수정2019-09-04 16:45:20

[Anchor Lead]

The acquisition of Asiana Airlines, a deal worth trillions of won, has begun. At least three companies have expressed willingness to become the airline's new owner.

[Pkg]

The sell-off of Asiana Airlines has begun. Kumho Industrial is trying to keep the deal a secret, but already, three companies revealed they participated in the initial bidding. They are Aekyung Group, the parent-company of Jeju Air; the private equity fund KCGI, which is also the second largest shareholder at Korean Air. Also, Mirae Asset Daewoo and Hyundai Development Company, which filed a joint bid. Jeju Air stands a higher chance of winning the bid as a leading local low-budget carrier and an airline operator. KCGI has vowed to improve Asiana's financial structure as it did with Korean Air. Hyundai Development company is looking to diversify its business areas, and apparently joined hands with Mirae Asset in a bid to solve funding-related problems.

[Soundbite] (STAFF AT HYUNDAI DEVELOPMENT COMPANY(VOICE MODIFIED)) : "We have been considering various items in a bid to diversify our business."

Large conglomerates such as SK, Hanhwa and CJ did not take part. There is also a possibility that several private equity funds might have jumped on the bandwagon. The market reaction was mixed. Aekyung's shares rose slightly, whereas those of Mirae Asset declined. Shares of Hyundai Development Company plummeted nearly 10 percent.

[Soundbite] LEE SANG-HEON(HI INVESTMENT AND SECURITIES) : "Hyundai Development Company specializes in construction. Many doubt that it will manage to produce a synergistic effect by delving into the airline business."

The acquisition of Asiana Airlines is expected to cost between one and two trillion won. Once the candidate is finalized, an examination will be conducted by the end of this month, and the sell-off will be complete by the year's end.

The acquisition of Asiana Airlines, a deal worth trillions of won, has begun. At least three companies have expressed willingness to become the airline's new owner.

[Pkg]

The sell-off of Asiana Airlines has begun. Kumho Industrial is trying to keep the deal a secret, but already, three companies revealed they participated in the initial bidding. They are Aekyung Group, the parent-company of Jeju Air; the private equity fund KCGI, which is also the second largest shareholder at Korean Air. Also, Mirae Asset Daewoo and Hyundai Development Company, which filed a joint bid. Jeju Air stands a higher chance of winning the bid as a leading local low-budget carrier and an airline operator. KCGI has vowed to improve Asiana's financial structure as it did with Korean Air. Hyundai Development company is looking to diversify its business areas, and apparently joined hands with Mirae Asset in a bid to solve funding-related problems.

[Soundbite] (STAFF AT HYUNDAI DEVELOPMENT COMPANY(VOICE MODIFIED)) : "We have been considering various items in a bid to diversify our business."

Large conglomerates such as SK, Hanhwa and CJ did not take part. There is also a possibility that several private equity funds might have jumped on the bandwagon. The market reaction was mixed. Aekyung's shares rose slightly, whereas those of Mirae Asset declined. Shares of Hyundai Development Company plummeted nearly 10 percent.

[Soundbite] LEE SANG-HEON(HI INVESTMENT AND SECURITIES) : "Hyundai Development Company specializes in construction. Many doubt that it will manage to produce a synergistic effect by delving into the airline business."

The acquisition of Asiana Airlines is expected to cost between one and two trillion won. Once the candidate is finalized, an examination will be conducted by the end of this month, and the sell-off will be complete by the year's end.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] 도이치 주포 “김건희, 내 덕에 떼돈 벌어…22억 원 주문”](/data/news/2025/07/03/20250703_KpuU43.png)

![[단독] “쪽지 얼핏 봤다, 안 받았다”더니…CCTV에선 문건 챙긴 이상민](/data/news/2025/07/03/20250703_Lv3LjI.png)

이 기사에 대한 의견을 남겨주세요.