DEVELOPMENT OF BANKING APPLICATION

입력 2019.10.31 (15:05)

수정 2019.10.31 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

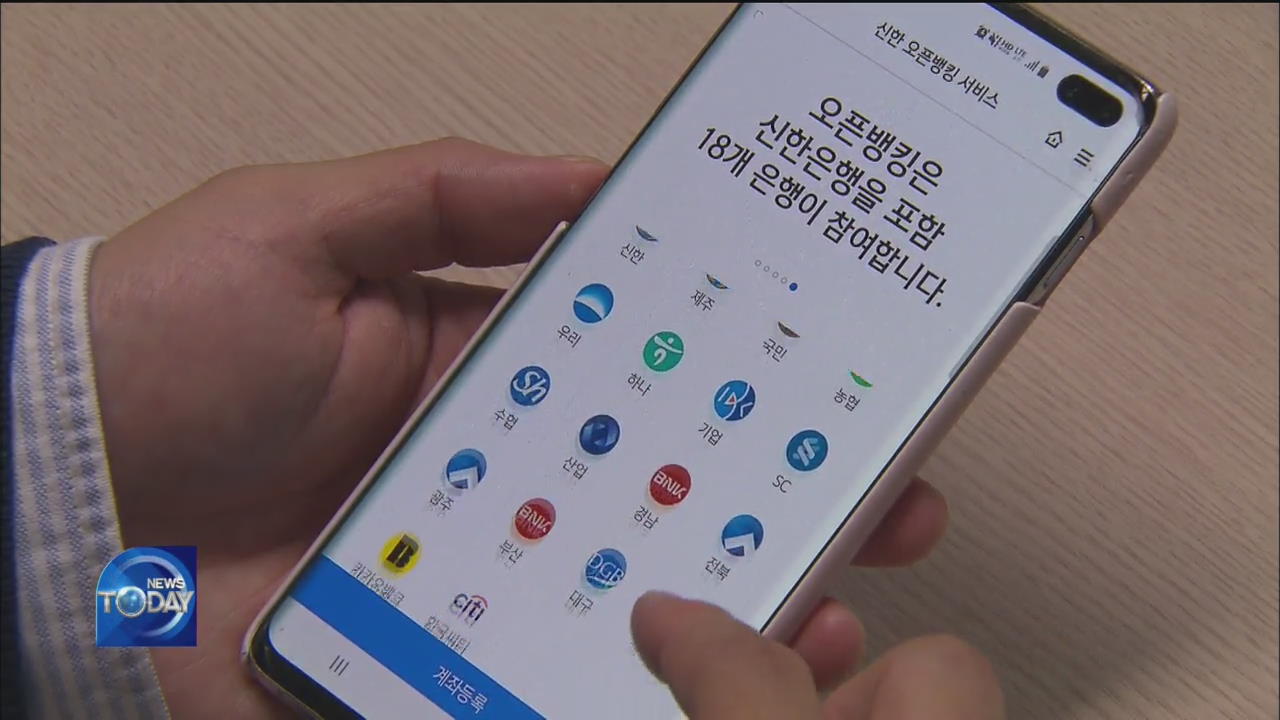

It can be a hassle to install and use a separate mobile application for each of your bank. But, starting today, you can make withdrawals and transfers from all your accounts through a single open banking app.

[Pkg]

Passers-by were asked how many smart phone banking apps they use.

[Soundbite] KOH JI-CHEOL(SEOUL RESIDENT) : "(How many bank apps do you use?) About 3 to 4."

[Soundbite] KIM JIN-MAN(SEOUL RESIDENT) : "I use about 4 bank apps. It's inconvenient, having to renew official certificate for each one."

Now a single app can take care of all the banking needs as an open banking service that integrates all financial payment networks is implemented. Users can check their balances and make deposits or withdrawals once they register their accounts in other banks through the open banking option on any bank app in use. Ten commercial banks, including Shinhan and KB Kookmin Bank, already joined this service. Users can make one-stop comparison of their banks' loan programs, asset management systems, and other financial products so they can choose products with the best interest rates or convenience. New financial services can be expected as competition among financial institutions is bound to grow fiercer. However, since financial information is stored at one place, a single security breach could lead to extensive losses.

[Soundbite] SONG HYUN-DO(FINANCIAL SERVICES COMMISSION) : "Only the banks that passed security inspections are allowed to participate in the open banking system. We plan to keep checking for problems by activating the abnormal transaction detection system."

KakaoPay and some 100 other digital payment service providers will start joining the open banking system on December 18th, while savings banks and other secondary financial firms will be allowed to participate next year.

It can be a hassle to install and use a separate mobile application for each of your bank. But, starting today, you can make withdrawals and transfers from all your accounts through a single open banking app.

[Pkg]

Passers-by were asked how many smart phone banking apps they use.

[Soundbite] KOH JI-CHEOL(SEOUL RESIDENT) : "(How many bank apps do you use?) About 3 to 4."

[Soundbite] KIM JIN-MAN(SEOUL RESIDENT) : "I use about 4 bank apps. It's inconvenient, having to renew official certificate for each one."

Now a single app can take care of all the banking needs as an open banking service that integrates all financial payment networks is implemented. Users can check their balances and make deposits or withdrawals once they register their accounts in other banks through the open banking option on any bank app in use. Ten commercial banks, including Shinhan and KB Kookmin Bank, already joined this service. Users can make one-stop comparison of their banks' loan programs, asset management systems, and other financial products so they can choose products with the best interest rates or convenience. New financial services can be expected as competition among financial institutions is bound to grow fiercer. However, since financial information is stored at one place, a single security breach could lead to extensive losses.

[Soundbite] SONG HYUN-DO(FINANCIAL SERVICES COMMISSION) : "Only the banks that passed security inspections are allowed to participate in the open banking system. We plan to keep checking for problems by activating the abnormal transaction detection system."

KakaoPay and some 100 other digital payment service providers will start joining the open banking system on December 18th, while savings banks and other secondary financial firms will be allowed to participate next year.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- DEVELOPMENT OF BANKING APPLICATION

-

- 입력 2019-10-31 15:16:34

- 수정2019-10-31 16:45:21

[Anchor Lead]

It can be a hassle to install and use a separate mobile application for each of your bank. But, starting today, you can make withdrawals and transfers from all your accounts through a single open banking app.

[Pkg]

Passers-by were asked how many smart phone banking apps they use.

[Soundbite] KOH JI-CHEOL(SEOUL RESIDENT) : "(How many bank apps do you use?) About 3 to 4."

[Soundbite] KIM JIN-MAN(SEOUL RESIDENT) : "I use about 4 bank apps. It's inconvenient, having to renew official certificate for each one."

Now a single app can take care of all the banking needs as an open banking service that integrates all financial payment networks is implemented. Users can check their balances and make deposits or withdrawals once they register their accounts in other banks through the open banking option on any bank app in use. Ten commercial banks, including Shinhan and KB Kookmin Bank, already joined this service. Users can make one-stop comparison of their banks' loan programs, asset management systems, and other financial products so they can choose products with the best interest rates or convenience. New financial services can be expected as competition among financial institutions is bound to grow fiercer. However, since financial information is stored at one place, a single security breach could lead to extensive losses.

[Soundbite] SONG HYUN-DO(FINANCIAL SERVICES COMMISSION) : "Only the banks that passed security inspections are allowed to participate in the open banking system. We plan to keep checking for problems by activating the abnormal transaction detection system."

KakaoPay and some 100 other digital payment service providers will start joining the open banking system on December 18th, while savings banks and other secondary financial firms will be allowed to participate next year.

It can be a hassle to install and use a separate mobile application for each of your bank. But, starting today, you can make withdrawals and transfers from all your accounts through a single open banking app.

[Pkg]

Passers-by were asked how many smart phone banking apps they use.

[Soundbite] KOH JI-CHEOL(SEOUL RESIDENT) : "(How many bank apps do you use?) About 3 to 4."

[Soundbite] KIM JIN-MAN(SEOUL RESIDENT) : "I use about 4 bank apps. It's inconvenient, having to renew official certificate for each one."

Now a single app can take care of all the banking needs as an open banking service that integrates all financial payment networks is implemented. Users can check their balances and make deposits or withdrawals once they register their accounts in other banks through the open banking option on any bank app in use. Ten commercial banks, including Shinhan and KB Kookmin Bank, already joined this service. Users can make one-stop comparison of their banks' loan programs, asset management systems, and other financial products so they can choose products with the best interest rates or convenience. New financial services can be expected as competition among financial institutions is bound to grow fiercer. However, since financial information is stored at one place, a single security breach could lead to extensive losses.

[Soundbite] SONG HYUN-DO(FINANCIAL SERVICES COMMISSION) : "Only the banks that passed security inspections are allowed to participate in the open banking system. We plan to keep checking for problems by activating the abnormal transaction detection system."

KakaoPay and some 100 other digital payment service providers will start joining the open banking system on December 18th, while savings banks and other secondary financial firms will be allowed to participate next year.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[영상] 정성호 “검찰 해체 표현 적절치 않아…수사·기소 분리 국민 공감대”](/data/fckeditor/vod/2025/07/01/305901751367182615.png)

이 기사에 대한 의견을 남겨주세요.