EXTENSION OF SHORT SALE BAN

입력 2021.02.04 (15:18)

수정 2021.02.04 (16:46)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

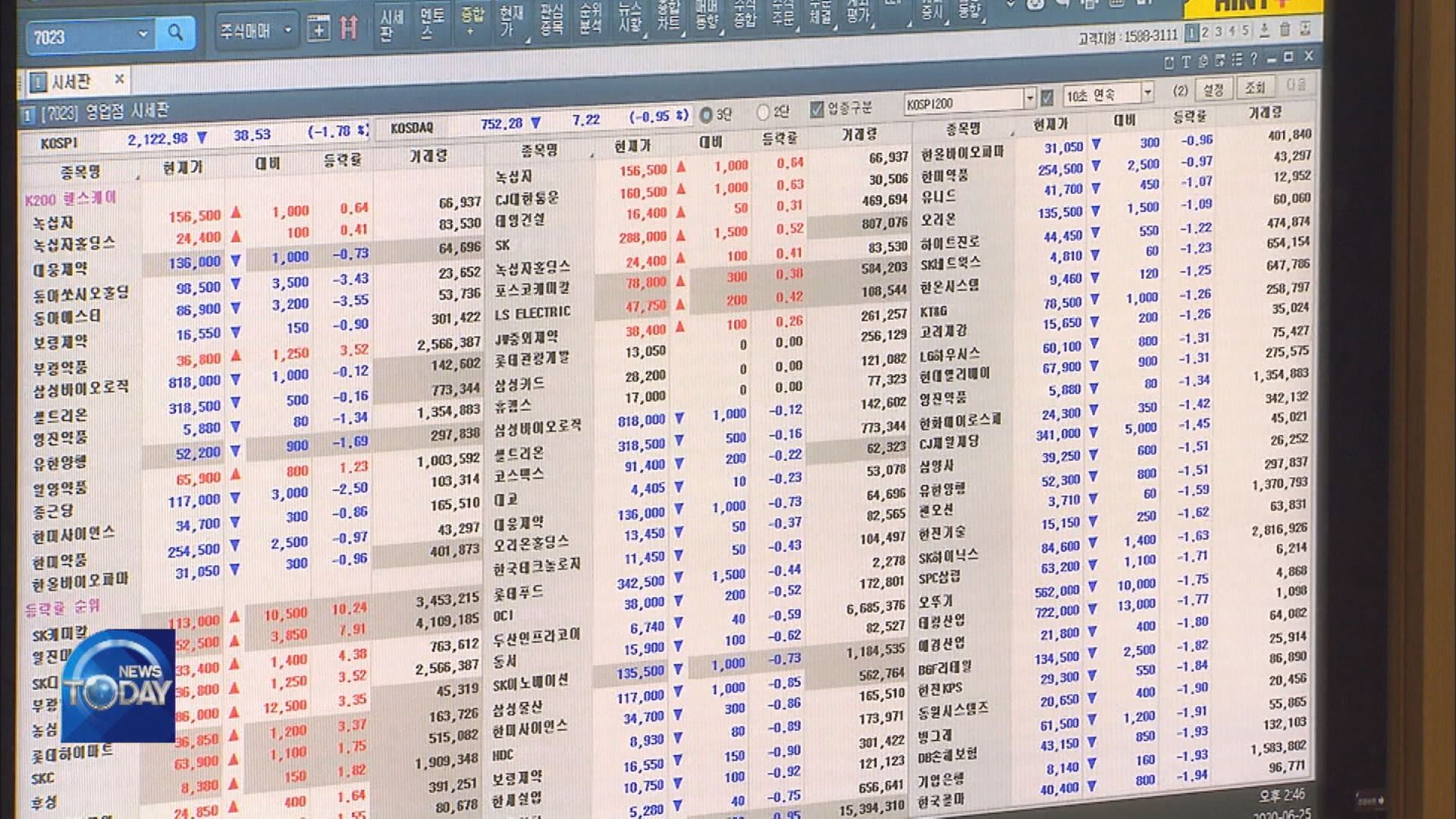

The hottest issue among private investors is the abolishment of the short sale system. Subsequently, the ban on short sale, which went into effect last March, has been extended to May 2nd. Financial authorities announced that a new system will be established in May which would allow individual investors’ participation and wipe out illegal short sale activities.

[Pkg]

The Financial Services Commission concluded that the resumption of short sale will be deferred and even when short sale is allowed again, large-cap stocks will be the first ones in line. The resumption of short sale has been pushed back about a month and a half, from March 16th to May 3rd.

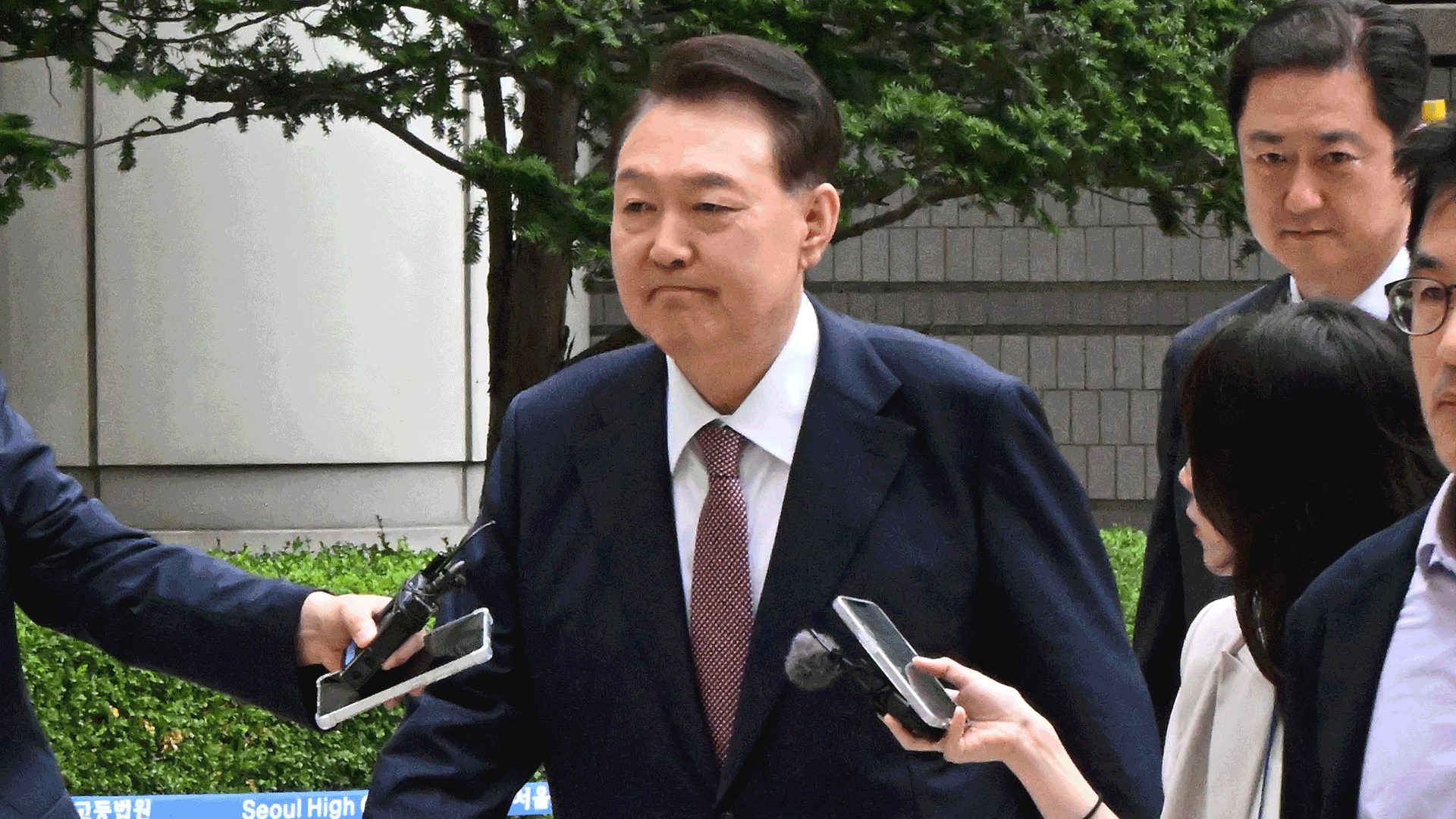

[Soundbite] Eun Sung-soo(Chair, Financial Services Commission) : "We agreed that it is difficult to completely or indefinitely ban the global practice of short sale."

Short sale will be allowed for large-cap stocks first. Starting off will be big stocks comprising KOSPI 200 and KOSDAQ 150. The number of shares account for a fifth of KOSPI issues and one-tenth of KOSDAQ issues. These company stocks are not impacted much by the resumption of short sale as they feature large market capitalization and high trading volume. Other items are postponed indefinitely, which means it will be determined again in the future, whether they can be sold short.

[Soundbite] Eun Sung-soo(Chair, Financial Services Commission) : "As the market is very concerned about resuming short sale activities, we plan to allow short sale only partially to minimize the shock to the stock market."

Financial authorities presented a plan to remedy an “Uneven playing field,” which supposedly benefits only institutional and foreign investors. Starting in May, between two to three trillion won’s worth of short sale stocks will be set aside for individual investors. This new measure incorporates private investors’ requests to boost their chances of participating in short sale activities. However, the initial investment in short sale has been capped at 30 million won and investment training is made mandatory to protect private investors. Monitoring and crackdown on illegal short sale have been toughened. South Korea is the only OECD member to ban short sale. Since re-allowing short sale trade is inevitable, the FSC plans to soften the impact of short sale resumption. However, the new measure appears to be just a compromise reached with retail investors and politicians who have been opposing the restart of short sale.

The hottest issue among private investors is the abolishment of the short sale system. Subsequently, the ban on short sale, which went into effect last March, has been extended to May 2nd. Financial authorities announced that a new system will be established in May which would allow individual investors’ participation and wipe out illegal short sale activities.

[Pkg]

The Financial Services Commission concluded that the resumption of short sale will be deferred and even when short sale is allowed again, large-cap stocks will be the first ones in line. The resumption of short sale has been pushed back about a month and a half, from March 16th to May 3rd.

[Soundbite] Eun Sung-soo(Chair, Financial Services Commission) : "We agreed that it is difficult to completely or indefinitely ban the global practice of short sale."

Short sale will be allowed for large-cap stocks first. Starting off will be big stocks comprising KOSPI 200 and KOSDAQ 150. The number of shares account for a fifth of KOSPI issues and one-tenth of KOSDAQ issues. These company stocks are not impacted much by the resumption of short sale as they feature large market capitalization and high trading volume. Other items are postponed indefinitely, which means it will be determined again in the future, whether they can be sold short.

[Soundbite] Eun Sung-soo(Chair, Financial Services Commission) : "As the market is very concerned about resuming short sale activities, we plan to allow short sale only partially to minimize the shock to the stock market."

Financial authorities presented a plan to remedy an “Uneven playing field,” which supposedly benefits only institutional and foreign investors. Starting in May, between two to three trillion won’s worth of short sale stocks will be set aside for individual investors. This new measure incorporates private investors’ requests to boost their chances of participating in short sale activities. However, the initial investment in short sale has been capped at 30 million won and investment training is made mandatory to protect private investors. Monitoring and crackdown on illegal short sale have been toughened. South Korea is the only OECD member to ban short sale. Since re-allowing short sale trade is inevitable, the FSC plans to soften the impact of short sale resumption. However, the new measure appears to be just a compromise reached with retail investors and politicians who have been opposing the restart of short sale.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- EXTENSION OF SHORT SALE BAN

-

- 입력 2021-02-04 15:18:08

- 수정2021-02-04 16:46:48

[Anchor Lead]

The hottest issue among private investors is the abolishment of the short sale system. Subsequently, the ban on short sale, which went into effect last March, has been extended to May 2nd. Financial authorities announced that a new system will be established in May which would allow individual investors’ participation and wipe out illegal short sale activities.

[Pkg]

The Financial Services Commission concluded that the resumption of short sale will be deferred and even when short sale is allowed again, large-cap stocks will be the first ones in line. The resumption of short sale has been pushed back about a month and a half, from March 16th to May 3rd.

[Soundbite] Eun Sung-soo(Chair, Financial Services Commission) : "We agreed that it is difficult to completely or indefinitely ban the global practice of short sale."

Short sale will be allowed for large-cap stocks first. Starting off will be big stocks comprising KOSPI 200 and KOSDAQ 150. The number of shares account for a fifth of KOSPI issues and one-tenth of KOSDAQ issues. These company stocks are not impacted much by the resumption of short sale as they feature large market capitalization and high trading volume. Other items are postponed indefinitely, which means it will be determined again in the future, whether they can be sold short.

[Soundbite] Eun Sung-soo(Chair, Financial Services Commission) : "As the market is very concerned about resuming short sale activities, we plan to allow short sale only partially to minimize the shock to the stock market."

Financial authorities presented a plan to remedy an “Uneven playing field,” which supposedly benefits only institutional and foreign investors. Starting in May, between two to three trillion won’s worth of short sale stocks will be set aside for individual investors. This new measure incorporates private investors’ requests to boost their chances of participating in short sale activities. However, the initial investment in short sale has been capped at 30 million won and investment training is made mandatory to protect private investors. Monitoring and crackdown on illegal short sale have been toughened. South Korea is the only OECD member to ban short sale. Since re-allowing short sale trade is inevitable, the FSC plans to soften the impact of short sale resumption. However, the new measure appears to be just a compromise reached with retail investors and politicians who have been opposing the restart of short sale.

The hottest issue among private investors is the abolishment of the short sale system. Subsequently, the ban on short sale, which went into effect last March, has been extended to May 2nd. Financial authorities announced that a new system will be established in May which would allow individual investors’ participation and wipe out illegal short sale activities.

[Pkg]

The Financial Services Commission concluded that the resumption of short sale will be deferred and even when short sale is allowed again, large-cap stocks will be the first ones in line. The resumption of short sale has been pushed back about a month and a half, from March 16th to May 3rd.

[Soundbite] Eun Sung-soo(Chair, Financial Services Commission) : "We agreed that it is difficult to completely or indefinitely ban the global practice of short sale."

Short sale will be allowed for large-cap stocks first. Starting off will be big stocks comprising KOSPI 200 and KOSDAQ 150. The number of shares account for a fifth of KOSPI issues and one-tenth of KOSDAQ issues. These company stocks are not impacted much by the resumption of short sale as they feature large market capitalization and high trading volume. Other items are postponed indefinitely, which means it will be determined again in the future, whether they can be sold short.

[Soundbite] Eun Sung-soo(Chair, Financial Services Commission) : "As the market is very concerned about resuming short sale activities, we plan to allow short sale only partially to minimize the shock to the stock market."

Financial authorities presented a plan to remedy an “Uneven playing field,” which supposedly benefits only institutional and foreign investors. Starting in May, between two to three trillion won’s worth of short sale stocks will be set aside for individual investors. This new measure incorporates private investors’ requests to boost their chances of participating in short sale activities. However, the initial investment in short sale has been capped at 30 million won and investment training is made mandatory to protect private investors. Monitoring and crackdown on illegal short sale have been toughened. South Korea is the only OECD member to ban short sale. Since re-allowing short sale trade is inevitable, the FSC plans to soften the impact of short sale resumption. However, the new measure appears to be just a compromise reached with retail investors and politicians who have been opposing the restart of short sale.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.