CONCERNS OVER INFLATION CONTINUES

입력 2021.02.24 (15:01)

수정 2021.02.24 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

Concerns over inflation are rising these days following a surge in the prices of crude oil and consumer goods. Could such concerns become a reality even before the economy gets back on track?

[Pkg]

As prices keep surging, shoppers think twice before filling their carts. Prices of daily necessities, especially processed foods, are constantly rising.

[Soundbite] Lee Myung-shin(Seoul resident) : "Prices are rising more this year than last year. I only buy the most essential items, and make sure to compare prices."

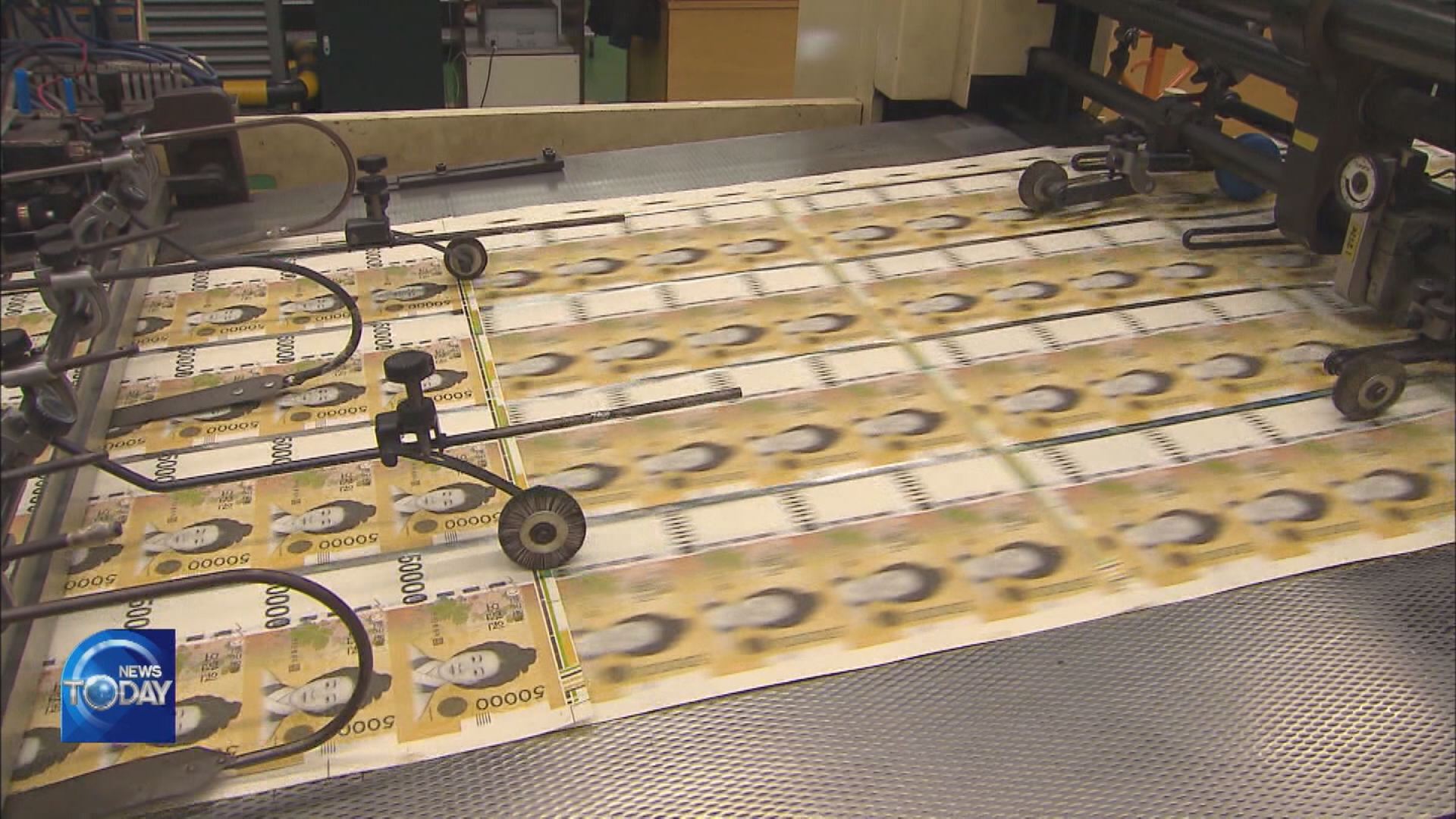

With a whopping 3000 trillion won released on the market, the most to date, a faster-than-expected economic recovery could push consumer prices up further.

[Soundbite] Kim Han-jin(KTB Investment Securities) : "The high currency growth might have affected consumer prices. China's inflation could affect the entire world because the Chinese economy is expected to post high growth this year."

If prices soar steeply, the Bank of Korea could raise the key interest rate. Market interest rates are the first to react to such developments. In fact, the ten-year bond yield has already surpassed 1.9 percent. That's higher than before the COVID-19 pandemic. If market interest rates push mortgage rates higher, the economy will have to bear the brunt of the burden. As of the end of the third quarter of 2020, household and business debt in the nation had already doubled the GDP. However, the prevailing opinion is that the current inflation is a temporary phenomenon stemming from the rising prices of raw materials, and interest rates are unlikely to be raised for now. The important prerequisite of inflation is growing demand through wage raises. But the job market is recovering at a slow pace.

[Soundbite] Cho Young-moo(LG Economic Research Institute) : "The rising demand for goods and services as a result of an improving global economy is not pushing consumer prices higher or causing inflation yet."

Some say debt management and other kinds of preparation are needed, as the situation could change if consumption rebounds quickly after vaccinations.

Concerns over inflation are rising these days following a surge in the prices of crude oil and consumer goods. Could such concerns become a reality even before the economy gets back on track?

[Pkg]

As prices keep surging, shoppers think twice before filling their carts. Prices of daily necessities, especially processed foods, are constantly rising.

[Soundbite] Lee Myung-shin(Seoul resident) : "Prices are rising more this year than last year. I only buy the most essential items, and make sure to compare prices."

With a whopping 3000 trillion won released on the market, the most to date, a faster-than-expected economic recovery could push consumer prices up further.

[Soundbite] Kim Han-jin(KTB Investment Securities) : "The high currency growth might have affected consumer prices. China's inflation could affect the entire world because the Chinese economy is expected to post high growth this year."

If prices soar steeply, the Bank of Korea could raise the key interest rate. Market interest rates are the first to react to such developments. In fact, the ten-year bond yield has already surpassed 1.9 percent. That's higher than before the COVID-19 pandemic. If market interest rates push mortgage rates higher, the economy will have to bear the brunt of the burden. As of the end of the third quarter of 2020, household and business debt in the nation had already doubled the GDP. However, the prevailing opinion is that the current inflation is a temporary phenomenon stemming from the rising prices of raw materials, and interest rates are unlikely to be raised for now. The important prerequisite of inflation is growing demand through wage raises. But the job market is recovering at a slow pace.

[Soundbite] Cho Young-moo(LG Economic Research Institute) : "The rising demand for goods and services as a result of an improving global economy is not pushing consumer prices higher or causing inflation yet."

Some say debt management and other kinds of preparation are needed, as the situation could change if consumption rebounds quickly after vaccinations.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- CONCERNS OVER INFLATION CONTINUES

-

- 입력 2021-02-24 15:01:12

- 수정2021-02-24 16:45:43

[Anchor Lead]

Concerns over inflation are rising these days following a surge in the prices of crude oil and consumer goods. Could such concerns become a reality even before the economy gets back on track?

[Pkg]

As prices keep surging, shoppers think twice before filling their carts. Prices of daily necessities, especially processed foods, are constantly rising.

[Soundbite] Lee Myung-shin(Seoul resident) : "Prices are rising more this year than last year. I only buy the most essential items, and make sure to compare prices."

With a whopping 3000 trillion won released on the market, the most to date, a faster-than-expected economic recovery could push consumer prices up further.

[Soundbite] Kim Han-jin(KTB Investment Securities) : "The high currency growth might have affected consumer prices. China's inflation could affect the entire world because the Chinese economy is expected to post high growth this year."

If prices soar steeply, the Bank of Korea could raise the key interest rate. Market interest rates are the first to react to such developments. In fact, the ten-year bond yield has already surpassed 1.9 percent. That's higher than before the COVID-19 pandemic. If market interest rates push mortgage rates higher, the economy will have to bear the brunt of the burden. As of the end of the third quarter of 2020, household and business debt in the nation had already doubled the GDP. However, the prevailing opinion is that the current inflation is a temporary phenomenon stemming from the rising prices of raw materials, and interest rates are unlikely to be raised for now. The important prerequisite of inflation is growing demand through wage raises. But the job market is recovering at a slow pace.

[Soundbite] Cho Young-moo(LG Economic Research Institute) : "The rising demand for goods and services as a result of an improving global economy is not pushing consumer prices higher or causing inflation yet."

Some say debt management and other kinds of preparation are needed, as the situation could change if consumption rebounds quickly after vaccinations.

Concerns over inflation are rising these days following a surge in the prices of crude oil and consumer goods. Could such concerns become a reality even before the economy gets back on track?

[Pkg]

As prices keep surging, shoppers think twice before filling their carts. Prices of daily necessities, especially processed foods, are constantly rising.

[Soundbite] Lee Myung-shin(Seoul resident) : "Prices are rising more this year than last year. I only buy the most essential items, and make sure to compare prices."

With a whopping 3000 trillion won released on the market, the most to date, a faster-than-expected economic recovery could push consumer prices up further.

[Soundbite] Kim Han-jin(KTB Investment Securities) : "The high currency growth might have affected consumer prices. China's inflation could affect the entire world because the Chinese economy is expected to post high growth this year."

If prices soar steeply, the Bank of Korea could raise the key interest rate. Market interest rates are the first to react to such developments. In fact, the ten-year bond yield has already surpassed 1.9 percent. That's higher than before the COVID-19 pandemic. If market interest rates push mortgage rates higher, the economy will have to bear the brunt of the burden. As of the end of the third quarter of 2020, household and business debt in the nation had already doubled the GDP. However, the prevailing opinion is that the current inflation is a temporary phenomenon stemming from the rising prices of raw materials, and interest rates are unlikely to be raised for now. The important prerequisite of inflation is growing demand through wage raises. But the job market is recovering at a slow pace.

[Soundbite] Cho Young-moo(LG Economic Research Institute) : "The rising demand for goods and services as a result of an improving global economy is not pushing consumer prices higher or causing inflation yet."

Some say debt management and other kinds of preparation are needed, as the situation could change if consumption rebounds quickly after vaccinations.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] 골프연습장 아니라더니<br>…‘한남동 골프연습장’ 도면 입수](/data/news/2025/07/01/20250701_Uh8Jnu.png)

이 기사에 대한 의견을 남겨주세요.