CYRPTOCURRENCY FRAUD REPORTS

입력 2021.05.10 (15:05)

수정 2021.05.10 (16:48)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

A growing number of people are investing in cryptocurrencies or using new online financial transactions these days. Many middle-aged and elderly investors are losing their money through such investment techniques.

[Pkg]

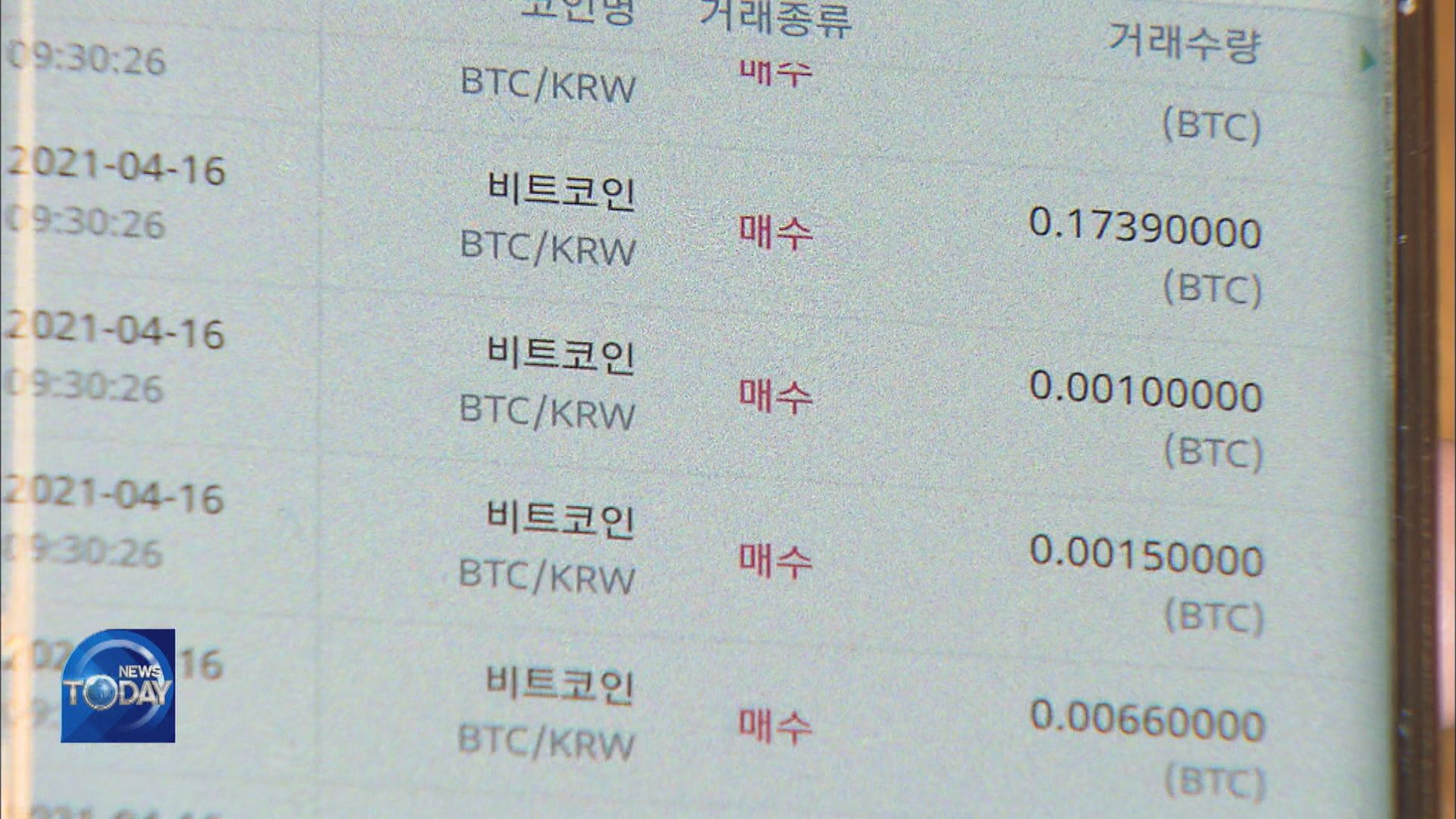

Forty-six-year-old Park works as a truck driver. Last month he used the money he had been saving to buy a home to purchase 50 million won worth of bitcoins at a small-sized cryptocurrency exchange. He expected profits because the price offered by the exchange was about 40 percent lower than at other exchanges. But when he tried to move his bitcoins to another exchange, he was denied access.

[Soundbite] (Cryptocurrency investor) : "It's very nerve-racking. It makes me nervous if I can't withdraw it even half an hour later."

More than 100 people have seen their cryptocurrencies seized at this exchange so far. They plan to file a lawsuit next week.

[Soundbite] (Cryptocurrency investor) : "I'm still very anxious. I drink every day, and all I can think about is my investment."

A woman surnamed Kim in her 40s began P2P investment last year. This financial technique pursues high profits by connecting people who need money urgently to unspecified investors. 60 million won she borrowed from her husband and parents was used. She was promised 10-percent annual interest on her investment every month. Two months later, she stopped receiving interest payments. She can't get back the principal, either.

[Soundbite] (P2P investor(VOICE MODIFIED)) : "I lost a lot of money. I don't know if it's worth the stress and the risk. It is still very distressing."

Some 3400 reports of investment losses were received by the Korea Consumer Agency last year. Most of them were filed by investors in their 50s. They were followed by those in their 40s. People in their 40s and 50s account for more than half of all investors who have sustained losses. Middle-aged and elderly investors who are not savvy at new investment techniques are advised to approach financial products that guarantee the principal or promise high profits with caution.

A growing number of people are investing in cryptocurrencies or using new online financial transactions these days. Many middle-aged and elderly investors are losing their money through such investment techniques.

[Pkg]

Forty-six-year-old Park works as a truck driver. Last month he used the money he had been saving to buy a home to purchase 50 million won worth of bitcoins at a small-sized cryptocurrency exchange. He expected profits because the price offered by the exchange was about 40 percent lower than at other exchanges. But when he tried to move his bitcoins to another exchange, he was denied access.

[Soundbite] (Cryptocurrency investor) : "It's very nerve-racking. It makes me nervous if I can't withdraw it even half an hour later."

More than 100 people have seen their cryptocurrencies seized at this exchange so far. They plan to file a lawsuit next week.

[Soundbite] (Cryptocurrency investor) : "I'm still very anxious. I drink every day, and all I can think about is my investment."

A woman surnamed Kim in her 40s began P2P investment last year. This financial technique pursues high profits by connecting people who need money urgently to unspecified investors. 60 million won she borrowed from her husband and parents was used. She was promised 10-percent annual interest on her investment every month. Two months later, she stopped receiving interest payments. She can't get back the principal, either.

[Soundbite] (P2P investor(VOICE MODIFIED)) : "I lost a lot of money. I don't know if it's worth the stress and the risk. It is still very distressing."

Some 3400 reports of investment losses were received by the Korea Consumer Agency last year. Most of them were filed by investors in their 50s. They were followed by those in their 40s. People in their 40s and 50s account for more than half of all investors who have sustained losses. Middle-aged and elderly investors who are not savvy at new investment techniques are advised to approach financial products that guarantee the principal or promise high profits with caution.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- CYRPTOCURRENCY FRAUD REPORTS

-

- 입력 2021-05-10 15:05:37

- 수정2021-05-10 16:48:42

[Anchor Lead]

A growing number of people are investing in cryptocurrencies or using new online financial transactions these days. Many middle-aged and elderly investors are losing their money through such investment techniques.

[Pkg]

Forty-six-year-old Park works as a truck driver. Last month he used the money he had been saving to buy a home to purchase 50 million won worth of bitcoins at a small-sized cryptocurrency exchange. He expected profits because the price offered by the exchange was about 40 percent lower than at other exchanges. But when he tried to move his bitcoins to another exchange, he was denied access.

[Soundbite] (Cryptocurrency investor) : "It's very nerve-racking. It makes me nervous if I can't withdraw it even half an hour later."

More than 100 people have seen their cryptocurrencies seized at this exchange so far. They plan to file a lawsuit next week.

[Soundbite] (Cryptocurrency investor) : "I'm still very anxious. I drink every day, and all I can think about is my investment."

A woman surnamed Kim in her 40s began P2P investment last year. This financial technique pursues high profits by connecting people who need money urgently to unspecified investors. 60 million won she borrowed from her husband and parents was used. She was promised 10-percent annual interest on her investment every month. Two months later, she stopped receiving interest payments. She can't get back the principal, either.

[Soundbite] (P2P investor(VOICE MODIFIED)) : "I lost a lot of money. I don't know if it's worth the stress and the risk. It is still very distressing."

Some 3400 reports of investment losses were received by the Korea Consumer Agency last year. Most of them were filed by investors in their 50s. They were followed by those in their 40s. People in their 40s and 50s account for more than half of all investors who have sustained losses. Middle-aged and elderly investors who are not savvy at new investment techniques are advised to approach financial products that guarantee the principal or promise high profits with caution.

A growing number of people are investing in cryptocurrencies or using new online financial transactions these days. Many middle-aged and elderly investors are losing their money through such investment techniques.

[Pkg]

Forty-six-year-old Park works as a truck driver. Last month he used the money he had been saving to buy a home to purchase 50 million won worth of bitcoins at a small-sized cryptocurrency exchange. He expected profits because the price offered by the exchange was about 40 percent lower than at other exchanges. But when he tried to move his bitcoins to another exchange, he was denied access.

[Soundbite] (Cryptocurrency investor) : "It's very nerve-racking. It makes me nervous if I can't withdraw it even half an hour later."

More than 100 people have seen their cryptocurrencies seized at this exchange so far. They plan to file a lawsuit next week.

[Soundbite] (Cryptocurrency investor) : "I'm still very anxious. I drink every day, and all I can think about is my investment."

A woman surnamed Kim in her 40s began P2P investment last year. This financial technique pursues high profits by connecting people who need money urgently to unspecified investors. 60 million won she borrowed from her husband and parents was used. She was promised 10-percent annual interest on her investment every month. Two months later, she stopped receiving interest payments. She can't get back the principal, either.

[Soundbite] (P2P investor(VOICE MODIFIED)) : "I lost a lot of money. I don't know if it's worth the stress and the risk. It is still very distressing."

Some 3400 reports of investment losses were received by the Korea Consumer Agency last year. Most of them were filed by investors in their 50s. They were followed by those in their 40s. People in their 40s and 50s account for more than half of all investors who have sustained losses. Middle-aged and elderly investors who are not savvy at new investment techniques are advised to approach financial products that guarantee the principal or promise high profits with caution.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.