TAX CODE REVISION PLAN

입력 2021.07.27 (15:18)

수정 2021.07.27 (16:55)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

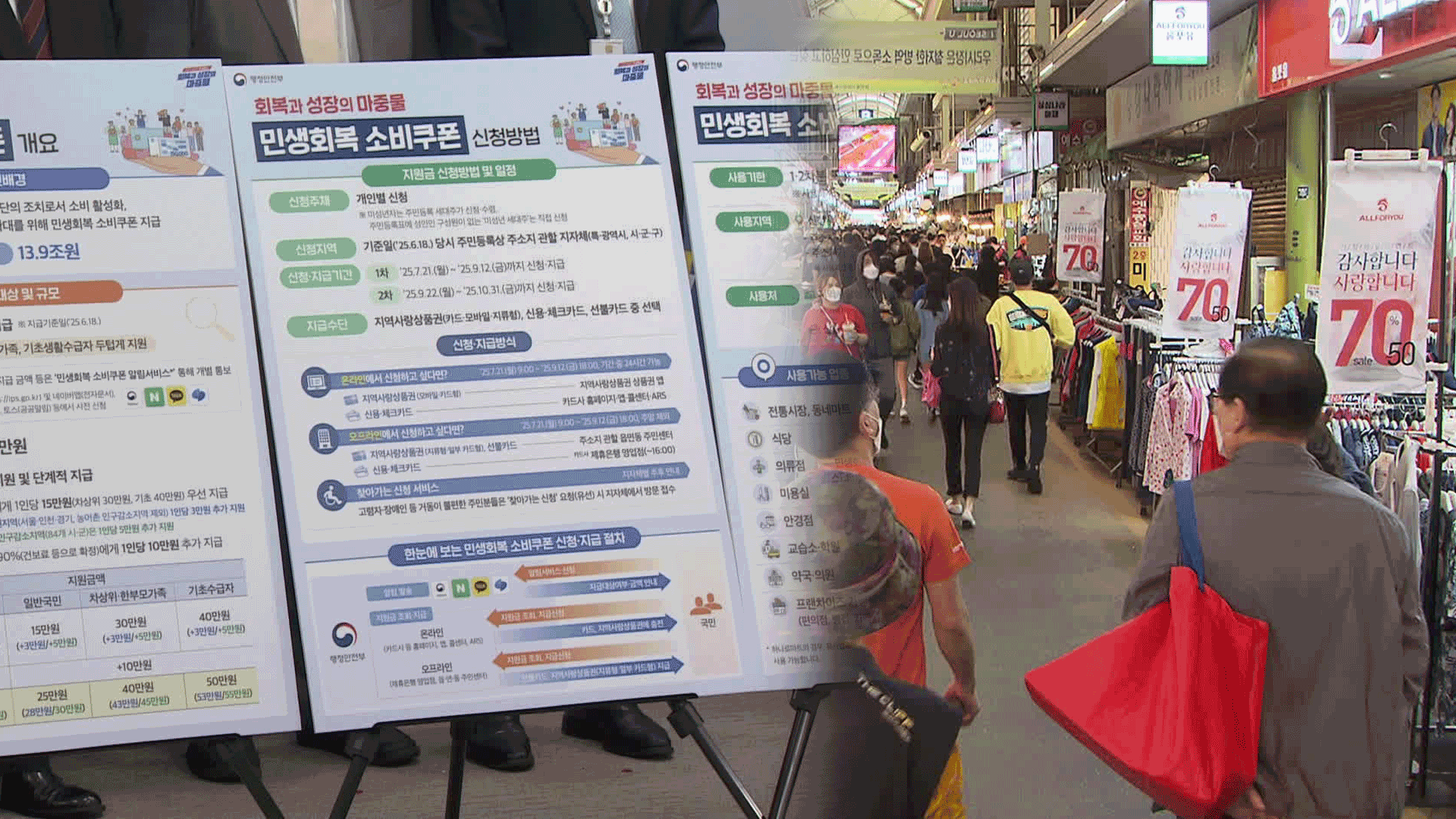

The government has announced its annual tax code revision plan, the key to which is reducing the tax burden by some 1.5 trillion won for pandemic-hit businesses and citizens over the next 5 years.

[Pkg]

For one, the government will expand tax benefits for companies investing in the three major national strategic technologies which are semiconductors, batteries and vaccines. Businesses investing in research and development as well as facilities in these areas can receive tax deductions of up to 50 and 20% respectively. Small and medium sized firms and small business owners hit hard by pandemic restrictions are also eligible for tax breaks. In the case of startups, if their annual revenue is under 80 million won, they can receive reductions in income and corporate taxes by 50 to as much as 100% for five years. A scheme that offers tax discounts to companies hiring more workers will also be extended for 3 more years. If firms expand hires of young people, seniors and those with disabilities, tax incentives of up to 13 million are possible per one such employment. In an effort to help young Koreans increase their overall assets, new tax breaks will also be introduced. For instance, those investing in long-term fund products will receive income tax deductions for 40% of their investment. An installment savings plan designed for youths working short-term or part time jobs will also provide full tax exemptions for income that comes from interest. Recipients of employment subsidies will also be further expanded to benefit an additional 300-thousand low-income households. Other areas of tax support include VAT exemptions for housekeeping services which is to help families with household chores and child rearing. Meanwhile, tax deduction on donations will be tentatively raised by 5 percentage points this year to encourage charitable giving. The government expects that under the revisions, tax revenue will decrease by one and a half trillion won over the next 5 years. The tax code bill will be submitted to parliament on September 3rd following an advance legislation notice and Cabinet approval.

The government has announced its annual tax code revision plan, the key to which is reducing the tax burden by some 1.5 trillion won for pandemic-hit businesses and citizens over the next 5 years.

[Pkg]

For one, the government will expand tax benefits for companies investing in the three major national strategic technologies which are semiconductors, batteries and vaccines. Businesses investing in research and development as well as facilities in these areas can receive tax deductions of up to 50 and 20% respectively. Small and medium sized firms and small business owners hit hard by pandemic restrictions are also eligible for tax breaks. In the case of startups, if their annual revenue is under 80 million won, they can receive reductions in income and corporate taxes by 50 to as much as 100% for five years. A scheme that offers tax discounts to companies hiring more workers will also be extended for 3 more years. If firms expand hires of young people, seniors and those with disabilities, tax incentives of up to 13 million are possible per one such employment. In an effort to help young Koreans increase their overall assets, new tax breaks will also be introduced. For instance, those investing in long-term fund products will receive income tax deductions for 40% of their investment. An installment savings plan designed for youths working short-term or part time jobs will also provide full tax exemptions for income that comes from interest. Recipients of employment subsidies will also be further expanded to benefit an additional 300-thousand low-income households. Other areas of tax support include VAT exemptions for housekeeping services which is to help families with household chores and child rearing. Meanwhile, tax deduction on donations will be tentatively raised by 5 percentage points this year to encourage charitable giving. The government expects that under the revisions, tax revenue will decrease by one and a half trillion won over the next 5 years. The tax code bill will be submitted to parliament on September 3rd following an advance legislation notice and Cabinet approval.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- TAX CODE REVISION PLAN

-

- 입력 2021-07-27 15:18:53

- 수정2021-07-27 16:55:19

[Anchor Lead]

The government has announced its annual tax code revision plan, the key to which is reducing the tax burden by some 1.5 trillion won for pandemic-hit businesses and citizens over the next 5 years.

[Pkg]

For one, the government will expand tax benefits for companies investing in the three major national strategic technologies which are semiconductors, batteries and vaccines. Businesses investing in research and development as well as facilities in these areas can receive tax deductions of up to 50 and 20% respectively. Small and medium sized firms and small business owners hit hard by pandemic restrictions are also eligible for tax breaks. In the case of startups, if their annual revenue is under 80 million won, they can receive reductions in income and corporate taxes by 50 to as much as 100% for five years. A scheme that offers tax discounts to companies hiring more workers will also be extended for 3 more years. If firms expand hires of young people, seniors and those with disabilities, tax incentives of up to 13 million are possible per one such employment. In an effort to help young Koreans increase their overall assets, new tax breaks will also be introduced. For instance, those investing in long-term fund products will receive income tax deductions for 40% of their investment. An installment savings plan designed for youths working short-term or part time jobs will also provide full tax exemptions for income that comes from interest. Recipients of employment subsidies will also be further expanded to benefit an additional 300-thousand low-income households. Other areas of tax support include VAT exemptions for housekeeping services which is to help families with household chores and child rearing. Meanwhile, tax deduction on donations will be tentatively raised by 5 percentage points this year to encourage charitable giving. The government expects that under the revisions, tax revenue will decrease by one and a half trillion won over the next 5 years. The tax code bill will be submitted to parliament on September 3rd following an advance legislation notice and Cabinet approval.

The government has announced its annual tax code revision plan, the key to which is reducing the tax burden by some 1.5 trillion won for pandemic-hit businesses and citizens over the next 5 years.

[Pkg]

For one, the government will expand tax benefits for companies investing in the three major national strategic technologies which are semiconductors, batteries and vaccines. Businesses investing in research and development as well as facilities in these areas can receive tax deductions of up to 50 and 20% respectively. Small and medium sized firms and small business owners hit hard by pandemic restrictions are also eligible for tax breaks. In the case of startups, if their annual revenue is under 80 million won, they can receive reductions in income and corporate taxes by 50 to as much as 100% for five years. A scheme that offers tax discounts to companies hiring more workers will also be extended for 3 more years. If firms expand hires of young people, seniors and those with disabilities, tax incentives of up to 13 million are possible per one such employment. In an effort to help young Koreans increase their overall assets, new tax breaks will also be introduced. For instance, those investing in long-term fund products will receive income tax deductions for 40% of their investment. An installment savings plan designed for youths working short-term or part time jobs will also provide full tax exemptions for income that comes from interest. Recipients of employment subsidies will also be further expanded to benefit an additional 300-thousand low-income households. Other areas of tax support include VAT exemptions for housekeeping services which is to help families with household chores and child rearing. Meanwhile, tax deduction on donations will be tentatively raised by 5 percentage points this year to encourage charitable giving. The government expects that under the revisions, tax revenue will decrease by one and a half trillion won over the next 5 years. The tax code bill will be submitted to parliament on September 3rd following an advance legislation notice and Cabinet approval.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.