CANDIDATES' STANCE ON REAL ESTATE POLICY

입력 2021.11.17 (15:19)

수정 2021.11.17 (16:46)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

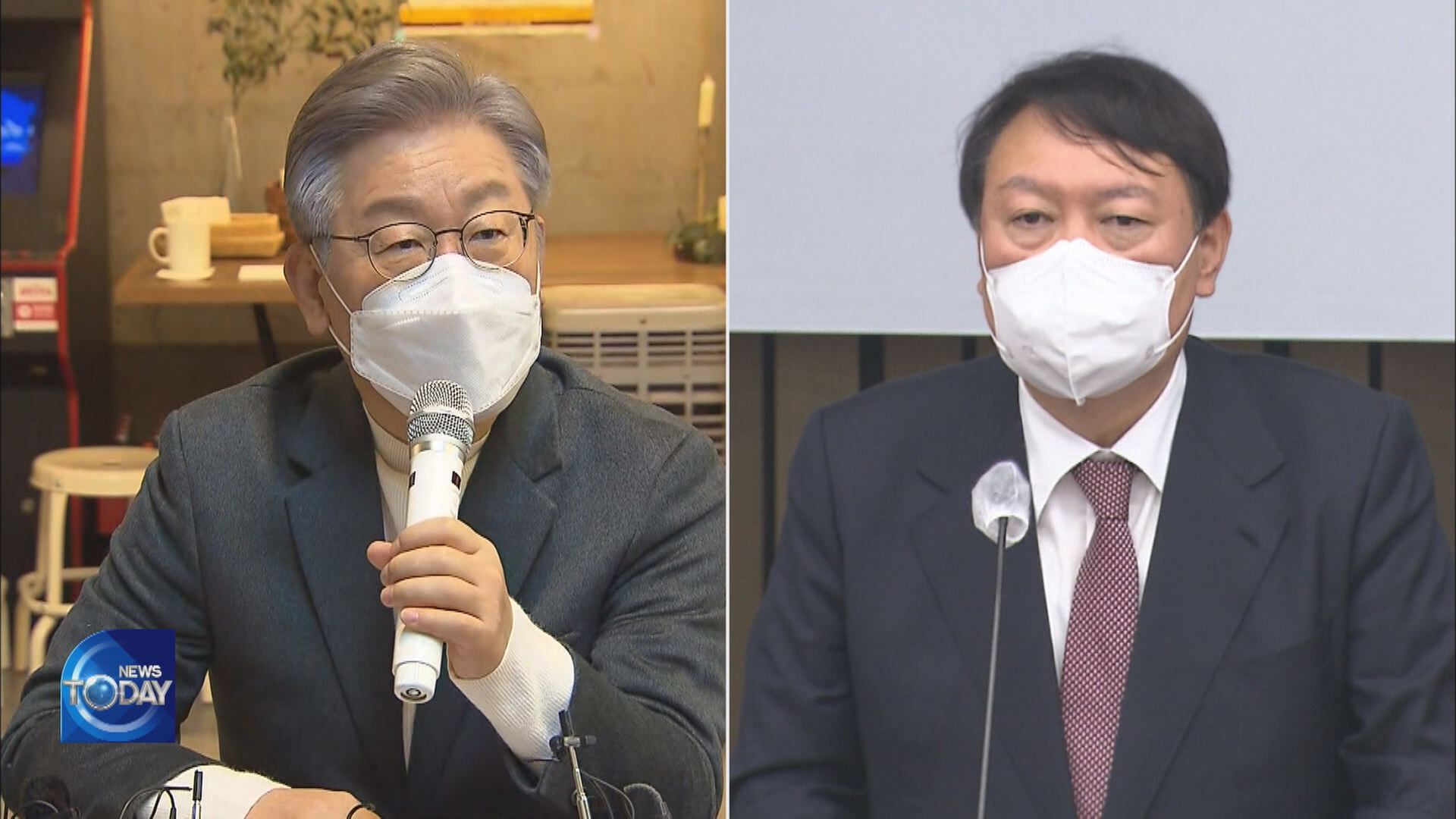

Democratic Party presidential candidate Lee Jae-myung and his People Power Party counterpart Yoon Seok-youl clearly have different opinions about various issues, especially about real estate policies. They started speaking up about their policy ideas as the comprehensive real estate tax is to be notified next week. Let’s take a look at how their real estate policy proposals differ.

[Pkg]

Claiming that unearned income from real estate is the cause of inequality, Lee Jae-myung said he plans to eradicate it.

[Soundbite] Lee Jae-myung(DP Presidential Candidate(Nov. 2)) : "I will stake the Lee Jae-myung administration’s future on erasing the stigma of the republic of unearned income from real estate."

He proposed the establishment of a new territory ownership tax to achieve that goal. He plans to collect ownership tax from all land at a certain percentage and return it to the people as basic income. This means 90 percent of people who own little land stand to receive more tax refunds. The PPP's presidential candidate Yoon Seok-youl stressed the Moon administration’s failed real estate policy. He specifically questioned the validity of the comprehensive real estate tax.

[Soundbite] Yoon Seok-youl(PPP Presidential Candidate(Aug.)) : "I will review the comprehensive real estate tax system and lower the taxation rate for families with one house."

He pledged that the comprehensive real estate tax will be overhauled so that property owners will be freed from the worries of a tax bomb and owners of just one house would be exempt from the tax. Both parties have started supporting their candidates’ policy ideas.

[Soundbite] Yoo Dong-soo(Senior Vice Chair, DP’s Policy Committee) : "Removal of the comprehensive real estate tax on one-house owners will end up reducing taxes for the rich. It will drive people to own one profitable home, which will cause real estate prices nationwide to increase again."

[Soundbite] Choo Kyung-ho(PPP's Senior Vice Floor Leader) : "People with properties pay property tax. The comprehensive real estate tax is an additional tax burden. This is double taxation and punitive taxation."

Both candidates promised to supply 2.5 million new homes. But Lee focused on supply from the public sector, while Yoon focused on supply from the private sector.

Democratic Party presidential candidate Lee Jae-myung and his People Power Party counterpart Yoon Seok-youl clearly have different opinions about various issues, especially about real estate policies. They started speaking up about their policy ideas as the comprehensive real estate tax is to be notified next week. Let’s take a look at how their real estate policy proposals differ.

[Pkg]

Claiming that unearned income from real estate is the cause of inequality, Lee Jae-myung said he plans to eradicate it.

[Soundbite] Lee Jae-myung(DP Presidential Candidate(Nov. 2)) : "I will stake the Lee Jae-myung administration’s future on erasing the stigma of the republic of unearned income from real estate."

He proposed the establishment of a new territory ownership tax to achieve that goal. He plans to collect ownership tax from all land at a certain percentage and return it to the people as basic income. This means 90 percent of people who own little land stand to receive more tax refunds. The PPP's presidential candidate Yoon Seok-youl stressed the Moon administration’s failed real estate policy. He specifically questioned the validity of the comprehensive real estate tax.

[Soundbite] Yoon Seok-youl(PPP Presidential Candidate(Aug.)) : "I will review the comprehensive real estate tax system and lower the taxation rate for families with one house."

He pledged that the comprehensive real estate tax will be overhauled so that property owners will be freed from the worries of a tax bomb and owners of just one house would be exempt from the tax. Both parties have started supporting their candidates’ policy ideas.

[Soundbite] Yoo Dong-soo(Senior Vice Chair, DP’s Policy Committee) : "Removal of the comprehensive real estate tax on one-house owners will end up reducing taxes for the rich. It will drive people to own one profitable home, which will cause real estate prices nationwide to increase again."

[Soundbite] Choo Kyung-ho(PPP's Senior Vice Floor Leader) : "People with properties pay property tax. The comprehensive real estate tax is an additional tax burden. This is double taxation and punitive taxation."

Both candidates promised to supply 2.5 million new homes. But Lee focused on supply from the public sector, while Yoon focused on supply from the private sector.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- CANDIDATES' STANCE ON REAL ESTATE POLICY

-

- 입력 2021-11-17 15:19:27

- 수정2021-11-17 16:46:35

[Anchor Lead]

Democratic Party presidential candidate Lee Jae-myung and his People Power Party counterpart Yoon Seok-youl clearly have different opinions about various issues, especially about real estate policies. They started speaking up about their policy ideas as the comprehensive real estate tax is to be notified next week. Let’s take a look at how their real estate policy proposals differ.

[Pkg]

Claiming that unearned income from real estate is the cause of inequality, Lee Jae-myung said he plans to eradicate it.

[Soundbite] Lee Jae-myung(DP Presidential Candidate(Nov. 2)) : "I will stake the Lee Jae-myung administration’s future on erasing the stigma of the republic of unearned income from real estate."

He proposed the establishment of a new territory ownership tax to achieve that goal. He plans to collect ownership tax from all land at a certain percentage and return it to the people as basic income. This means 90 percent of people who own little land stand to receive more tax refunds. The PPP's presidential candidate Yoon Seok-youl stressed the Moon administration’s failed real estate policy. He specifically questioned the validity of the comprehensive real estate tax.

[Soundbite] Yoon Seok-youl(PPP Presidential Candidate(Aug.)) : "I will review the comprehensive real estate tax system and lower the taxation rate for families with one house."

He pledged that the comprehensive real estate tax will be overhauled so that property owners will be freed from the worries of a tax bomb and owners of just one house would be exempt from the tax. Both parties have started supporting their candidates’ policy ideas.

[Soundbite] Yoo Dong-soo(Senior Vice Chair, DP’s Policy Committee) : "Removal of the comprehensive real estate tax on one-house owners will end up reducing taxes for the rich. It will drive people to own one profitable home, which will cause real estate prices nationwide to increase again."

[Soundbite] Choo Kyung-ho(PPP's Senior Vice Floor Leader) : "People with properties pay property tax. The comprehensive real estate tax is an additional tax burden. This is double taxation and punitive taxation."

Both candidates promised to supply 2.5 million new homes. But Lee focused on supply from the public sector, while Yoon focused on supply from the private sector.

Democratic Party presidential candidate Lee Jae-myung and his People Power Party counterpart Yoon Seok-youl clearly have different opinions about various issues, especially about real estate policies. They started speaking up about their policy ideas as the comprehensive real estate tax is to be notified next week. Let’s take a look at how their real estate policy proposals differ.

[Pkg]

Claiming that unearned income from real estate is the cause of inequality, Lee Jae-myung said he plans to eradicate it.

[Soundbite] Lee Jae-myung(DP Presidential Candidate(Nov. 2)) : "I will stake the Lee Jae-myung administration’s future on erasing the stigma of the republic of unearned income from real estate."

He proposed the establishment of a new territory ownership tax to achieve that goal. He plans to collect ownership tax from all land at a certain percentage and return it to the people as basic income. This means 90 percent of people who own little land stand to receive more tax refunds. The PPP's presidential candidate Yoon Seok-youl stressed the Moon administration’s failed real estate policy. He specifically questioned the validity of the comprehensive real estate tax.

[Soundbite] Yoon Seok-youl(PPP Presidential Candidate(Aug.)) : "I will review the comprehensive real estate tax system and lower the taxation rate for families with one house."

He pledged that the comprehensive real estate tax will be overhauled so that property owners will be freed from the worries of a tax bomb and owners of just one house would be exempt from the tax. Both parties have started supporting their candidates’ policy ideas.

[Soundbite] Yoo Dong-soo(Senior Vice Chair, DP’s Policy Committee) : "Removal of the comprehensive real estate tax on one-house owners will end up reducing taxes for the rich. It will drive people to own one profitable home, which will cause real estate prices nationwide to increase again."

[Soundbite] Choo Kyung-ho(PPP's Senior Vice Floor Leader) : "People with properties pay property tax. The comprehensive real estate tax is an additional tax burden. This is double taxation and punitive taxation."

Both candidates promised to supply 2.5 million new homes. But Lee focused on supply from the public sector, while Yoon focused on supply from the private sector.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] 도이치 주포 “김건희, 내 덕에 떼돈 벌어…22억 원 주문”](/data/news/2025/07/03/20250703_KpuU43.png)

![[단독] “쪽지 얼핏 봤다, 안 받았다”더니…CCTV에선 문건 챙긴 이상민](/data/news/2025/07/03/20250703_Lv3LjI.png)

이 기사에 대한 의견을 남겨주세요.