BOK RAISES BENCHMARK INTEREST RATE

입력 2021.11.25 (15:12)

수정 2021.11.25 (16:49)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The Bank of Korea raised the nation’s benchmark interest rate by 0.25, ending 20 months of 0%-range interest rates. The central bank’s decision was driven by increasing household debts and rising prices.

[Pkg]

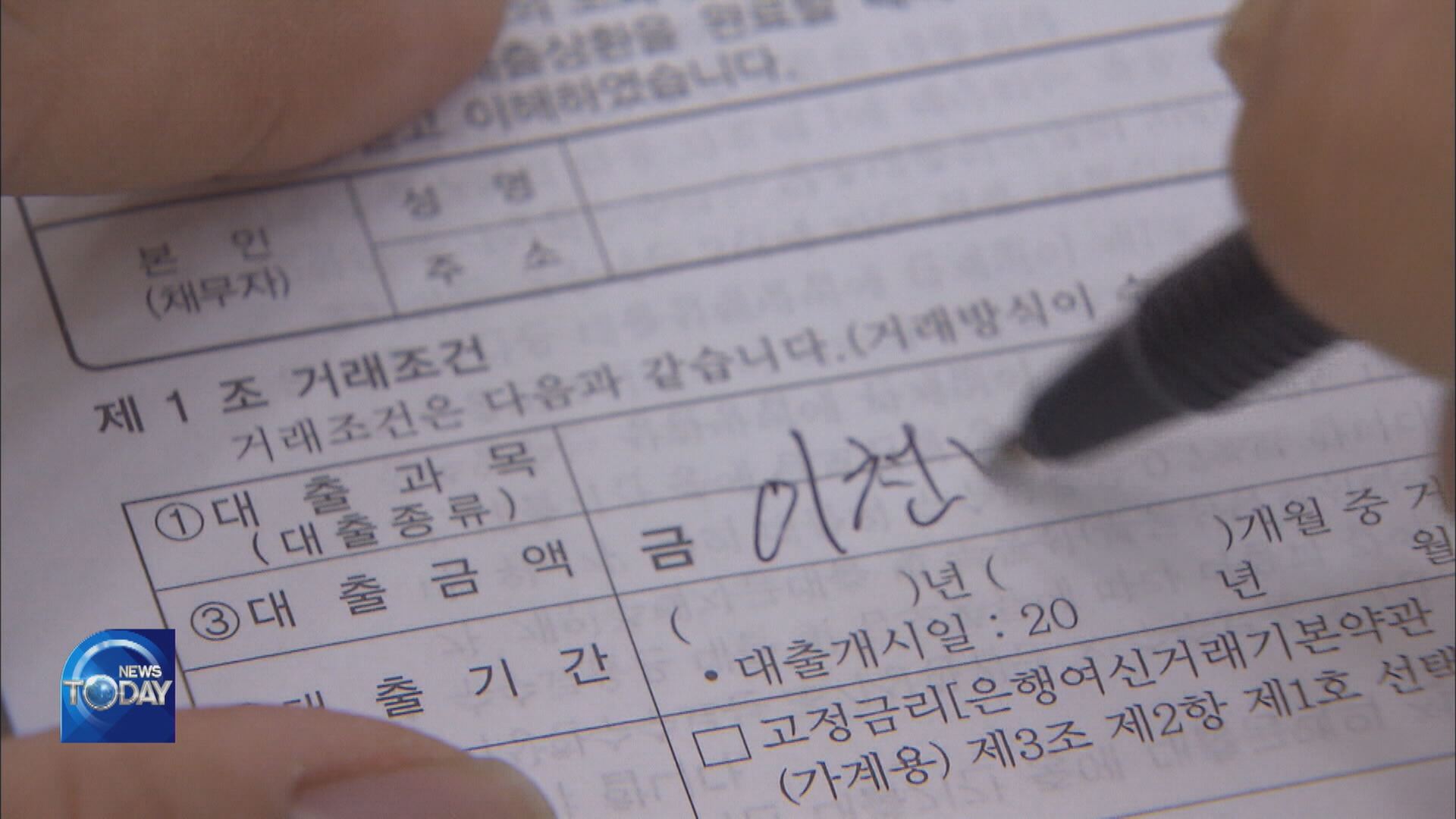

The Bank of Korea raised the nation’s benchmark annual interest rate from 0.75% to 1%. It was the second quarter percentage point hike since one in August. Interest rates had fallen to the zero-percent-range after two cuts in March and May last year. Now the rate has rebounded up to one percent again in 20 months. The BOK concluded that the benchmark rate could be restored to the previous level since the Korean economy has shown decent growth lately. Steep inflation was another factor for the rate hike. Last month’s consumer price index rose 3.2% compared to the same period last year and expected inflation also spiked to the high 2% range. Prompted by the inflation, the BOK boosted its projection of consumer price increases by 0.2 percentage points to 2.3%. Experts believe that ballooning household debt and other financial imbalances have influenced the central bank to raise the benchmark rate. As of the end of the third quarter this year, Korea’s total household debt amounted to more than 1.844 quadrillion won. That is a record high, up by more than 16.3 trillion won from a year ago. With a higher interest rate under these circumstances, commercial banks are expected to further raise lending interest rates at a faster pace, further pressuring indebted households. The BOK added that Korea’s economic growth projection will remain unchanged from August at 4% as private spending looks to recover quickly and the nation’s export and investment appear to be faring well.

The Bank of Korea raised the nation’s benchmark interest rate by 0.25, ending 20 months of 0%-range interest rates. The central bank’s decision was driven by increasing household debts and rising prices.

[Pkg]

The Bank of Korea raised the nation’s benchmark annual interest rate from 0.75% to 1%. It was the second quarter percentage point hike since one in August. Interest rates had fallen to the zero-percent-range after two cuts in March and May last year. Now the rate has rebounded up to one percent again in 20 months. The BOK concluded that the benchmark rate could be restored to the previous level since the Korean economy has shown decent growth lately. Steep inflation was another factor for the rate hike. Last month’s consumer price index rose 3.2% compared to the same period last year and expected inflation also spiked to the high 2% range. Prompted by the inflation, the BOK boosted its projection of consumer price increases by 0.2 percentage points to 2.3%. Experts believe that ballooning household debt and other financial imbalances have influenced the central bank to raise the benchmark rate. As of the end of the third quarter this year, Korea’s total household debt amounted to more than 1.844 quadrillion won. That is a record high, up by more than 16.3 trillion won from a year ago. With a higher interest rate under these circumstances, commercial banks are expected to further raise lending interest rates at a faster pace, further pressuring indebted households. The BOK added that Korea’s economic growth projection will remain unchanged from August at 4% as private spending looks to recover quickly and the nation’s export and investment appear to be faring well.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- BOK RAISES BENCHMARK INTEREST RATE

-

- 입력 2021-11-25 15:12:26

- 수정2021-11-25 16:49:00

[Anchor Lead]

The Bank of Korea raised the nation’s benchmark interest rate by 0.25, ending 20 months of 0%-range interest rates. The central bank’s decision was driven by increasing household debts and rising prices.

[Pkg]

The Bank of Korea raised the nation’s benchmark annual interest rate from 0.75% to 1%. It was the second quarter percentage point hike since one in August. Interest rates had fallen to the zero-percent-range after two cuts in March and May last year. Now the rate has rebounded up to one percent again in 20 months. The BOK concluded that the benchmark rate could be restored to the previous level since the Korean economy has shown decent growth lately. Steep inflation was another factor for the rate hike. Last month’s consumer price index rose 3.2% compared to the same period last year and expected inflation also spiked to the high 2% range. Prompted by the inflation, the BOK boosted its projection of consumer price increases by 0.2 percentage points to 2.3%. Experts believe that ballooning household debt and other financial imbalances have influenced the central bank to raise the benchmark rate. As of the end of the third quarter this year, Korea’s total household debt amounted to more than 1.844 quadrillion won. That is a record high, up by more than 16.3 trillion won from a year ago. With a higher interest rate under these circumstances, commercial banks are expected to further raise lending interest rates at a faster pace, further pressuring indebted households. The BOK added that Korea’s economic growth projection will remain unchanged from August at 4% as private spending looks to recover quickly and the nation’s export and investment appear to be faring well.

The Bank of Korea raised the nation’s benchmark interest rate by 0.25, ending 20 months of 0%-range interest rates. The central bank’s decision was driven by increasing household debts and rising prices.

[Pkg]

The Bank of Korea raised the nation’s benchmark annual interest rate from 0.75% to 1%. It was the second quarter percentage point hike since one in August. Interest rates had fallen to the zero-percent-range after two cuts in March and May last year. Now the rate has rebounded up to one percent again in 20 months. The BOK concluded that the benchmark rate could be restored to the previous level since the Korean economy has shown decent growth lately. Steep inflation was another factor for the rate hike. Last month’s consumer price index rose 3.2% compared to the same period last year and expected inflation also spiked to the high 2% range. Prompted by the inflation, the BOK boosted its projection of consumer price increases by 0.2 percentage points to 2.3%. Experts believe that ballooning household debt and other financial imbalances have influenced the central bank to raise the benchmark rate. As of the end of the third quarter this year, Korea’s total household debt amounted to more than 1.844 quadrillion won. That is a record high, up by more than 16.3 trillion won from a year ago. With a higher interest rate under these circumstances, commercial banks are expected to further raise lending interest rates at a faster pace, further pressuring indebted households. The BOK added that Korea’s economic growth projection will remain unchanged from August at 4% as private spending looks to recover quickly and the nation’s export and investment appear to be faring well.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.