REMOTE LOAN SERVICES CAUSE PROBLEMS

입력 2022.02.11 (15:08)

수정 2022.02.11 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

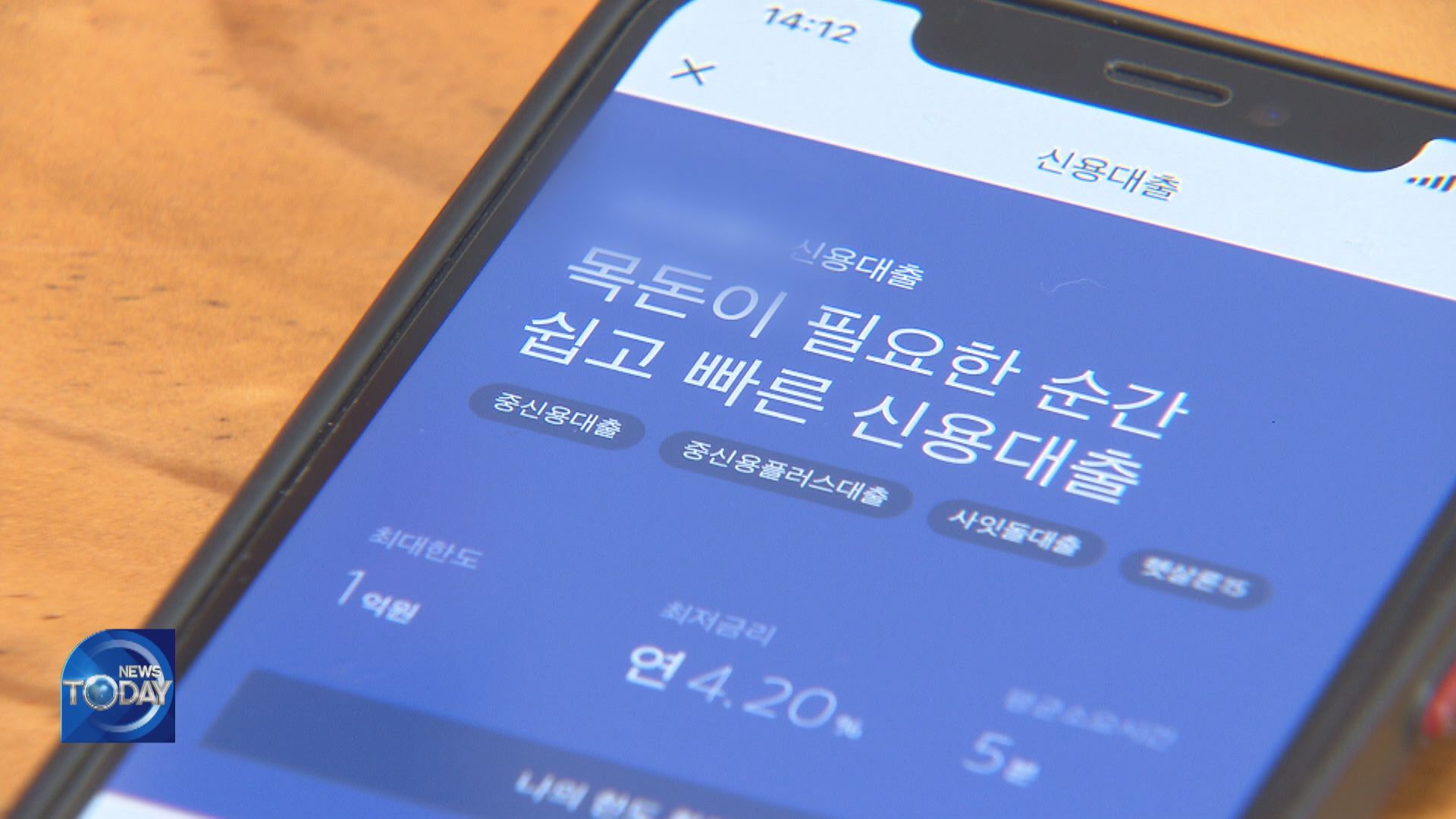

The pandemic has inspired a rising number of remote loans in which a borrower does not have to go to a bank in person to take out a loan. But this trend has also caused frauds to transpire, like in a case of a son who used his father’s name illegally to borrow more than 20 million won.

[Pkg]

This man in his 50s found out in last October that he had an outstanding loan amounting to 25 million won. But the person who had actually borrowed the money was his son. His son, a credit defaulter, used his father’s name to get a new mobile phone and used this number to set up an internet bank account and get a loan.

[Soundbite] Mr. A(VOICE MODIFIED) : "The bank said that since it was a remote loan, it verified the identity first by phone and then by my financial certificate before checking my other bank account and sending the money."

The son stole his father’s ID and found out his other bank account number to pass the identity verification. The son has turned off his phone and gone MIA after getting the loan.

[Soundbite] Mr. A(VOICE MODIFIED) : "It was my fault for not teaching my son properly. But if the bank had checked my identity by video call, this incident wouldn’t have happened at all."

The bank claims that there was nothing wrong with the lending process because it had undertaken proper steps to confirm the identity. The Financial Services Commission mandates that when a bank engages in a remote transaction with its customer, the bank should choose two out of five identity verification means such as checking the ID or making a video call. A civic group argues that the process for remote loans should be toughened by for example, mandating video calls. However, many others also oppose this option.

[Soundbite] Kim Deuk-ui(Head, Financial Justice) : "They can find out if a woman is pretending to be a man or a son is pretending to be his father."

[Soundbite] Prof. Kim Seung-joo(School of Cybersecurity, Korea Univ.) : "When remote identity confirmation processes are added, it could make the whole convenient services obsolete."

Local banks gave out 49.3 trillion won in remote loans in 2018, but the amount surged to 111.7 trillion won as of June 2021. A spate of fraudulent loans has prompted the FSC to reassess the remote identity confirmation guidelines.

The pandemic has inspired a rising number of remote loans in which a borrower does not have to go to a bank in person to take out a loan. But this trend has also caused frauds to transpire, like in a case of a son who used his father’s name illegally to borrow more than 20 million won.

[Pkg]

This man in his 50s found out in last October that he had an outstanding loan amounting to 25 million won. But the person who had actually borrowed the money was his son. His son, a credit defaulter, used his father’s name to get a new mobile phone and used this number to set up an internet bank account and get a loan.

[Soundbite] Mr. A(VOICE MODIFIED) : "The bank said that since it was a remote loan, it verified the identity first by phone and then by my financial certificate before checking my other bank account and sending the money."

The son stole his father’s ID and found out his other bank account number to pass the identity verification. The son has turned off his phone and gone MIA after getting the loan.

[Soundbite] Mr. A(VOICE MODIFIED) : "It was my fault for not teaching my son properly. But if the bank had checked my identity by video call, this incident wouldn’t have happened at all."

The bank claims that there was nothing wrong with the lending process because it had undertaken proper steps to confirm the identity. The Financial Services Commission mandates that when a bank engages in a remote transaction with its customer, the bank should choose two out of five identity verification means such as checking the ID or making a video call. A civic group argues that the process for remote loans should be toughened by for example, mandating video calls. However, many others also oppose this option.

[Soundbite] Kim Deuk-ui(Head, Financial Justice) : "They can find out if a woman is pretending to be a man or a son is pretending to be his father."

[Soundbite] Prof. Kim Seung-joo(School of Cybersecurity, Korea Univ.) : "When remote identity confirmation processes are added, it could make the whole convenient services obsolete."

Local banks gave out 49.3 trillion won in remote loans in 2018, but the amount surged to 111.7 trillion won as of June 2021. A spate of fraudulent loans has prompted the FSC to reassess the remote identity confirmation guidelines.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- REMOTE LOAN SERVICES CAUSE PROBLEMS

-

- 입력 2022-02-11 15:08:14

- 수정2022-02-11 16:45:57

[Anchor Lead]

The pandemic has inspired a rising number of remote loans in which a borrower does not have to go to a bank in person to take out a loan. But this trend has also caused frauds to transpire, like in a case of a son who used his father’s name illegally to borrow more than 20 million won.

[Pkg]

This man in his 50s found out in last October that he had an outstanding loan amounting to 25 million won. But the person who had actually borrowed the money was his son. His son, a credit defaulter, used his father’s name to get a new mobile phone and used this number to set up an internet bank account and get a loan.

[Soundbite] Mr. A(VOICE MODIFIED) : "The bank said that since it was a remote loan, it verified the identity first by phone and then by my financial certificate before checking my other bank account and sending the money."

The son stole his father’s ID and found out his other bank account number to pass the identity verification. The son has turned off his phone and gone MIA after getting the loan.

[Soundbite] Mr. A(VOICE MODIFIED) : "It was my fault for not teaching my son properly. But if the bank had checked my identity by video call, this incident wouldn’t have happened at all."

The bank claims that there was nothing wrong with the lending process because it had undertaken proper steps to confirm the identity. The Financial Services Commission mandates that when a bank engages in a remote transaction with its customer, the bank should choose two out of five identity verification means such as checking the ID or making a video call. A civic group argues that the process for remote loans should be toughened by for example, mandating video calls. However, many others also oppose this option.

[Soundbite] Kim Deuk-ui(Head, Financial Justice) : "They can find out if a woman is pretending to be a man or a son is pretending to be his father."

[Soundbite] Prof. Kim Seung-joo(School of Cybersecurity, Korea Univ.) : "When remote identity confirmation processes are added, it could make the whole convenient services obsolete."

Local banks gave out 49.3 trillion won in remote loans in 2018, but the amount surged to 111.7 trillion won as of June 2021. A spate of fraudulent loans has prompted the FSC to reassess the remote identity confirmation guidelines.

The pandemic has inspired a rising number of remote loans in which a borrower does not have to go to a bank in person to take out a loan. But this trend has also caused frauds to transpire, like in a case of a son who used his father’s name illegally to borrow more than 20 million won.

[Pkg]

This man in his 50s found out in last October that he had an outstanding loan amounting to 25 million won. But the person who had actually borrowed the money was his son. His son, a credit defaulter, used his father’s name to get a new mobile phone and used this number to set up an internet bank account and get a loan.

[Soundbite] Mr. A(VOICE MODIFIED) : "The bank said that since it was a remote loan, it verified the identity first by phone and then by my financial certificate before checking my other bank account and sending the money."

The son stole his father’s ID and found out his other bank account number to pass the identity verification. The son has turned off his phone and gone MIA after getting the loan.

[Soundbite] Mr. A(VOICE MODIFIED) : "It was my fault for not teaching my son properly. But if the bank had checked my identity by video call, this incident wouldn’t have happened at all."

The bank claims that there was nothing wrong with the lending process because it had undertaken proper steps to confirm the identity. The Financial Services Commission mandates that when a bank engages in a remote transaction with its customer, the bank should choose two out of five identity verification means such as checking the ID or making a video call. A civic group argues that the process for remote loans should be toughened by for example, mandating video calls. However, many others also oppose this option.

[Soundbite] Kim Deuk-ui(Head, Financial Justice) : "They can find out if a woman is pretending to be a man or a son is pretending to be his father."

[Soundbite] Prof. Kim Seung-joo(School of Cybersecurity, Korea Univ.) : "When remote identity confirmation processes are added, it could make the whole convenient services obsolete."

Local banks gave out 49.3 trillion won in remote loans in 2018, but the amount surged to 111.7 trillion won as of June 2021. A spate of fraudulent loans has prompted the FSC to reassess the remote identity confirmation guidelines.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] 도이치 주포 “김건희, 내 덕에 떼돈 벌어…22억 원 주문”](/data/news/2025/07/03/20250703_KpuU43.png)

![[단독] “쪽지 얼핏 봤다, 안 받았다”더니…CCTV에선 문건 챙긴 이상민](/data/news/2025/07/03/20250703_Lv3LjI.png)

이 기사에 대한 의견을 남겨주세요.