SAMSUNG ELECTRONICS’ LOW SHARE PRICES

입력 2022.04.08 (15:12)

수정 2022.04.08 (16:46)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

Samsung Electronics has announced record first-quarter sales. But its share prices hit a 16-month low. Analysts say it is because Samsung’s reputation as a technology powerhouse is under threat.

[Pkg]

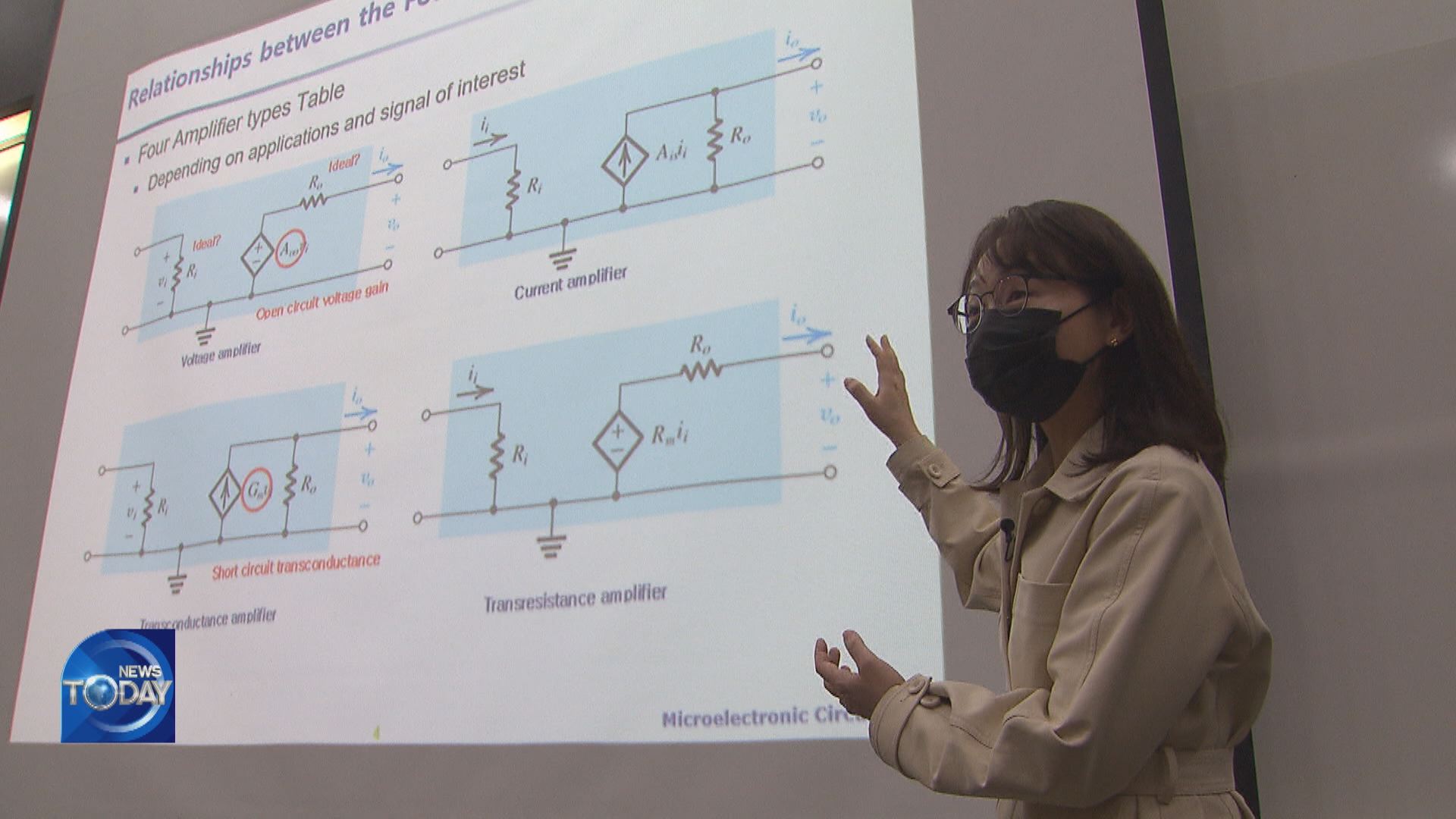

Samsung Electronics has announced sales of 77 trillion won for the first quarter, an all-time high figure. Operating profit jumped 50% on-year. The surprise earnings have exceeded market expectations. However the company’s share prices hit the lowest level in 16 months. This is attributed to weak DRAM prices and signs of America’s monetary tightening. But some pundits argue this shows that the technological edge, which made Samsung a global brand, is faltering. One example is the use of Game Optimizing Service in Samsung’s latest smartphone which was to prevent excessive heat generation. The issue was resolved following an outburst of criticism but critics said it demonstrated a lack of technology.

[Soundbite] (Samsung Electronics Shareholder(Mar. 16)) : "Samsung adverts claim maximum performance while in fact, game performance has been throttled."

[Soundbite] Han Jong-hee(Samsung Electronics Vice Chair) : "We are sorry for causing concern."

There’s also concern of a high rate of defective products in the chip production line.

[Soundbite] (Samsung Electronics Shareholder(Recited by shareholder meeting’s host)) : "I heard that product approval rate is very low in 5-nanometer chip production and those that are more sophisticated. Is there a way to solve this?"

[Soundbite] Kyung Kye-hyun(Samsung Electronics Chair) : "Gradual improvements are stabilizing the situation."

Rivals such as Apple and TSMC are widening their gap with Samsung based on technological prowess while Chinese firms such as Xiaomi are quickly catching up with the Korean tech giant through price competitiveness.

[Soundbite] Lee Seung-woo(Eugene Investment & Securities Co.) : "In the past decade, excluding chips, sales continuously fell in all other Samsung divisions. It will be concerning if even semiconductors start to face growth hurdles."

Experts call for setting up mid to long term strategies and making bold investments to enable future growth and maintain Samsung’s technological edge.

Samsung Electronics has announced record first-quarter sales. But its share prices hit a 16-month low. Analysts say it is because Samsung’s reputation as a technology powerhouse is under threat.

[Pkg]

Samsung Electronics has announced sales of 77 trillion won for the first quarter, an all-time high figure. Operating profit jumped 50% on-year. The surprise earnings have exceeded market expectations. However the company’s share prices hit the lowest level in 16 months. This is attributed to weak DRAM prices and signs of America’s monetary tightening. But some pundits argue this shows that the technological edge, which made Samsung a global brand, is faltering. One example is the use of Game Optimizing Service in Samsung’s latest smartphone which was to prevent excessive heat generation. The issue was resolved following an outburst of criticism but critics said it demonstrated a lack of technology.

[Soundbite] (Samsung Electronics Shareholder(Mar. 16)) : "Samsung adverts claim maximum performance while in fact, game performance has been throttled."

[Soundbite] Han Jong-hee(Samsung Electronics Vice Chair) : "We are sorry for causing concern."

There’s also concern of a high rate of defective products in the chip production line.

[Soundbite] (Samsung Electronics Shareholder(Recited by shareholder meeting’s host)) : "I heard that product approval rate is very low in 5-nanometer chip production and those that are more sophisticated. Is there a way to solve this?"

[Soundbite] Kyung Kye-hyun(Samsung Electronics Chair) : "Gradual improvements are stabilizing the situation."

Rivals such as Apple and TSMC are widening their gap with Samsung based on technological prowess while Chinese firms such as Xiaomi are quickly catching up with the Korean tech giant through price competitiveness.

[Soundbite] Lee Seung-woo(Eugene Investment & Securities Co.) : "In the past decade, excluding chips, sales continuously fell in all other Samsung divisions. It will be concerning if even semiconductors start to face growth hurdles."

Experts call for setting up mid to long term strategies and making bold investments to enable future growth and maintain Samsung’s technological edge.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- SAMSUNG ELECTRONICS’ LOW SHARE PRICES

-

- 입력 2022-04-08 15:12:27

- 수정2022-04-08 16:46:23

[Anchor Lead]

Samsung Electronics has announced record first-quarter sales. But its share prices hit a 16-month low. Analysts say it is because Samsung’s reputation as a technology powerhouse is under threat.

[Pkg]

Samsung Electronics has announced sales of 77 trillion won for the first quarter, an all-time high figure. Operating profit jumped 50% on-year. The surprise earnings have exceeded market expectations. However the company’s share prices hit the lowest level in 16 months. This is attributed to weak DRAM prices and signs of America’s monetary tightening. But some pundits argue this shows that the technological edge, which made Samsung a global brand, is faltering. One example is the use of Game Optimizing Service in Samsung’s latest smartphone which was to prevent excessive heat generation. The issue was resolved following an outburst of criticism but critics said it demonstrated a lack of technology.

[Soundbite] (Samsung Electronics Shareholder(Mar. 16)) : "Samsung adverts claim maximum performance while in fact, game performance has been throttled."

[Soundbite] Han Jong-hee(Samsung Electronics Vice Chair) : "We are sorry for causing concern."

There’s also concern of a high rate of defective products in the chip production line.

[Soundbite] (Samsung Electronics Shareholder(Recited by shareholder meeting’s host)) : "I heard that product approval rate is very low in 5-nanometer chip production and those that are more sophisticated. Is there a way to solve this?"

[Soundbite] Kyung Kye-hyun(Samsung Electronics Chair) : "Gradual improvements are stabilizing the situation."

Rivals such as Apple and TSMC are widening their gap with Samsung based on technological prowess while Chinese firms such as Xiaomi are quickly catching up with the Korean tech giant through price competitiveness.

[Soundbite] Lee Seung-woo(Eugene Investment & Securities Co.) : "In the past decade, excluding chips, sales continuously fell in all other Samsung divisions. It will be concerning if even semiconductors start to face growth hurdles."

Experts call for setting up mid to long term strategies and making bold investments to enable future growth and maintain Samsung’s technological edge.

Samsung Electronics has announced record first-quarter sales. But its share prices hit a 16-month low. Analysts say it is because Samsung’s reputation as a technology powerhouse is under threat.

[Pkg]

Samsung Electronics has announced sales of 77 trillion won for the first quarter, an all-time high figure. Operating profit jumped 50% on-year. The surprise earnings have exceeded market expectations. However the company’s share prices hit the lowest level in 16 months. This is attributed to weak DRAM prices and signs of America’s monetary tightening. But some pundits argue this shows that the technological edge, which made Samsung a global brand, is faltering. One example is the use of Game Optimizing Service in Samsung’s latest smartphone which was to prevent excessive heat generation. The issue was resolved following an outburst of criticism but critics said it demonstrated a lack of technology.

[Soundbite] (Samsung Electronics Shareholder(Mar. 16)) : "Samsung adverts claim maximum performance while in fact, game performance has been throttled."

[Soundbite] Han Jong-hee(Samsung Electronics Vice Chair) : "We are sorry for causing concern."

There’s also concern of a high rate of defective products in the chip production line.

[Soundbite] (Samsung Electronics Shareholder(Recited by shareholder meeting’s host)) : "I heard that product approval rate is very low in 5-nanometer chip production and those that are more sophisticated. Is there a way to solve this?"

[Soundbite] Kyung Kye-hyun(Samsung Electronics Chair) : "Gradual improvements are stabilizing the situation."

Rivals such as Apple and TSMC are widening their gap with Samsung based on technological prowess while Chinese firms such as Xiaomi are quickly catching up with the Korean tech giant through price competitiveness.

[Soundbite] Lee Seung-woo(Eugene Investment & Securities Co.) : "In the past decade, excluding chips, sales continuously fell in all other Samsung divisions. It will be concerning if even semiconductors start to face growth hurdles."

Experts call for setting up mid to long term strategies and making bold investments to enable future growth and maintain Samsung’s technological edge.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.