SHARP INCREASE IN FOREIGN EXCHANGE RATES

입력 2022.06.15 (15:23)

수정 2022.06.15 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

With foreign investors exiting the local bond market, the cost of borrowing and foreign exchange rates are sharply rising. Financial authorities have reiterated their resolve to stabilize markets. In an unusual move, the two heads of fiscal and monetary management held an emergency meeting.

[Pkg]

The won-dollar exchange rate has inched closer to 1,300 won. The rate gained nearly 50 won over the past 8 trading days as the dollar appreciation accelerates.

[Soundbite] Min Gyeong-won(Lead Researcher, Woori Bank) : "The absence of clear signals regarding the US Fed’s monetary tightening will raise uncertainties over the normalization of monetary policies."

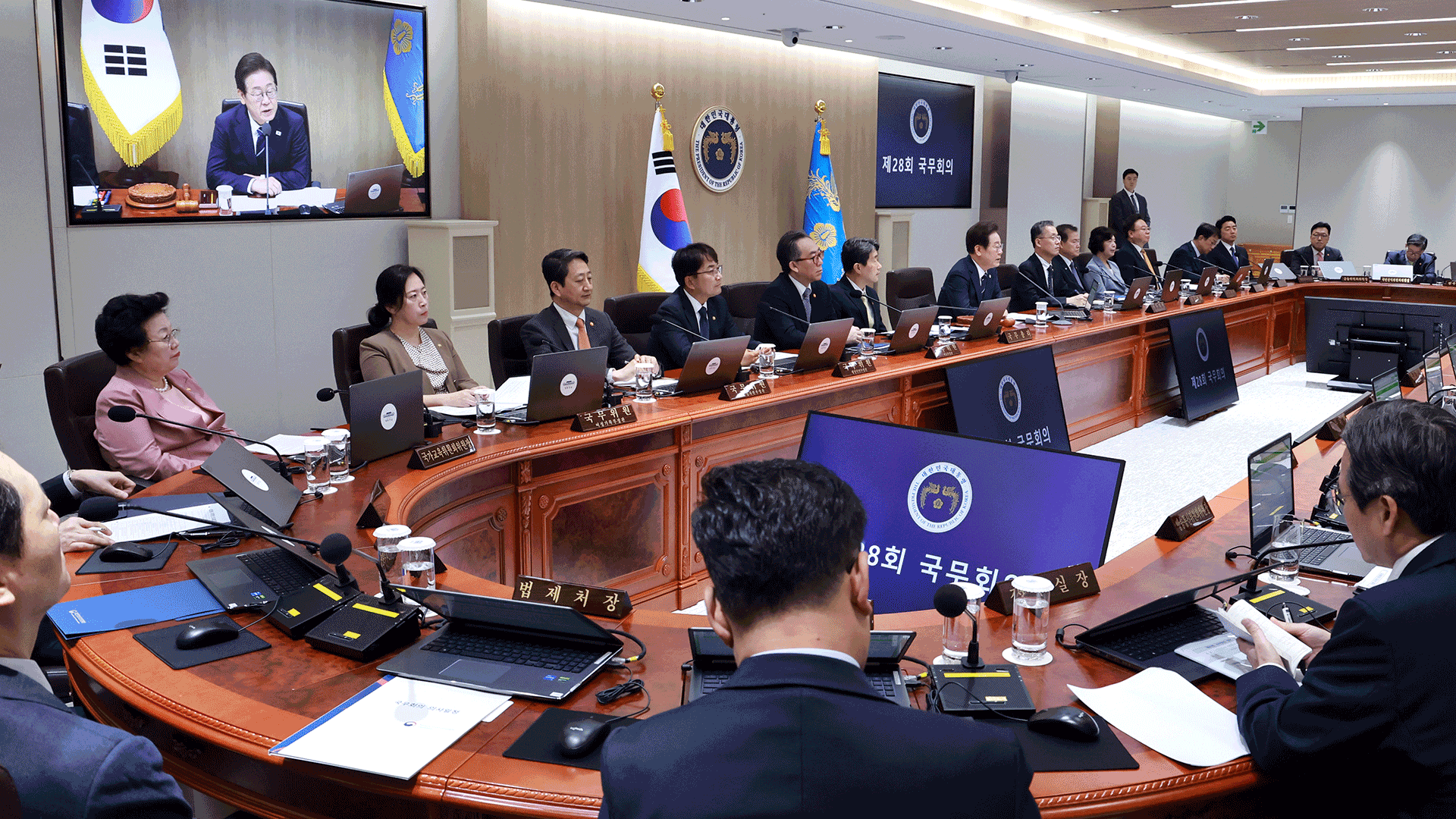

A sharp rise in the exchange rate also affects inflation and the financial market. A higher exchange rate raises the price of imported goods, fueling inflation. Foreign investors are buying up the greenback at a faster speed when its won value is lower, which in turn further increases the exchange rate in a vicious cycle. In fact, foreign investors retrieved close to 10 trillion won worth of Korean stocks and bonds this month alone. This had led to a drop in local stock prices and a rise in interest and foreign exchange rates. This is why Finance Minister Choo Kyung-ho held an emergency meeting with Bank of Korea governor Rhee Chang-yong.

[Soundbite] Joo Won (Hyundai Research Institute) : "U.S.-led jitters are also increasing volatility in Korea’s financial and forex markets. It’s necessary to tame the sentiment of market participants."

For a second day in a row, the central bank has called for strong market stabilization measures. Through minute adjustments, the BOK is trying to put a lid on any further exchange rate hikes. The government has also vowed to purchase an additional one trillion won worth of national bonds in a bid to stabilize interest rates. Facing a triple challenge of high interest, high inflation and high exchange rate, policy responses by fiscal and financial chiefs are being put to the test.

With foreign investors exiting the local bond market, the cost of borrowing and foreign exchange rates are sharply rising. Financial authorities have reiterated their resolve to stabilize markets. In an unusual move, the two heads of fiscal and monetary management held an emergency meeting.

[Pkg]

The won-dollar exchange rate has inched closer to 1,300 won. The rate gained nearly 50 won over the past 8 trading days as the dollar appreciation accelerates.

[Soundbite] Min Gyeong-won(Lead Researcher, Woori Bank) : "The absence of clear signals regarding the US Fed’s monetary tightening will raise uncertainties over the normalization of monetary policies."

A sharp rise in the exchange rate also affects inflation and the financial market. A higher exchange rate raises the price of imported goods, fueling inflation. Foreign investors are buying up the greenback at a faster speed when its won value is lower, which in turn further increases the exchange rate in a vicious cycle. In fact, foreign investors retrieved close to 10 trillion won worth of Korean stocks and bonds this month alone. This had led to a drop in local stock prices and a rise in interest and foreign exchange rates. This is why Finance Minister Choo Kyung-ho held an emergency meeting with Bank of Korea governor Rhee Chang-yong.

[Soundbite] Joo Won (Hyundai Research Institute) : "U.S.-led jitters are also increasing volatility in Korea’s financial and forex markets. It’s necessary to tame the sentiment of market participants."

For a second day in a row, the central bank has called for strong market stabilization measures. Through minute adjustments, the BOK is trying to put a lid on any further exchange rate hikes. The government has also vowed to purchase an additional one trillion won worth of national bonds in a bid to stabilize interest rates. Facing a triple challenge of high interest, high inflation and high exchange rate, policy responses by fiscal and financial chiefs are being put to the test.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- SHARP INCREASE IN FOREIGN EXCHANGE RATES

-

- 입력 2022-06-15 15:23:03

- 수정2022-06-15 16:45:03

[Anchor Lead]

With foreign investors exiting the local bond market, the cost of borrowing and foreign exchange rates are sharply rising. Financial authorities have reiterated their resolve to stabilize markets. In an unusual move, the two heads of fiscal and monetary management held an emergency meeting.

[Pkg]

The won-dollar exchange rate has inched closer to 1,300 won. The rate gained nearly 50 won over the past 8 trading days as the dollar appreciation accelerates.

[Soundbite] Min Gyeong-won(Lead Researcher, Woori Bank) : "The absence of clear signals regarding the US Fed’s monetary tightening will raise uncertainties over the normalization of monetary policies."

A sharp rise in the exchange rate also affects inflation and the financial market. A higher exchange rate raises the price of imported goods, fueling inflation. Foreign investors are buying up the greenback at a faster speed when its won value is lower, which in turn further increases the exchange rate in a vicious cycle. In fact, foreign investors retrieved close to 10 trillion won worth of Korean stocks and bonds this month alone. This had led to a drop in local stock prices and a rise in interest and foreign exchange rates. This is why Finance Minister Choo Kyung-ho held an emergency meeting with Bank of Korea governor Rhee Chang-yong.

[Soundbite] Joo Won (Hyundai Research Institute) : "U.S.-led jitters are also increasing volatility in Korea’s financial and forex markets. It’s necessary to tame the sentiment of market participants."

For a second day in a row, the central bank has called for strong market stabilization measures. Through minute adjustments, the BOK is trying to put a lid on any further exchange rate hikes. The government has also vowed to purchase an additional one trillion won worth of national bonds in a bid to stabilize interest rates. Facing a triple challenge of high interest, high inflation and high exchange rate, policy responses by fiscal and financial chiefs are being put to the test.

With foreign investors exiting the local bond market, the cost of borrowing and foreign exchange rates are sharply rising. Financial authorities have reiterated their resolve to stabilize markets. In an unusual move, the two heads of fiscal and monetary management held an emergency meeting.

[Pkg]

The won-dollar exchange rate has inched closer to 1,300 won. The rate gained nearly 50 won over the past 8 trading days as the dollar appreciation accelerates.

[Soundbite] Min Gyeong-won(Lead Researcher, Woori Bank) : "The absence of clear signals regarding the US Fed’s monetary tightening will raise uncertainties over the normalization of monetary policies."

A sharp rise in the exchange rate also affects inflation and the financial market. A higher exchange rate raises the price of imported goods, fueling inflation. Foreign investors are buying up the greenback at a faster speed when its won value is lower, which in turn further increases the exchange rate in a vicious cycle. In fact, foreign investors retrieved close to 10 trillion won worth of Korean stocks and bonds this month alone. This had led to a drop in local stock prices and a rise in interest and foreign exchange rates. This is why Finance Minister Choo Kyung-ho held an emergency meeting with Bank of Korea governor Rhee Chang-yong.

[Soundbite] Joo Won (Hyundai Research Institute) : "U.S.-led jitters are also increasing volatility in Korea’s financial and forex markets. It’s necessary to tame the sentiment of market participants."

For a second day in a row, the central bank has called for strong market stabilization measures. Through minute adjustments, the BOK is trying to put a lid on any further exchange rate hikes. The government has also vowed to purchase an additional one trillion won worth of national bonds in a bid to stabilize interest rates. Facing a triple challenge of high interest, high inflation and high exchange rate, policy responses by fiscal and financial chiefs are being put to the test.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[속보] 심우정 검찰총장, 검찰개혁에 “결론 정해놓고 추진하면 부작용”](/data/layer/904/2025/07/20250701_Y3C8sh.jpg)

이 기사에 대한 의견을 남겨주세요.