GOVT’S SUPPORT MEASURES FOR RATE HIKE

입력 2022.07.15 (15:04)

수정 2022.07.15 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

People who have taken out bank loans during the pandemic are now facing steep interest rates before the debt can be repaid. To address these difficulties, the government has laid out support measures for small business owners such as converting debt to a long-term payment plan and even reducing the original principal.

[Pkg]

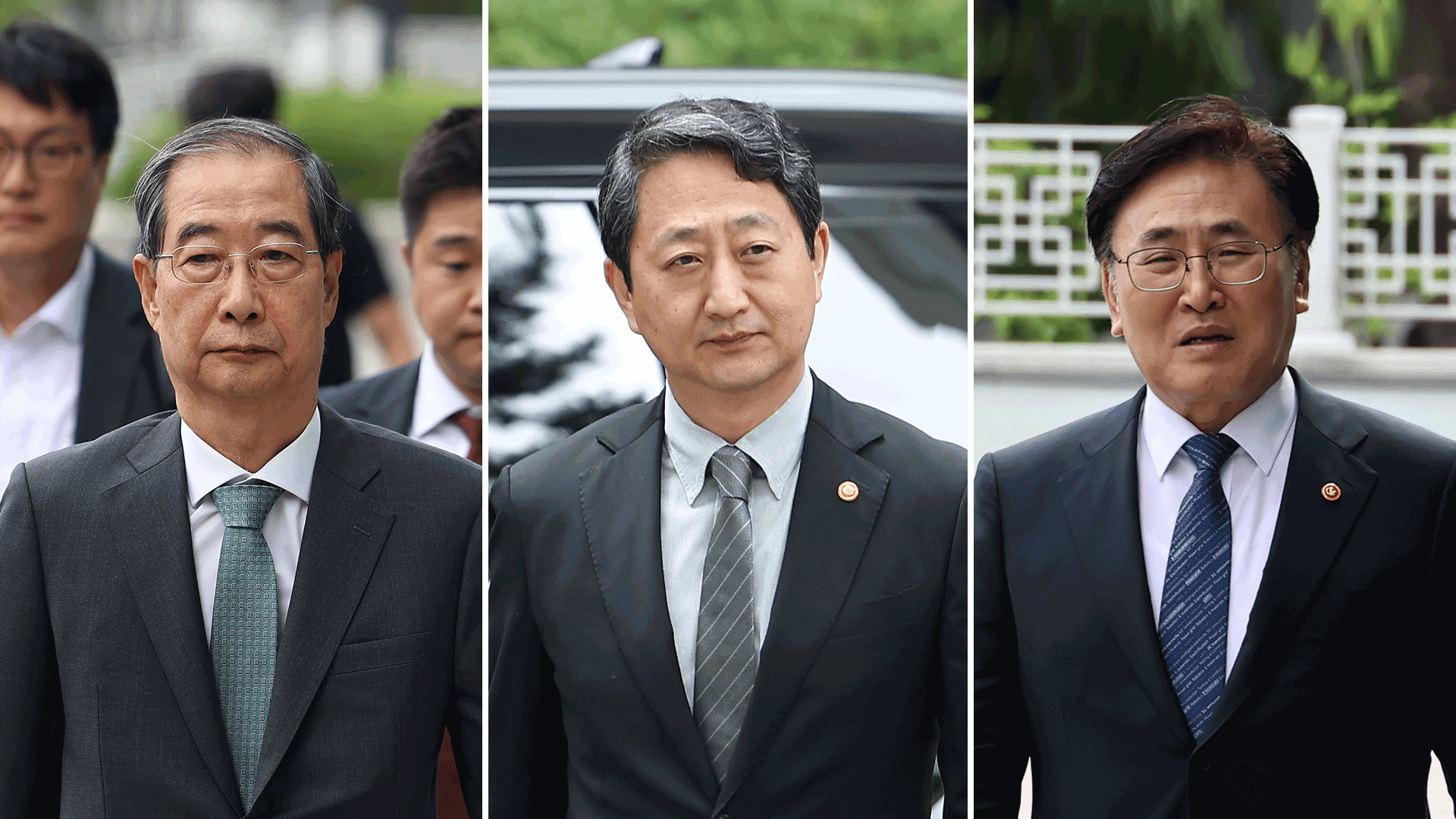

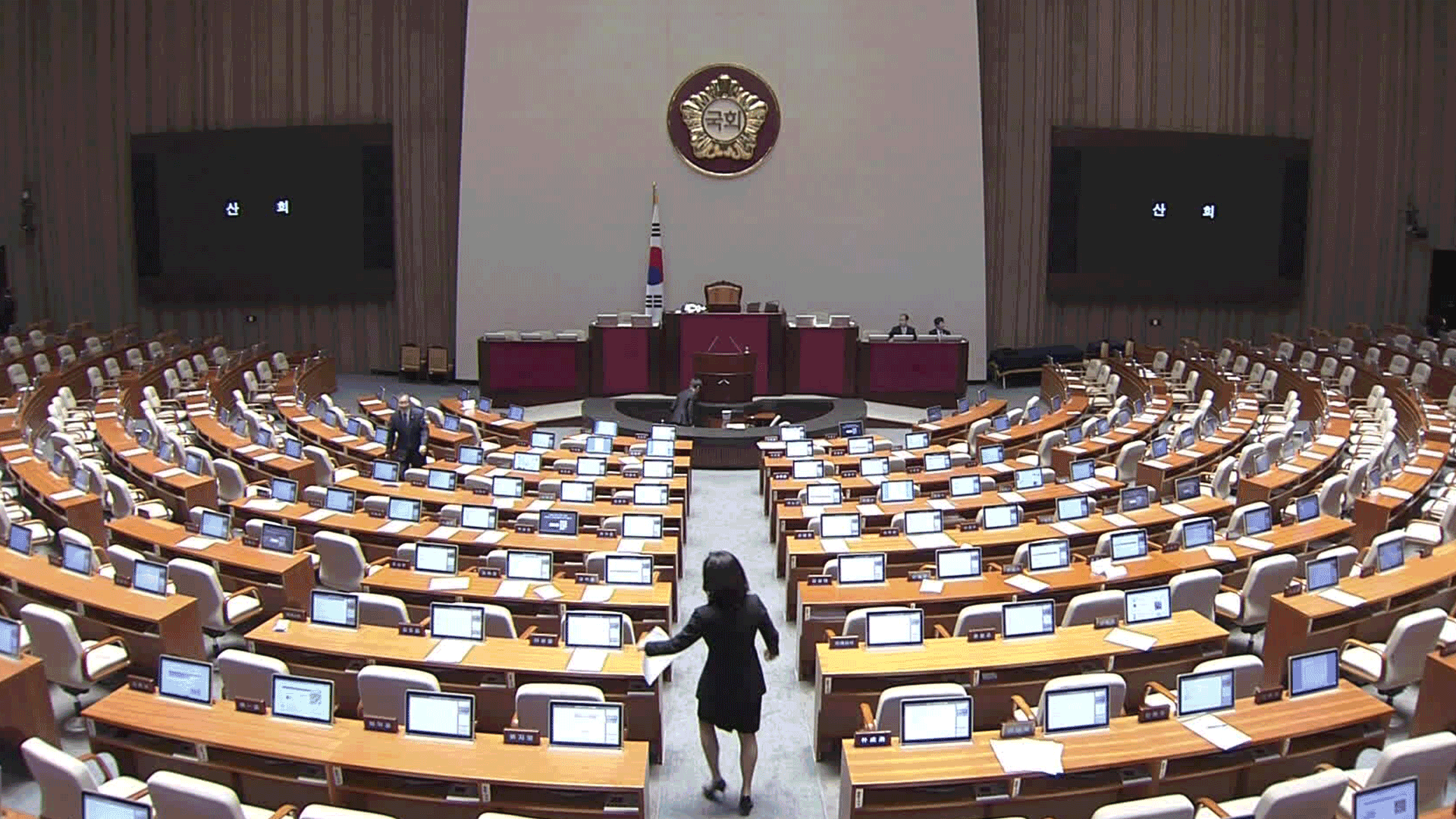

A day after the central bank raised its key rate by a record 50 basis points, President Yoon Suk-yeol chaired the second emergency economic meeting. The key discussion topic was around the debt burden for the socially vulnerable groups.

[Soundbite] Yoon Suk-yeol(President) : "Small merchants and the self-employed whose loans increased during the pandemic are now struggling to pay them off."

The government has been deferring the maturity of various loans for small merchants and the self-employed until now but the outstanding debt balance still stands at around 80 trillion won. The Financial Services Commission has decided to end the maturity extension measure by September and from then on shift the policy focus and help borrowers repay their debt over a longer period of time in installments. Loans worth some 30 trillion won which are at the greatest risk of going insolvent will be handled by the Korea Asset Management Corporation. Borrowers will be allowed to pay back loans over 20 years after paying interest only for a maximum of 3 years. Borrowers placed in worse situations such as those faced with business closures will see their principal reduced by as much as 90%. Loans with high annual interest rates of over seven percent, worth some 8.7 trillion won, will be converted to low-interest loans.

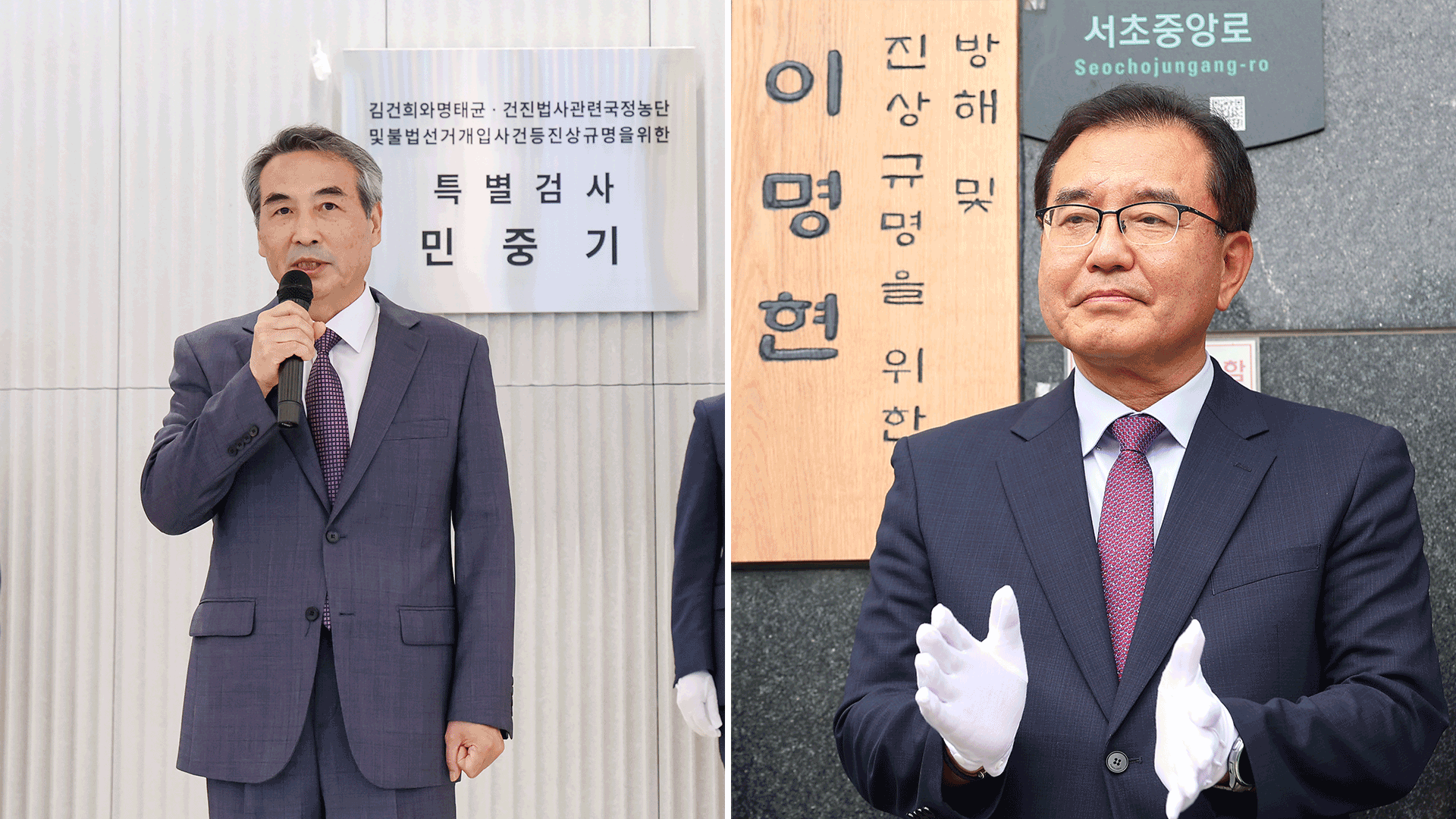

[Soundbite] Kim Joo-hyun(Chair, Financial Services Commission) : "We believe that a sustainable and healthy society is not feasible without support for these vulnerable groups."

Remaining loans will have their maturity further extended so full repayments can be made within 5 years.

[Soundbite] Go Jang-soo(Nat’l Cafe Owners Cooperative) : "Inevitably some people will be left out if support measures contain restrictions."

The government said the new set of measures will take effect in late September or early October. The measures also include slashing interest rates for young people who are undergoing a restoration of their credit level. This has raised concerns of fairness as such assistance can also benefit those who took out loans to make reckless investments that only resulted in losses.

People who have taken out bank loans during the pandemic are now facing steep interest rates before the debt can be repaid. To address these difficulties, the government has laid out support measures for small business owners such as converting debt to a long-term payment plan and even reducing the original principal.

[Pkg]

A day after the central bank raised its key rate by a record 50 basis points, President Yoon Suk-yeol chaired the second emergency economic meeting. The key discussion topic was around the debt burden for the socially vulnerable groups.

[Soundbite] Yoon Suk-yeol(President) : "Small merchants and the self-employed whose loans increased during the pandemic are now struggling to pay them off."

The government has been deferring the maturity of various loans for small merchants and the self-employed until now but the outstanding debt balance still stands at around 80 trillion won. The Financial Services Commission has decided to end the maturity extension measure by September and from then on shift the policy focus and help borrowers repay their debt over a longer period of time in installments. Loans worth some 30 trillion won which are at the greatest risk of going insolvent will be handled by the Korea Asset Management Corporation. Borrowers will be allowed to pay back loans over 20 years after paying interest only for a maximum of 3 years. Borrowers placed in worse situations such as those faced with business closures will see their principal reduced by as much as 90%. Loans with high annual interest rates of over seven percent, worth some 8.7 trillion won, will be converted to low-interest loans.

[Soundbite] Kim Joo-hyun(Chair, Financial Services Commission) : "We believe that a sustainable and healthy society is not feasible without support for these vulnerable groups."

Remaining loans will have their maturity further extended so full repayments can be made within 5 years.

[Soundbite] Go Jang-soo(Nat’l Cafe Owners Cooperative) : "Inevitably some people will be left out if support measures contain restrictions."

The government said the new set of measures will take effect in late September or early October. The measures also include slashing interest rates for young people who are undergoing a restoration of their credit level. This has raised concerns of fairness as such assistance can also benefit those who took out loans to make reckless investments that only resulted in losses.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- GOVT’S SUPPORT MEASURES FOR RATE HIKE

-

- 입력 2022-07-15 15:04:27

- 수정2022-07-15 16:45:12

[Anchor Lead]

People who have taken out bank loans during the pandemic are now facing steep interest rates before the debt can be repaid. To address these difficulties, the government has laid out support measures for small business owners such as converting debt to a long-term payment plan and even reducing the original principal.

[Pkg]

A day after the central bank raised its key rate by a record 50 basis points, President Yoon Suk-yeol chaired the second emergency economic meeting. The key discussion topic was around the debt burden for the socially vulnerable groups.

[Soundbite] Yoon Suk-yeol(President) : "Small merchants and the self-employed whose loans increased during the pandemic are now struggling to pay them off."

The government has been deferring the maturity of various loans for small merchants and the self-employed until now but the outstanding debt balance still stands at around 80 trillion won. The Financial Services Commission has decided to end the maturity extension measure by September and from then on shift the policy focus and help borrowers repay their debt over a longer period of time in installments. Loans worth some 30 trillion won which are at the greatest risk of going insolvent will be handled by the Korea Asset Management Corporation. Borrowers will be allowed to pay back loans over 20 years after paying interest only for a maximum of 3 years. Borrowers placed in worse situations such as those faced with business closures will see their principal reduced by as much as 90%. Loans with high annual interest rates of over seven percent, worth some 8.7 trillion won, will be converted to low-interest loans.

[Soundbite] Kim Joo-hyun(Chair, Financial Services Commission) : "We believe that a sustainable and healthy society is not feasible without support for these vulnerable groups."

Remaining loans will have their maturity further extended so full repayments can be made within 5 years.

[Soundbite] Go Jang-soo(Nat’l Cafe Owners Cooperative) : "Inevitably some people will be left out if support measures contain restrictions."

The government said the new set of measures will take effect in late September or early October. The measures also include slashing interest rates for young people who are undergoing a restoration of their credit level. This has raised concerns of fairness as such assistance can also benefit those who took out loans to make reckless investments that only resulted in losses.

People who have taken out bank loans during the pandemic are now facing steep interest rates before the debt can be repaid. To address these difficulties, the government has laid out support measures for small business owners such as converting debt to a long-term payment plan and even reducing the original principal.

[Pkg]

A day after the central bank raised its key rate by a record 50 basis points, President Yoon Suk-yeol chaired the second emergency economic meeting. The key discussion topic was around the debt burden for the socially vulnerable groups.

[Soundbite] Yoon Suk-yeol(President) : "Small merchants and the self-employed whose loans increased during the pandemic are now struggling to pay them off."

The government has been deferring the maturity of various loans for small merchants and the self-employed until now but the outstanding debt balance still stands at around 80 trillion won. The Financial Services Commission has decided to end the maturity extension measure by September and from then on shift the policy focus and help borrowers repay their debt over a longer period of time in installments. Loans worth some 30 trillion won which are at the greatest risk of going insolvent will be handled by the Korea Asset Management Corporation. Borrowers will be allowed to pay back loans over 20 years after paying interest only for a maximum of 3 years. Borrowers placed in worse situations such as those faced with business closures will see their principal reduced by as much as 90%. Loans with high annual interest rates of over seven percent, worth some 8.7 trillion won, will be converted to low-interest loans.

[Soundbite] Kim Joo-hyun(Chair, Financial Services Commission) : "We believe that a sustainable and healthy society is not feasible without support for these vulnerable groups."

Remaining loans will have their maturity further extended so full repayments can be made within 5 years.

[Soundbite] Go Jang-soo(Nat’l Cafe Owners Cooperative) : "Inevitably some people will be left out if support measures contain restrictions."

The government said the new set of measures will take effect in late September or early October. The measures also include slashing interest rates for young people who are undergoing a restoration of their credit level. This has raised concerns of fairness as such assistance can also benefit those who took out loans to make reckless investments that only resulted in losses.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.