PLANS ON INCOME & CORPORATE TAXES

입력 2022.07.19 (15:22)

수정 2022.07.19 (22:01)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The government and ruling party discussed the new administration's tax policy on Monday and agreed to lower income and corporate taxes. The plan is to revive the economy through tax cuts but the main opposition Democratic Party voiced criticism against the state's financial burden.

[Pkg]

The Yoon Suk-yeol administration held its first meeting to discuss revising the tax code. The ruling People Power Party called for a tax reduction. They want to lower the income tax to ease the burden on middle and working class families struggling with high inflation and economic woes.

[Soundbite] Sung Il-jong(PPP Policy Committee) : "The PPP requested easing the income tax to assist middle working class households facing high inflation."

The plan is to adjust the tax rate criteria so that more people can benefit from lower rates. Other measures include expanding the fuel tax cut and tax deductions for office workers' meal costs. Real estate-related taxes will also seek reductions. The maximum corporate tax rate, currently at 25%, will also be lowered to 22%. The government has also hinted at tax revisions to make the transfer of family businesses easier for small and medium-sized companies. Such measures will seek to revitalize business conditions and also create jobs.

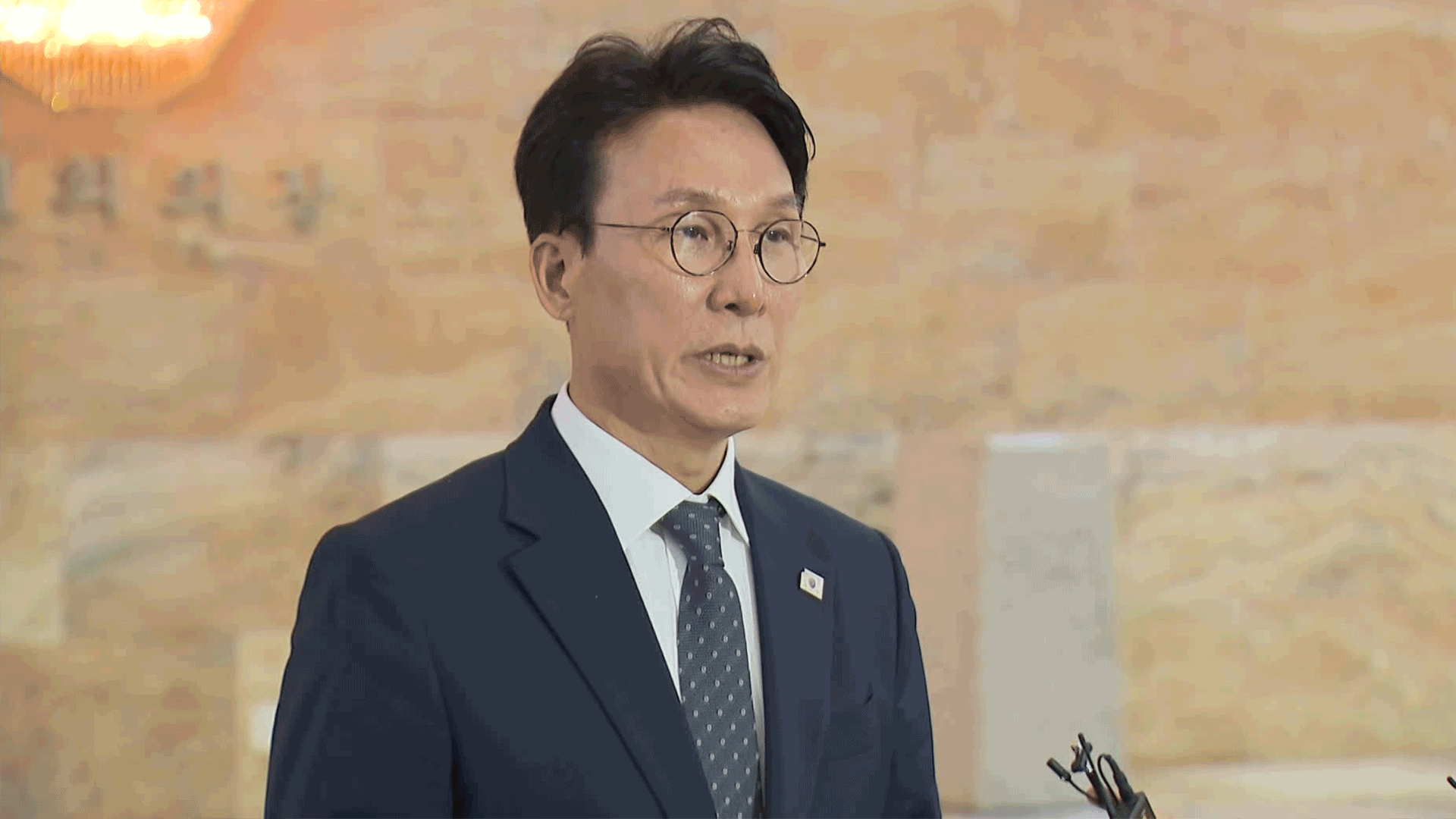

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will seek to revitalize the market, businesses and private sector through a reasonable tax revision that is in line with global standards and tax principles."

Meanwhile the main opposition Democratic Party, which has long opposed lowering corporate taxes saying it only benefits the wealthy, questioned the government about how it will source state finances.

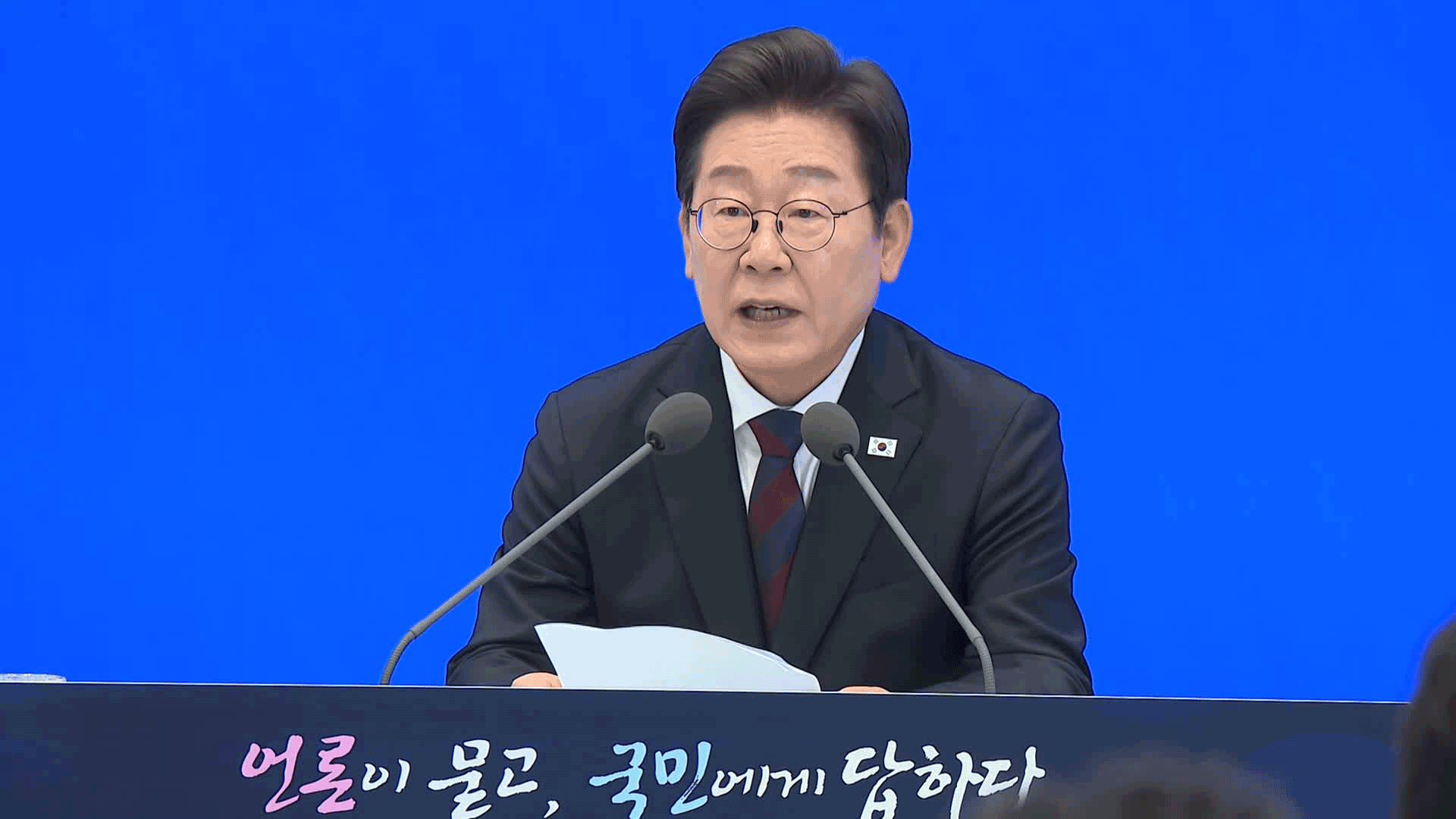

[Soundbite] Lee Yong-woo(Democratic Party) : "We wonder how the gov't will fund budgets amid tax cuts and monetary tightening."

However it's unlikely that the DP will oppose all tax measures as it also supports easing the income tax for middle and working classes and the overhauling of real estate taxes. The finalized tax code revision will be announced Thursday, the 21st this week.

The government and ruling party discussed the new administration's tax policy on Monday and agreed to lower income and corporate taxes. The plan is to revive the economy through tax cuts but the main opposition Democratic Party voiced criticism against the state's financial burden.

[Pkg]

The Yoon Suk-yeol administration held its first meeting to discuss revising the tax code. The ruling People Power Party called for a tax reduction. They want to lower the income tax to ease the burden on middle and working class families struggling with high inflation and economic woes.

[Soundbite] Sung Il-jong(PPP Policy Committee) : "The PPP requested easing the income tax to assist middle working class households facing high inflation."

The plan is to adjust the tax rate criteria so that more people can benefit from lower rates. Other measures include expanding the fuel tax cut and tax deductions for office workers' meal costs. Real estate-related taxes will also seek reductions. The maximum corporate tax rate, currently at 25%, will also be lowered to 22%. The government has also hinted at tax revisions to make the transfer of family businesses easier for small and medium-sized companies. Such measures will seek to revitalize business conditions and also create jobs.

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will seek to revitalize the market, businesses and private sector through a reasonable tax revision that is in line with global standards and tax principles."

Meanwhile the main opposition Democratic Party, which has long opposed lowering corporate taxes saying it only benefits the wealthy, questioned the government about how it will source state finances.

[Soundbite] Lee Yong-woo(Democratic Party) : "We wonder how the gov't will fund budgets amid tax cuts and monetary tightening."

However it's unlikely that the DP will oppose all tax measures as it also supports easing the income tax for middle and working classes and the overhauling of real estate taxes. The finalized tax code revision will be announced Thursday, the 21st this week.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- PLANS ON INCOME & CORPORATE TAXES

-

- 입력 2022-07-19 15:22:36

- 수정2022-07-19 22:01:54

[Anchor Lead]

The government and ruling party discussed the new administration's tax policy on Monday and agreed to lower income and corporate taxes. The plan is to revive the economy through tax cuts but the main opposition Democratic Party voiced criticism against the state's financial burden.

[Pkg]

The Yoon Suk-yeol administration held its first meeting to discuss revising the tax code. The ruling People Power Party called for a tax reduction. They want to lower the income tax to ease the burden on middle and working class families struggling with high inflation and economic woes.

[Soundbite] Sung Il-jong(PPP Policy Committee) : "The PPP requested easing the income tax to assist middle working class households facing high inflation."

The plan is to adjust the tax rate criteria so that more people can benefit from lower rates. Other measures include expanding the fuel tax cut and tax deductions for office workers' meal costs. Real estate-related taxes will also seek reductions. The maximum corporate tax rate, currently at 25%, will also be lowered to 22%. The government has also hinted at tax revisions to make the transfer of family businesses easier for small and medium-sized companies. Such measures will seek to revitalize business conditions and also create jobs.

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will seek to revitalize the market, businesses and private sector through a reasonable tax revision that is in line with global standards and tax principles."

Meanwhile the main opposition Democratic Party, which has long opposed lowering corporate taxes saying it only benefits the wealthy, questioned the government about how it will source state finances.

[Soundbite] Lee Yong-woo(Democratic Party) : "We wonder how the gov't will fund budgets amid tax cuts and monetary tightening."

However it's unlikely that the DP will oppose all tax measures as it also supports easing the income tax for middle and working classes and the overhauling of real estate taxes. The finalized tax code revision will be announced Thursday, the 21st this week.

The government and ruling party discussed the new administration's tax policy on Monday and agreed to lower income and corporate taxes. The plan is to revive the economy through tax cuts but the main opposition Democratic Party voiced criticism against the state's financial burden.

[Pkg]

The Yoon Suk-yeol administration held its first meeting to discuss revising the tax code. The ruling People Power Party called for a tax reduction. They want to lower the income tax to ease the burden on middle and working class families struggling with high inflation and economic woes.

[Soundbite] Sung Il-jong(PPP Policy Committee) : "The PPP requested easing the income tax to assist middle working class households facing high inflation."

The plan is to adjust the tax rate criteria so that more people can benefit from lower rates. Other measures include expanding the fuel tax cut and tax deductions for office workers' meal costs. Real estate-related taxes will also seek reductions. The maximum corporate tax rate, currently at 25%, will also be lowered to 22%. The government has also hinted at tax revisions to make the transfer of family businesses easier for small and medium-sized companies. Such measures will seek to revitalize business conditions and also create jobs.

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will seek to revitalize the market, businesses and private sector through a reasonable tax revision that is in line with global standards and tax principles."

Meanwhile the main opposition Democratic Party, which has long opposed lowering corporate taxes saying it only benefits the wealthy, questioned the government about how it will source state finances.

[Soundbite] Lee Yong-woo(Democratic Party) : "We wonder how the gov't will fund budgets amid tax cuts and monetary tightening."

However it's unlikely that the DP will oppose all tax measures as it also supports easing the income tax for middle and working classes and the overhauling of real estate taxes. The finalized tax code revision will be announced Thursday, the 21st this week.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] 도이치 주포 “김건희, 내 덕에 떼돈 벌어…22억 원 주문”](/data/news/2025/07/03/20250703_KpuU43.png)

![[단독] “쪽지 얼핏 봤다, 안 받았다”더니…CCTV에선 문건 챙긴 이상민](/data/news/2025/07/03/20250703_Lv3LjI.png)

이 기사에 대한 의견을 남겨주세요.