CORPORATE TAX TO BE LOWERED

입력 2022.07.22 (15:13)

수정 2022.07.22 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The government aims to let the private sector drive economic growth. As a way to achieve that goal, corporate tax will be lowered to lessen the financial burden on private companies.

[Pkg]

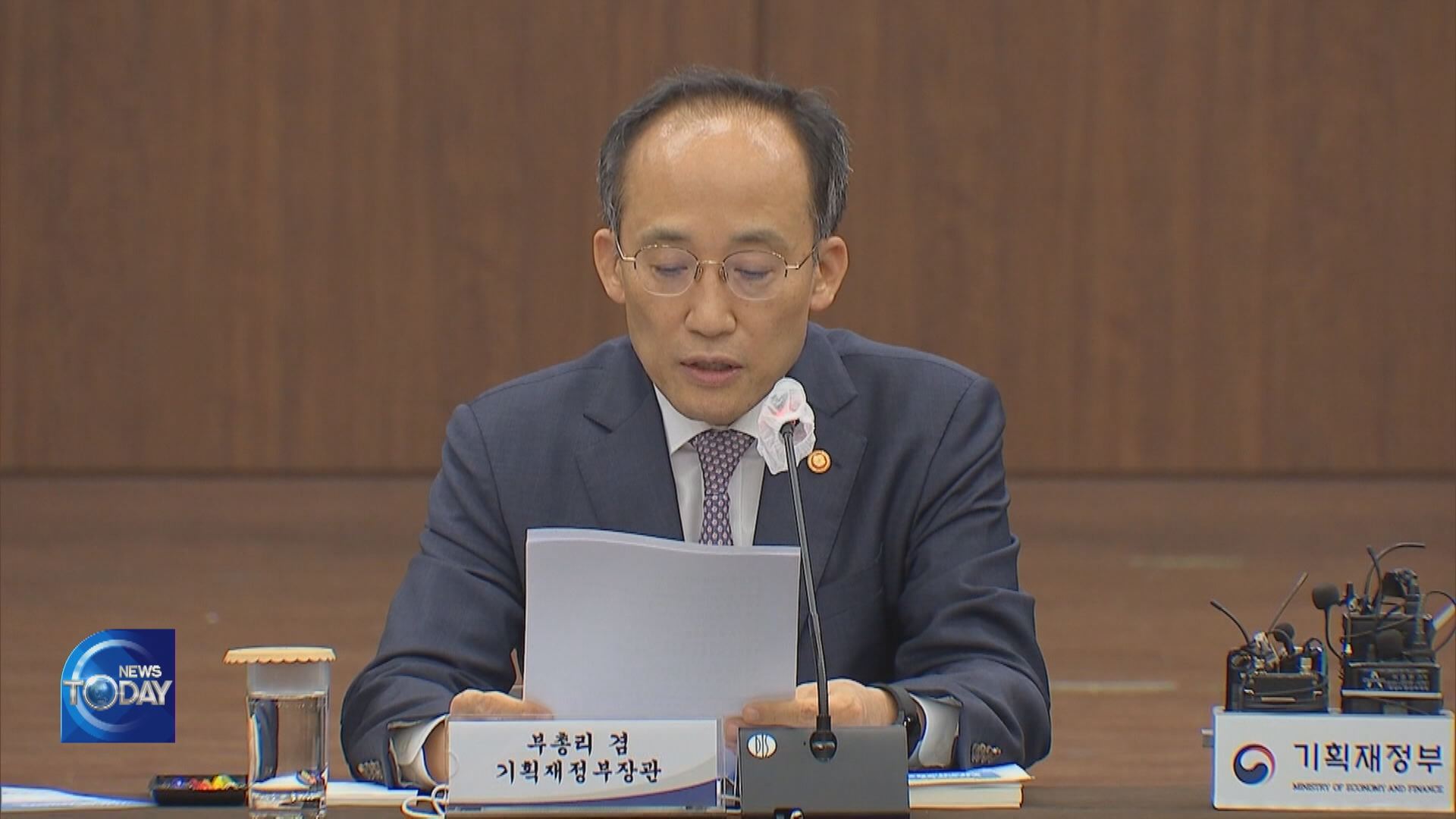

The government believes the corporate tax rate is relatively high and tax brackets are too complicated. So it plans to lower the corporate tax ceiling to 22% the first decrease in five years. Tax brackets will also be simplified. There will be only two tax brackets for conglomerates. But, in order to prevent the new taxation measure from benefiting only large corporations, the lowest tax rate bracket will be expanded for small and medium-sized companies.

[Soundbite] Sohn Kyung-shik(Chair, Tax System Development Deliberation Committee) : "The focus is on building the basis for an upgraded path to growth."

Also, the deduction for family business succession will be allowed for firms with sales of under one trillion won so that small and medium-sized companies with technical capabilities can continue operating. Subsequently, the amount of inheritance tax exemption will be raised to a maximum 100 billion won and the post-management period shortened. With reduced tax burdens, the government hopes that private companies would increase investment and employment, which will eventually boost local spending and new investments. However, it is unclear whether corporate investment would increase immediately. Inflation and interest and currency exchange rates all remain high and geopolitical situations are still uncertain.

[Soundbite] Joo Won(Hyundai Research Institute) : "The key to corporate tax reduction policy is to improve the overall local investment environment so that corporations can make investments locally."

Also, the special taxation for promoting investment and mutually beneficial cooperation, a tax imposed on a company's unspent money, will be terminated at the end of this year.

The government aims to let the private sector drive economic growth. As a way to achieve that goal, corporate tax will be lowered to lessen the financial burden on private companies.

[Pkg]

The government believes the corporate tax rate is relatively high and tax brackets are too complicated. So it plans to lower the corporate tax ceiling to 22% the first decrease in five years. Tax brackets will also be simplified. There will be only two tax brackets for conglomerates. But, in order to prevent the new taxation measure from benefiting only large corporations, the lowest tax rate bracket will be expanded for small and medium-sized companies.

[Soundbite] Sohn Kyung-shik(Chair, Tax System Development Deliberation Committee) : "The focus is on building the basis for an upgraded path to growth."

Also, the deduction for family business succession will be allowed for firms with sales of under one trillion won so that small and medium-sized companies with technical capabilities can continue operating. Subsequently, the amount of inheritance tax exemption will be raised to a maximum 100 billion won and the post-management period shortened. With reduced tax burdens, the government hopes that private companies would increase investment and employment, which will eventually boost local spending and new investments. However, it is unclear whether corporate investment would increase immediately. Inflation and interest and currency exchange rates all remain high and geopolitical situations are still uncertain.

[Soundbite] Joo Won(Hyundai Research Institute) : "The key to corporate tax reduction policy is to improve the overall local investment environment so that corporations can make investments locally."

Also, the special taxation for promoting investment and mutually beneficial cooperation, a tax imposed on a company's unspent money, will be terminated at the end of this year.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- CORPORATE TAX TO BE LOWERED

-

- 입력 2022-07-22 15:13:28

- 수정2022-07-22 16:45:30

[Anchor Lead]

The government aims to let the private sector drive economic growth. As a way to achieve that goal, corporate tax will be lowered to lessen the financial burden on private companies.

[Pkg]

The government believes the corporate tax rate is relatively high and tax brackets are too complicated. So it plans to lower the corporate tax ceiling to 22% the first decrease in five years. Tax brackets will also be simplified. There will be only two tax brackets for conglomerates. But, in order to prevent the new taxation measure from benefiting only large corporations, the lowest tax rate bracket will be expanded for small and medium-sized companies.

[Soundbite] Sohn Kyung-shik(Chair, Tax System Development Deliberation Committee) : "The focus is on building the basis for an upgraded path to growth."

Also, the deduction for family business succession will be allowed for firms with sales of under one trillion won so that small and medium-sized companies with technical capabilities can continue operating. Subsequently, the amount of inheritance tax exemption will be raised to a maximum 100 billion won and the post-management period shortened. With reduced tax burdens, the government hopes that private companies would increase investment and employment, which will eventually boost local spending and new investments. However, it is unclear whether corporate investment would increase immediately. Inflation and interest and currency exchange rates all remain high and geopolitical situations are still uncertain.

[Soundbite] Joo Won(Hyundai Research Institute) : "The key to corporate tax reduction policy is to improve the overall local investment environment so that corporations can make investments locally."

Also, the special taxation for promoting investment and mutually beneficial cooperation, a tax imposed on a company's unspent money, will be terminated at the end of this year.

The government aims to let the private sector drive economic growth. As a way to achieve that goal, corporate tax will be lowered to lessen the financial burden on private companies.

[Pkg]

The government believes the corporate tax rate is relatively high and tax brackets are too complicated. So it plans to lower the corporate tax ceiling to 22% the first decrease in five years. Tax brackets will also be simplified. There will be only two tax brackets for conglomerates. But, in order to prevent the new taxation measure from benefiting only large corporations, the lowest tax rate bracket will be expanded for small and medium-sized companies.

[Soundbite] Sohn Kyung-shik(Chair, Tax System Development Deliberation Committee) : "The focus is on building the basis for an upgraded path to growth."

Also, the deduction for family business succession will be allowed for firms with sales of under one trillion won so that small and medium-sized companies with technical capabilities can continue operating. Subsequently, the amount of inheritance tax exemption will be raised to a maximum 100 billion won and the post-management period shortened. With reduced tax burdens, the government hopes that private companies would increase investment and employment, which will eventually boost local spending and new investments. However, it is unclear whether corporate investment would increase immediately. Inflation and interest and currency exchange rates all remain high and geopolitical situations are still uncertain.

[Soundbite] Joo Won(Hyundai Research Institute) : "The key to corporate tax reduction policy is to improve the overall local investment environment so that corporations can make investments locally."

Also, the special taxation for promoting investment and mutually beneficial cooperation, a tax imposed on a company's unspent money, will be terminated at the end of this year.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[속보] 이 대통령 “주택 투기 수단되며 주거 불안정 초래”](/data/news/2025/07/01/20250701_NWBMR4.png)

이 기사에 대한 의견을 남겨주세요.