WON-DOLLAR RATE SOARS

입력 2022.09.23 (14:59)

수정 2022.09.23 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

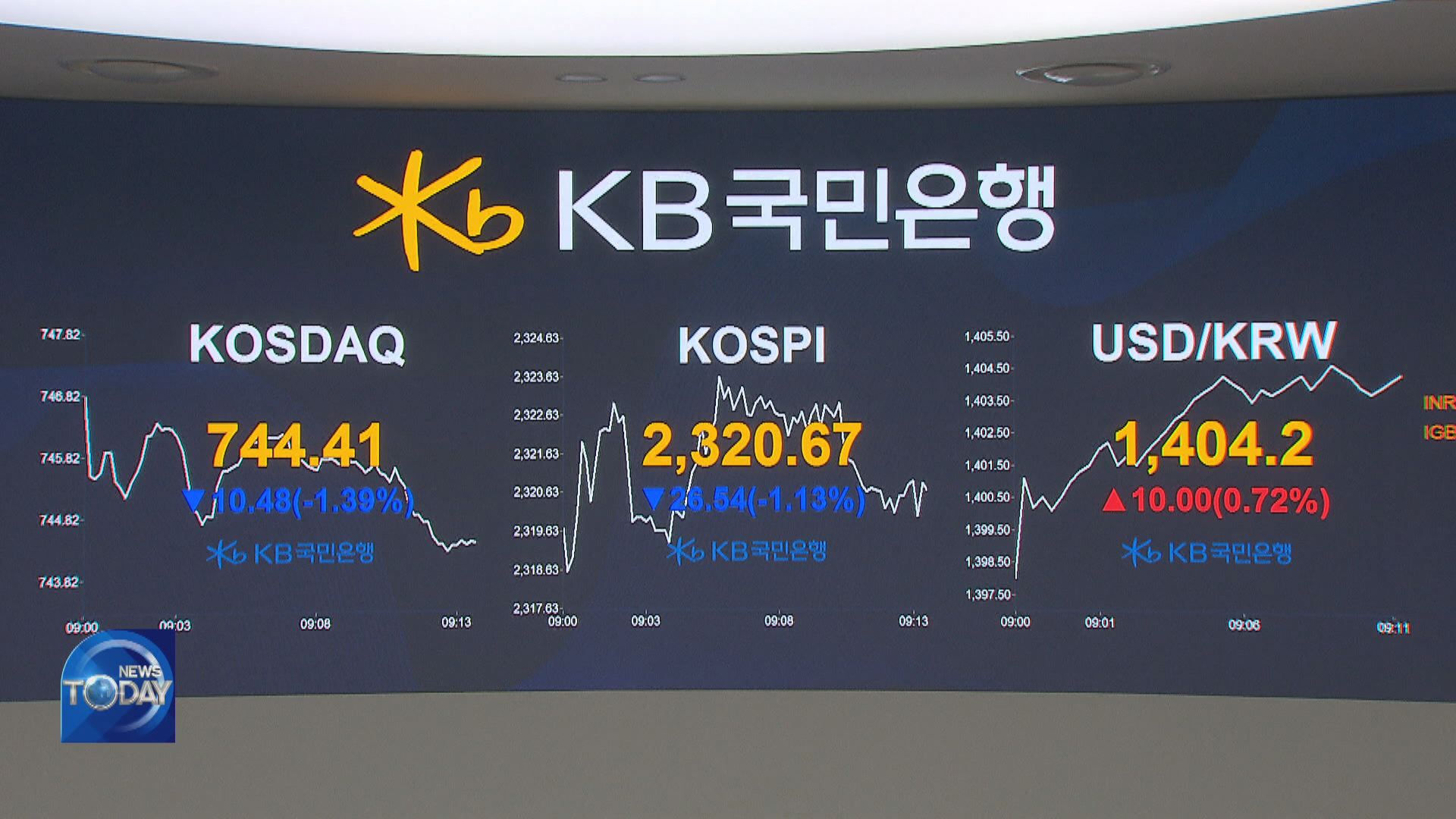

The U.S. Fed's refusal to lower interest rates until inflation is tamed has further fueled the rising value of the U.S. currency. The value of the Korean won has plummeted again the greenback, surpassing 1,400 won against the dollar for the first time since the Asian financial crisis.

[Pkg]

As soon as the market opened, the won-dollar exchange rate surpassed 1,400 won. Following Finance Minister Choo Kyung-ho's verbal intervention remarks, the presidential office said a currency swap would be included in liquidity facilities agreed upon by the leaders of South Korea and the U.S. in the afternoon. However, these weren't enough to stop the dollar from surging. The trading day ended with the exchange rate nearing 1,410 won per dollar. The main reason is the interest rate gap reversal following three consecutive 0.75 percentage point interest rate hikes by the Fed. Moreover, the Fed says it's not going to lower the key rate until inflation is tamed.

[Soundbite] Moon Jung-hee(Kookmin Bank) : "The won-dollar rate could go up to 1,430 won or 1,450 won because the U.S. Fed has raised the key rate more than expected."

The fact that the exchange rate has surpassed the psychological barrier of 1,400 won is shocking enough. But the pace of the rate's increase is all the more unnerving. The won-dollar exchange rate surged nearly 6 percent just one month after the Jackson Hole meeting, where the Fed made it clear it's committed to its tapering policy. Worried about possible losses, foreign investors sold shares worth more than 100 billion won. BOK Governor Rhee Chang-yong has hinted at raising the central bank's key rate by 0.5 percentage points, citing a change in conditions. That's an apparent referral to the interest rate gap.

[Soundbite] Rhee Chang-yong(Governor, Bank of Korea) : "Our initial expectation that the U.S. key rate would settle down in a 4-percent range has changed."

Rhee added that the decision on raising the key rate would be made based on foreign exchange rates and inflation, as there are still 2 to 3 weeks left before the next monetary policy meeting.

The U.S. Fed's refusal to lower interest rates until inflation is tamed has further fueled the rising value of the U.S. currency. The value of the Korean won has plummeted again the greenback, surpassing 1,400 won against the dollar for the first time since the Asian financial crisis.

[Pkg]

As soon as the market opened, the won-dollar exchange rate surpassed 1,400 won. Following Finance Minister Choo Kyung-ho's verbal intervention remarks, the presidential office said a currency swap would be included in liquidity facilities agreed upon by the leaders of South Korea and the U.S. in the afternoon. However, these weren't enough to stop the dollar from surging. The trading day ended with the exchange rate nearing 1,410 won per dollar. The main reason is the interest rate gap reversal following three consecutive 0.75 percentage point interest rate hikes by the Fed. Moreover, the Fed says it's not going to lower the key rate until inflation is tamed.

[Soundbite] Moon Jung-hee(Kookmin Bank) : "The won-dollar rate could go up to 1,430 won or 1,450 won because the U.S. Fed has raised the key rate more than expected."

The fact that the exchange rate has surpassed the psychological barrier of 1,400 won is shocking enough. But the pace of the rate's increase is all the more unnerving. The won-dollar exchange rate surged nearly 6 percent just one month after the Jackson Hole meeting, where the Fed made it clear it's committed to its tapering policy. Worried about possible losses, foreign investors sold shares worth more than 100 billion won. BOK Governor Rhee Chang-yong has hinted at raising the central bank's key rate by 0.5 percentage points, citing a change in conditions. That's an apparent referral to the interest rate gap.

[Soundbite] Rhee Chang-yong(Governor, Bank of Korea) : "Our initial expectation that the U.S. key rate would settle down in a 4-percent range has changed."

Rhee added that the decision on raising the key rate would be made based on foreign exchange rates and inflation, as there are still 2 to 3 weeks left before the next monetary policy meeting.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- WON-DOLLAR RATE SOARS

-

- 입력 2022-09-23 14:59:55

- 수정2022-09-23 16:45:07

[Anchor Lead]

The U.S. Fed's refusal to lower interest rates until inflation is tamed has further fueled the rising value of the U.S. currency. The value of the Korean won has plummeted again the greenback, surpassing 1,400 won against the dollar for the first time since the Asian financial crisis.

[Pkg]

As soon as the market opened, the won-dollar exchange rate surpassed 1,400 won. Following Finance Minister Choo Kyung-ho's verbal intervention remarks, the presidential office said a currency swap would be included in liquidity facilities agreed upon by the leaders of South Korea and the U.S. in the afternoon. However, these weren't enough to stop the dollar from surging. The trading day ended with the exchange rate nearing 1,410 won per dollar. The main reason is the interest rate gap reversal following three consecutive 0.75 percentage point interest rate hikes by the Fed. Moreover, the Fed says it's not going to lower the key rate until inflation is tamed.

[Soundbite] Moon Jung-hee(Kookmin Bank) : "The won-dollar rate could go up to 1,430 won or 1,450 won because the U.S. Fed has raised the key rate more than expected."

The fact that the exchange rate has surpassed the psychological barrier of 1,400 won is shocking enough. But the pace of the rate's increase is all the more unnerving. The won-dollar exchange rate surged nearly 6 percent just one month after the Jackson Hole meeting, where the Fed made it clear it's committed to its tapering policy. Worried about possible losses, foreign investors sold shares worth more than 100 billion won. BOK Governor Rhee Chang-yong has hinted at raising the central bank's key rate by 0.5 percentage points, citing a change in conditions. That's an apparent referral to the interest rate gap.

[Soundbite] Rhee Chang-yong(Governor, Bank of Korea) : "Our initial expectation that the U.S. key rate would settle down in a 4-percent range has changed."

Rhee added that the decision on raising the key rate would be made based on foreign exchange rates and inflation, as there are still 2 to 3 weeks left before the next monetary policy meeting.

The U.S. Fed's refusal to lower interest rates until inflation is tamed has further fueled the rising value of the U.S. currency. The value of the Korean won has plummeted again the greenback, surpassing 1,400 won against the dollar for the first time since the Asian financial crisis.

[Pkg]

As soon as the market opened, the won-dollar exchange rate surpassed 1,400 won. Following Finance Minister Choo Kyung-ho's verbal intervention remarks, the presidential office said a currency swap would be included in liquidity facilities agreed upon by the leaders of South Korea and the U.S. in the afternoon. However, these weren't enough to stop the dollar from surging. The trading day ended with the exchange rate nearing 1,410 won per dollar. The main reason is the interest rate gap reversal following three consecutive 0.75 percentage point interest rate hikes by the Fed. Moreover, the Fed says it's not going to lower the key rate until inflation is tamed.

[Soundbite] Moon Jung-hee(Kookmin Bank) : "The won-dollar rate could go up to 1,430 won or 1,450 won because the U.S. Fed has raised the key rate more than expected."

The fact that the exchange rate has surpassed the psychological barrier of 1,400 won is shocking enough. But the pace of the rate's increase is all the more unnerving. The won-dollar exchange rate surged nearly 6 percent just one month after the Jackson Hole meeting, where the Fed made it clear it's committed to its tapering policy. Worried about possible losses, foreign investors sold shares worth more than 100 billion won. BOK Governor Rhee Chang-yong has hinted at raising the central bank's key rate by 0.5 percentage points, citing a change in conditions. That's an apparent referral to the interest rate gap.

[Soundbite] Rhee Chang-yong(Governor, Bank of Korea) : "Our initial expectation that the U.S. key rate would settle down in a 4-percent range has changed."

Rhee added that the decision on raising the key rate would be made based on foreign exchange rates and inflation, as there are still 2 to 3 weeks left before the next monetary policy meeting.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] 김민석 총리, 취임 첫 일정으로 ‘송미령 반대’ <br>농민단체 농성장 방문](/data/news/2025/07/03/20250703_YUTdgQ.png)

이 기사에 대한 의견을 남겨주세요.