INTEREST RATE HIKE IMPACT YOUNG ADULTS

입력 2022.10.13 (15:09)

수정 2022.10.13 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The Bank of Korea's interest rate hike has caused many people who borrowed money on floating rates to pay more in interests. The move has impacted young adults in their 20s and 30s more profoundly since they have never experienced such high interest rates.

[Pkg]

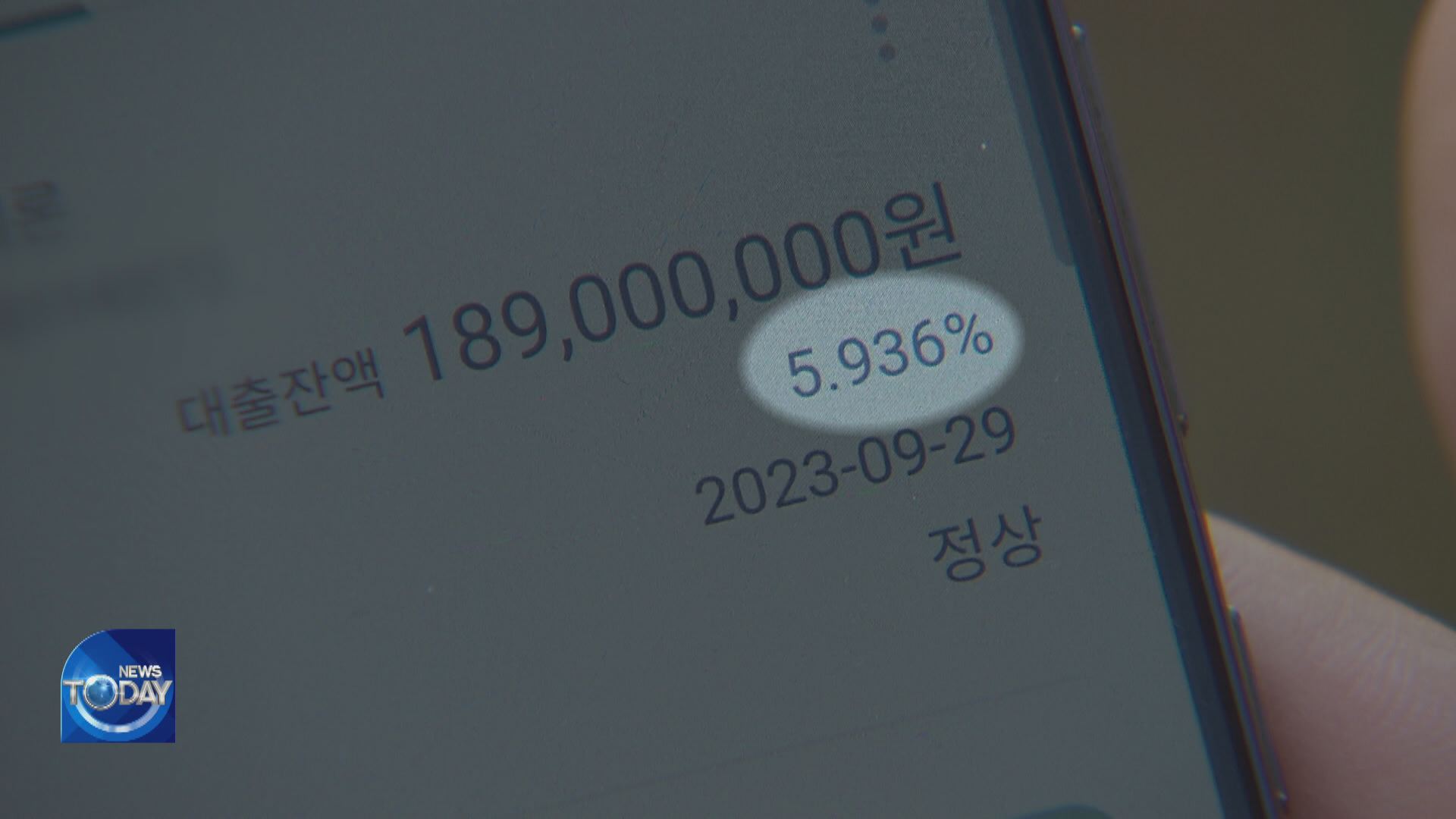

This young man in his 20s borrowed 190 million won at a floating rate for six months to lease a home. The interest rate, which used to be in the mid-3% range, is now nearing 6% one year later.

[Soundbite] (Office worker in his 20s (VOICE MODIFIED)) : "I never imagined this and never knew of such a case, which was why I borrowed at a floating rate. It’s shocking to see the rate still rising."

Having to pay about 40% of monthly salary in interest, he's left with almost no disposable income after paying for food and basic utilities.

[Soundbite] (Office worker in his 20s (VOICE MODIFIED)) : "My hands shake in fear every time I have to pay interest. It takes up most of my pay and I’m concerned about how to live another month."

Six out of ten jeonse mortgage loans by the banks are made to such young adults in their 20s and 30s. Floating interest rates account for about 94% of these jeonse mortgage loans which are entirely affected by the rising policy interest rate. This office worker in his 30s is in the same predicament. He took out 120 million won in credit loan. All he can do is sigh at the interest rate rising every three months.

[Soundbite] (Office worker in his 30s (VOICE MODIFIED)) : "My expenses keep mounting as my children grow. It’s become harder to bear rising interest rates."

As the highest interest rate on credit loans nears 7%, the latest hike is likely to push the ceiling above the 8% mark. Young people are likely to struggle under heavier debts let alone save.

[Soundbite] Prof. Seo Ji-yong(College of Business and Economics, Sangmyung Univ.) : "Since they save substantially less, it would take them longer to accumulate a decent sum."

The Bank of Korea projects the recent 0.5% point increase in interest rate would result in businesses and households paying 12.2 trillion won more in interests.

The Bank of Korea's interest rate hike has caused many people who borrowed money on floating rates to pay more in interests. The move has impacted young adults in their 20s and 30s more profoundly since they have never experienced such high interest rates.

[Pkg]

This young man in his 20s borrowed 190 million won at a floating rate for six months to lease a home. The interest rate, which used to be in the mid-3% range, is now nearing 6% one year later.

[Soundbite] (Office worker in his 20s (VOICE MODIFIED)) : "I never imagined this and never knew of such a case, which was why I borrowed at a floating rate. It’s shocking to see the rate still rising."

Having to pay about 40% of monthly salary in interest, he's left with almost no disposable income after paying for food and basic utilities.

[Soundbite] (Office worker in his 20s (VOICE MODIFIED)) : "My hands shake in fear every time I have to pay interest. It takes up most of my pay and I’m concerned about how to live another month."

Six out of ten jeonse mortgage loans by the banks are made to such young adults in their 20s and 30s. Floating interest rates account for about 94% of these jeonse mortgage loans which are entirely affected by the rising policy interest rate. This office worker in his 30s is in the same predicament. He took out 120 million won in credit loan. All he can do is sigh at the interest rate rising every three months.

[Soundbite] (Office worker in his 30s (VOICE MODIFIED)) : "My expenses keep mounting as my children grow. It’s become harder to bear rising interest rates."

As the highest interest rate on credit loans nears 7%, the latest hike is likely to push the ceiling above the 8% mark. Young people are likely to struggle under heavier debts let alone save.

[Soundbite] Prof. Seo Ji-yong(College of Business and Economics, Sangmyung Univ.) : "Since they save substantially less, it would take them longer to accumulate a decent sum."

The Bank of Korea projects the recent 0.5% point increase in interest rate would result in businesses and households paying 12.2 trillion won more in interests.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- INTEREST RATE HIKE IMPACT YOUNG ADULTS

-

- 입력 2022-10-13 15:09:12

- 수정2022-10-13 16:45:12

[Anchor Lead]

The Bank of Korea's interest rate hike has caused many people who borrowed money on floating rates to pay more in interests. The move has impacted young adults in their 20s and 30s more profoundly since they have never experienced such high interest rates.

[Pkg]

This young man in his 20s borrowed 190 million won at a floating rate for six months to lease a home. The interest rate, which used to be in the mid-3% range, is now nearing 6% one year later.

[Soundbite] (Office worker in his 20s (VOICE MODIFIED)) : "I never imagined this and never knew of such a case, which was why I borrowed at a floating rate. It’s shocking to see the rate still rising."

Having to pay about 40% of monthly salary in interest, he's left with almost no disposable income after paying for food and basic utilities.

[Soundbite] (Office worker in his 20s (VOICE MODIFIED)) : "My hands shake in fear every time I have to pay interest. It takes up most of my pay and I’m concerned about how to live another month."

Six out of ten jeonse mortgage loans by the banks are made to such young adults in their 20s and 30s. Floating interest rates account for about 94% of these jeonse mortgage loans which are entirely affected by the rising policy interest rate. This office worker in his 30s is in the same predicament. He took out 120 million won in credit loan. All he can do is sigh at the interest rate rising every three months.

[Soundbite] (Office worker in his 30s (VOICE MODIFIED)) : "My expenses keep mounting as my children grow. It’s become harder to bear rising interest rates."

As the highest interest rate on credit loans nears 7%, the latest hike is likely to push the ceiling above the 8% mark. Young people are likely to struggle under heavier debts let alone save.

[Soundbite] Prof. Seo Ji-yong(College of Business and Economics, Sangmyung Univ.) : "Since they save substantially less, it would take them longer to accumulate a decent sum."

The Bank of Korea projects the recent 0.5% point increase in interest rate would result in businesses and households paying 12.2 trillion won more in interests.

The Bank of Korea's interest rate hike has caused many people who borrowed money on floating rates to pay more in interests. The move has impacted young adults in their 20s and 30s more profoundly since they have never experienced such high interest rates.

[Pkg]

This young man in his 20s borrowed 190 million won at a floating rate for six months to lease a home. The interest rate, which used to be in the mid-3% range, is now nearing 6% one year later.

[Soundbite] (Office worker in his 20s (VOICE MODIFIED)) : "I never imagined this and never knew of such a case, which was why I borrowed at a floating rate. It’s shocking to see the rate still rising."

Having to pay about 40% of monthly salary in interest, he's left with almost no disposable income after paying for food and basic utilities.

[Soundbite] (Office worker in his 20s (VOICE MODIFIED)) : "My hands shake in fear every time I have to pay interest. It takes up most of my pay and I’m concerned about how to live another month."

Six out of ten jeonse mortgage loans by the banks are made to such young adults in their 20s and 30s. Floating interest rates account for about 94% of these jeonse mortgage loans which are entirely affected by the rising policy interest rate. This office worker in his 30s is in the same predicament. He took out 120 million won in credit loan. All he can do is sigh at the interest rate rising every three months.

[Soundbite] (Office worker in his 30s (VOICE MODIFIED)) : "My expenses keep mounting as my children grow. It’s become harder to bear rising interest rates."

As the highest interest rate on credit loans nears 7%, the latest hike is likely to push the ceiling above the 8% mark. Young people are likely to struggle under heavier debts let alone save.

[Soundbite] Prof. Seo Ji-yong(College of Business and Economics, Sangmyung Univ.) : "Since they save substantially less, it would take them longer to accumulate a decent sum."

The Bank of Korea projects the recent 0.5% point increase in interest rate would result in businesses and households paying 12.2 trillion won more in interests.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[영상] 정성호 “검찰 해체 표현 적절치 않아…수사·기소 분리 국민 공감대”](/data/fckeditor/vod/2025/07/01/305901751367182615.png)

이 기사에 대한 의견을 남겨주세요.