MEASURES TO REVITALIZE HOUSING MARKET

입력 2022.10.28 (15:08)

수정 2022.10.28 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The government is set to ease financial regulations to revitalize the sluggish housing market. Home buyers can take out loans for up to half of the price of the house even in speculation-prone areas. This includes high-end apartments costing over 1.5 billion won.

[Pkg]

An apartment complex in Seoul's Songpa-gu district. An 84 square meter unit was recently sold at 1.95 billion won. The price is down by some 750 million won compared to the peak level.

[Soundbite] (Realtor Songpa-gu Dist. (VOICE MODIFIED)) : "Home buyers must shoulder the very high interest on loans. So the situation is still a tug of war. Only the urgent offers and listings get transacted."

Since May, apartment prices in Seoul have been falling for the 22nd consecutive week, and the decline has also widened. With the real estate market rapidly cooling off, the government has decided to further ease financial regulations.

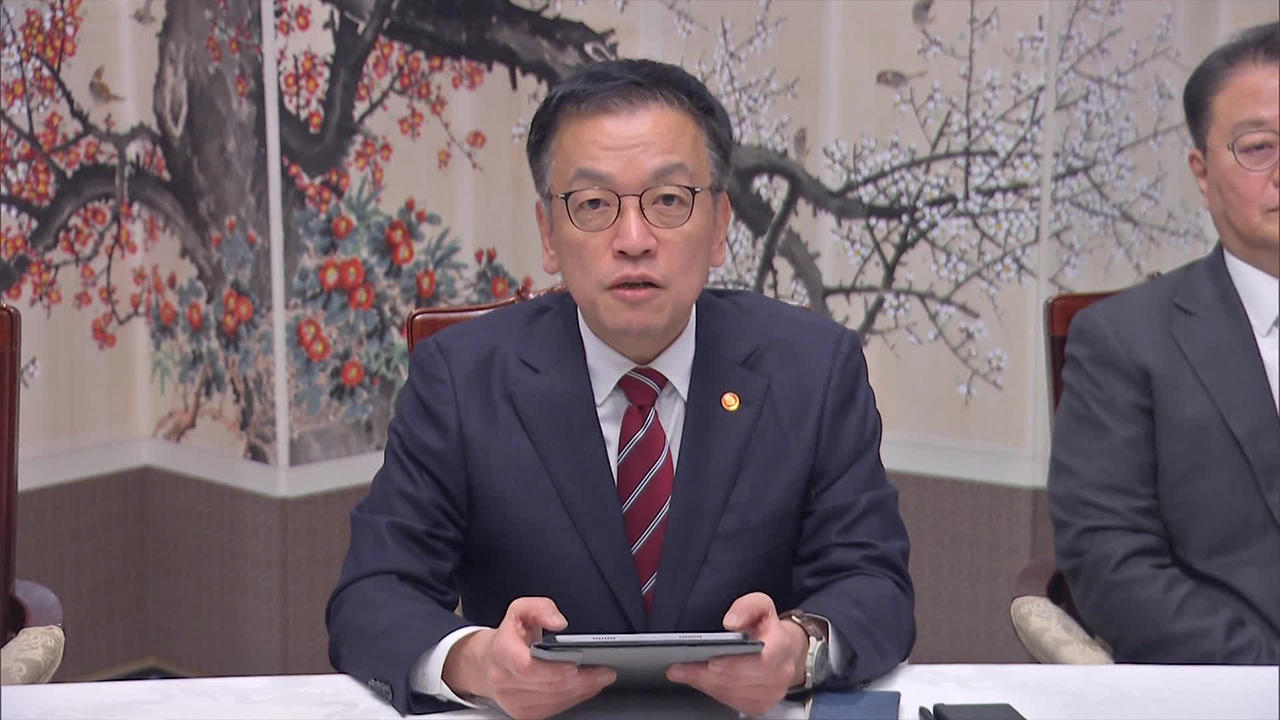

[Soundbite] Kim Joo-hyun(Chair, Financial Services Commission) : "Regulations have been very strong. We are sharply easing them for the financial sector, in light of rising interest rate and changing policy conditions."

Taking out mortgage loans will be allowed for the purchase of apartment units priced over 1.5 billion won even in speculation-ridden areas. This measure is designed to help lower the threshold for people wanting to buy a house. The loan to value ratio will also be lowered to 50% for first-time home buyers and single-home owners. These changes will be implemented from early next year after related regulations are revised. From next month, more housing zones will see the lifting of restrictions. This particular measure is aimed at reducing the tax burden of multiple home owners. If it does materialize, it will be the third such deregulation so far under the current administration. However, reversing the market trend doesn't appear to be easy.

[Soundbite] Park Won-gap(KB Kookmin Bank) : "People are often insensitive to deregulation during a market decline because they delay buying a house in the hope prices will further drop. With even higher interest rates expected, it will be difficult to buck the current trend."

Other government measures will seek to revive the pre-sale market where many homes are left unsold. The loan limit for the second payment in a home purchase will be raised from the current ceiling of houses costing below 900 million won to below 1.2 billion won. Also those who win a subscription to buy a newly built home in a speculative area will now have 2 years, instead of 6 months, to sell off their existing house.

The government is set to ease financial regulations to revitalize the sluggish housing market. Home buyers can take out loans for up to half of the price of the house even in speculation-prone areas. This includes high-end apartments costing over 1.5 billion won.

[Pkg]

An apartment complex in Seoul's Songpa-gu district. An 84 square meter unit was recently sold at 1.95 billion won. The price is down by some 750 million won compared to the peak level.

[Soundbite] (Realtor Songpa-gu Dist. (VOICE MODIFIED)) : "Home buyers must shoulder the very high interest on loans. So the situation is still a tug of war. Only the urgent offers and listings get transacted."

Since May, apartment prices in Seoul have been falling for the 22nd consecutive week, and the decline has also widened. With the real estate market rapidly cooling off, the government has decided to further ease financial regulations.

[Soundbite] Kim Joo-hyun(Chair, Financial Services Commission) : "Regulations have been very strong. We are sharply easing them for the financial sector, in light of rising interest rate and changing policy conditions."

Taking out mortgage loans will be allowed for the purchase of apartment units priced over 1.5 billion won even in speculation-ridden areas. This measure is designed to help lower the threshold for people wanting to buy a house. The loan to value ratio will also be lowered to 50% for first-time home buyers and single-home owners. These changes will be implemented from early next year after related regulations are revised. From next month, more housing zones will see the lifting of restrictions. This particular measure is aimed at reducing the tax burden of multiple home owners. If it does materialize, it will be the third such deregulation so far under the current administration. However, reversing the market trend doesn't appear to be easy.

[Soundbite] Park Won-gap(KB Kookmin Bank) : "People are often insensitive to deregulation during a market decline because they delay buying a house in the hope prices will further drop. With even higher interest rates expected, it will be difficult to buck the current trend."

Other government measures will seek to revive the pre-sale market where many homes are left unsold. The loan limit for the second payment in a home purchase will be raised from the current ceiling of houses costing below 900 million won to below 1.2 billion won. Also those who win a subscription to buy a newly built home in a speculative area will now have 2 years, instead of 6 months, to sell off their existing house.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- MEASURES TO REVITALIZE HOUSING MARKET

-

- 입력 2022-10-28 15:08:39

- 수정2022-10-28 16:45:04

[Anchor Lead]

The government is set to ease financial regulations to revitalize the sluggish housing market. Home buyers can take out loans for up to half of the price of the house even in speculation-prone areas. This includes high-end apartments costing over 1.5 billion won.

[Pkg]

An apartment complex in Seoul's Songpa-gu district. An 84 square meter unit was recently sold at 1.95 billion won. The price is down by some 750 million won compared to the peak level.

[Soundbite] (Realtor Songpa-gu Dist. (VOICE MODIFIED)) : "Home buyers must shoulder the very high interest on loans. So the situation is still a tug of war. Only the urgent offers and listings get transacted."

Since May, apartment prices in Seoul have been falling for the 22nd consecutive week, and the decline has also widened. With the real estate market rapidly cooling off, the government has decided to further ease financial regulations.

[Soundbite] Kim Joo-hyun(Chair, Financial Services Commission) : "Regulations have been very strong. We are sharply easing them for the financial sector, in light of rising interest rate and changing policy conditions."

Taking out mortgage loans will be allowed for the purchase of apartment units priced over 1.5 billion won even in speculation-ridden areas. This measure is designed to help lower the threshold for people wanting to buy a house. The loan to value ratio will also be lowered to 50% for first-time home buyers and single-home owners. These changes will be implemented from early next year after related regulations are revised. From next month, more housing zones will see the lifting of restrictions. This particular measure is aimed at reducing the tax burden of multiple home owners. If it does materialize, it will be the third such deregulation so far under the current administration. However, reversing the market trend doesn't appear to be easy.

[Soundbite] Park Won-gap(KB Kookmin Bank) : "People are often insensitive to deregulation during a market decline because they delay buying a house in the hope prices will further drop. With even higher interest rates expected, it will be difficult to buck the current trend."

Other government measures will seek to revive the pre-sale market where many homes are left unsold. The loan limit for the second payment in a home purchase will be raised from the current ceiling of houses costing below 900 million won to below 1.2 billion won. Also those who win a subscription to buy a newly built home in a speculative area will now have 2 years, instead of 6 months, to sell off their existing house.

The government is set to ease financial regulations to revitalize the sluggish housing market. Home buyers can take out loans for up to half of the price of the house even in speculation-prone areas. This includes high-end apartments costing over 1.5 billion won.

[Pkg]

An apartment complex in Seoul's Songpa-gu district. An 84 square meter unit was recently sold at 1.95 billion won. The price is down by some 750 million won compared to the peak level.

[Soundbite] (Realtor Songpa-gu Dist. (VOICE MODIFIED)) : "Home buyers must shoulder the very high interest on loans. So the situation is still a tug of war. Only the urgent offers and listings get transacted."

Since May, apartment prices in Seoul have been falling for the 22nd consecutive week, and the decline has also widened. With the real estate market rapidly cooling off, the government has decided to further ease financial regulations.

[Soundbite] Kim Joo-hyun(Chair, Financial Services Commission) : "Regulations have been very strong. We are sharply easing them for the financial sector, in light of rising interest rate and changing policy conditions."

Taking out mortgage loans will be allowed for the purchase of apartment units priced over 1.5 billion won even in speculation-ridden areas. This measure is designed to help lower the threshold for people wanting to buy a house. The loan to value ratio will also be lowered to 50% for first-time home buyers and single-home owners. These changes will be implemented from early next year after related regulations are revised. From next month, more housing zones will see the lifting of restrictions. This particular measure is aimed at reducing the tax burden of multiple home owners. If it does materialize, it will be the third such deregulation so far under the current administration. However, reversing the market trend doesn't appear to be easy.

[Soundbite] Park Won-gap(KB Kookmin Bank) : "People are often insensitive to deregulation during a market decline because they delay buying a house in the hope prices will further drop. With even higher interest rates expected, it will be difficult to buck the current trend."

Other government measures will seek to revive the pre-sale market where many homes are left unsold. The loan limit for the second payment in a home purchase will be raised from the current ceiling of houses costing below 900 million won to below 1.2 billion won. Also those who win a subscription to buy a newly built home in a speculative area will now have 2 years, instead of 6 months, to sell off their existing house.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[HEADLINE]](https://news.kbs.co.kr/data/news/2022/10/28/20221028_75PEmK.jpg)

이 기사에 대한 의견을 남겨주세요.