[News Today] TACKLING TAX REVENUE SHORTFALL

입력 2024.10.29 (16:18)

수정 2024.10.29 (16:18)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[LEAD]

The government has introduced a plan to tackle a 30 trillion won tax revenue shortfall. It proposes using special funds and cutting allocations to local governments, avoiding new national debt. This approach has drawn criticism for simply reshuffling fiscal resources.

[REPORT]

A former elementary school building in Chuncheon, Gangwondo Province.

A special education facility for children with disabilities is set to open here.

However, uncertainty over the amount of an expected government grant for the project has fueled budget concerns.

Based on a recalculated estimate projecting a tax revenue shortfall of some 29.6 trillion won, or 21 billion U.S. dollars, grants and subsidies connected to tax revenue will be slashed by 9.7 trillion won, or seven billion dollars.

Considering tight provincial finances, the central government will provide 3.2 trillion won, or 2.3 billion dollars, upfront and deduct that amount over the next two years.

It's essentially an advance payment system.

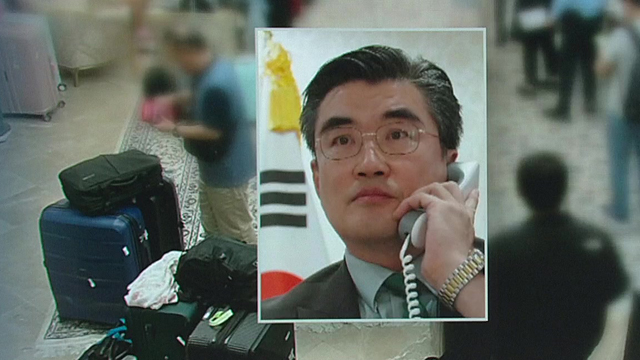

Choi Sang-mok / Deputy Prime Minister for Economy (Oct. 28)

Many local gov'ts struggle financially. So we are discussing relevant support measures, such as acquiring municipal bonds.

To cover half of the revenue shortfall, about 16 trillion won, or 11.6 billion dollars, will be borrowed from state reserve funds set aside for specific purposes.

Such funds include the foreign exchange equalization fund, aimed at tackling forex volatility, as well as the urban housing fund and other emergency public funds.

Such borrowing can avoid the issuance of government bonds, but will instead increase the proportion of what's called the 'deficit liability' out of total national debt that needs to be paid off through taxpayer money.

Prof. Woo Seok-jin / Myongji Univ.

In terms of opportunity cost, no profit will generate from reserve funds, similar to issuing gov't bonds.

There's also concern over taking out a maximum 6 trillion won, or 4.3 billion dollars, from the foreign exchange equalization fund at a time when forex market volatility is rising amid the U.S. election and the Middle East conflict.

In response, the government said it needs to inevitably use the fund but within the bounds of not affecting foreign exchange market response measures.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- [News Today] TACKLING TAX REVENUE SHORTFALL

-

- 입력 2024-10-29 16:18:13

- 수정2024-10-29 16:18:21

[LEAD]

The government has introduced a plan to tackle a 30 trillion won tax revenue shortfall. It proposes using special funds and cutting allocations to local governments, avoiding new national debt. This approach has drawn criticism for simply reshuffling fiscal resources.

[REPORT]

A former elementary school building in Chuncheon, Gangwondo Province.

A special education facility for children with disabilities is set to open here.

However, uncertainty over the amount of an expected government grant for the project has fueled budget concerns.

Based on a recalculated estimate projecting a tax revenue shortfall of some 29.6 trillion won, or 21 billion U.S. dollars, grants and subsidies connected to tax revenue will be slashed by 9.7 trillion won, or seven billion dollars.

Considering tight provincial finances, the central government will provide 3.2 trillion won, or 2.3 billion dollars, upfront and deduct that amount over the next two years.

It's essentially an advance payment system.

Choi Sang-mok / Deputy Prime Minister for Economy (Oct. 28)

Many local gov'ts struggle financially. So we are discussing relevant support measures, such as acquiring municipal bonds.

To cover half of the revenue shortfall, about 16 trillion won, or 11.6 billion dollars, will be borrowed from state reserve funds set aside for specific purposes.

Such funds include the foreign exchange equalization fund, aimed at tackling forex volatility, as well as the urban housing fund and other emergency public funds.

Such borrowing can avoid the issuance of government bonds, but will instead increase the proportion of what's called the 'deficit liability' out of total national debt that needs to be paid off through taxpayer money.

Prof. Woo Seok-jin / Myongji Univ.

In terms of opportunity cost, no profit will generate from reserve funds, similar to issuing gov't bonds.

There's also concern over taking out a maximum 6 trillion won, or 4.3 billion dollars, from the foreign exchange equalization fund at a time when forex market volatility is rising amid the U.S. election and the Middle East conflict.

In response, the government said it needs to inevitably use the fund but within the bounds of not affecting foreign exchange market response measures.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.