[News Today] KRW/USD RATE SOARS, KOSPI DROPS

입력 2024.11.13 (15:42)

수정 2024.11.13 (15:44)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[LEAD]

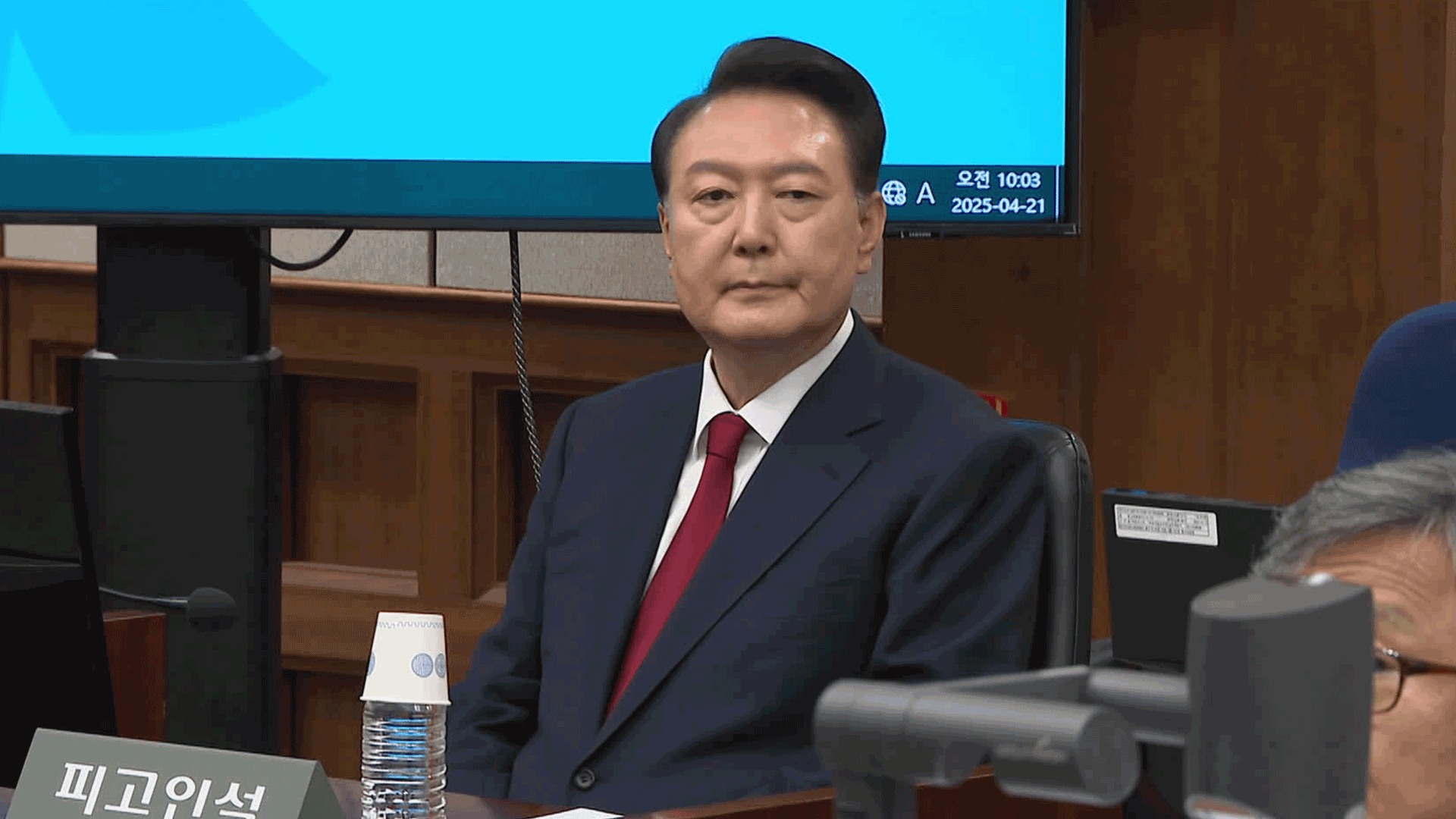

The Korean won closed at a weakened price against the U.S. dollar yesterday, breaking the 1,400 mark. A stronger dollar, fueled by Donald Trump's America-first stance, has pushed up the exchange rate. With semiconductor concerns also in play, the KOSPI has fallen below 2,500 for the first time in three months.

[REPORT]

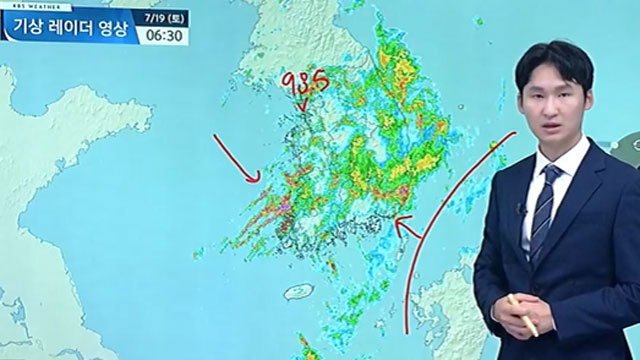

On Tuesday, the value of the Korean won against the U.S. dollar recorded 1,403.5 won, surpassing the psychological barrier of 1,400 won. It was the highest closing price in two years.

Like Korea, Taiwan, a major semiconductor supplier to the U.S., and Mexico, which suffered economic hits during Donald Trump’s first term, have both seen their exchange rates rise.

Concerns are growing that higher tariffs during Trump's second term could further propel prices and interest rates, keeping the U.S. currency strong.

Moon Jung-hee / Kookmin Bank

A Republican House win means Trump's policies will gain momentum. Markets are already factoring in 70-80% of his policies.

The so-called "Trump trade" phenomenon, whereby money flows into virtual assets and the U.S. stock market, will get more severe over time.

The three major indexes on Wall Street have soared to record highs. Korea's benchmark KOSPI plummeted below 2,500 on Tuesday for the first time in three months due to the strong dollar and concerns over sluggish chip exports.

Seo Sang-young / Mirae Asset Securities

Concerns over the U.S.-China trade dispute, a semiconductor peak are pushing our stock market down.

Because of changes in the U.S. trade policies, rising concerns about Korean businesses, which rely heavily on exports to the U.S., are also contributing to the jittery stock market.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- [News Today] KRW/USD RATE SOARS, KOSPI DROPS

-

- 입력 2024-11-13 15:42:50

- 수정2024-11-13 15:44:12

[LEAD]

The Korean won closed at a weakened price against the U.S. dollar yesterday, breaking the 1,400 mark. A stronger dollar, fueled by Donald Trump's America-first stance, has pushed up the exchange rate. With semiconductor concerns also in play, the KOSPI has fallen below 2,500 for the first time in three months.

[REPORT]

On Tuesday, the value of the Korean won against the U.S. dollar recorded 1,403.5 won, surpassing the psychological barrier of 1,400 won. It was the highest closing price in two years.

Like Korea, Taiwan, a major semiconductor supplier to the U.S., and Mexico, which suffered economic hits during Donald Trump’s first term, have both seen their exchange rates rise.

Concerns are growing that higher tariffs during Trump's second term could further propel prices and interest rates, keeping the U.S. currency strong.

Moon Jung-hee / Kookmin Bank

A Republican House win means Trump's policies will gain momentum. Markets are already factoring in 70-80% of his policies.

The so-called "Trump trade" phenomenon, whereby money flows into virtual assets and the U.S. stock market, will get more severe over time.

The three major indexes on Wall Street have soared to record highs. Korea's benchmark KOSPI plummeted below 2,500 on Tuesday for the first time in three months due to the strong dollar and concerns over sluggish chip exports.

Seo Sang-young / Mirae Asset Securities

Concerns over the U.S.-China trade dispute, a semiconductor peak are pushing our stock market down.

Because of changes in the U.S. trade policies, rising concerns about Korean businesses, which rely heavily on exports to the U.S., are also contributing to the jittery stock market.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.