S. Korean companies brace for uncertainty as Trump's second term approaches

입력 2024.11.14 (00:44)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

As the stock prices continue to decline, our companies and the industrial sector are not at ease.

With about two months remaining until the start of Trump’s second term, companies are grappling with heightened uncertainty due to America First policies and discussions on tariff increases, which are among their top concerns, as they work to devise response measures.

The government has also formed a special team to address urgent issues.

Today (11.13), meetings were held consecutively with the automobile and battery industries, and inspections are planned for the steel and semiconductor sectors as well.

In particular, our companies that have made large-scale investments in the U.S. are in a situation where it is not an exaggeration to say that they are in a state of emergency.

To understand how concerning the situation is, reporter Gye Hyun-woo has looked into it.

[Report]

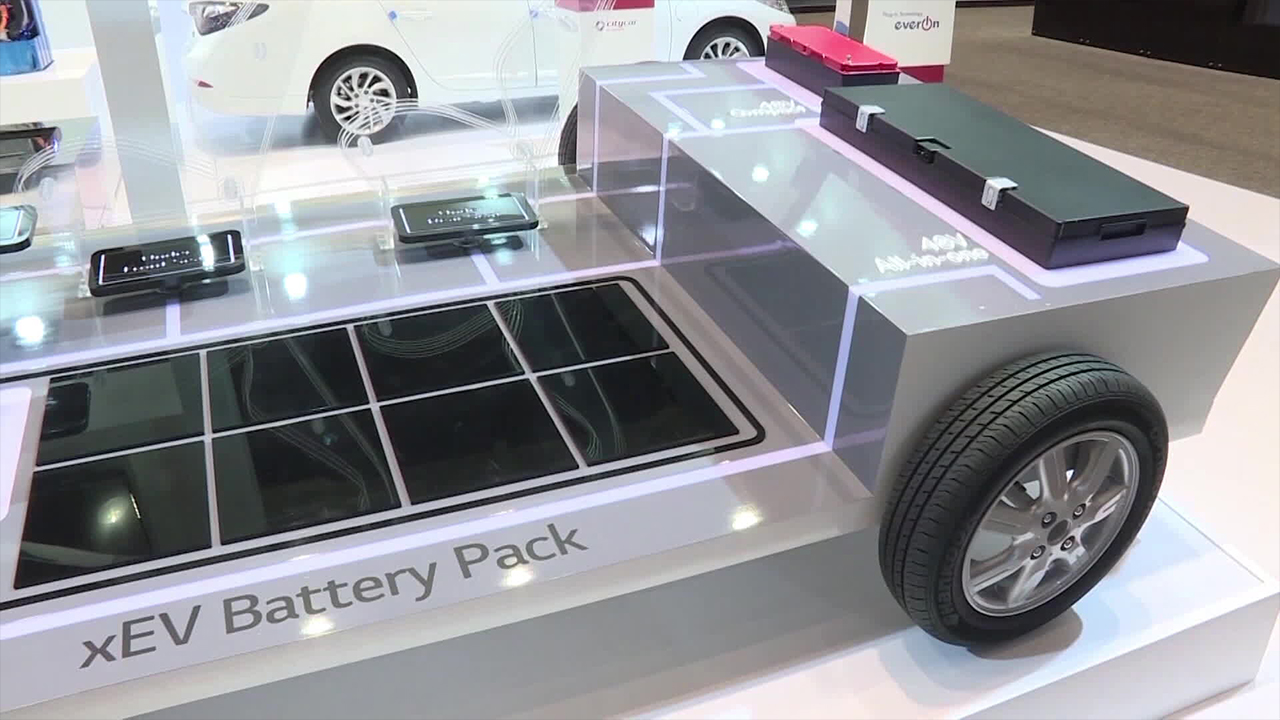

Currently, there are 14 battery plants that our companies are operating or planning to operate in the U.S., with investments amounting to tens of trillions of won.

The background for such aggressive investments is largely due to the production tax credit benefits from the Biden administration's IRA, or Inflation Reduction Act.

In the third quarter of this year, two of our companies received tax credits amounting to over 500 billion won, and without these tax credits, they would essentially be in a loss situation.

However, President-elect Trump has consistently expressed his intention to abolish the IRA.

[Donald Trump/U.S. President-elect/Oct. 2024: "We will end the 'green new scam' once and for all."]

However, it is analyzed that a complete repeal of the IRA is not easy, as many of the local lawmakers benefiting from the IRA are affiliated with the Republican Party, but concerns in the related industries are inevitable.

[Kim Seung-tae/Director of Policy Support, Korea Battery Industry Association: "It is essential to emphasize the positive role of (our investments) in stimulating the local economy and creating jobs."]

In particular, the electric vehicle industry must also pay attention to whether the promise to abolish the electric vehicle mandate will be fulfilled amid the uncertainties surrounding the IRA.

There is also significant interest in semiconductor subsidies.

This is because President-elect Trump is negative about the provision of subsidies.

In particular, Samsung Electronics, which plans to invest $45 billion in its Taylor, Texas plant, has already received a promise of $6.4 billion in subsidies from the Biden administration.

[Jung In-kyo/Director General of Trade Negotiation, Ministry of Trade, Industry and Energy: "We need to actively promote our contributions to having enhanced manufacturing capabilities and supply chains to the U.S. side."]

The strengthening of trade restrictions against China is also a point to watch, as the level of restrictions could lead to intensified competition with cheaper Chinese products outside the U.S.

This is KBS News, Gye Hyun-woo.

As the stock prices continue to decline, our companies and the industrial sector are not at ease.

With about two months remaining until the start of Trump’s second term, companies are grappling with heightened uncertainty due to America First policies and discussions on tariff increases, which are among their top concerns, as they work to devise response measures.

The government has also formed a special team to address urgent issues.

Today (11.13), meetings were held consecutively with the automobile and battery industries, and inspections are planned for the steel and semiconductor sectors as well.

In particular, our companies that have made large-scale investments in the U.S. are in a situation where it is not an exaggeration to say that they are in a state of emergency.

To understand how concerning the situation is, reporter Gye Hyun-woo has looked into it.

[Report]

Currently, there are 14 battery plants that our companies are operating or planning to operate in the U.S., with investments amounting to tens of trillions of won.

The background for such aggressive investments is largely due to the production tax credit benefits from the Biden administration's IRA, or Inflation Reduction Act.

In the third quarter of this year, two of our companies received tax credits amounting to over 500 billion won, and without these tax credits, they would essentially be in a loss situation.

However, President-elect Trump has consistently expressed his intention to abolish the IRA.

[Donald Trump/U.S. President-elect/Oct. 2024: "We will end the 'green new scam' once and for all."]

However, it is analyzed that a complete repeal of the IRA is not easy, as many of the local lawmakers benefiting from the IRA are affiliated with the Republican Party, but concerns in the related industries are inevitable.

[Kim Seung-tae/Director of Policy Support, Korea Battery Industry Association: "It is essential to emphasize the positive role of (our investments) in stimulating the local economy and creating jobs."]

In particular, the electric vehicle industry must also pay attention to whether the promise to abolish the electric vehicle mandate will be fulfilled amid the uncertainties surrounding the IRA.

There is also significant interest in semiconductor subsidies.

This is because President-elect Trump is negative about the provision of subsidies.

In particular, Samsung Electronics, which plans to invest $45 billion in its Taylor, Texas plant, has already received a promise of $6.4 billion in subsidies from the Biden administration.

[Jung In-kyo/Director General of Trade Negotiation, Ministry of Trade, Industry and Energy: "We need to actively promote our contributions to having enhanced manufacturing capabilities and supply chains to the U.S. side."]

The strengthening of trade restrictions against China is also a point to watch, as the level of restrictions could lead to intensified competition with cheaper Chinese products outside the U.S.

This is KBS News, Gye Hyun-woo.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- S. Korean companies brace for uncertainty as Trump's second term approaches

-

- 입력 2024-11-14 00:44:05

[Anchor]

As the stock prices continue to decline, our companies and the industrial sector are not at ease.

With about two months remaining until the start of Trump’s second term, companies are grappling with heightened uncertainty due to America First policies and discussions on tariff increases, which are among their top concerns, as they work to devise response measures.

The government has also formed a special team to address urgent issues.

Today (11.13), meetings were held consecutively with the automobile and battery industries, and inspections are planned for the steel and semiconductor sectors as well.

In particular, our companies that have made large-scale investments in the U.S. are in a situation where it is not an exaggeration to say that they are in a state of emergency.

To understand how concerning the situation is, reporter Gye Hyun-woo has looked into it.

[Report]

Currently, there are 14 battery plants that our companies are operating or planning to operate in the U.S., with investments amounting to tens of trillions of won.

The background for such aggressive investments is largely due to the production tax credit benefits from the Biden administration's IRA, or Inflation Reduction Act.

In the third quarter of this year, two of our companies received tax credits amounting to over 500 billion won, and without these tax credits, they would essentially be in a loss situation.

However, President-elect Trump has consistently expressed his intention to abolish the IRA.

[Donald Trump/U.S. President-elect/Oct. 2024: "We will end the 'green new scam' once and for all."]

However, it is analyzed that a complete repeal of the IRA is not easy, as many of the local lawmakers benefiting from the IRA are affiliated with the Republican Party, but concerns in the related industries are inevitable.

[Kim Seung-tae/Director of Policy Support, Korea Battery Industry Association: "It is essential to emphasize the positive role of (our investments) in stimulating the local economy and creating jobs."]

In particular, the electric vehicle industry must also pay attention to whether the promise to abolish the electric vehicle mandate will be fulfilled amid the uncertainties surrounding the IRA.

There is also significant interest in semiconductor subsidies.

This is because President-elect Trump is negative about the provision of subsidies.

In particular, Samsung Electronics, which plans to invest $45 billion in its Taylor, Texas plant, has already received a promise of $6.4 billion in subsidies from the Biden administration.

[Jung In-kyo/Director General of Trade Negotiation, Ministry of Trade, Industry and Energy: "We need to actively promote our contributions to having enhanced manufacturing capabilities and supply chains to the U.S. side."]

The strengthening of trade restrictions against China is also a point to watch, as the level of restrictions could lead to intensified competition with cheaper Chinese products outside the U.S.

This is KBS News, Gye Hyun-woo.

As the stock prices continue to decline, our companies and the industrial sector are not at ease.

With about two months remaining until the start of Trump’s second term, companies are grappling with heightened uncertainty due to America First policies and discussions on tariff increases, which are among their top concerns, as they work to devise response measures.

The government has also formed a special team to address urgent issues.

Today (11.13), meetings were held consecutively with the automobile and battery industries, and inspections are planned for the steel and semiconductor sectors as well.

In particular, our companies that have made large-scale investments in the U.S. are in a situation where it is not an exaggeration to say that they are in a state of emergency.

To understand how concerning the situation is, reporter Gye Hyun-woo has looked into it.

[Report]

Currently, there are 14 battery plants that our companies are operating or planning to operate in the U.S., with investments amounting to tens of trillions of won.

The background for such aggressive investments is largely due to the production tax credit benefits from the Biden administration's IRA, or Inflation Reduction Act.

In the third quarter of this year, two of our companies received tax credits amounting to over 500 billion won, and without these tax credits, they would essentially be in a loss situation.

However, President-elect Trump has consistently expressed his intention to abolish the IRA.

[Donald Trump/U.S. President-elect/Oct. 2024: "We will end the 'green new scam' once and for all."]

However, it is analyzed that a complete repeal of the IRA is not easy, as many of the local lawmakers benefiting from the IRA are affiliated with the Republican Party, but concerns in the related industries are inevitable.

[Kim Seung-tae/Director of Policy Support, Korea Battery Industry Association: "It is essential to emphasize the positive role of (our investments) in stimulating the local economy and creating jobs."]

In particular, the electric vehicle industry must also pay attention to whether the promise to abolish the electric vehicle mandate will be fulfilled amid the uncertainties surrounding the IRA.

There is also significant interest in semiconductor subsidies.

This is because President-elect Trump is negative about the provision of subsidies.

In particular, Samsung Electronics, which plans to invest $45 billion in its Taylor, Texas plant, has already received a promise of $6.4 billion in subsidies from the Biden administration.

[Jung In-kyo/Director General of Trade Negotiation, Ministry of Trade, Industry and Energy: "We need to actively promote our contributions to having enhanced manufacturing capabilities and supply chains to the U.S. side."]

The strengthening of trade restrictions against China is also a point to watch, as the level of restrictions could lead to intensified competition with cheaper Chinese products outside the U.S.

This is KBS News, Gye Hyun-woo.

-

-

계현우 기자 kye@kbs.co.kr

계현우 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] ‘공천개입 핵심 물증’ 윤상현 휴대전화 미제출…야간 추가 압수수색도 실패](/data/layer/904/2025/07/20250709_dRidEM.png)

이 기사에 대한 의견을 남겨주세요.