Bank of Korea cuts interest rates again amid economic concerns

입력 2024.11.29 (00:40)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

The Bank of Korea has lowered the base interest rate again, following last month.

This is the first time since 2009 that the base interest rate has been cut for two consecutive months.

This decision was contrary to market expectations, which anticipated a freeze in rates.

This indicates that the Bank of Korea judged the economic situation in our country to be poor.

The central bank has also revised down its economic growth forecasts for this year and next year.

Just last month, when the rate was cut for the first time in 38 months, it seemed unlikely that there would be further cuts for the time being, but the situation changed significantly with Trump's election in the U.S.

Reporter Son Seo-young has investigated the detailed background.

[Report]

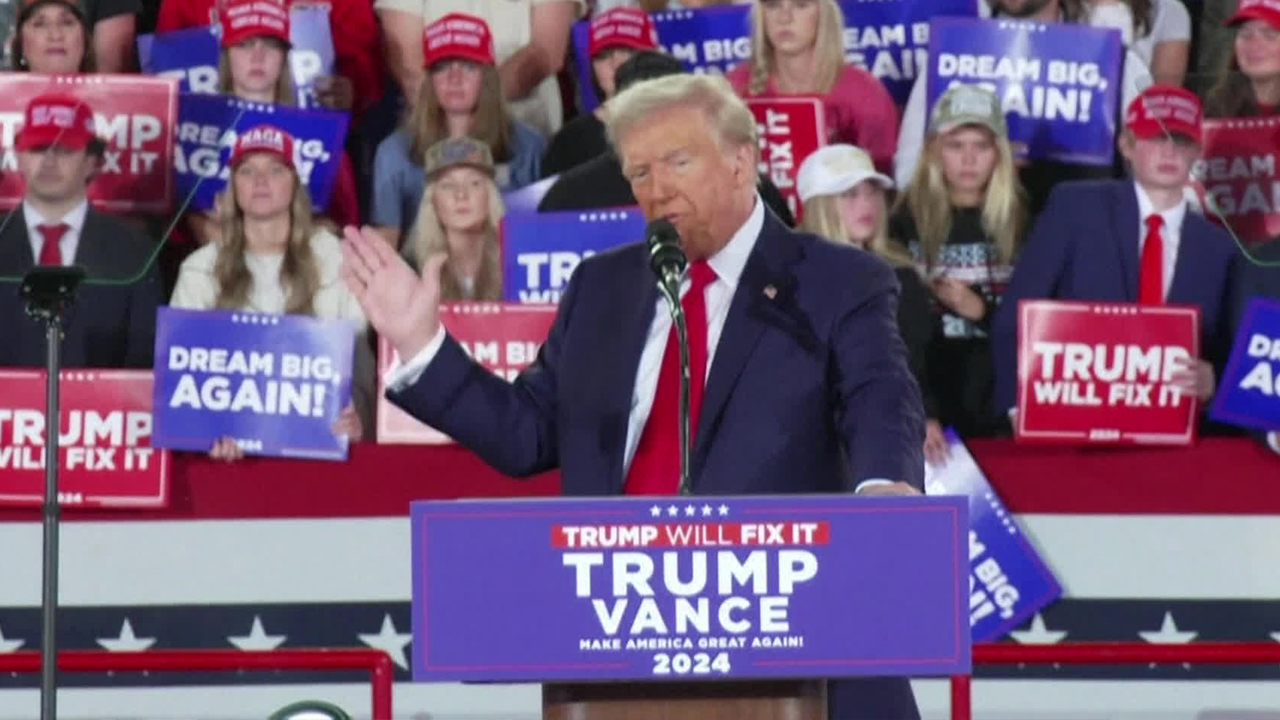

President-elect Trump has introduced a hardline tariff strategy against key trading partners Canada, Mexico, and China.

[Trump/U.S. President-elect/Nov. 4: "I'm going to immediately impose a 25% tariff on everything they send in to the United States of America."]

Countries are beginning to respond with tariffs, igniting the potential for a contraction in global trade.

Competition with China in our key export sectors such as semiconductors, chemicals, and steel has intensified.

The Bank of Korea pointed out this reality and lowered its export growth forecast for next year from 2.9% to 1.5%.

Accordingly, it also predicted that economic growth would decline and decided to lower interest rates.

[Lee Chang-yong/Bank of Korea Governor/Nov. 28: "With the decline in export growth, the economic outlook was downgraded, and to prepare for a significant reduction in the ripple effect of exports on domestic demand, the interest rate was fundamentally lowered."]

Even during last month's rate cut, the Bank of Korea was cautious about further reductions.

This was due to concerns that the exchange rate could rise and household debt could increase.

[Lee Chang-yong/Bank of Korea Governor/Nov. 11: "It will take time to assess (the rate cut) impact on financial stability, such as real estate prices and household debt, and we need to monitor the results of the U.S. presidential election and the developments of geopolitical risks."]

The perception has changed in just a month due to the variables of Trump's second administration, and the exchange rate fluctuating around 1,400 won is expected to be a burden.

[Park Hyung-jung/Economist at Woori Bank: "There is a possibility that the won-dollar exchange rate will skyrocket after Trump's inauguration next year, which could negatively impact all aspects of the domestic macroeconomy, including consumption, investment, and exports."]

The widening interest rate gap due to the base rate cut could also exacerbate the decline in the value of the won.

This is KBS News, Son Seo-young.

The Bank of Korea has lowered the base interest rate again, following last month.

This is the first time since 2009 that the base interest rate has been cut for two consecutive months.

This decision was contrary to market expectations, which anticipated a freeze in rates.

This indicates that the Bank of Korea judged the economic situation in our country to be poor.

The central bank has also revised down its economic growth forecasts for this year and next year.

Just last month, when the rate was cut for the first time in 38 months, it seemed unlikely that there would be further cuts for the time being, but the situation changed significantly with Trump's election in the U.S.

Reporter Son Seo-young has investigated the detailed background.

[Report]

President-elect Trump has introduced a hardline tariff strategy against key trading partners Canada, Mexico, and China.

[Trump/U.S. President-elect/Nov. 4: "I'm going to immediately impose a 25% tariff on everything they send in to the United States of America."]

Countries are beginning to respond with tariffs, igniting the potential for a contraction in global trade.

Competition with China in our key export sectors such as semiconductors, chemicals, and steel has intensified.

The Bank of Korea pointed out this reality and lowered its export growth forecast for next year from 2.9% to 1.5%.

Accordingly, it also predicted that economic growth would decline and decided to lower interest rates.

[Lee Chang-yong/Bank of Korea Governor/Nov. 28: "With the decline in export growth, the economic outlook was downgraded, and to prepare for a significant reduction in the ripple effect of exports on domestic demand, the interest rate was fundamentally lowered."]

Even during last month's rate cut, the Bank of Korea was cautious about further reductions.

This was due to concerns that the exchange rate could rise and household debt could increase.

[Lee Chang-yong/Bank of Korea Governor/Nov. 11: "It will take time to assess (the rate cut) impact on financial stability, such as real estate prices and household debt, and we need to monitor the results of the U.S. presidential election and the developments of geopolitical risks."]

The perception has changed in just a month due to the variables of Trump's second administration, and the exchange rate fluctuating around 1,400 won is expected to be a burden.

[Park Hyung-jung/Economist at Woori Bank: "There is a possibility that the won-dollar exchange rate will skyrocket after Trump's inauguration next year, which could negatively impact all aspects of the domestic macroeconomy, including consumption, investment, and exports."]

The widening interest rate gap due to the base rate cut could also exacerbate the decline in the value of the won.

This is KBS News, Son Seo-young.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Bank of Korea cuts interest rates again amid economic concerns

-

- 입력 2024-11-29 00:40:14

[Anchor]

The Bank of Korea has lowered the base interest rate again, following last month.

This is the first time since 2009 that the base interest rate has been cut for two consecutive months.

This decision was contrary to market expectations, which anticipated a freeze in rates.

This indicates that the Bank of Korea judged the economic situation in our country to be poor.

The central bank has also revised down its economic growth forecasts for this year and next year.

Just last month, when the rate was cut for the first time in 38 months, it seemed unlikely that there would be further cuts for the time being, but the situation changed significantly with Trump's election in the U.S.

Reporter Son Seo-young has investigated the detailed background.

[Report]

President-elect Trump has introduced a hardline tariff strategy against key trading partners Canada, Mexico, and China.

[Trump/U.S. President-elect/Nov. 4: "I'm going to immediately impose a 25% tariff on everything they send in to the United States of America."]

Countries are beginning to respond with tariffs, igniting the potential for a contraction in global trade.

Competition with China in our key export sectors such as semiconductors, chemicals, and steel has intensified.

The Bank of Korea pointed out this reality and lowered its export growth forecast for next year from 2.9% to 1.5%.

Accordingly, it also predicted that economic growth would decline and decided to lower interest rates.

[Lee Chang-yong/Bank of Korea Governor/Nov. 28: "With the decline in export growth, the economic outlook was downgraded, and to prepare for a significant reduction in the ripple effect of exports on domestic demand, the interest rate was fundamentally lowered."]

Even during last month's rate cut, the Bank of Korea was cautious about further reductions.

This was due to concerns that the exchange rate could rise and household debt could increase.

[Lee Chang-yong/Bank of Korea Governor/Nov. 11: "It will take time to assess (the rate cut) impact on financial stability, such as real estate prices and household debt, and we need to monitor the results of the U.S. presidential election and the developments of geopolitical risks."]

The perception has changed in just a month due to the variables of Trump's second administration, and the exchange rate fluctuating around 1,400 won is expected to be a burden.

[Park Hyung-jung/Economist at Woori Bank: "There is a possibility that the won-dollar exchange rate will skyrocket after Trump's inauguration next year, which could negatively impact all aspects of the domestic macroeconomy, including consumption, investment, and exports."]

The widening interest rate gap due to the base rate cut could also exacerbate the decline in the value of the won.

This is KBS News, Son Seo-young.

The Bank of Korea has lowered the base interest rate again, following last month.

This is the first time since 2009 that the base interest rate has been cut for two consecutive months.

This decision was contrary to market expectations, which anticipated a freeze in rates.

This indicates that the Bank of Korea judged the economic situation in our country to be poor.

The central bank has also revised down its economic growth forecasts for this year and next year.

Just last month, when the rate was cut for the first time in 38 months, it seemed unlikely that there would be further cuts for the time being, but the situation changed significantly with Trump's election in the U.S.

Reporter Son Seo-young has investigated the detailed background.

[Report]

President-elect Trump has introduced a hardline tariff strategy against key trading partners Canada, Mexico, and China.

[Trump/U.S. President-elect/Nov. 4: "I'm going to immediately impose a 25% tariff on everything they send in to the United States of America."]

Countries are beginning to respond with tariffs, igniting the potential for a contraction in global trade.

Competition with China in our key export sectors such as semiconductors, chemicals, and steel has intensified.

The Bank of Korea pointed out this reality and lowered its export growth forecast for next year from 2.9% to 1.5%.

Accordingly, it also predicted that economic growth would decline and decided to lower interest rates.

[Lee Chang-yong/Bank of Korea Governor/Nov. 28: "With the decline in export growth, the economic outlook was downgraded, and to prepare for a significant reduction in the ripple effect of exports on domestic demand, the interest rate was fundamentally lowered."]

Even during last month's rate cut, the Bank of Korea was cautious about further reductions.

This was due to concerns that the exchange rate could rise and household debt could increase.

[Lee Chang-yong/Bank of Korea Governor/Nov. 11: "It will take time to assess (the rate cut) impact on financial stability, such as real estate prices and household debt, and we need to monitor the results of the U.S. presidential election and the developments of geopolitical risks."]

The perception has changed in just a month due to the variables of Trump's second administration, and the exchange rate fluctuating around 1,400 won is expected to be a burden.

[Park Hyung-jung/Economist at Woori Bank: "There is a possibility that the won-dollar exchange rate will skyrocket after Trump's inauguration next year, which could negatively impact all aspects of the domestic macroeconomy, including consumption, investment, and exports."]

The widening interest rate gap due to the base rate cut could also exacerbate the decline in the value of the won.

This is KBS News, Son Seo-young.

-

-

손서영 기자 bellesy@kbs.co.kr

손서영 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.