DP agrees to two-year deferment of ‘virtual asset income tax’ implementation

입력 2024.12.01 (22:16)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

The Democratic Party has agreed to postpone the implementation of the law that imposes taxes on profits made from virtual assets by two years.

Although they initially maintained that it should be implemented as scheduled, they have taken a step back and accepted the proposal of the government and ruling party.

It appears that they changed their stance as opposition among virtual asset investors grew stronger.

This is Jeon Hyun-woo reporting.

[Report]

The Democratic Party has agreed to a two-year deferment of the 'virtual asset income tax'.

As a result of internal discussions, they concluded that additional institutional arrangements are necessary.

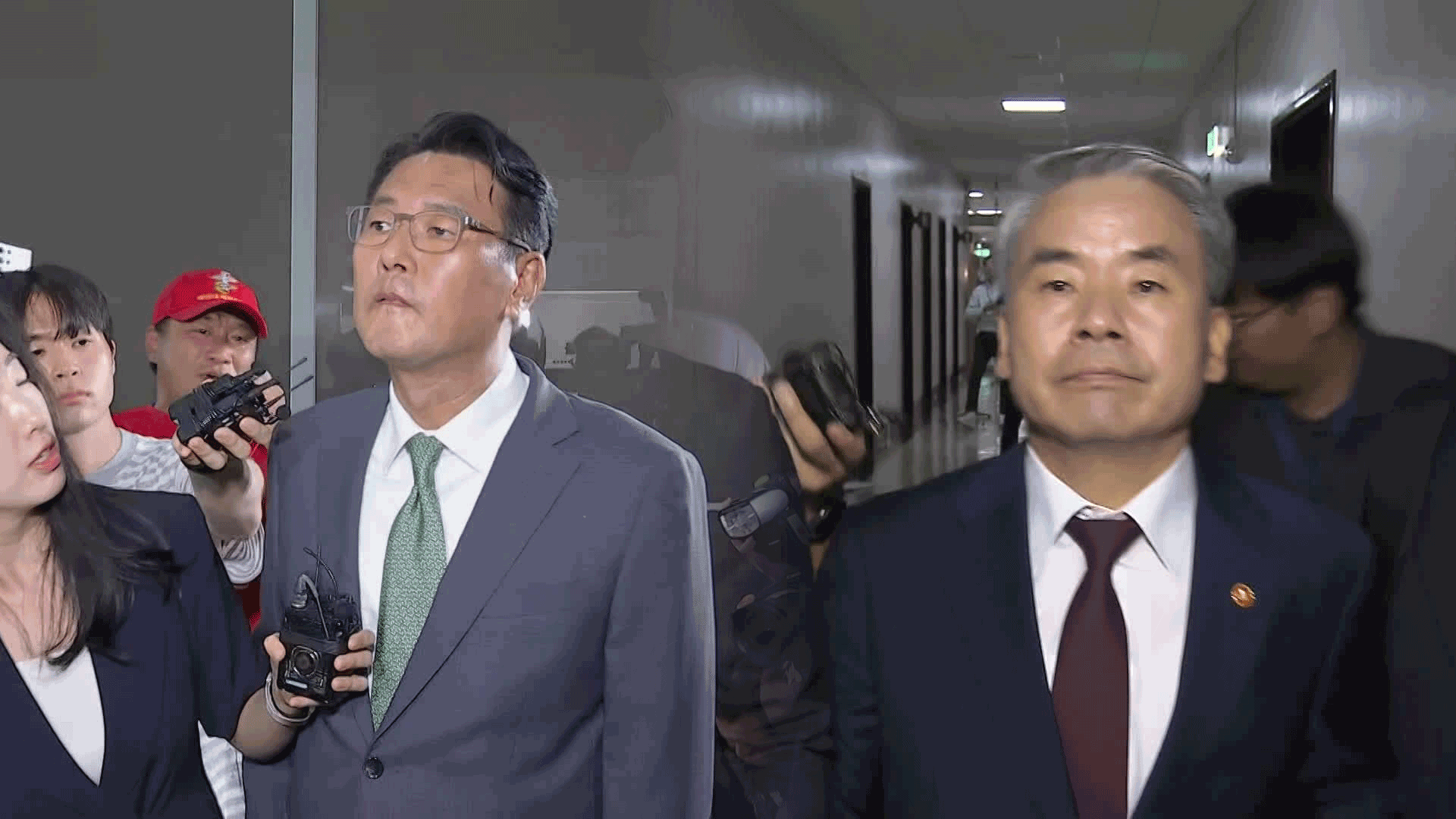

[Park Chan-dae/Democratic Party Representative: "Regarding the deferment of virtual assets, after deep discussions, we believe that it is time for additional institutional arrangements, so we have agreed to a two-year deferment of the taxation on virtual assets."]

The Democratic Party has previously stated that, under the principle that taxation applies where there is income, the 'virtual asset income tax' should be implemented as scheduled in January next year.

However, as more than 70,000 people signed the request for a tax deferment on the 'Public Consent Petition' board of the National Assembly, it seems they changed their position due to the growing backlash from virtual asset investors.

In particular, the fact that 57% of virtual asset investors are in their 30s and 40s has been analyzed as a significant burden for the Democratic Party.

It is also reported that issues such as tax equity between domestic and foreign investors and the difficulty of tracking virtual asset transactions were taken into consideration.

The People Power Party welcomed the Democratic Party's decision but stated that since international information exchange regarding virtual assets will be possible starting in 2027, a deferment is a natural step for fair taxation domestically and internationally.

They criticized the Democratic Party for going back-and-forth and ultimately succumbing to public opinion to confirm the deferment policy.

[Choo Kyung-ho/People Power Party Floor Leader: "We proposed a two-year deferment to start taxing from 2027, when tax information can be exchanged between countries... The Democratic Party has been back-and-forth and has now succumbed to public opinion..."]

With the deferment of the virtual asset income tax following the planned abolition of the financial investment income tax next year, criticism regarding the credibility of tax policy has become unavoidable.

This is KBS News Jeon Hyun-woo.

The Democratic Party has agreed to postpone the implementation of the law that imposes taxes on profits made from virtual assets by two years.

Although they initially maintained that it should be implemented as scheduled, they have taken a step back and accepted the proposal of the government and ruling party.

It appears that they changed their stance as opposition among virtual asset investors grew stronger.

This is Jeon Hyun-woo reporting.

[Report]

The Democratic Party has agreed to a two-year deferment of the 'virtual asset income tax'.

As a result of internal discussions, they concluded that additional institutional arrangements are necessary.

[Park Chan-dae/Democratic Party Representative: "Regarding the deferment of virtual assets, after deep discussions, we believe that it is time for additional institutional arrangements, so we have agreed to a two-year deferment of the taxation on virtual assets."]

The Democratic Party has previously stated that, under the principle that taxation applies where there is income, the 'virtual asset income tax' should be implemented as scheduled in January next year.

However, as more than 70,000 people signed the request for a tax deferment on the 'Public Consent Petition' board of the National Assembly, it seems they changed their position due to the growing backlash from virtual asset investors.

In particular, the fact that 57% of virtual asset investors are in their 30s and 40s has been analyzed as a significant burden for the Democratic Party.

It is also reported that issues such as tax equity between domestic and foreign investors and the difficulty of tracking virtual asset transactions were taken into consideration.

The People Power Party welcomed the Democratic Party's decision but stated that since international information exchange regarding virtual assets will be possible starting in 2027, a deferment is a natural step for fair taxation domestically and internationally.

They criticized the Democratic Party for going back-and-forth and ultimately succumbing to public opinion to confirm the deferment policy.

[Choo Kyung-ho/People Power Party Floor Leader: "We proposed a two-year deferment to start taxing from 2027, when tax information can be exchanged between countries... The Democratic Party has been back-and-forth and has now succumbed to public opinion..."]

With the deferment of the virtual asset income tax following the planned abolition of the financial investment income tax next year, criticism regarding the credibility of tax policy has become unavoidable.

This is KBS News Jeon Hyun-woo.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- DP agrees to two-year deferment of ‘virtual asset income tax’ implementation

-

- 입력 2024-12-01 22:16:47

[Anchor]

The Democratic Party has agreed to postpone the implementation of the law that imposes taxes on profits made from virtual assets by two years.

Although they initially maintained that it should be implemented as scheduled, they have taken a step back and accepted the proposal of the government and ruling party.

It appears that they changed their stance as opposition among virtual asset investors grew stronger.

This is Jeon Hyun-woo reporting.

[Report]

The Democratic Party has agreed to a two-year deferment of the 'virtual asset income tax'.

As a result of internal discussions, they concluded that additional institutional arrangements are necessary.

[Park Chan-dae/Democratic Party Representative: "Regarding the deferment of virtual assets, after deep discussions, we believe that it is time for additional institutional arrangements, so we have agreed to a two-year deferment of the taxation on virtual assets."]

The Democratic Party has previously stated that, under the principle that taxation applies where there is income, the 'virtual asset income tax' should be implemented as scheduled in January next year.

However, as more than 70,000 people signed the request for a tax deferment on the 'Public Consent Petition' board of the National Assembly, it seems they changed their position due to the growing backlash from virtual asset investors.

In particular, the fact that 57% of virtual asset investors are in their 30s and 40s has been analyzed as a significant burden for the Democratic Party.

It is also reported that issues such as tax equity between domestic and foreign investors and the difficulty of tracking virtual asset transactions were taken into consideration.

The People Power Party welcomed the Democratic Party's decision but stated that since international information exchange regarding virtual assets will be possible starting in 2027, a deferment is a natural step for fair taxation domestically and internationally.

They criticized the Democratic Party for going back-and-forth and ultimately succumbing to public opinion to confirm the deferment policy.

[Choo Kyung-ho/People Power Party Floor Leader: "We proposed a two-year deferment to start taxing from 2027, when tax information can be exchanged between countries... The Democratic Party has been back-and-forth and has now succumbed to public opinion..."]

With the deferment of the virtual asset income tax following the planned abolition of the financial investment income tax next year, criticism regarding the credibility of tax policy has become unavoidable.

This is KBS News Jeon Hyun-woo.

The Democratic Party has agreed to postpone the implementation of the law that imposes taxes on profits made from virtual assets by two years.

Although they initially maintained that it should be implemented as scheduled, they have taken a step back and accepted the proposal of the government and ruling party.

It appears that they changed their stance as opposition among virtual asset investors grew stronger.

This is Jeon Hyun-woo reporting.

[Report]

The Democratic Party has agreed to a two-year deferment of the 'virtual asset income tax'.

As a result of internal discussions, they concluded that additional institutional arrangements are necessary.

[Park Chan-dae/Democratic Party Representative: "Regarding the deferment of virtual assets, after deep discussions, we believe that it is time for additional institutional arrangements, so we have agreed to a two-year deferment of the taxation on virtual assets."]

The Democratic Party has previously stated that, under the principle that taxation applies where there is income, the 'virtual asset income tax' should be implemented as scheduled in January next year.

However, as more than 70,000 people signed the request for a tax deferment on the 'Public Consent Petition' board of the National Assembly, it seems they changed their position due to the growing backlash from virtual asset investors.

In particular, the fact that 57% of virtual asset investors are in their 30s and 40s has been analyzed as a significant burden for the Democratic Party.

It is also reported that issues such as tax equity between domestic and foreign investors and the difficulty of tracking virtual asset transactions were taken into consideration.

The People Power Party welcomed the Democratic Party's decision but stated that since international information exchange regarding virtual assets will be possible starting in 2027, a deferment is a natural step for fair taxation domestically and internationally.

They criticized the Democratic Party for going back-and-forth and ultimately succumbing to public opinion to confirm the deferment policy.

[Choo Kyung-ho/People Power Party Floor Leader: "We proposed a two-year deferment to start taxing from 2027, when tax information can be exchanged between countries... The Democratic Party has been back-and-forth and has now succumbed to public opinion..."]

With the deferment of the virtual asset income tax following the planned abolition of the financial investment income tax next year, criticism regarding the credibility of tax policy has become unavoidable.

This is KBS News Jeon Hyun-woo.

-

-

전현우 기자 kbsni@kbs.co.kr

전현우 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.