Insurance companies in deficit due to inflated non-covered medical procedures

입력 2024.12.04 (01:52)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

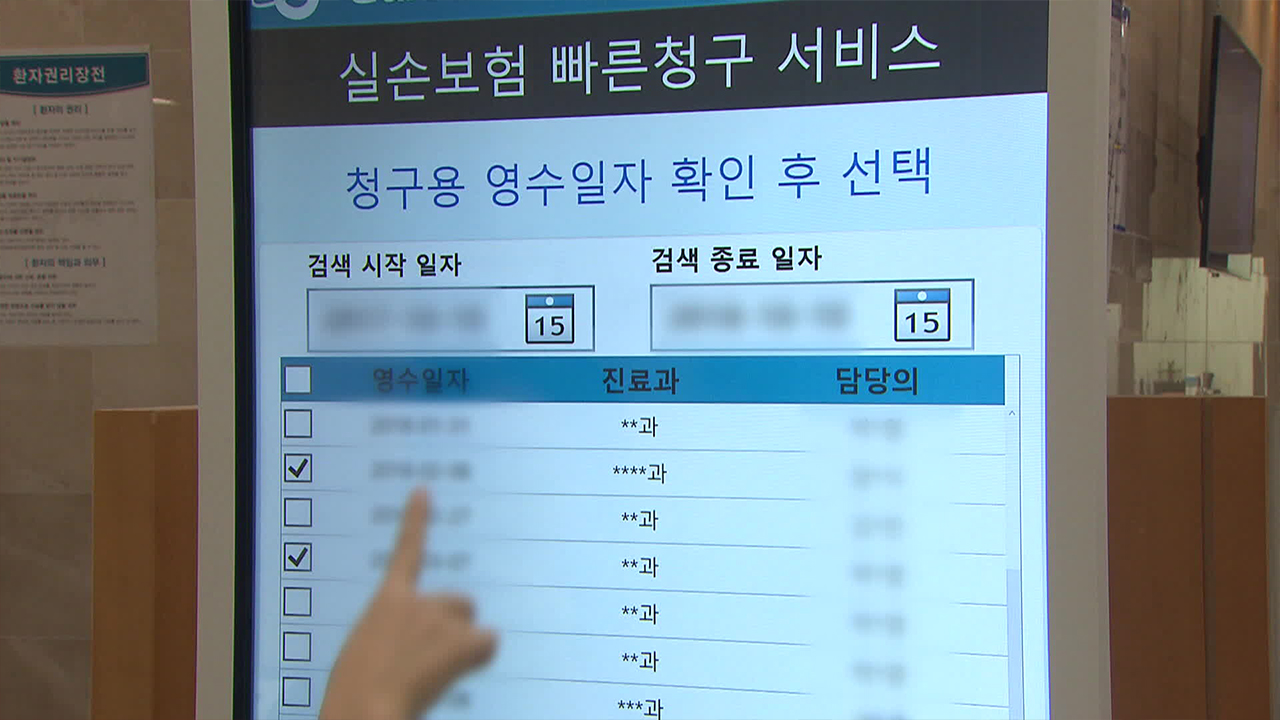

The actual loss health insurance was introduced, aimed at reducing the burden of medical expenses for the public, but has now accumulated deficits amid suspicions of over-treatment.

There have been numerous cases of abusing health insurance by inflating non-covered treatments such as physical therapy.

Reporter Jin Sun-min investigated the reality of excessive non-covered treatments.

[Report]

A 20-year-old individual, referred to as A, visited a local clinic six months ago due to joint pain.

The consulting staff first asked A if they were enrolled in 'actual loss health insurance' and suggested that in addition to physical therapy, they could receive liposuction at a 'special price.'

[A○○/Actual Loss Health Insurance Holder: "(At the hospital) they said since I have first-generation (actual loss health) insurance, I can get a rebate on all the physical therapy. They said the five sessions of liposuction was conceptually a provided service, and there’s absolutely no issue with insurance payouts."]

The total medical cost was 11 million won.

Physical therapy was set at 250,000 won per session for 39 sessions, and the abdominal liposuction was to be performed for 1.2 million won.

The cost of physical therapy is among the highest in the country, while the liposuction cost was relatively low.

By inflating the non-covered treatment costs which would be processed through actual loss health insurance, it effectively covered the cosmetic procedure costs that the patient would have to pay, but the hospital claims there is no problem.

[A's treating physician/voice altered: "It's not like we created a bill for physical therapy without providing the treatment. (The cosmetic procedure cost) was a bit cheaper than typical surgical fees, but that doesn’t mean we made it absurdly rebateable through the actual loss health insurance."]

However, this was not just A's case.

A woman in her 50s visited a surgical clinic in Seoul due to unexplained leg pain and ended up undergoing varicose vein surgery on the same day as the consultation.

The surgery cost was 13 million won.

She went under the knife because it was said to be covered by actual loss health insurance, but she saw no significant improvement to her pain.

[Lee Sang-wook/'Varicose Vein Surgery' Patient's Son: "If spending that money leads to recovery, that’s fine, but on what basis did they determine that this surgery was necessary, and did my mother dramatically recover after the procedure? That’s not the case at all."]

In the first half of this year, five health insurance companies paid out 2.8 trillion won for non-covered medical expenses, an 8% increase compared to last year.

This is KBS News, Jin Sun-min.

The actual loss health insurance was introduced, aimed at reducing the burden of medical expenses for the public, but has now accumulated deficits amid suspicions of over-treatment.

There have been numerous cases of abusing health insurance by inflating non-covered treatments such as physical therapy.

Reporter Jin Sun-min investigated the reality of excessive non-covered treatments.

[Report]

A 20-year-old individual, referred to as A, visited a local clinic six months ago due to joint pain.

The consulting staff first asked A if they were enrolled in 'actual loss health insurance' and suggested that in addition to physical therapy, they could receive liposuction at a 'special price.'

[A○○/Actual Loss Health Insurance Holder: "(At the hospital) they said since I have first-generation (actual loss health) insurance, I can get a rebate on all the physical therapy. They said the five sessions of liposuction was conceptually a provided service, and there’s absolutely no issue with insurance payouts."]

The total medical cost was 11 million won.

Physical therapy was set at 250,000 won per session for 39 sessions, and the abdominal liposuction was to be performed for 1.2 million won.

The cost of physical therapy is among the highest in the country, while the liposuction cost was relatively low.

By inflating the non-covered treatment costs which would be processed through actual loss health insurance, it effectively covered the cosmetic procedure costs that the patient would have to pay, but the hospital claims there is no problem.

[A's treating physician/voice altered: "It's not like we created a bill for physical therapy without providing the treatment. (The cosmetic procedure cost) was a bit cheaper than typical surgical fees, but that doesn’t mean we made it absurdly rebateable through the actual loss health insurance."]

However, this was not just A's case.

A woman in her 50s visited a surgical clinic in Seoul due to unexplained leg pain and ended up undergoing varicose vein surgery on the same day as the consultation.

The surgery cost was 13 million won.

She went under the knife because it was said to be covered by actual loss health insurance, but she saw no significant improvement to her pain.

[Lee Sang-wook/'Varicose Vein Surgery' Patient's Son: "If spending that money leads to recovery, that’s fine, but on what basis did they determine that this surgery was necessary, and did my mother dramatically recover after the procedure? That’s not the case at all."]

In the first half of this year, five health insurance companies paid out 2.8 trillion won for non-covered medical expenses, an 8% increase compared to last year.

This is KBS News, Jin Sun-min.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Insurance companies in deficit due to inflated non-covered medical procedures

-

- 입력 2024-12-04 01:52:42

[Anchor]

The actual loss health insurance was introduced, aimed at reducing the burden of medical expenses for the public, but has now accumulated deficits amid suspicions of over-treatment.

There have been numerous cases of abusing health insurance by inflating non-covered treatments such as physical therapy.

Reporter Jin Sun-min investigated the reality of excessive non-covered treatments.

[Report]

A 20-year-old individual, referred to as A, visited a local clinic six months ago due to joint pain.

The consulting staff first asked A if they were enrolled in 'actual loss health insurance' and suggested that in addition to physical therapy, they could receive liposuction at a 'special price.'

[A○○/Actual Loss Health Insurance Holder: "(At the hospital) they said since I have first-generation (actual loss health) insurance, I can get a rebate on all the physical therapy. They said the five sessions of liposuction was conceptually a provided service, and there’s absolutely no issue with insurance payouts."]

The total medical cost was 11 million won.

Physical therapy was set at 250,000 won per session for 39 sessions, and the abdominal liposuction was to be performed for 1.2 million won.

The cost of physical therapy is among the highest in the country, while the liposuction cost was relatively low.

By inflating the non-covered treatment costs which would be processed through actual loss health insurance, it effectively covered the cosmetic procedure costs that the patient would have to pay, but the hospital claims there is no problem.

[A's treating physician/voice altered: "It's not like we created a bill for physical therapy without providing the treatment. (The cosmetic procedure cost) was a bit cheaper than typical surgical fees, but that doesn’t mean we made it absurdly rebateable through the actual loss health insurance."]

However, this was not just A's case.

A woman in her 50s visited a surgical clinic in Seoul due to unexplained leg pain and ended up undergoing varicose vein surgery on the same day as the consultation.

The surgery cost was 13 million won.

She went under the knife because it was said to be covered by actual loss health insurance, but she saw no significant improvement to her pain.

[Lee Sang-wook/'Varicose Vein Surgery' Patient's Son: "If spending that money leads to recovery, that’s fine, but on what basis did they determine that this surgery was necessary, and did my mother dramatically recover after the procedure? That’s not the case at all."]

In the first half of this year, five health insurance companies paid out 2.8 trillion won for non-covered medical expenses, an 8% increase compared to last year.

This is KBS News, Jin Sun-min.

The actual loss health insurance was introduced, aimed at reducing the burden of medical expenses for the public, but has now accumulated deficits amid suspicions of over-treatment.

There have been numerous cases of abusing health insurance by inflating non-covered treatments such as physical therapy.

Reporter Jin Sun-min investigated the reality of excessive non-covered treatments.

[Report]

A 20-year-old individual, referred to as A, visited a local clinic six months ago due to joint pain.

The consulting staff first asked A if they were enrolled in 'actual loss health insurance' and suggested that in addition to physical therapy, they could receive liposuction at a 'special price.'

[A○○/Actual Loss Health Insurance Holder: "(At the hospital) they said since I have first-generation (actual loss health) insurance, I can get a rebate on all the physical therapy. They said the five sessions of liposuction was conceptually a provided service, and there’s absolutely no issue with insurance payouts."]

The total medical cost was 11 million won.

Physical therapy was set at 250,000 won per session for 39 sessions, and the abdominal liposuction was to be performed for 1.2 million won.

The cost of physical therapy is among the highest in the country, while the liposuction cost was relatively low.

By inflating the non-covered treatment costs which would be processed through actual loss health insurance, it effectively covered the cosmetic procedure costs that the patient would have to pay, but the hospital claims there is no problem.

[A's treating physician/voice altered: "It's not like we created a bill for physical therapy without providing the treatment. (The cosmetic procedure cost) was a bit cheaper than typical surgical fees, but that doesn’t mean we made it absurdly rebateable through the actual loss health insurance."]

However, this was not just A's case.

A woman in her 50s visited a surgical clinic in Seoul due to unexplained leg pain and ended up undergoing varicose vein surgery on the same day as the consultation.

The surgery cost was 13 million won.

She went under the knife because it was said to be covered by actual loss health insurance, but she saw no significant improvement to her pain.

[Lee Sang-wook/'Varicose Vein Surgery' Patient's Son: "If spending that money leads to recovery, that’s fine, but on what basis did they determine that this surgery was necessary, and did my mother dramatically recover after the procedure? That’s not the case at all."]

In the first half of this year, five health insurance companies paid out 2.8 trillion won for non-covered medical expenses, an 8% increase compared to last year.

This is KBS News, Jin Sun-min.

-

-

진선민 기자 jsm@kbs.co.kr

진선민 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.