[News Today] WON-DOLLAR RATE ON THE RISE

입력 2024.12.12 (16:40)

수정 2024.12.12 (16:43)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[LEAD]

Political unrest continues amid martial law conflicts and impeachment standoff. This has caused persistent volatility in the Korean won's value. Experts predict that a return to previous exchange rates is unlikely in the near future.

[REPORT]

The won-dollar exchange rate has risen again after dropping to the 1,420-won-per-dollar level at authorities' suggestion of market intervention

The foreign exchange rate climbed 5.3 won to end at 1,432.2 won against the greenback, compared to the previous session.

It is because Korea's political uncertaines are continuing in the wake of the post-martial law crisis and the U.S. dollar has gained strength ahead of next week's Federal Open Market Committee meeting, which will decide on the U.S. key interest rate.

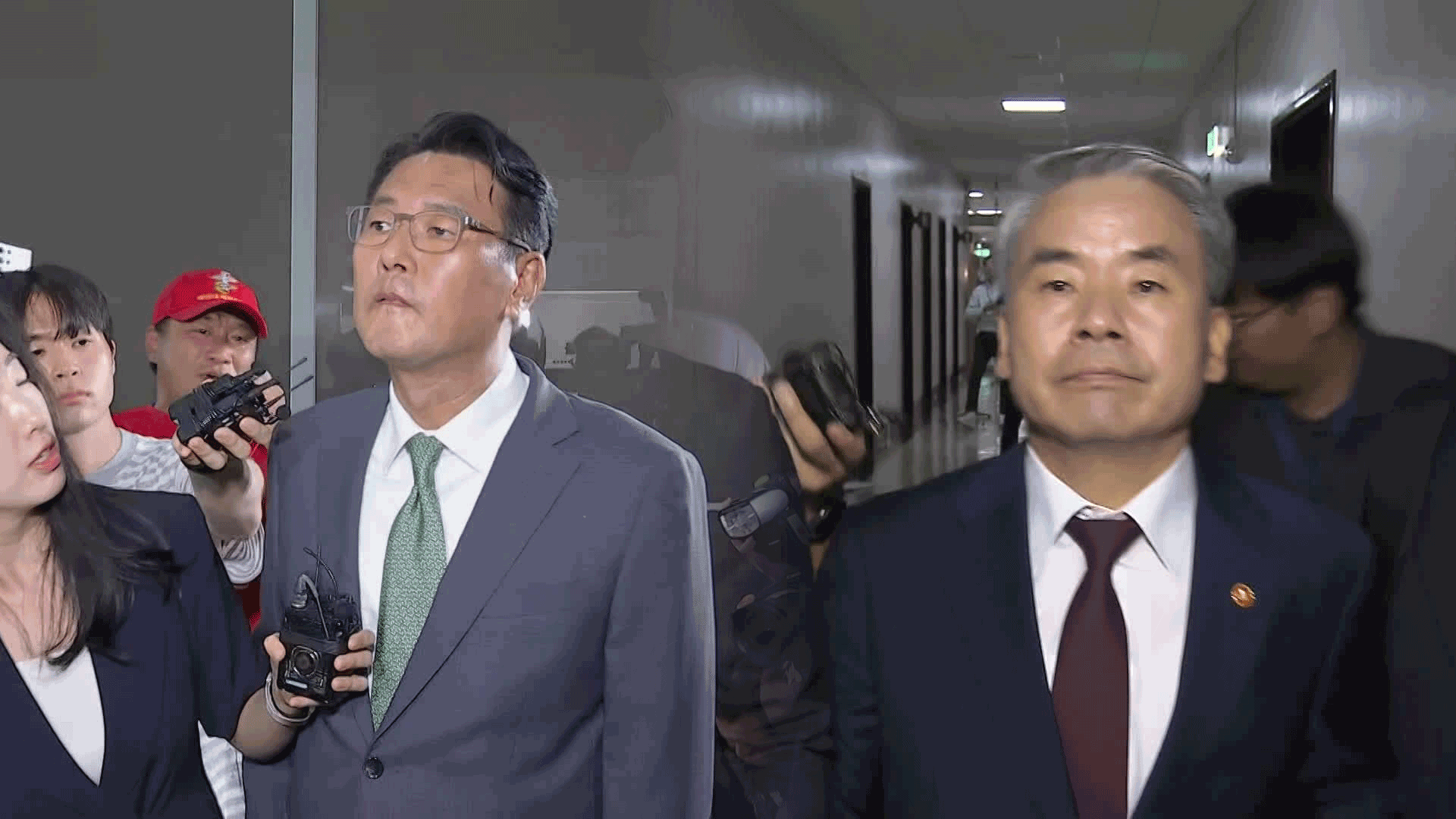

Park Hyung-joong / Woori Bank

The won-dollar rate may rise more quickly if comments suggest interest rate cuts could slow or inflation concerns heightened.

Bank of Korea Governor Rhee Chang-yong said that the won-dollar rate will unlikely return to previous levels for the time being.

Amid concerns that the exchange rate may remain at the 1,400-won level, some market watchers say that it might even jump to 1,450 won per dollar.

This is an unprecedented level that hasn't been experienced except only during the currency crisis or global financial crisis.

The problem is that the nation's foreign reserves will drop if authorities actively intervene in the market to keep the exchange rate stable.

If the foreign reserves are found to fall below 400 billion U.S. dollars next month, it will likely trigger greater market jitters.

On the back of institutional investors' buying, Korean shares gained both on the benchmark KOSPI and the tech-heavy KOSDAQ for the second straight session.

However, foreign investors sold off over 210 billion won, or some 147 million U.S. dollars, worth of stocks on the KOSPI and KOSDAQ.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- [News Today] WON-DOLLAR RATE ON THE RISE

-

- 입력 2024-12-12 16:40:58

- 수정2024-12-12 16:43:09

[LEAD]

Political unrest continues amid martial law conflicts and impeachment standoff. This has caused persistent volatility in the Korean won's value. Experts predict that a return to previous exchange rates is unlikely in the near future.

[REPORT]

The won-dollar exchange rate has risen again after dropping to the 1,420-won-per-dollar level at authorities' suggestion of market intervention

The foreign exchange rate climbed 5.3 won to end at 1,432.2 won against the greenback, compared to the previous session.

It is because Korea's political uncertaines are continuing in the wake of the post-martial law crisis and the U.S. dollar has gained strength ahead of next week's Federal Open Market Committee meeting, which will decide on the U.S. key interest rate.

Park Hyung-joong / Woori Bank

The won-dollar rate may rise more quickly if comments suggest interest rate cuts could slow or inflation concerns heightened.

Bank of Korea Governor Rhee Chang-yong said that the won-dollar rate will unlikely return to previous levels for the time being.

Amid concerns that the exchange rate may remain at the 1,400-won level, some market watchers say that it might even jump to 1,450 won per dollar.

This is an unprecedented level that hasn't been experienced except only during the currency crisis or global financial crisis.

The problem is that the nation's foreign reserves will drop if authorities actively intervene in the market to keep the exchange rate stable.

If the foreign reserves are found to fall below 400 billion U.S. dollars next month, it will likely trigger greater market jitters.

On the back of institutional investors' buying, Korean shares gained both on the benchmark KOSPI and the tech-heavy KOSDAQ for the second straight session.

However, foreign investors sold off over 210 billion won, or some 147 million U.S. dollars, worth of stocks on the KOSPI and KOSDAQ.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.