[News Today] TRADE RISKS OF 2ND TRUMP ADMIN.

입력 2024.12.17 (16:13)

수정 2024.12.17 (16:14)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[LEAD]

Amid a domestic leadership crisis, President Donald Trump's second term is set to begin in a month. Heightened trade pressures and potential major adjustments to the Biden administration's Inflation Reduction Act could diminish the value of Korean investments in the U.S.

[REPORT]

Electric vehicle battery manufacturers LG Energy Solution and SK On received tax credits worth over 500 billion won, or nearly 400 million dollars, for their factories in the U.S. in the third quarter of 2024 alone.

This was possible thanks to the Biden administration's Inflation Reduction Act.

Otherwise, the companies would have sustained losses.

However, the incoming Trump administration, which is to take office next month, has hinted at the possibility of abolishing the IRA.

Donald Trump / U.S. President-elect (Oct. 2024)

We will end the green new scam once and for all.

It is also unclear if Samsung Electronics will be able to receive 6.4 billion dollars, or 9.17 trillion won, in promised incentives for its investment in the Taylor factory in Texas.

That's because Trump has vowed to adjust the CHIPS and Science Act, which is the basis for incentives.

At a seminar held on Monday, concerns were raised that strong tariff policies and the repeal of the IRA could undermine the significance of investments made by Korean companies in the U.S. during the Biden administration.

Stephen Vaughn / Former acting U.S. Trade Representative

The voters have now reaffirmed their support for the president, which puts him in a strong position politically. I think you're going to anticipate a very aggressive trade policy from the president.

Trump has even warned of imposing 10-20% universal baseline tariffs on all imports.

Korea's exports, which have slowed in August, could also suffer a blow.

Joo Won / Hyundai Economic Research Inst.

Some trade issues can be resolved easily when the presidents discuss them personally. But given the political situation in Korea, trade talks with the U.S. are unlikely to go well.

If the Trump administration applies strong pressure in negotiations, an immediate response may be necessary, but Korea's leadership vacuum could become an even greater challenge.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- [News Today] TRADE RISKS OF 2ND TRUMP ADMIN.

-

- 입력 2024-12-17 16:13:19

- 수정2024-12-17 16:14:23

[LEAD]

Amid a domestic leadership crisis, President Donald Trump's second term is set to begin in a month. Heightened trade pressures and potential major adjustments to the Biden administration's Inflation Reduction Act could diminish the value of Korean investments in the U.S.

[REPORT]

Electric vehicle battery manufacturers LG Energy Solution and SK On received tax credits worth over 500 billion won, or nearly 400 million dollars, for their factories in the U.S. in the third quarter of 2024 alone.

This was possible thanks to the Biden administration's Inflation Reduction Act.

Otherwise, the companies would have sustained losses.

However, the incoming Trump administration, which is to take office next month, has hinted at the possibility of abolishing the IRA.

Donald Trump / U.S. President-elect (Oct. 2024)

We will end the green new scam once and for all.

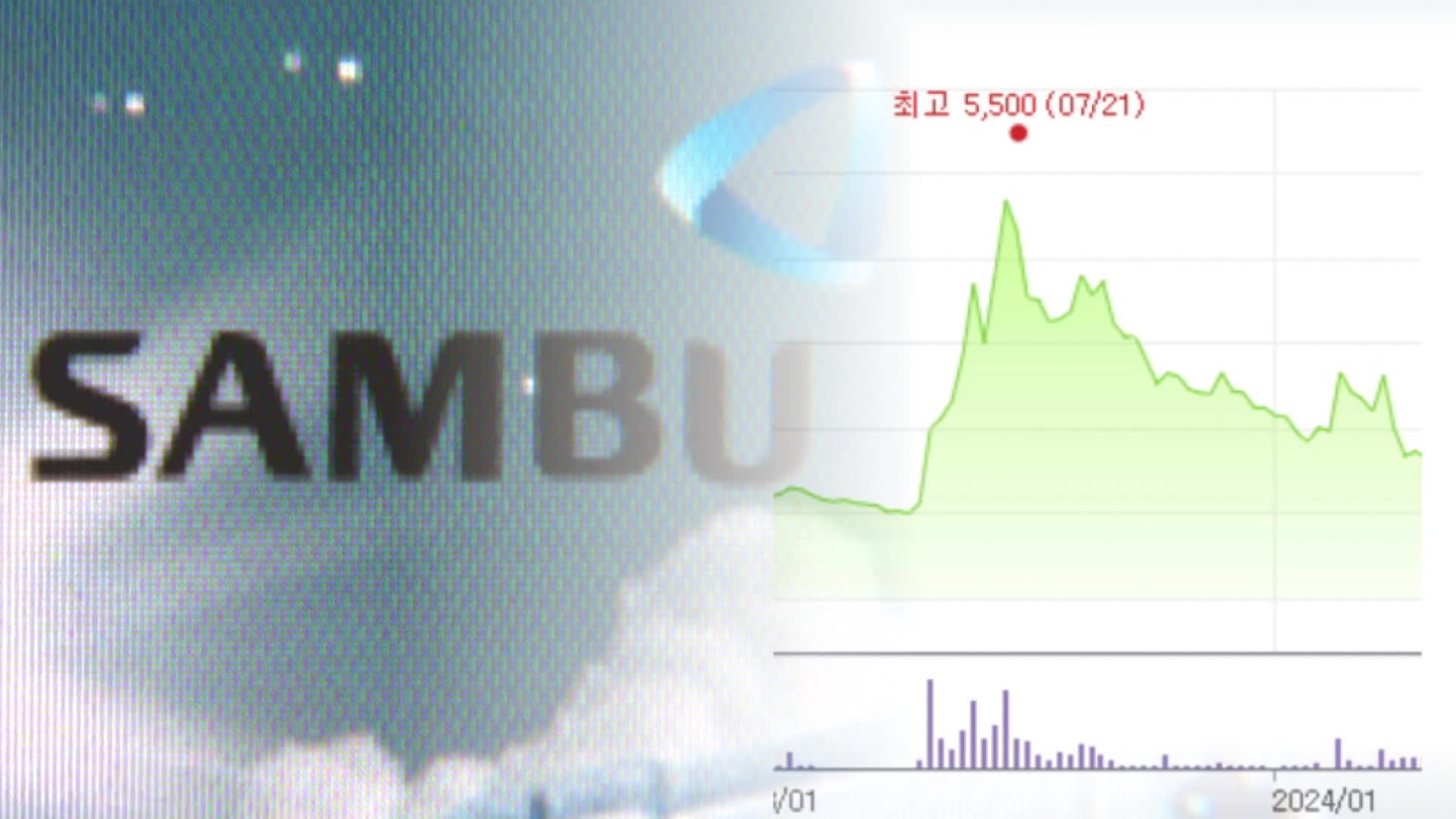

It is also unclear if Samsung Electronics will be able to receive 6.4 billion dollars, or 9.17 trillion won, in promised incentives for its investment in the Taylor factory in Texas.

That's because Trump has vowed to adjust the CHIPS and Science Act, which is the basis for incentives.

At a seminar held on Monday, concerns were raised that strong tariff policies and the repeal of the IRA could undermine the significance of investments made by Korean companies in the U.S. during the Biden administration.

Stephen Vaughn / Former acting U.S. Trade Representative

The voters have now reaffirmed their support for the president, which puts him in a strong position politically. I think you're going to anticipate a very aggressive trade policy from the president.

Trump has even warned of imposing 10-20% universal baseline tariffs on all imports.

Korea's exports, which have slowed in August, could also suffer a blow.

Joo Won / Hyundai Economic Research Inst.

Some trade issues can be resolved easily when the presidents discuss them personally. But given the political situation in Korea, trade talks with the U.S. are unlikely to go well.

If the Trump administration applies strong pressure in negotiations, an immediate response may be necessary, but Korea's leadership vacuum could become an even greater challenge.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] 김민석 총리, 취임 첫 일정으로 ‘송미령 반대’ 농민단체 농성장 방문](/data/news/2025/07/03/20250703_YUTdgQ.png)

이 기사에 대한 의견을 남겨주세요.