[News Today] WON-DOLLAR RATE KEEPS SOARING

입력 2024.12.19 (16:39)

수정 2024.12.19 (16:39)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[LEAD]

Meanwhile, the won-dollar exchange rate is showing no signs of stablizing. The passing of the impeachment motion was expected to help ease uncertainties but other factors are weighing in.

[REPORT]

The weekly trading at the foreign exchange market closed at 1,435.50 won per dollar.

The rate rose to almost 1,450 won per dollar immediately after the declaration of martial law and has remained around the mid-1,400 won level since then.

The passing of the impeachment motion was expected to dispel uncertainties, but external factors, especially the incoming Trump administration, has eclipsed expectations.

Paik Seok-hyun/ Shinhan Bank Economist

Our domestic politics is a short-term factor for the KRW-USD exchange rate. The rate is bound to rise as global capital is headed only into the US.

The U.S. economy is the only one thriving, prompting everyone to buy the U.S. currency.

Three months earlier, the exchange rate was around the low 1,300 won per dollar mark. The rate spiked more than 100 won in just three months. It's rising too fast.

The rapid increase is giving rise to the fear that the won-dollar rate would exceed 1,500 won per dollar.

The rate rose above 1,500 won only twice in the past - during the 1997 foreign currency crisis and the 2008 financial crisis. It is almost at the critical level.

The Korean government has made it clear that fearing another foreign currency crisis is excessive.

Authorities emphasize the fact that Korea is a net creditor country with more dollar receivables than dollar liabilities.

Also, Korea's foreign currency reserve ranks ninth highest in the world.

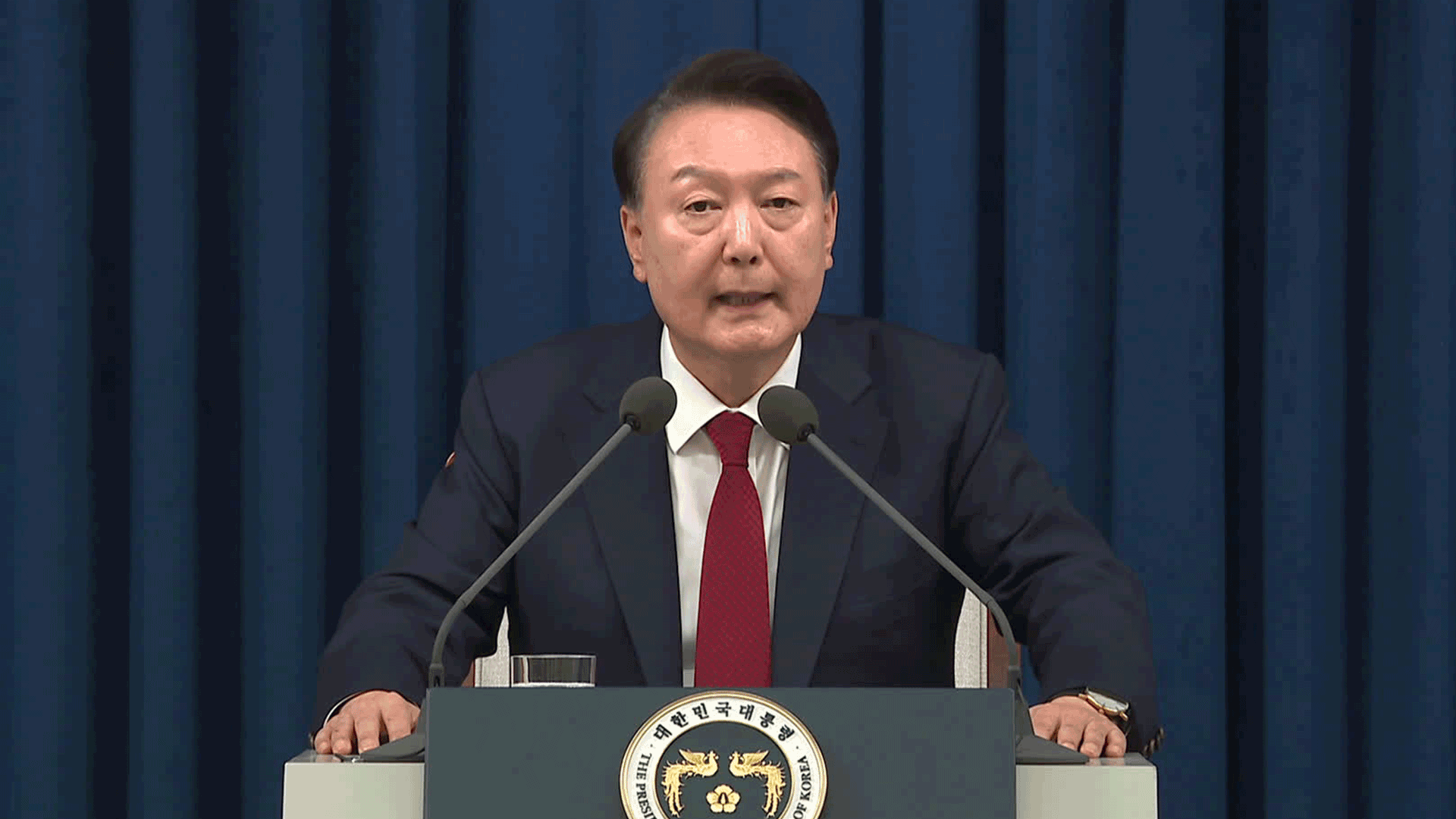

Rhee Chang-yong / Governor, Bank Of Korea

I believe the volatility is somewhat down even though we didn't intervene much.

However, Korea's foreign currency reserve fell to 410 billion dollars last month. The reserve was in excess of 460 billion dollars as recently as 2021.

The amount is down because the nation's trade surplus hasn't been as robust as before and the government has kept releasing the U.S. currency to hold down the exchange rate.

The nation is hoping that the foreign reserve wouldn't fall below the psychological barrier of 400 billion dollars.

Meanwhile, the won-dollar exchange rate is showing no signs of stablizing. The passing of the impeachment motion was expected to help ease uncertainties but other factors are weighing in.

[REPORT]

The weekly trading at the foreign exchange market closed at 1,435.50 won per dollar.

The rate rose to almost 1,450 won per dollar immediately after the declaration of martial law and has remained around the mid-1,400 won level since then.

The passing of the impeachment motion was expected to dispel uncertainties, but external factors, especially the incoming Trump administration, has eclipsed expectations.

Paik Seok-hyun/ Shinhan Bank Economist

Our domestic politics is a short-term factor for the KRW-USD exchange rate. The rate is bound to rise as global capital is headed only into the US.

The U.S. economy is the only one thriving, prompting everyone to buy the U.S. currency.

Three months earlier, the exchange rate was around the low 1,300 won per dollar mark. The rate spiked more than 100 won in just three months. It's rising too fast.

The rapid increase is giving rise to the fear that the won-dollar rate would exceed 1,500 won per dollar.

The rate rose above 1,500 won only twice in the past - during the 1997 foreign currency crisis and the 2008 financial crisis. It is almost at the critical level.

The Korean government has made it clear that fearing another foreign currency crisis is excessive.

Authorities emphasize the fact that Korea is a net creditor country with more dollar receivables than dollar liabilities.

Also, Korea's foreign currency reserve ranks ninth highest in the world.

Rhee Chang-yong / Governor, Bank Of Korea

I believe the volatility is somewhat down even though we didn't intervene much.

However, Korea's foreign currency reserve fell to 410 billion dollars last month. The reserve was in excess of 460 billion dollars as recently as 2021.

The amount is down because the nation's trade surplus hasn't been as robust as before and the government has kept releasing the U.S. currency to hold down the exchange rate.

The nation is hoping that the foreign reserve wouldn't fall below the psychological barrier of 400 billion dollars.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- [News Today] WON-DOLLAR RATE KEEPS SOARING

-

- 입력 2024-12-19 16:39:02

- 수정2024-12-19 16:39:57

[LEAD]

Meanwhile, the won-dollar exchange rate is showing no signs of stablizing. The passing of the impeachment motion was expected to help ease uncertainties but other factors are weighing in.

[REPORT]

The weekly trading at the foreign exchange market closed at 1,435.50 won per dollar.

The rate rose to almost 1,450 won per dollar immediately after the declaration of martial law and has remained around the mid-1,400 won level since then.

The passing of the impeachment motion was expected to dispel uncertainties, but external factors, especially the incoming Trump administration, has eclipsed expectations.

Paik Seok-hyun/ Shinhan Bank Economist

Our domestic politics is a short-term factor for the KRW-USD exchange rate. The rate is bound to rise as global capital is headed only into the US.

The U.S. economy is the only one thriving, prompting everyone to buy the U.S. currency.

Three months earlier, the exchange rate was around the low 1,300 won per dollar mark. The rate spiked more than 100 won in just three months. It's rising too fast.

The rapid increase is giving rise to the fear that the won-dollar rate would exceed 1,500 won per dollar.

The rate rose above 1,500 won only twice in the past - during the 1997 foreign currency crisis and the 2008 financial crisis. It is almost at the critical level.

The Korean government has made it clear that fearing another foreign currency crisis is excessive.

Authorities emphasize the fact that Korea is a net creditor country with more dollar receivables than dollar liabilities.

Also, Korea's foreign currency reserve ranks ninth highest in the world.

Rhee Chang-yong / Governor, Bank Of Korea

I believe the volatility is somewhat down even though we didn't intervene much.

However, Korea's foreign currency reserve fell to 410 billion dollars last month. The reserve was in excess of 460 billion dollars as recently as 2021.

The amount is down because the nation's trade surplus hasn't been as robust as before and the government has kept releasing the U.S. currency to hold down the exchange rate.

The nation is hoping that the foreign reserve wouldn't fall below the psychological barrier of 400 billion dollars.

Meanwhile, the won-dollar exchange rate is showing no signs of stablizing. The passing of the impeachment motion was expected to help ease uncertainties but other factors are weighing in.

[REPORT]

The weekly trading at the foreign exchange market closed at 1,435.50 won per dollar.

The rate rose to almost 1,450 won per dollar immediately after the declaration of martial law and has remained around the mid-1,400 won level since then.

The passing of the impeachment motion was expected to dispel uncertainties, but external factors, especially the incoming Trump administration, has eclipsed expectations.

Paik Seok-hyun/ Shinhan Bank Economist

Our domestic politics is a short-term factor for the KRW-USD exchange rate. The rate is bound to rise as global capital is headed only into the US.

The U.S. economy is the only one thriving, prompting everyone to buy the U.S. currency.

Three months earlier, the exchange rate was around the low 1,300 won per dollar mark. The rate spiked more than 100 won in just three months. It's rising too fast.

The rapid increase is giving rise to the fear that the won-dollar rate would exceed 1,500 won per dollar.

The rate rose above 1,500 won only twice in the past - during the 1997 foreign currency crisis and the 2008 financial crisis. It is almost at the critical level.

The Korean government has made it clear that fearing another foreign currency crisis is excessive.

Authorities emphasize the fact that Korea is a net creditor country with more dollar receivables than dollar liabilities.

Also, Korea's foreign currency reserve ranks ninth highest in the world.

Rhee Chang-yong / Governor, Bank Of Korea

I believe the volatility is somewhat down even though we didn't intervene much.

However, Korea's foreign currency reserve fell to 410 billion dollars last month. The reserve was in excess of 460 billion dollars as recently as 2021.

The amount is down because the nation's trade surplus hasn't been as robust as before and the government has kept releasing the U.S. currency to hold down the exchange rate.

The nation is hoping that the foreign reserve wouldn't fall below the psychological barrier of 400 billion dollars.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.