Korean won weakens more than others due to internal factors

입력 2024.12.19 (23:55)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

We will take a closer look with our economic reporter on what kind of impact the exchange rate will have on our economy and what breakthroughs we need to find.

Reporter Kim Jin-hwa, as we saw in the previous report, the dollar exchange rate is rising because the U.S. economy is doing so well, but isn't it true that the Korean won has weakened more than others?

[Reporter]

That's correct.

When there are big waves in the ocean, smaller boats tend to shake more easily.

It's a similar situation; I have summarized how much 1 dollar converts to in won, yen, and yuan.

In the past year, the value of the won has dropped by nearly 10%.

However, the yen has decreased by about 8%, and the yuan has dropped by around 3%.

The strength of the dollar is one thing, but the fact that the won has weakened more indicates that there are internal factors in Korea.

[Anchor]

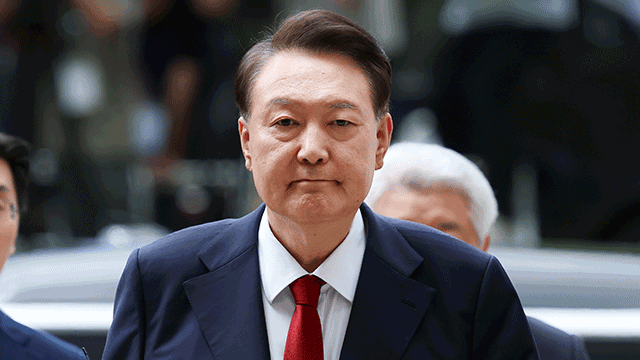

The state of martial law and impeachment were certainly negative factors, but what other factors are there?

[Reporter]

Let's think about it this way.

Was our economy doing well before the martial law?

No, it wasn't.

There were many concerns starting with our largest export item, semiconductors.

You can see that just by looking at Samsung Electronics' stock price.

Various institutions, including the IMF, have also lowered their growth rate forecasts.

Just before the martial law, the exchange rate was already at 1,402 won.

Even without the shock of martial law, the high exchange rate has been steadily accumulating.

[Anchor]

That's why there are concerns these days that a financial crisis might be coming. How should we view this?

[Reporter]

If we only look at the exchange rate numbers, such concerns are understandable.

At this rate, even 1,500 won per dollar seems risky.

However, during the 1997 financial crisis, there was literally a national default, and there were no dollars.

But now, we have the 9th largest foreign exchange reserves in the world, exceeding 400 billion dollars.

The 2008 financial crisis shook the entire world, including the U.S., but now the U.S., which is most closely tied to our economy, is strong.

We can say that there is no need for excessive fear, at least not yet.

[Anchor]

Still, urgent measures are necessary. What actions can be taken?

[Reporter]

The exchange rate is rising because of a shortage of dollars.

We need to supply more dollars.

We are gradually tapping into our foreign exchange reserves and releasing them into the market.

This is something we have always done, and today (12.19), several measures were announced, the most significant being that the National Pension Service will expand the 'foreign exchange swap' where the Bank of Korea directly provides dollars for overseas investments.

This is intended to suppress the demand for dollars in the market.

[Anchor]

Long-term solutions are also important. Where should we look for fundamental breakthroughs?

[Reporter]

Ultimately, the Korean economy needs to improve for the won to strengthen, which will help stabilize the exchange rate.

External factors are difficult for us to control, and the quickest way to act is on the domestic front. Lowering the base rate can stimulate consumption.

However, if done incorrectly, it could lead to more money flowing out to the U.S., which could again affect the exchange rate.

Another method is for the government to loosen its fiscal policy, but this requires a supplementary budget and agreement between the ruling and opposition parties.

We will take a closer look with our economic reporter on what kind of impact the exchange rate will have on our economy and what breakthroughs we need to find.

Reporter Kim Jin-hwa, as we saw in the previous report, the dollar exchange rate is rising because the U.S. economy is doing so well, but isn't it true that the Korean won has weakened more than others?

[Reporter]

That's correct.

When there are big waves in the ocean, smaller boats tend to shake more easily.

It's a similar situation; I have summarized how much 1 dollar converts to in won, yen, and yuan.

In the past year, the value of the won has dropped by nearly 10%.

However, the yen has decreased by about 8%, and the yuan has dropped by around 3%.

The strength of the dollar is one thing, but the fact that the won has weakened more indicates that there are internal factors in Korea.

[Anchor]

The state of martial law and impeachment were certainly negative factors, but what other factors are there?

[Reporter]

Let's think about it this way.

Was our economy doing well before the martial law?

No, it wasn't.

There were many concerns starting with our largest export item, semiconductors.

You can see that just by looking at Samsung Electronics' stock price.

Various institutions, including the IMF, have also lowered their growth rate forecasts.

Just before the martial law, the exchange rate was already at 1,402 won.

Even without the shock of martial law, the high exchange rate has been steadily accumulating.

[Anchor]

That's why there are concerns these days that a financial crisis might be coming. How should we view this?

[Reporter]

If we only look at the exchange rate numbers, such concerns are understandable.

At this rate, even 1,500 won per dollar seems risky.

However, during the 1997 financial crisis, there was literally a national default, and there were no dollars.

But now, we have the 9th largest foreign exchange reserves in the world, exceeding 400 billion dollars.

The 2008 financial crisis shook the entire world, including the U.S., but now the U.S., which is most closely tied to our economy, is strong.

We can say that there is no need for excessive fear, at least not yet.

[Anchor]

Still, urgent measures are necessary. What actions can be taken?

[Reporter]

The exchange rate is rising because of a shortage of dollars.

We need to supply more dollars.

We are gradually tapping into our foreign exchange reserves and releasing them into the market.

This is something we have always done, and today (12.19), several measures were announced, the most significant being that the National Pension Service will expand the 'foreign exchange swap' where the Bank of Korea directly provides dollars for overseas investments.

This is intended to suppress the demand for dollars in the market.

[Anchor]

Long-term solutions are also important. Where should we look for fundamental breakthroughs?

[Reporter]

Ultimately, the Korean economy needs to improve for the won to strengthen, which will help stabilize the exchange rate.

External factors are difficult for us to control, and the quickest way to act is on the domestic front. Lowering the base rate can stimulate consumption.

However, if done incorrectly, it could lead to more money flowing out to the U.S., which could again affect the exchange rate.

Another method is for the government to loosen its fiscal policy, but this requires a supplementary budget and agreement between the ruling and opposition parties.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Korean won weakens more than others due to internal factors

-

- 입력 2024-12-19 23:55:00

[Anchor]

We will take a closer look with our economic reporter on what kind of impact the exchange rate will have on our economy and what breakthroughs we need to find.

Reporter Kim Jin-hwa, as we saw in the previous report, the dollar exchange rate is rising because the U.S. economy is doing so well, but isn't it true that the Korean won has weakened more than others?

[Reporter]

That's correct.

When there are big waves in the ocean, smaller boats tend to shake more easily.

It's a similar situation; I have summarized how much 1 dollar converts to in won, yen, and yuan.

In the past year, the value of the won has dropped by nearly 10%.

However, the yen has decreased by about 8%, and the yuan has dropped by around 3%.

The strength of the dollar is one thing, but the fact that the won has weakened more indicates that there are internal factors in Korea.

[Anchor]

The state of martial law and impeachment were certainly negative factors, but what other factors are there?

[Reporter]

Let's think about it this way.

Was our economy doing well before the martial law?

No, it wasn't.

There were many concerns starting with our largest export item, semiconductors.

You can see that just by looking at Samsung Electronics' stock price.

Various institutions, including the IMF, have also lowered their growth rate forecasts.

Just before the martial law, the exchange rate was already at 1,402 won.

Even without the shock of martial law, the high exchange rate has been steadily accumulating.

[Anchor]

That's why there are concerns these days that a financial crisis might be coming. How should we view this?

[Reporter]

If we only look at the exchange rate numbers, such concerns are understandable.

At this rate, even 1,500 won per dollar seems risky.

However, during the 1997 financial crisis, there was literally a national default, and there were no dollars.

But now, we have the 9th largest foreign exchange reserves in the world, exceeding 400 billion dollars.

The 2008 financial crisis shook the entire world, including the U.S., but now the U.S., which is most closely tied to our economy, is strong.

We can say that there is no need for excessive fear, at least not yet.

[Anchor]

Still, urgent measures are necessary. What actions can be taken?

[Reporter]

The exchange rate is rising because of a shortage of dollars.

We need to supply more dollars.

We are gradually tapping into our foreign exchange reserves and releasing them into the market.

This is something we have always done, and today (12.19), several measures were announced, the most significant being that the National Pension Service will expand the 'foreign exchange swap' where the Bank of Korea directly provides dollars for overseas investments.

This is intended to suppress the demand for dollars in the market.

[Anchor]

Long-term solutions are also important. Where should we look for fundamental breakthroughs?

[Reporter]

Ultimately, the Korean economy needs to improve for the won to strengthen, which will help stabilize the exchange rate.

External factors are difficult for us to control, and the quickest way to act is on the domestic front. Lowering the base rate can stimulate consumption.

However, if done incorrectly, it could lead to more money flowing out to the U.S., which could again affect the exchange rate.

Another method is for the government to loosen its fiscal policy, but this requires a supplementary budget and agreement between the ruling and opposition parties.

We will take a closer look with our economic reporter on what kind of impact the exchange rate will have on our economy and what breakthroughs we need to find.

Reporter Kim Jin-hwa, as we saw in the previous report, the dollar exchange rate is rising because the U.S. economy is doing so well, but isn't it true that the Korean won has weakened more than others?

[Reporter]

That's correct.

When there are big waves in the ocean, smaller boats tend to shake more easily.

It's a similar situation; I have summarized how much 1 dollar converts to in won, yen, and yuan.

In the past year, the value of the won has dropped by nearly 10%.

However, the yen has decreased by about 8%, and the yuan has dropped by around 3%.

The strength of the dollar is one thing, but the fact that the won has weakened more indicates that there are internal factors in Korea.

[Anchor]

The state of martial law and impeachment were certainly negative factors, but what other factors are there?

[Reporter]

Let's think about it this way.

Was our economy doing well before the martial law?

No, it wasn't.

There were many concerns starting with our largest export item, semiconductors.

You can see that just by looking at Samsung Electronics' stock price.

Various institutions, including the IMF, have also lowered their growth rate forecasts.

Just before the martial law, the exchange rate was already at 1,402 won.

Even without the shock of martial law, the high exchange rate has been steadily accumulating.

[Anchor]

That's why there are concerns these days that a financial crisis might be coming. How should we view this?

[Reporter]

If we only look at the exchange rate numbers, such concerns are understandable.

At this rate, even 1,500 won per dollar seems risky.

However, during the 1997 financial crisis, there was literally a national default, and there were no dollars.

But now, we have the 9th largest foreign exchange reserves in the world, exceeding 400 billion dollars.

The 2008 financial crisis shook the entire world, including the U.S., but now the U.S., which is most closely tied to our economy, is strong.

We can say that there is no need for excessive fear, at least not yet.

[Anchor]

Still, urgent measures are necessary. What actions can be taken?

[Reporter]

The exchange rate is rising because of a shortage of dollars.

We need to supply more dollars.

We are gradually tapping into our foreign exchange reserves and releasing them into the market.

This is something we have always done, and today (12.19), several measures were announced, the most significant being that the National Pension Service will expand the 'foreign exchange swap' where the Bank of Korea directly provides dollars for overseas investments.

This is intended to suppress the demand for dollars in the market.

[Anchor]

Long-term solutions are also important. Where should we look for fundamental breakthroughs?

[Reporter]

Ultimately, the Korean economy needs to improve for the won to strengthen, which will help stabilize the exchange rate.

External factors are difficult for us to control, and the quickest way to act is on the domestic front. Lowering the base rate can stimulate consumption.

However, if done incorrectly, it could lead to more money flowing out to the U.S., which could again affect the exchange rate.

Another method is for the government to loosen its fiscal policy, but this requires a supplementary budget and agreement between the ruling and opposition parties.

-

-

김진화 기자 evolution@kbs.co.kr

김진화 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] “윤석열·김용현 등 공모해 군사상 이익 해쳐”…외환죄 대신 일반이적죄 적용](/data/layer/904/2025/07/20250714_3VTJV3.jpg)

이 기사에 대한 의견을 남겨주세요.