Both domestic and foreign factors drive complex national crisis

입력 2024.12.28 (00:30)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

There are no positive signals for our economy, including a rising exchange rate, sluggish domestic consumption, and weak exports.

Let's discuss with our economic reporter what the breakthrough might be in this complex crisis situation.

Reporter Kim Jin-hwa, the reason for the sharp rise in exchange rates must be due to both domestic and international factors, but which do you think is more significant?

[Reporter]

To put it simply, if you ask whether it's due to the U.S. or Korea, the answer is obviously both. However, since the martial law, the exchange rate has significantly been influenced by our own actions.

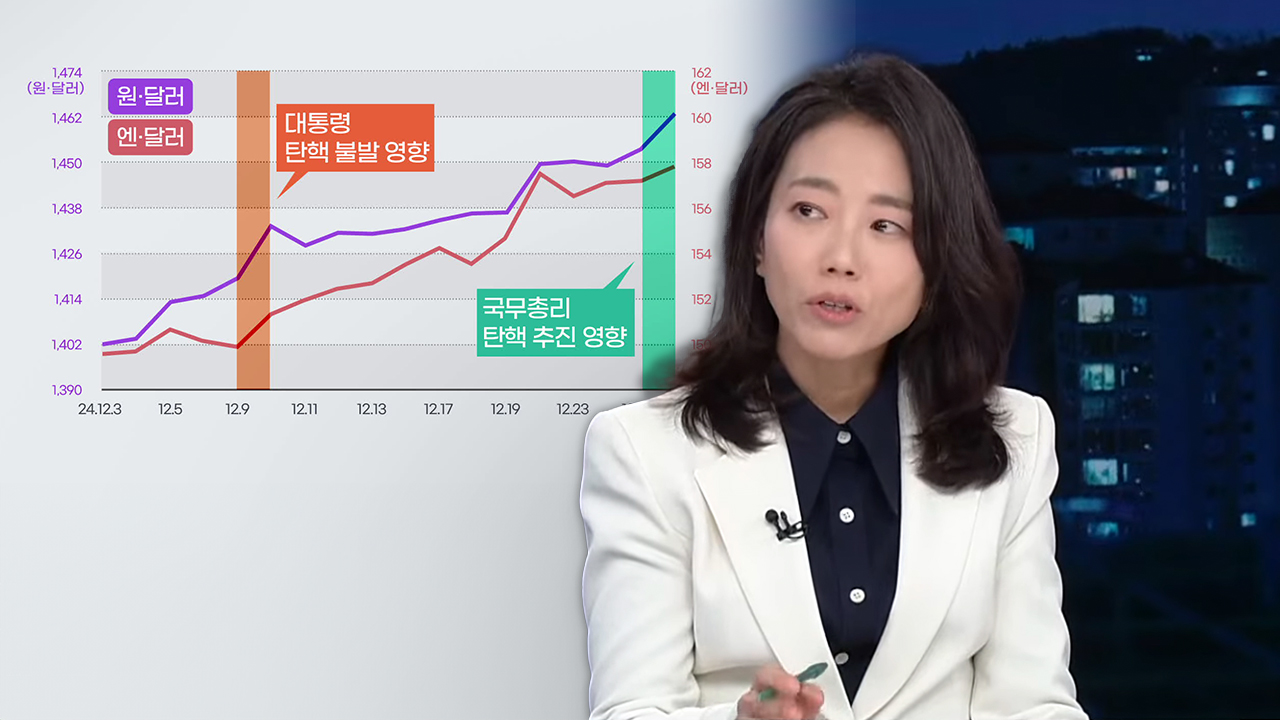

If you look at this graph, it will be quite clear.

This is a comparison of this month's won-dollar and yen-dollar exchange rates, with the 'won' on top and the 'yen' below.

The won-dollar exchange rate is worse, and during times like the failed first impeachment of the president and the introduction of the prime minister's impeachment motion, the won-dollar rate particularly fluctuates, right?

It shows how much politics is affecting the exchange rate.

[Anchor]

The government has also introduced various measures, but they don't seem to have a significant visible effect. What do you think?

[Reporter]

As you saw in the report by Hwang Hyun-kyu earlier, today (12.27) it went up to 1,486 won and closed at 1,467 won.

It seems that the government's release of dollars had an impact, and the market generally views it this way.

Directly releasing dollars does have a suppressive effect, but due to 'foreign exchange reserves', it's difficult to do it every time, and 'exchange rate manipulation' is burdensome, so they can't do it openly.

Therefore, they are using indirect measures to increase dollar supply.

For example, they are temporarily relaxing regulations so that banks can borrow more dollars from abroad, but the situation is not calm enough for such indirect methods to be effective.

[Anchor]

Given this trend, it seems like the exchange rate could reach 1,500 won per dollar. What do you think?

[Reporter]

Yes, that seems likely.

Why is the exchange rate like this now?

There are three main reasons.

First, the U.S. is doing well on its own, which increases the popularity of the dollar.

On the other hand, the Korean economy is the opposite.

Recently, the government projected next year's growth rate to be in the 1% range.

Lastly, when will the martial law and impeachment situation end?

Is there anything among these three that will be resolved soon?

It wouldn't be surprising if the dollar becomes more expensive than it is now.

[Anchor]

Let's also look at the export situation.

This year, the export performance was relatively good, but the outlook for the future does not seem bright. What do you think?

[Reporter]

As you all know, Korea relies on exports, and we need active global trade for our economy to improve.

Two months ago, in October, the IMF released a report.

It projected that if Trump's second term tariff policies are fully implemented, the global economic growth rate will decline by 0.8 percentage points next year and by 1.3 percentage points the year after.

This means that it will be difficult for exports to be as good as they were this year for the time being, and the export growth rate has already started to decline since the second half of this year.

[Anchor]

If it's difficult to control such external factors, it seems we should focus more on revitalizing domestic consumption.

[Reporter]

Yes, that's why the Bank of Korea is suggesting interest rate cuts, while the political sphere is calling for increasing fiscal spending, but both have their challenges.

Lowering interest rates usually leads to increased lending and consumption, but this link has weakened and is no longer as effective as before.

While increasing fiscal spending has a quicker effect, the supplementary budget has become a subject of political bargaining, making it difficult to predict when it will happen.

There are no positive signals for our economy, including a rising exchange rate, sluggish domestic consumption, and weak exports.

Let's discuss with our economic reporter what the breakthrough might be in this complex crisis situation.

Reporter Kim Jin-hwa, the reason for the sharp rise in exchange rates must be due to both domestic and international factors, but which do you think is more significant?

[Reporter]

To put it simply, if you ask whether it's due to the U.S. or Korea, the answer is obviously both. However, since the martial law, the exchange rate has significantly been influenced by our own actions.

If you look at this graph, it will be quite clear.

This is a comparison of this month's won-dollar and yen-dollar exchange rates, with the 'won' on top and the 'yen' below.

The won-dollar exchange rate is worse, and during times like the failed first impeachment of the president and the introduction of the prime minister's impeachment motion, the won-dollar rate particularly fluctuates, right?

It shows how much politics is affecting the exchange rate.

[Anchor]

The government has also introduced various measures, but they don't seem to have a significant visible effect. What do you think?

[Reporter]

As you saw in the report by Hwang Hyun-kyu earlier, today (12.27) it went up to 1,486 won and closed at 1,467 won.

It seems that the government's release of dollars had an impact, and the market generally views it this way.

Directly releasing dollars does have a suppressive effect, but due to 'foreign exchange reserves', it's difficult to do it every time, and 'exchange rate manipulation' is burdensome, so they can't do it openly.

Therefore, they are using indirect measures to increase dollar supply.

For example, they are temporarily relaxing regulations so that banks can borrow more dollars from abroad, but the situation is not calm enough for such indirect methods to be effective.

[Anchor]

Given this trend, it seems like the exchange rate could reach 1,500 won per dollar. What do you think?

[Reporter]

Yes, that seems likely.

Why is the exchange rate like this now?

There are three main reasons.

First, the U.S. is doing well on its own, which increases the popularity of the dollar.

On the other hand, the Korean economy is the opposite.

Recently, the government projected next year's growth rate to be in the 1% range.

Lastly, when will the martial law and impeachment situation end?

Is there anything among these three that will be resolved soon?

It wouldn't be surprising if the dollar becomes more expensive than it is now.

[Anchor]

Let's also look at the export situation.

This year, the export performance was relatively good, but the outlook for the future does not seem bright. What do you think?

[Reporter]

As you all know, Korea relies on exports, and we need active global trade for our economy to improve.

Two months ago, in October, the IMF released a report.

It projected that if Trump's second term tariff policies are fully implemented, the global economic growth rate will decline by 0.8 percentage points next year and by 1.3 percentage points the year after.

This means that it will be difficult for exports to be as good as they were this year for the time being, and the export growth rate has already started to decline since the second half of this year.

[Anchor]

If it's difficult to control such external factors, it seems we should focus more on revitalizing domestic consumption.

[Reporter]

Yes, that's why the Bank of Korea is suggesting interest rate cuts, while the political sphere is calling for increasing fiscal spending, but both have their challenges.

Lowering interest rates usually leads to increased lending and consumption, but this link has weakened and is no longer as effective as before.

While increasing fiscal spending has a quicker effect, the supplementary budget has become a subject of political bargaining, making it difficult to predict when it will happen.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Both domestic and foreign factors drive complex national crisis

-

- 입력 2024-12-28 00:30:03

[Anchor]

There are no positive signals for our economy, including a rising exchange rate, sluggish domestic consumption, and weak exports.

Let's discuss with our economic reporter what the breakthrough might be in this complex crisis situation.

Reporter Kim Jin-hwa, the reason for the sharp rise in exchange rates must be due to both domestic and international factors, but which do you think is more significant?

[Reporter]

To put it simply, if you ask whether it's due to the U.S. or Korea, the answer is obviously both. However, since the martial law, the exchange rate has significantly been influenced by our own actions.

If you look at this graph, it will be quite clear.

This is a comparison of this month's won-dollar and yen-dollar exchange rates, with the 'won' on top and the 'yen' below.

The won-dollar exchange rate is worse, and during times like the failed first impeachment of the president and the introduction of the prime minister's impeachment motion, the won-dollar rate particularly fluctuates, right?

It shows how much politics is affecting the exchange rate.

[Anchor]

The government has also introduced various measures, but they don't seem to have a significant visible effect. What do you think?

[Reporter]

As you saw in the report by Hwang Hyun-kyu earlier, today (12.27) it went up to 1,486 won and closed at 1,467 won.

It seems that the government's release of dollars had an impact, and the market generally views it this way.

Directly releasing dollars does have a suppressive effect, but due to 'foreign exchange reserves', it's difficult to do it every time, and 'exchange rate manipulation' is burdensome, so they can't do it openly.

Therefore, they are using indirect measures to increase dollar supply.

For example, they are temporarily relaxing regulations so that banks can borrow more dollars from abroad, but the situation is not calm enough for such indirect methods to be effective.

[Anchor]

Given this trend, it seems like the exchange rate could reach 1,500 won per dollar. What do you think?

[Reporter]

Yes, that seems likely.

Why is the exchange rate like this now?

There are three main reasons.

First, the U.S. is doing well on its own, which increases the popularity of the dollar.

On the other hand, the Korean economy is the opposite.

Recently, the government projected next year's growth rate to be in the 1% range.

Lastly, when will the martial law and impeachment situation end?

Is there anything among these three that will be resolved soon?

It wouldn't be surprising if the dollar becomes more expensive than it is now.

[Anchor]

Let's also look at the export situation.

This year, the export performance was relatively good, but the outlook for the future does not seem bright. What do you think?

[Reporter]

As you all know, Korea relies on exports, and we need active global trade for our economy to improve.

Two months ago, in October, the IMF released a report.

It projected that if Trump's second term tariff policies are fully implemented, the global economic growth rate will decline by 0.8 percentage points next year and by 1.3 percentage points the year after.

This means that it will be difficult for exports to be as good as they were this year for the time being, and the export growth rate has already started to decline since the second half of this year.

[Anchor]

If it's difficult to control such external factors, it seems we should focus more on revitalizing domestic consumption.

[Reporter]

Yes, that's why the Bank of Korea is suggesting interest rate cuts, while the political sphere is calling for increasing fiscal spending, but both have their challenges.

Lowering interest rates usually leads to increased lending and consumption, but this link has weakened and is no longer as effective as before.

While increasing fiscal spending has a quicker effect, the supplementary budget has become a subject of political bargaining, making it difficult to predict when it will happen.

There are no positive signals for our economy, including a rising exchange rate, sluggish domestic consumption, and weak exports.

Let's discuss with our economic reporter what the breakthrough might be in this complex crisis situation.

Reporter Kim Jin-hwa, the reason for the sharp rise in exchange rates must be due to both domestic and international factors, but which do you think is more significant?

[Reporter]

To put it simply, if you ask whether it's due to the U.S. or Korea, the answer is obviously both. However, since the martial law, the exchange rate has significantly been influenced by our own actions.

If you look at this graph, it will be quite clear.

This is a comparison of this month's won-dollar and yen-dollar exchange rates, with the 'won' on top and the 'yen' below.

The won-dollar exchange rate is worse, and during times like the failed first impeachment of the president and the introduction of the prime minister's impeachment motion, the won-dollar rate particularly fluctuates, right?

It shows how much politics is affecting the exchange rate.

[Anchor]

The government has also introduced various measures, but they don't seem to have a significant visible effect. What do you think?

[Reporter]

As you saw in the report by Hwang Hyun-kyu earlier, today (12.27) it went up to 1,486 won and closed at 1,467 won.

It seems that the government's release of dollars had an impact, and the market generally views it this way.

Directly releasing dollars does have a suppressive effect, but due to 'foreign exchange reserves', it's difficult to do it every time, and 'exchange rate manipulation' is burdensome, so they can't do it openly.

Therefore, they are using indirect measures to increase dollar supply.

For example, they are temporarily relaxing regulations so that banks can borrow more dollars from abroad, but the situation is not calm enough for such indirect methods to be effective.

[Anchor]

Given this trend, it seems like the exchange rate could reach 1,500 won per dollar. What do you think?

[Reporter]

Yes, that seems likely.

Why is the exchange rate like this now?

There are three main reasons.

First, the U.S. is doing well on its own, which increases the popularity of the dollar.

On the other hand, the Korean economy is the opposite.

Recently, the government projected next year's growth rate to be in the 1% range.

Lastly, when will the martial law and impeachment situation end?

Is there anything among these three that will be resolved soon?

It wouldn't be surprising if the dollar becomes more expensive than it is now.

[Anchor]

Let's also look at the export situation.

This year, the export performance was relatively good, but the outlook for the future does not seem bright. What do you think?

[Reporter]

As you all know, Korea relies on exports, and we need active global trade for our economy to improve.

Two months ago, in October, the IMF released a report.

It projected that if Trump's second term tariff policies are fully implemented, the global economic growth rate will decline by 0.8 percentage points next year and by 1.3 percentage points the year after.

This means that it will be difficult for exports to be as good as they were this year for the time being, and the export growth rate has already started to decline since the second half of this year.

[Anchor]

If it's difficult to control such external factors, it seems we should focus more on revitalizing domestic consumption.

[Reporter]

Yes, that's why the Bank of Korea is suggesting interest rate cuts, while the political sphere is calling for increasing fiscal spending, but both have their challenges.

Lowering interest rates usually leads to increased lending and consumption, but this link has weakened and is no longer as effective as before.

While increasing fiscal spending has a quicker effect, the supplementary budget has become a subject of political bargaining, making it difficult to predict when it will happen.

-

-

김진화 기자 evolution@kbs.co.kr

김진화 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] “윤석열·김용현 등 공모해 군사상 이익 해쳐”…외환죄 대신 일반이적죄 적용](/data/layer/904/2025/07/20250714_3VTJV3.jpg)

이 기사에 대한 의견을 남겨주세요.