Early repayment charge on loans reduced

입력 2025.01.13 (00:49)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

The 'early repayment charge' that has been a hurdle when trying to repay loans early will be reduced starting tomorrow (Jan. 13).

While the burden will be significantly lessened, why is it difficult to completely eliminate the fees?

Reporter Song Soo-jin has the details.

[Report]

One reason it is hard to switch to loans with lower interest rates is the early repayment charges

incurred when the loan is repaid within three years of starting.

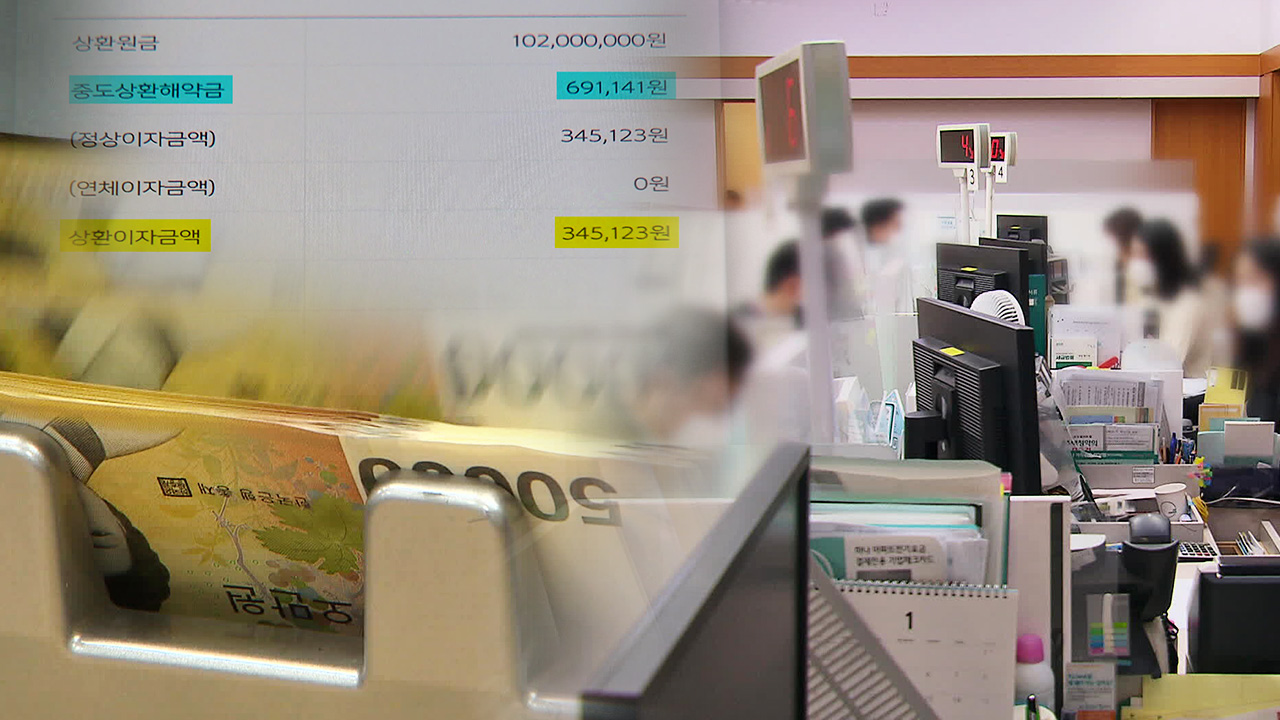

We looked at a case where a loan of over 100 million won was taken out two years ago.

The monthly interest is 350,000 won, but if the entire amount is repaid early, the early repayment charges come to nearly 700,000 won.

As complaints about the high fees accumulated, financial authorities have been pushing for a reduction.

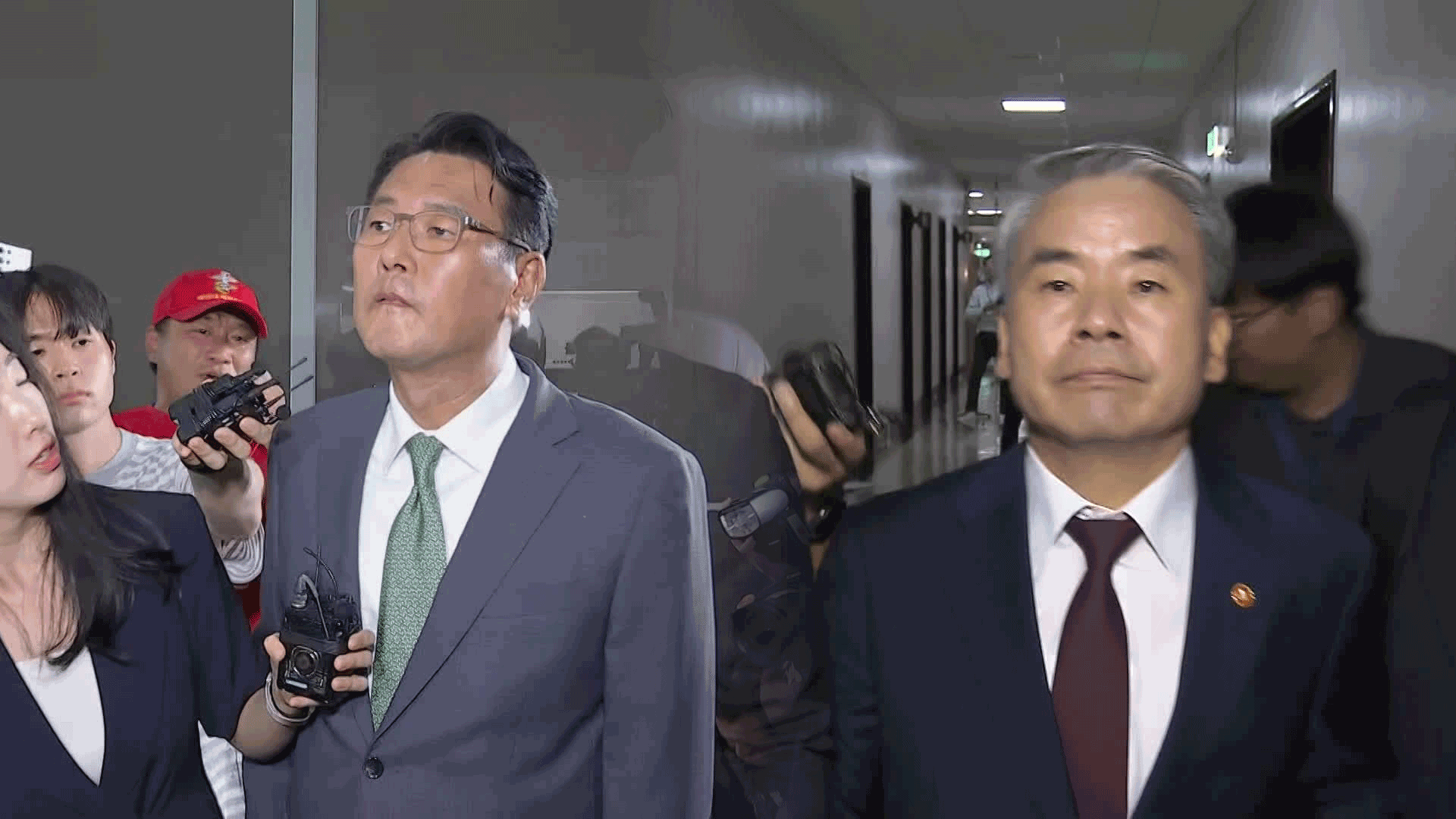

[Kim Byeong-hwan/Chairman of the Financial Services Commission/Oct. 30 last year: "Preliminary simulation results suggest that there is room for adjustment."]

For bank mortgage loans, the early repayment charge rate will decrease from 1.43% to 0.56%, and for credit loans, it will drop from 0.83% to 0.11%.

This will apply to new loans signed from tomorrow.

If a 300 million won mortgage is fully repaid in one year, the early repayment charge will decrease from 2.8 million won to 1.16 million won.

While the burden is considerably reduced, consumers still have fundamental questions.

They are dissatisfied with being penalized for repaying debt more quickly.

Banks also have their reasons.

If a loan is repaid suddenly, they incur costs in searching for new loan customers and have to spend on administrative costs like setting up a mortgage.

For this reason, early repayment charges also exist overseas, but competition varies among financial institutions.

[Kang Kyung-hoon/Professor of Business Administration at Dongguk University: "Competition should be fierce enough that institutions can autonomously lower their fees, and this should be monitored continuously."]

In the future, each financial institution will have to reassess and publicly announce their early repayment charge rates once a year.

This is KBS News, Song Soo-jin.

The 'early repayment charge' that has been a hurdle when trying to repay loans early will be reduced starting tomorrow (Jan. 13).

While the burden will be significantly lessened, why is it difficult to completely eliminate the fees?

Reporter Song Soo-jin has the details.

[Report]

One reason it is hard to switch to loans with lower interest rates is the early repayment charges

incurred when the loan is repaid within three years of starting.

We looked at a case where a loan of over 100 million won was taken out two years ago.

The monthly interest is 350,000 won, but if the entire amount is repaid early, the early repayment charges come to nearly 700,000 won.

As complaints about the high fees accumulated, financial authorities have been pushing for a reduction.

[Kim Byeong-hwan/Chairman of the Financial Services Commission/Oct. 30 last year: "Preliminary simulation results suggest that there is room for adjustment."]

For bank mortgage loans, the early repayment charge rate will decrease from 1.43% to 0.56%, and for credit loans, it will drop from 0.83% to 0.11%.

This will apply to new loans signed from tomorrow.

If a 300 million won mortgage is fully repaid in one year, the early repayment charge will decrease from 2.8 million won to 1.16 million won.

While the burden is considerably reduced, consumers still have fundamental questions.

They are dissatisfied with being penalized for repaying debt more quickly.

Banks also have their reasons.

If a loan is repaid suddenly, they incur costs in searching for new loan customers and have to spend on administrative costs like setting up a mortgage.

For this reason, early repayment charges also exist overseas, but competition varies among financial institutions.

[Kang Kyung-hoon/Professor of Business Administration at Dongguk University: "Competition should be fierce enough that institutions can autonomously lower their fees, and this should be monitored continuously."]

In the future, each financial institution will have to reassess and publicly announce their early repayment charge rates once a year.

This is KBS News, Song Soo-jin.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Early repayment charge on loans reduced

-

- 입력 2025-01-13 00:49:17

[Anchor]

The 'early repayment charge' that has been a hurdle when trying to repay loans early will be reduced starting tomorrow (Jan. 13).

While the burden will be significantly lessened, why is it difficult to completely eliminate the fees?

Reporter Song Soo-jin has the details.

[Report]

One reason it is hard to switch to loans with lower interest rates is the early repayment charges

incurred when the loan is repaid within three years of starting.

We looked at a case where a loan of over 100 million won was taken out two years ago.

The monthly interest is 350,000 won, but if the entire amount is repaid early, the early repayment charges come to nearly 700,000 won.

As complaints about the high fees accumulated, financial authorities have been pushing for a reduction.

[Kim Byeong-hwan/Chairman of the Financial Services Commission/Oct. 30 last year: "Preliminary simulation results suggest that there is room for adjustment."]

For bank mortgage loans, the early repayment charge rate will decrease from 1.43% to 0.56%, and for credit loans, it will drop from 0.83% to 0.11%.

This will apply to new loans signed from tomorrow.

If a 300 million won mortgage is fully repaid in one year, the early repayment charge will decrease from 2.8 million won to 1.16 million won.

While the burden is considerably reduced, consumers still have fundamental questions.

They are dissatisfied with being penalized for repaying debt more quickly.

Banks also have their reasons.

If a loan is repaid suddenly, they incur costs in searching for new loan customers and have to spend on administrative costs like setting up a mortgage.

For this reason, early repayment charges also exist overseas, but competition varies among financial institutions.

[Kang Kyung-hoon/Professor of Business Administration at Dongguk University: "Competition should be fierce enough that institutions can autonomously lower their fees, and this should be monitored continuously."]

In the future, each financial institution will have to reassess and publicly announce their early repayment charge rates once a year.

This is KBS News, Song Soo-jin.

The 'early repayment charge' that has been a hurdle when trying to repay loans early will be reduced starting tomorrow (Jan. 13).

While the burden will be significantly lessened, why is it difficult to completely eliminate the fees?

Reporter Song Soo-jin has the details.

[Report]

One reason it is hard to switch to loans with lower interest rates is the early repayment charges

incurred when the loan is repaid within three years of starting.

We looked at a case where a loan of over 100 million won was taken out two years ago.

The monthly interest is 350,000 won, but if the entire amount is repaid early, the early repayment charges come to nearly 700,000 won.

As complaints about the high fees accumulated, financial authorities have been pushing for a reduction.

[Kim Byeong-hwan/Chairman of the Financial Services Commission/Oct. 30 last year: "Preliminary simulation results suggest that there is room for adjustment."]

For bank mortgage loans, the early repayment charge rate will decrease from 1.43% to 0.56%, and for credit loans, it will drop from 0.83% to 0.11%.

This will apply to new loans signed from tomorrow.

If a 300 million won mortgage is fully repaid in one year, the early repayment charge will decrease from 2.8 million won to 1.16 million won.

While the burden is considerably reduced, consumers still have fundamental questions.

They are dissatisfied with being penalized for repaying debt more quickly.

Banks also have their reasons.

If a loan is repaid suddenly, they incur costs in searching for new loan customers and have to spend on administrative costs like setting up a mortgage.

For this reason, early repayment charges also exist overseas, but competition varies among financial institutions.

[Kang Kyung-hoon/Professor of Business Administration at Dongguk University: "Competition should be fierce enough that institutions can autonomously lower their fees, and this should be monitored continuously."]

In the future, each financial institution will have to reassess and publicly announce their early repayment charge rates once a year.

This is KBS News, Song Soo-jin.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] 제2의 ‘김건희·이진숙 논란’ 막을까…<br>‘교육부 직권검증’ 입법 추진](/data/layer/904/2025/07/20250713_X3MaMR.jpg)

이 기사에 대한 의견을 남겨주세요.