Markets unreactive to Yoon's arrest

입력 2025.01.16 (00:31)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

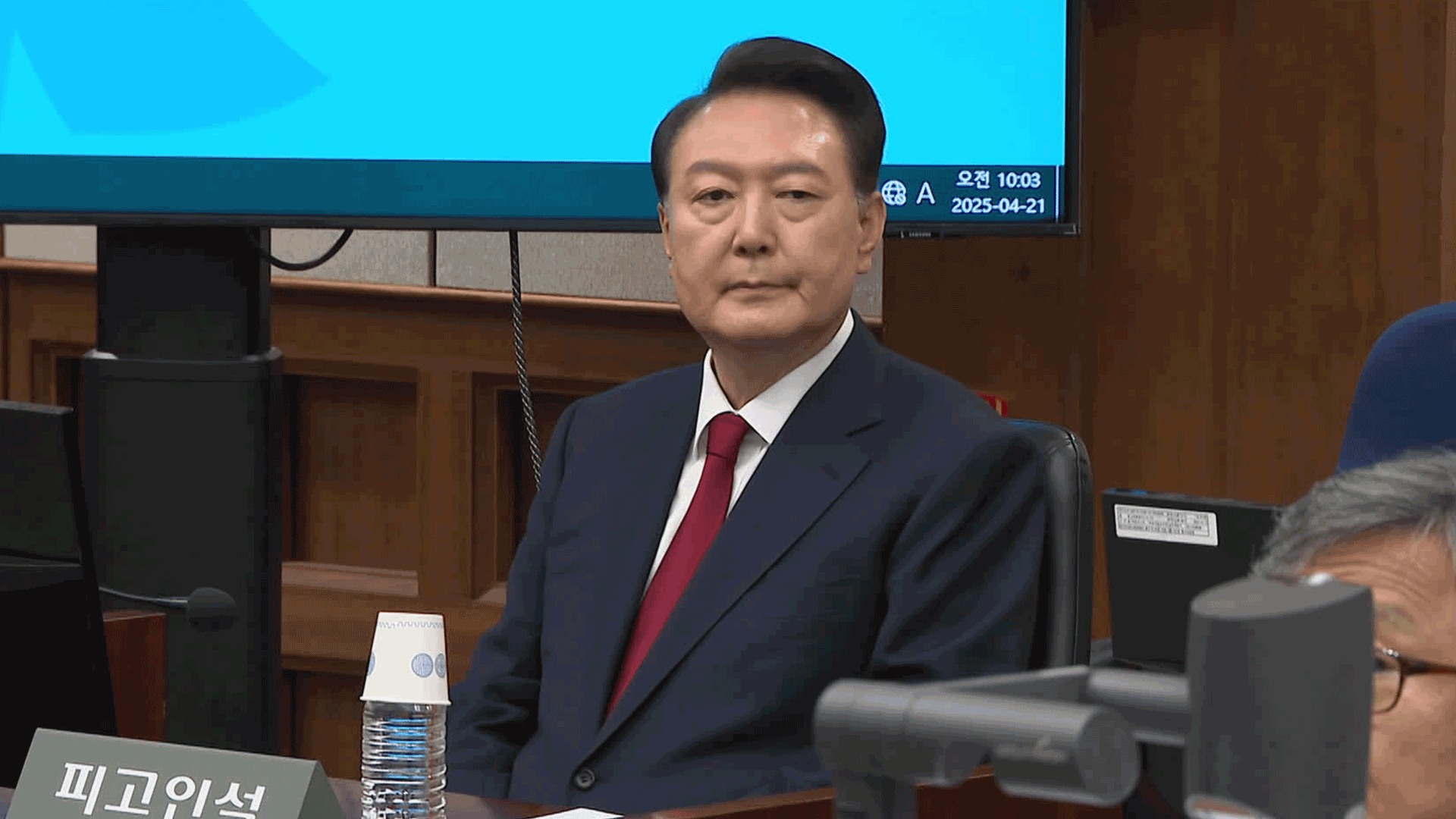

The current president's arrest did not elicit a significant reaction from our financial markets.

Stocks and the exchange rate were almost unchanged.

Reporter Song Soo-jin analyzed the reasons for the market's calmness despite this unprecedented situation.

[Report]

At 9 AM, the CIO and the police were almost done entering the residence.

Right after the market opened, it rose to the 2,520 level, increasing by more than 1% compared to yesterday (1.14), but that was it.

Shortly after, around 10 AM, most of the gains were given back, and the market closed without significant movement.

Based on the closing price, it fell by 0.02% compared to yesterday, essentially remaining in place.

Compared to the 1.8% rise during the first execution on Jan. 3, the market was almost unresponsive to the second execution.

The won-dollar exchange rate also fell by 2 won, showing almost no movement.

[Cho Byeong-hyeon/Head of Investment Strategy Team at Daol Investment & Securities: "Since the execution of the arrest warrant is part of the impeachment process, I think the market has already reflected quite a bit of the content that could affect price indicators around the end of December and early January."]

The issues of martial law, impeachment, and the investigation are expected to span over several months, so the market is not reacting drastically on a daily basis.

In this context, the analysis that the market could react significantly when the conclusions of the impeachment or investigation are reached gains strength.

But the buildup of negative factors is undeniable.

[Cho Byeong-hyeon/Head of Investment Strategy Team at Daol Investment & Securities: "Political uncertainty, along with factors such as exchange rates, seem to be acting as burdens. There's also a gradual expression of fear about the potential escalation."]

Last month, foreign capital saw a net outflow of 5.7 trillion won from the domestic stock and bond markets.

This is the largest amount since March 2020, when COVID-19 was at its peak.

Many forecasts suggest that external variables, such as Trump's inauguration, will have a much greater impact than domestic factors due to the nature of financial markets.

KBS News, Song Soo-jin.

The current president's arrest did not elicit a significant reaction from our financial markets.

Stocks and the exchange rate were almost unchanged.

Reporter Song Soo-jin analyzed the reasons for the market's calmness despite this unprecedented situation.

[Report]

At 9 AM, the CIO and the police were almost done entering the residence.

Right after the market opened, it rose to the 2,520 level, increasing by more than 1% compared to yesterday (1.14), but that was it.

Shortly after, around 10 AM, most of the gains were given back, and the market closed without significant movement.

Based on the closing price, it fell by 0.02% compared to yesterday, essentially remaining in place.

Compared to the 1.8% rise during the first execution on Jan. 3, the market was almost unresponsive to the second execution.

The won-dollar exchange rate also fell by 2 won, showing almost no movement.

[Cho Byeong-hyeon/Head of Investment Strategy Team at Daol Investment & Securities: "Since the execution of the arrest warrant is part of the impeachment process, I think the market has already reflected quite a bit of the content that could affect price indicators around the end of December and early January."]

The issues of martial law, impeachment, and the investigation are expected to span over several months, so the market is not reacting drastically on a daily basis.

In this context, the analysis that the market could react significantly when the conclusions of the impeachment or investigation are reached gains strength.

But the buildup of negative factors is undeniable.

[Cho Byeong-hyeon/Head of Investment Strategy Team at Daol Investment & Securities: "Political uncertainty, along with factors such as exchange rates, seem to be acting as burdens. There's also a gradual expression of fear about the potential escalation."]

Last month, foreign capital saw a net outflow of 5.7 trillion won from the domestic stock and bond markets.

This is the largest amount since March 2020, when COVID-19 was at its peak.

Many forecasts suggest that external variables, such as Trump's inauguration, will have a much greater impact than domestic factors due to the nature of financial markets.

KBS News, Song Soo-jin.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Markets unreactive to Yoon's arrest

-

- 입력 2025-01-16 00:30:59

[Anchor]

The current president's arrest did not elicit a significant reaction from our financial markets.

Stocks and the exchange rate were almost unchanged.

Reporter Song Soo-jin analyzed the reasons for the market's calmness despite this unprecedented situation.

[Report]

At 9 AM, the CIO and the police were almost done entering the residence.

Right after the market opened, it rose to the 2,520 level, increasing by more than 1% compared to yesterday (1.14), but that was it.

Shortly after, around 10 AM, most of the gains were given back, and the market closed without significant movement.

Based on the closing price, it fell by 0.02% compared to yesterday, essentially remaining in place.

Compared to the 1.8% rise during the first execution on Jan. 3, the market was almost unresponsive to the second execution.

The won-dollar exchange rate also fell by 2 won, showing almost no movement.

[Cho Byeong-hyeon/Head of Investment Strategy Team at Daol Investment & Securities: "Since the execution of the arrest warrant is part of the impeachment process, I think the market has already reflected quite a bit of the content that could affect price indicators around the end of December and early January."]

The issues of martial law, impeachment, and the investigation are expected to span over several months, so the market is not reacting drastically on a daily basis.

In this context, the analysis that the market could react significantly when the conclusions of the impeachment or investigation are reached gains strength.

But the buildup of negative factors is undeniable.

[Cho Byeong-hyeon/Head of Investment Strategy Team at Daol Investment & Securities: "Political uncertainty, along with factors such as exchange rates, seem to be acting as burdens. There's also a gradual expression of fear about the potential escalation."]

Last month, foreign capital saw a net outflow of 5.7 trillion won from the domestic stock and bond markets.

This is the largest amount since March 2020, when COVID-19 was at its peak.

Many forecasts suggest that external variables, such as Trump's inauguration, will have a much greater impact than domestic factors due to the nature of financial markets.

KBS News, Song Soo-jin.

The current president's arrest did not elicit a significant reaction from our financial markets.

Stocks and the exchange rate were almost unchanged.

Reporter Song Soo-jin analyzed the reasons for the market's calmness despite this unprecedented situation.

[Report]

At 9 AM, the CIO and the police were almost done entering the residence.

Right after the market opened, it rose to the 2,520 level, increasing by more than 1% compared to yesterday (1.14), but that was it.

Shortly after, around 10 AM, most of the gains were given back, and the market closed without significant movement.

Based on the closing price, it fell by 0.02% compared to yesterday, essentially remaining in place.

Compared to the 1.8% rise during the first execution on Jan. 3, the market was almost unresponsive to the second execution.

The won-dollar exchange rate also fell by 2 won, showing almost no movement.

[Cho Byeong-hyeon/Head of Investment Strategy Team at Daol Investment & Securities: "Since the execution of the arrest warrant is part of the impeachment process, I think the market has already reflected quite a bit of the content that could affect price indicators around the end of December and early January."]

The issues of martial law, impeachment, and the investigation are expected to span over several months, so the market is not reacting drastically on a daily basis.

In this context, the analysis that the market could react significantly when the conclusions of the impeachment or investigation are reached gains strength.

But the buildup of negative factors is undeniable.

[Cho Byeong-hyeon/Head of Investment Strategy Team at Daol Investment & Securities: "Political uncertainty, along with factors such as exchange rates, seem to be acting as burdens. There's also a gradual expression of fear about the potential escalation."]

Last month, foreign capital saw a net outflow of 5.7 trillion won from the domestic stock and bond markets.

This is the largest amount since March 2020, when COVID-19 was at its peak.

Many forecasts suggest that external variables, such as Trump's inauguration, will have a much greater impact than domestic factors due to the nature of financial markets.

KBS News, Song Soo-jin.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.