[Anchor]

As you just saw, changing to an estate acquisition tax would generally reduce taxes.

However, the amount of tax reduction varies significantly depending on the size of the estate and the number of family members.

Reporter Kim Jin-hwa has calculated various scenarios with experts.

[Report]

In 2023, about 20,000 people were subject to inheritance tax.

This accounted for approximately 6% of annual deaths.

The most frequent inheritance tax cases occur in the taxable amount range of 1 billion to 2 billion won.

Considering this, we examined the changes in various situations in collaboration with the Korean Association of Certified Public Tax Accountants.

In the case of an inherited estate of 2 billion won.

When there is one spouse and one child, whether it is 'inheritance tax' or 'estate acquisition tax,' the inheritance tax remains at 50 million won, with no difference.

If the number of children increases to two with one spouse, the tax significantly decreases.

Currently, it is 130 million won, but it becomes 14 million won.

If there are three children, it goes from 190 million won to 0 won.

The more children there are, the greater the individual deduction benefits unique to the estate acquisition tax.

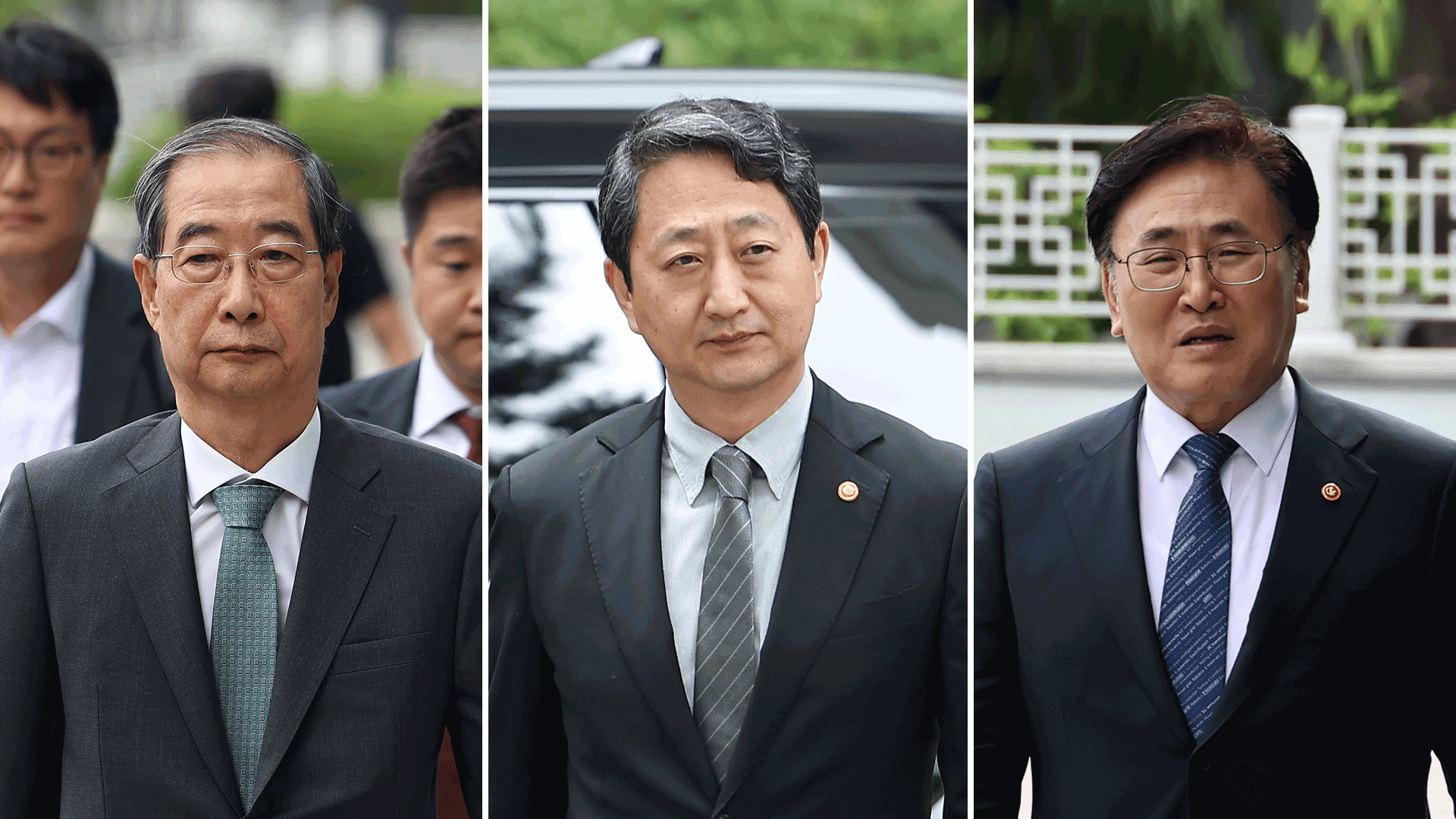

[Jeong Jeong-hoon/Director of Tax Policy, Ministry of Economy and Finance: "Households with multiple children receive more benefits, and from a demographic perspective, this is a more urgent and desirable policy direction."]

The effects based on the amount of asset are also differentiated.

When there is one spouse and two children, comparing the effective tax rates before and after the 'inheritance tax' and 'estate acquisition tax,' the larger the inherited estate, the greater the tax reduction effect, with the 10 billion to 20 billion won range receiving the most benefits.

This structure is prone to repeat the controversy of 'tax cuts for the wealthy.'

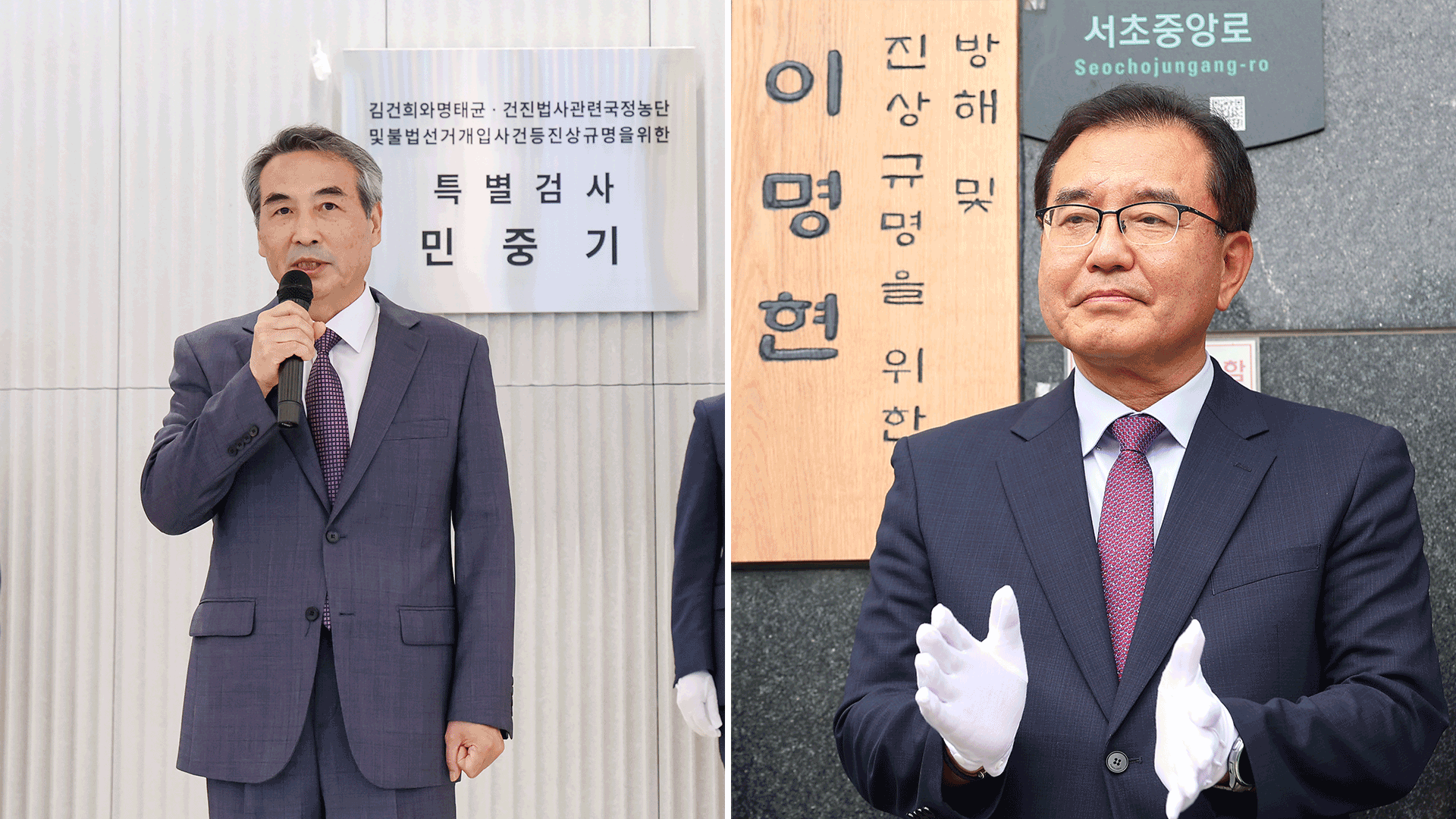

[Lee Sang-min/Senior Researcher, Fiscal Reform Institute: "Those with higher inheritance values will inevitably receive more benefits because the applicable tax rates differ. The fact that some benefit from tax cuts means that someone else has to bear additional burdens..."]

The inheritance tax revenue in 2023 was 8.5 trillion won.

If it is converted to an estate acquisition tax, it is estimated that tax revenue will decrease by about 2 trillion won.

The government has not disclosed how it plans to make up for this shortfall.

This is KBS News, Kim Jin-hwa.

As you just saw, changing to an estate acquisition tax would generally reduce taxes.

However, the amount of tax reduction varies significantly depending on the size of the estate and the number of family members.

Reporter Kim Jin-hwa has calculated various scenarios with experts.

[Report]

In 2023, about 20,000 people were subject to inheritance tax.

This accounted for approximately 6% of annual deaths.

The most frequent inheritance tax cases occur in the taxable amount range of 1 billion to 2 billion won.

Considering this, we examined the changes in various situations in collaboration with the Korean Association of Certified Public Tax Accountants.

In the case of an inherited estate of 2 billion won.

When there is one spouse and one child, whether it is 'inheritance tax' or 'estate acquisition tax,' the inheritance tax remains at 50 million won, with no difference.

If the number of children increases to two with one spouse, the tax significantly decreases.

Currently, it is 130 million won, but it becomes 14 million won.

If there are three children, it goes from 190 million won to 0 won.

The more children there are, the greater the individual deduction benefits unique to the estate acquisition tax.

[Jeong Jeong-hoon/Director of Tax Policy, Ministry of Economy and Finance: "Households with multiple children receive more benefits, and from a demographic perspective, this is a more urgent and desirable policy direction."]

The effects based on the amount of asset are also differentiated.

When there is one spouse and two children, comparing the effective tax rates before and after the 'inheritance tax' and 'estate acquisition tax,' the larger the inherited estate, the greater the tax reduction effect, with the 10 billion to 20 billion won range receiving the most benefits.

This structure is prone to repeat the controversy of 'tax cuts for the wealthy.'

[Lee Sang-min/Senior Researcher, Fiscal Reform Institute: "Those with higher inheritance values will inevitably receive more benefits because the applicable tax rates differ. The fact that some benefit from tax cuts means that someone else has to bear additional burdens..."]

The inheritance tax revenue in 2023 was 8.5 trillion won.

If it is converted to an estate acquisition tax, it is estimated that tax revenue will decrease by about 2 trillion won.

The government has not disclosed how it plans to make up for this shortfall.

This is KBS News, Kim Jin-hwa.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Estate tax cut

-

- 입력 2025-03-12 23:49:15

[Anchor]

As you just saw, changing to an estate acquisition tax would generally reduce taxes.

However, the amount of tax reduction varies significantly depending on the size of the estate and the number of family members.

Reporter Kim Jin-hwa has calculated various scenarios with experts.

[Report]

In 2023, about 20,000 people were subject to inheritance tax.

This accounted for approximately 6% of annual deaths.

The most frequent inheritance tax cases occur in the taxable amount range of 1 billion to 2 billion won.

Considering this, we examined the changes in various situations in collaboration with the Korean Association of Certified Public Tax Accountants.

In the case of an inherited estate of 2 billion won.

When there is one spouse and one child, whether it is 'inheritance tax' or 'estate acquisition tax,' the inheritance tax remains at 50 million won, with no difference.

If the number of children increases to two with one spouse, the tax significantly decreases.

Currently, it is 130 million won, but it becomes 14 million won.

If there are three children, it goes from 190 million won to 0 won.

The more children there are, the greater the individual deduction benefits unique to the estate acquisition tax.

[Jeong Jeong-hoon/Director of Tax Policy, Ministry of Economy and Finance: "Households with multiple children receive more benefits, and from a demographic perspective, this is a more urgent and desirable policy direction."]

The effects based on the amount of asset are also differentiated.

When there is one spouse and two children, comparing the effective tax rates before and after the 'inheritance tax' and 'estate acquisition tax,' the larger the inherited estate, the greater the tax reduction effect, with the 10 billion to 20 billion won range receiving the most benefits.

This structure is prone to repeat the controversy of 'tax cuts for the wealthy.'

[Lee Sang-min/Senior Researcher, Fiscal Reform Institute: "Those with higher inheritance values will inevitably receive more benefits because the applicable tax rates differ. The fact that some benefit from tax cuts means that someone else has to bear additional burdens..."]

The inheritance tax revenue in 2023 was 8.5 trillion won.

If it is converted to an estate acquisition tax, it is estimated that tax revenue will decrease by about 2 trillion won.

The government has not disclosed how it plans to make up for this shortfall.

This is KBS News, Kim Jin-hwa.

As you just saw, changing to an estate acquisition tax would generally reduce taxes.

However, the amount of tax reduction varies significantly depending on the size of the estate and the number of family members.

Reporter Kim Jin-hwa has calculated various scenarios with experts.

[Report]

In 2023, about 20,000 people were subject to inheritance tax.

This accounted for approximately 6% of annual deaths.

The most frequent inheritance tax cases occur in the taxable amount range of 1 billion to 2 billion won.

Considering this, we examined the changes in various situations in collaboration with the Korean Association of Certified Public Tax Accountants.

In the case of an inherited estate of 2 billion won.

When there is one spouse and one child, whether it is 'inheritance tax' or 'estate acquisition tax,' the inheritance tax remains at 50 million won, with no difference.

If the number of children increases to two with one spouse, the tax significantly decreases.

Currently, it is 130 million won, but it becomes 14 million won.

If there are three children, it goes from 190 million won to 0 won.

The more children there are, the greater the individual deduction benefits unique to the estate acquisition tax.

[Jeong Jeong-hoon/Director of Tax Policy, Ministry of Economy and Finance: "Households with multiple children receive more benefits, and from a demographic perspective, this is a more urgent and desirable policy direction."]

The effects based on the amount of asset are also differentiated.

When there is one spouse and two children, comparing the effective tax rates before and after the 'inheritance tax' and 'estate acquisition tax,' the larger the inherited estate, the greater the tax reduction effect, with the 10 billion to 20 billion won range receiving the most benefits.

This structure is prone to repeat the controversy of 'tax cuts for the wealthy.'

[Lee Sang-min/Senior Researcher, Fiscal Reform Institute: "Those with higher inheritance values will inevitably receive more benefits because the applicable tax rates differ. The fact that some benefit from tax cuts means that someone else has to bear additional burdens..."]

The inheritance tax revenue in 2023 was 8.5 trillion won.

If it is converted to an estate acquisition tax, it is estimated that tax revenue will decrease by about 2 trillion won.

The government has not disclosed how it plans to make up for this shortfall.

This is KBS News, Kim Jin-hwa.

-

-

김진화 기자 evolution@kbs.co.kr

김진화 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.