Middle East tensions hit oil supply

입력 2025.06.23 (23:48)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

The crisis in the Middle East has also put Korean industries on high alert.

Given Korea's heavy reliance on Middle Eastern oil, a rise in oil prices could have serious negative impacts.

Park Kyung-joon reports.

[Report]

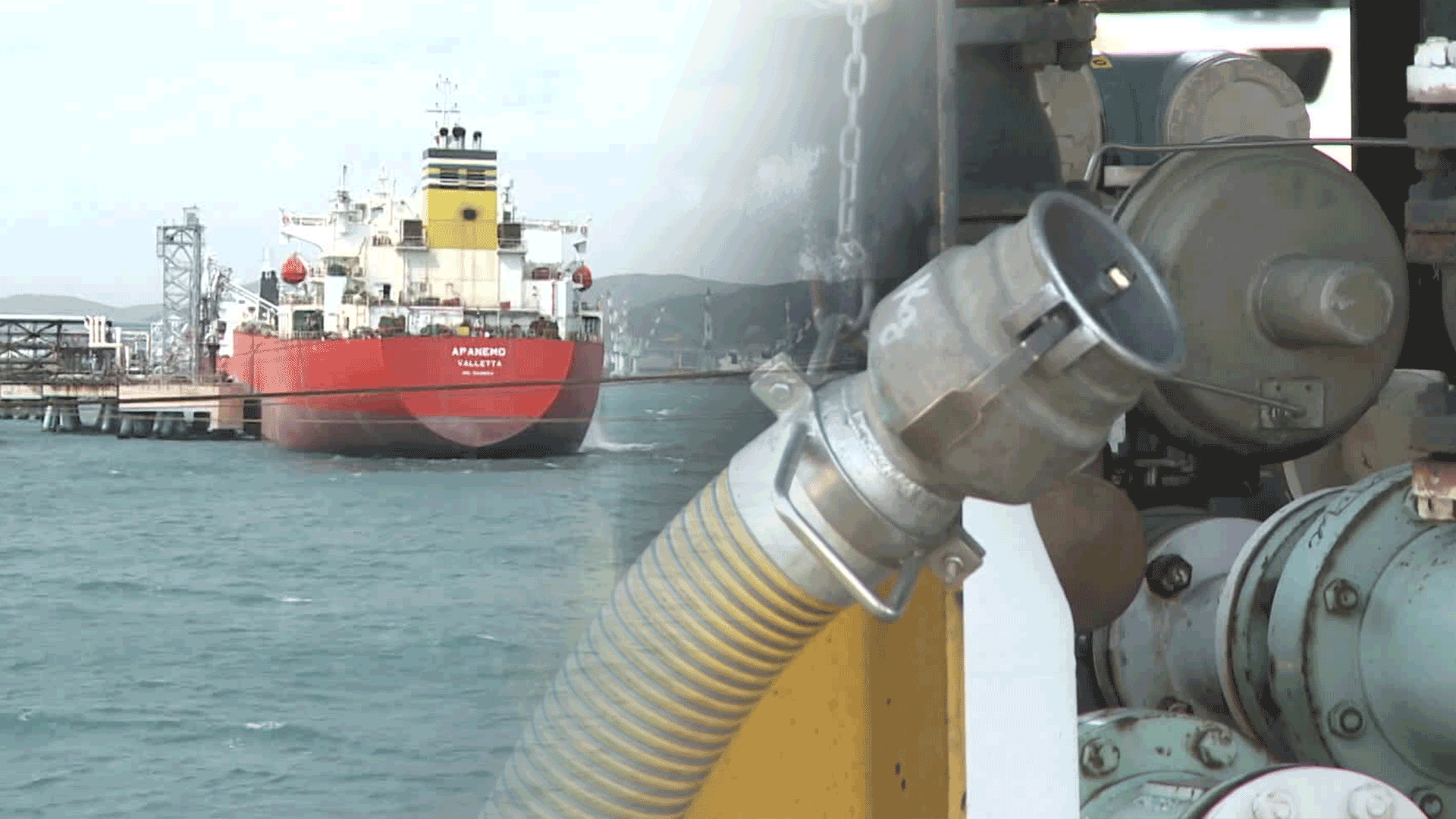

71.5% of the crude oil imported into South Korea comes from the Middle East, and most of it passes through the Strait of Hormuz, off the coast of Iran.

Tankers are still operating normally in the region, but if the Strait of Hormuz is blocked, there are few viable alternative routes.

A sharp rise in oil prices and supply disruptions would be inevitable.

[Cho Sang-beom/Director of External Cooperation, Korea Petroleum Association: “If the strait is blocked, there would be no way for oil to come through. That would push up prices, and it’s hard to predict how high oil prices could go.”]

For South Korea, which imports over 90% of its energy, this is a major blow.

The refining industry, which purchases oil in U.S. dollars, is already concerned about declining profitability due to both rising exchange rates and oil prices.

The petrochemical industry, already under pressure, would be hit directly by higher raw material costs.

As for the shipping industry, a temporary rise in freight rates could be a short-term benefit, but rising fuel costs and insurance premiums would likely offset those gains in the long run.

Some forecasts suggest that if oil prices rise by 10%, production costs for companies would increase by 0.38%, while exports would decrease by 0.32%.

The government and private sector currently hold enough oil reserves to last 200 days.

For now, supply remains stable, but a prolonged crisis could become problematic.

[Jang Sang-sik/Director of International Trade Research Institute, Korea International Trade Association: “If the global economy slows down, it could have long-term effects on Korea’s exports as well.”]

If rising raw material costs lead to global inflation, Korea's exports could face even more difficulties.

There are also concerns that large-scale projects involving Korean companies in the Middle East could be delayed or canceled.

This is KBS News, Park Kyung-jun.

The crisis in the Middle East has also put Korean industries on high alert.

Given Korea's heavy reliance on Middle Eastern oil, a rise in oil prices could have serious negative impacts.

Park Kyung-joon reports.

[Report]

71.5% of the crude oil imported into South Korea comes from the Middle East, and most of it passes through the Strait of Hormuz, off the coast of Iran.

Tankers are still operating normally in the region, but if the Strait of Hormuz is blocked, there are few viable alternative routes.

A sharp rise in oil prices and supply disruptions would be inevitable.

[Cho Sang-beom/Director of External Cooperation, Korea Petroleum Association: “If the strait is blocked, there would be no way for oil to come through. That would push up prices, and it’s hard to predict how high oil prices could go.”]

For South Korea, which imports over 90% of its energy, this is a major blow.

The refining industry, which purchases oil in U.S. dollars, is already concerned about declining profitability due to both rising exchange rates and oil prices.

The petrochemical industry, already under pressure, would be hit directly by higher raw material costs.

As for the shipping industry, a temporary rise in freight rates could be a short-term benefit, but rising fuel costs and insurance premiums would likely offset those gains in the long run.

Some forecasts suggest that if oil prices rise by 10%, production costs for companies would increase by 0.38%, while exports would decrease by 0.32%.

The government and private sector currently hold enough oil reserves to last 200 days.

For now, supply remains stable, but a prolonged crisis could become problematic.

[Jang Sang-sik/Director of International Trade Research Institute, Korea International Trade Association: “If the global economy slows down, it could have long-term effects on Korea’s exports as well.”]

If rising raw material costs lead to global inflation, Korea's exports could face even more difficulties.

There are also concerns that large-scale projects involving Korean companies in the Middle East could be delayed or canceled.

This is KBS News, Park Kyung-jun.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Middle East tensions hit oil supply

-

- 입력 2025-06-23 23:48:48

[Anchor]

The crisis in the Middle East has also put Korean industries on high alert.

Given Korea's heavy reliance on Middle Eastern oil, a rise in oil prices could have serious negative impacts.

Park Kyung-joon reports.

[Report]

71.5% of the crude oil imported into South Korea comes from the Middle East, and most of it passes through the Strait of Hormuz, off the coast of Iran.

Tankers are still operating normally in the region, but if the Strait of Hormuz is blocked, there are few viable alternative routes.

A sharp rise in oil prices and supply disruptions would be inevitable.

[Cho Sang-beom/Director of External Cooperation, Korea Petroleum Association: “If the strait is blocked, there would be no way for oil to come through. That would push up prices, and it’s hard to predict how high oil prices could go.”]

For South Korea, which imports over 90% of its energy, this is a major blow.

The refining industry, which purchases oil in U.S. dollars, is already concerned about declining profitability due to both rising exchange rates and oil prices.

The petrochemical industry, already under pressure, would be hit directly by higher raw material costs.

As for the shipping industry, a temporary rise in freight rates could be a short-term benefit, but rising fuel costs and insurance premiums would likely offset those gains in the long run.

Some forecasts suggest that if oil prices rise by 10%, production costs for companies would increase by 0.38%, while exports would decrease by 0.32%.

The government and private sector currently hold enough oil reserves to last 200 days.

For now, supply remains stable, but a prolonged crisis could become problematic.

[Jang Sang-sik/Director of International Trade Research Institute, Korea International Trade Association: “If the global economy slows down, it could have long-term effects on Korea’s exports as well.”]

If rising raw material costs lead to global inflation, Korea's exports could face even more difficulties.

There are also concerns that large-scale projects involving Korean companies in the Middle East could be delayed or canceled.

This is KBS News, Park Kyung-jun.

The crisis in the Middle East has also put Korean industries on high alert.

Given Korea's heavy reliance on Middle Eastern oil, a rise in oil prices could have serious negative impacts.

Park Kyung-joon reports.

[Report]

71.5% of the crude oil imported into South Korea comes from the Middle East, and most of it passes through the Strait of Hormuz, off the coast of Iran.

Tankers are still operating normally in the region, but if the Strait of Hormuz is blocked, there are few viable alternative routes.

A sharp rise in oil prices and supply disruptions would be inevitable.

[Cho Sang-beom/Director of External Cooperation, Korea Petroleum Association: “If the strait is blocked, there would be no way for oil to come through. That would push up prices, and it’s hard to predict how high oil prices could go.”]

For South Korea, which imports over 90% of its energy, this is a major blow.

The refining industry, which purchases oil in U.S. dollars, is already concerned about declining profitability due to both rising exchange rates and oil prices.

The petrochemical industry, already under pressure, would be hit directly by higher raw material costs.

As for the shipping industry, a temporary rise in freight rates could be a short-term benefit, but rising fuel costs and insurance premiums would likely offset those gains in the long run.

Some forecasts suggest that if oil prices rise by 10%, production costs for companies would increase by 0.38%, while exports would decrease by 0.32%.

The government and private sector currently hold enough oil reserves to last 200 days.

For now, supply remains stable, but a prolonged crisis could become problematic.

[Jang Sang-sik/Director of International Trade Research Institute, Korea International Trade Association: “If the global economy slows down, it could have long-term effects on Korea’s exports as well.”]

If rising raw material costs lead to global inflation, Korea's exports could face even more difficulties.

There are also concerns that large-scale projects involving Korean companies in the Middle East could be delayed or canceled.

This is KBS News, Park Kyung-jun.

-

-

박경준 기자 kjpark@kbs.co.kr

박경준 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.