[Anchor]

Hybe Chairman Bang Si-hyuk is now under investigation by the prosecution on suspicion of misleading investors regarding the company’s listing plans.

From now on, not only celebrities and corporate executives, but anyone involved in securities crimes may have their real names disclosed even before a verdict is reached.

The government has unveiled new measures to eradicate stock price manipulation. Hwang Hyun-kyu reports.

[Report]

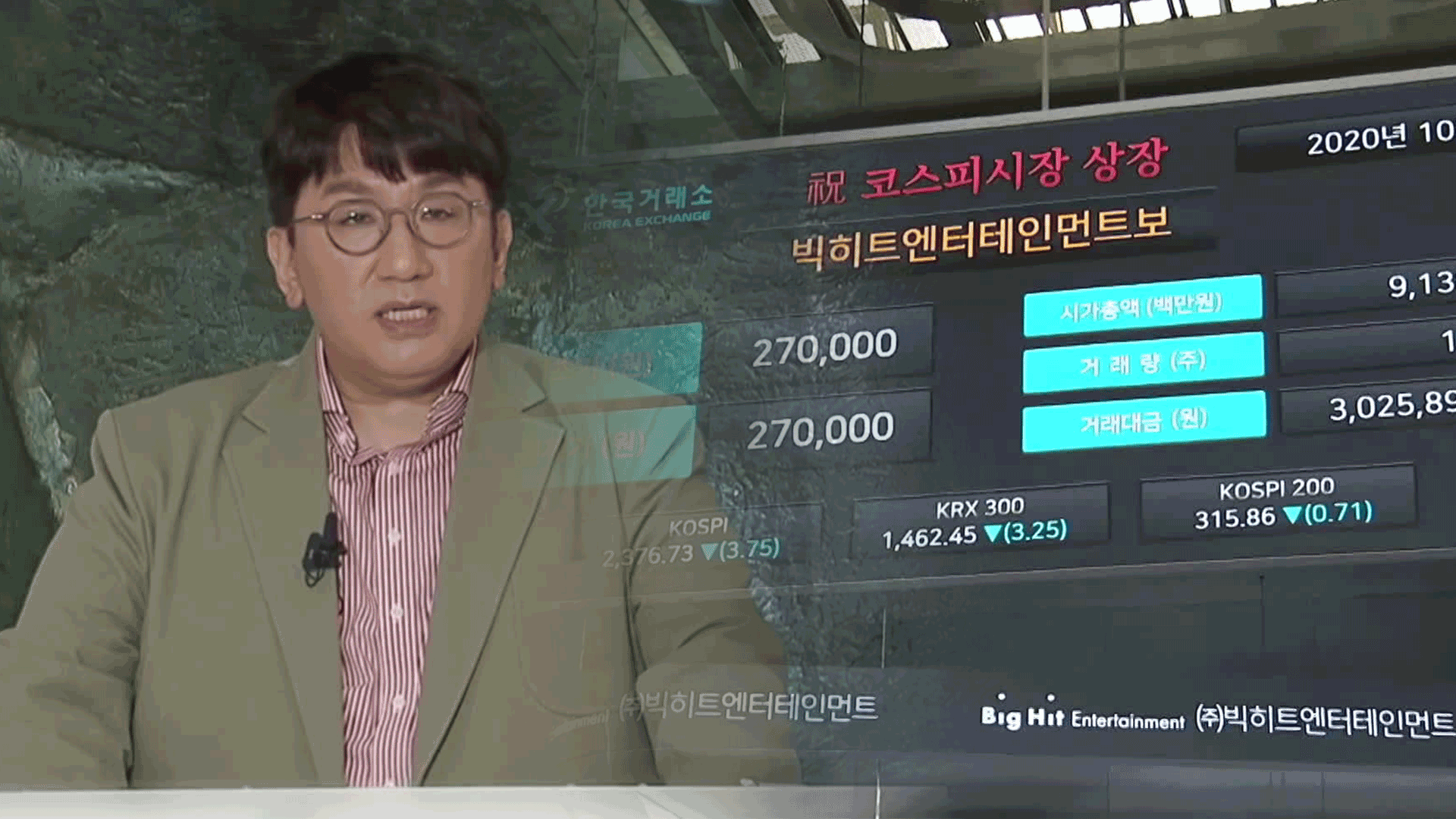

[Bang Si-hyuk/Hybe Chairman/Oct. 2020: "As a listed company, I feel a deep sense of responsibility to our shareholders and to society."]

Hybe's stock market debut drew worldwide attention, with the event even being broadcast live.

But the problem goes back to more than a year ago.

Hybe’s early investors sold their shares one after another to three private equity funds.

They claim they trusted Bang’s assurance that "there were no plans for a listing for the time being."

Yet, just about a month after the listing, Hybe’s stock price more than tripled from its IPO value.

The private equity funds reportedly made at least 700 billion won, while the early investors suffered significant losses.

It later came to light that Bang had secretly signed contracts with the private equity funds and shared in profits totaling billions of won.

Financial authorities believe Bang misled early investors and seized profit opportunities through deception. He is now being reported to the prosecution for alleged fraudulent unfair trading.

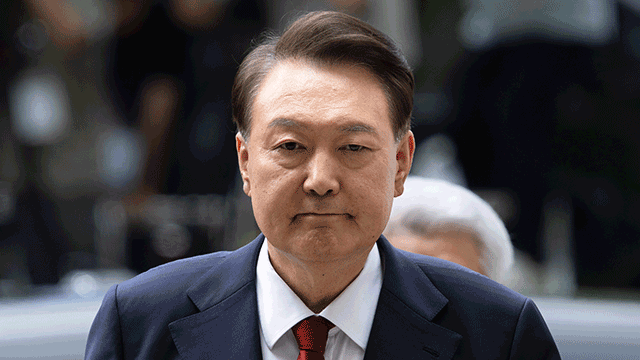

[President Lee Jae Myung/June 11: "We will send a clear message that anyone who plays games in Korea’s stock market will face total ruin."]

This is the government’s first announced measure under what it calls its "One Strike Out" policy against stock manipulation.

The core of the policy is preemptive action even before a final court ruling.

Once the Securities and Futures Commission (SFC) makes a decision, the suspect’s accounts will be immediately frozen and fines imposed.

They will also be barred from serving as executives at other companies, and the names of suspects and their firms will be publicly disclosed.

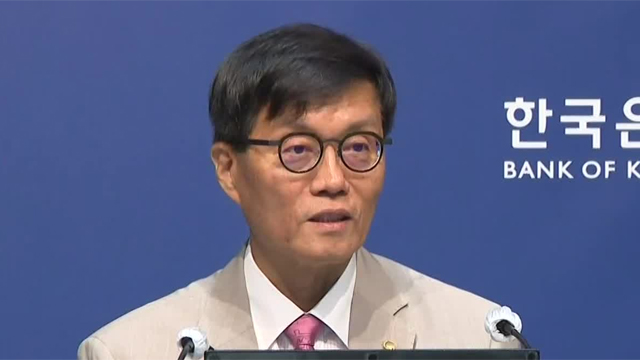

[Lee Yoon-soo/Standing Commissioner, SFC: "We plan to immediately make public the identity of stock manipulation suspects, details of their illegal conduct, and the corresponding actions taken—right after the SFC’s decision—to ensure a ‘one strike out’ system socially as well."]

A joint task force for the eradication of stock manipulation will also be launched by the end of this month, overseeing everything from detecting suspicious accounts to investigations and enforcement.

This is Hwang Hyun-kyu, KBS News.

Hybe Chairman Bang Si-hyuk is now under investigation by the prosecution on suspicion of misleading investors regarding the company’s listing plans.

From now on, not only celebrities and corporate executives, but anyone involved in securities crimes may have their real names disclosed even before a verdict is reached.

The government has unveiled new measures to eradicate stock price manipulation. Hwang Hyun-kyu reports.

[Report]

[Bang Si-hyuk/Hybe Chairman/Oct. 2020: "As a listed company, I feel a deep sense of responsibility to our shareholders and to society."]

Hybe's stock market debut drew worldwide attention, with the event even being broadcast live.

But the problem goes back to more than a year ago.

Hybe’s early investors sold their shares one after another to three private equity funds.

They claim they trusted Bang’s assurance that "there were no plans for a listing for the time being."

Yet, just about a month after the listing, Hybe’s stock price more than tripled from its IPO value.

The private equity funds reportedly made at least 700 billion won, while the early investors suffered significant losses.

It later came to light that Bang had secretly signed contracts with the private equity funds and shared in profits totaling billions of won.

Financial authorities believe Bang misled early investors and seized profit opportunities through deception. He is now being reported to the prosecution for alleged fraudulent unfair trading.

[President Lee Jae Myung/June 11: "We will send a clear message that anyone who plays games in Korea’s stock market will face total ruin."]

This is the government’s first announced measure under what it calls its "One Strike Out" policy against stock manipulation.

The core of the policy is preemptive action even before a final court ruling.

Once the Securities and Futures Commission (SFC) makes a decision, the suspect’s accounts will be immediately frozen and fines imposed.

They will also be barred from serving as executives at other companies, and the names of suspects and their firms will be publicly disclosed.

[Lee Yoon-soo/Standing Commissioner, SFC: "We plan to immediately make public the identity of stock manipulation suspects, details of their illegal conduct, and the corresponding actions taken—right after the SFC’s decision—to ensure a ‘one strike out’ system socially as well."]

A joint task force for the eradication of stock manipulation will also be launched by the end of this month, overseeing everything from detecting suspicious accounts to investigations and enforcement.

This is Hwang Hyun-kyu, KBS News.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Hybe chairman under probe

-

- 입력 2025-07-10 00:56:27

[Anchor]

Hybe Chairman Bang Si-hyuk is now under investigation by the prosecution on suspicion of misleading investors regarding the company’s listing plans.

From now on, not only celebrities and corporate executives, but anyone involved in securities crimes may have their real names disclosed even before a verdict is reached.

The government has unveiled new measures to eradicate stock price manipulation. Hwang Hyun-kyu reports.

[Report]

[Bang Si-hyuk/Hybe Chairman/Oct. 2020: "As a listed company, I feel a deep sense of responsibility to our shareholders and to society."]

Hybe's stock market debut drew worldwide attention, with the event even being broadcast live.

But the problem goes back to more than a year ago.

Hybe’s early investors sold their shares one after another to three private equity funds.

They claim they trusted Bang’s assurance that "there were no plans for a listing for the time being."

Yet, just about a month after the listing, Hybe’s stock price more than tripled from its IPO value.

The private equity funds reportedly made at least 700 billion won, while the early investors suffered significant losses.

It later came to light that Bang had secretly signed contracts with the private equity funds and shared in profits totaling billions of won.

Financial authorities believe Bang misled early investors and seized profit opportunities through deception. He is now being reported to the prosecution for alleged fraudulent unfair trading.

[President Lee Jae Myung/June 11: "We will send a clear message that anyone who plays games in Korea’s stock market will face total ruin."]

This is the government’s first announced measure under what it calls its "One Strike Out" policy against stock manipulation.

The core of the policy is preemptive action even before a final court ruling.

Once the Securities and Futures Commission (SFC) makes a decision, the suspect’s accounts will be immediately frozen and fines imposed.

They will also be barred from serving as executives at other companies, and the names of suspects and their firms will be publicly disclosed.

[Lee Yoon-soo/Standing Commissioner, SFC: "We plan to immediately make public the identity of stock manipulation suspects, details of their illegal conduct, and the corresponding actions taken—right after the SFC’s decision—to ensure a ‘one strike out’ system socially as well."]

A joint task force for the eradication of stock manipulation will also be launched by the end of this month, overseeing everything from detecting suspicious accounts to investigations and enforcement.

This is Hwang Hyun-kyu, KBS News.

Hybe Chairman Bang Si-hyuk is now under investigation by the prosecution on suspicion of misleading investors regarding the company’s listing plans.

From now on, not only celebrities and corporate executives, but anyone involved in securities crimes may have their real names disclosed even before a verdict is reached.

The government has unveiled new measures to eradicate stock price manipulation. Hwang Hyun-kyu reports.

[Report]

[Bang Si-hyuk/Hybe Chairman/Oct. 2020: "As a listed company, I feel a deep sense of responsibility to our shareholders and to society."]

Hybe's stock market debut drew worldwide attention, with the event even being broadcast live.

But the problem goes back to more than a year ago.

Hybe’s early investors sold their shares one after another to three private equity funds.

They claim they trusted Bang’s assurance that "there were no plans for a listing for the time being."

Yet, just about a month after the listing, Hybe’s stock price more than tripled from its IPO value.

The private equity funds reportedly made at least 700 billion won, while the early investors suffered significant losses.

It later came to light that Bang had secretly signed contracts with the private equity funds and shared in profits totaling billions of won.

Financial authorities believe Bang misled early investors and seized profit opportunities through deception. He is now being reported to the prosecution for alleged fraudulent unfair trading.

[President Lee Jae Myung/June 11: "We will send a clear message that anyone who plays games in Korea’s stock market will face total ruin."]

This is the government’s first announced measure under what it calls its "One Strike Out" policy against stock manipulation.

The core of the policy is preemptive action even before a final court ruling.

Once the Securities and Futures Commission (SFC) makes a decision, the suspect’s accounts will be immediately frozen and fines imposed.

They will also be barred from serving as executives at other companies, and the names of suspects and their firms will be publicly disclosed.

[Lee Yoon-soo/Standing Commissioner, SFC: "We plan to immediately make public the identity of stock manipulation suspects, details of their illegal conduct, and the corresponding actions taken—right after the SFC’s decision—to ensure a ‘one strike out’ system socially as well."]

A joint task force for the eradication of stock manipulation will also be launched by the end of this month, overseeing everything from detecting suspicious accounts to investigations and enforcement.

This is Hwang Hyun-kyu, KBS News.

-

-

황현규 기자 help@kbs.co.kr

황현규 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.