Hanjin Group Challenges

입력 2019.04.09 (15:06)

수정 2019.04.09 (15:28)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

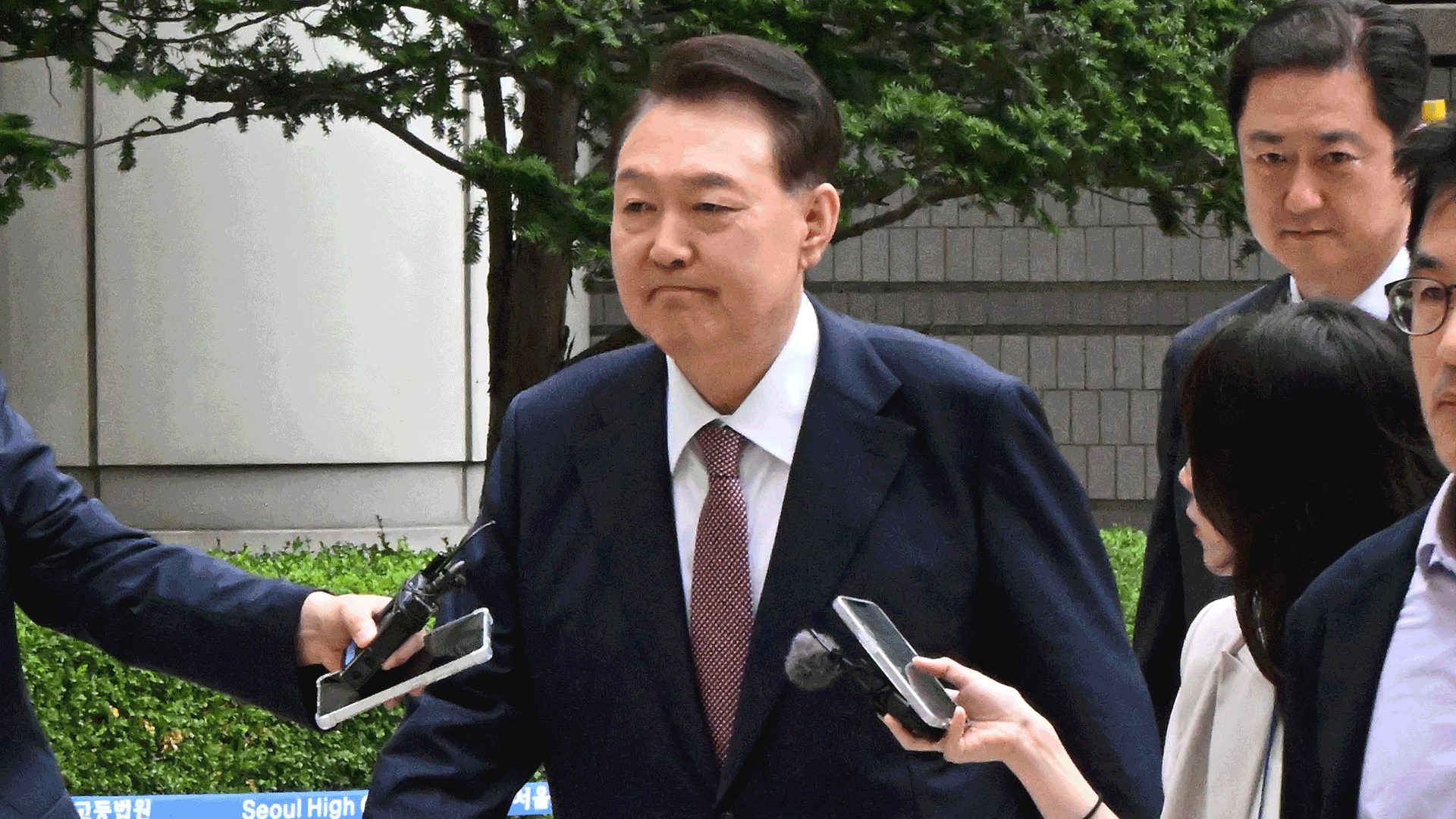

Hanjin Group and Korean Air Chairman Cho Yang-ho died on April 8 at age of 70. Cho was known to have directly taken care of the conglomerate's managerial issues until recently. Attention is being drawn to what impacts his sudden death will have on the management of Hanjin Group. Here is more.

[Pkg]

Hanjin Group is the unrivaled leader in Korea's air service and transportation industries. It is also the 14th largest conglomerate in the nation. Cho Yang-ho's sudden passing naturally raised concerns about managerial complications that could follow. To dispel such concerns, Hanjin immediately went into emergency management mode. Key decisions will be made in meetings of CEOs and top executives. According to the firm, there are no immediate problems with the Cho family's managerial control, since Seok Tae-soo, a close aide to the late chairman, was elected the head of Hanjin KAL for his second term at a shareholders' meeting held last month. Hanjin KAL is the holding company of the business group. However, observers predict a bumpy road ahead for the late chair's heir Cho Won-tae to take the management rights of Korean Air and become its president. There are also forecasts that the Chos could be involved in a conflict over management rights while securing funds to pay inheritance tax. The family holds a 29 percent share in Hanjin KAL. But their stake could drop to some 20 percent if they sell part of it to pay inheritance tax. Their position as the largest shareholder could be threatened, as the stakes of KCGI and the National Pension Service will exceed 20 percent when added up. KCGI and the National Pension played a major role behind the late chairman's ouster from Korean Air's directors' board last month. This is why industry insiders are predicting that Cho Won-tae and other family members will focus on defending management rights by paying inheritance tax with their own funds and loans instead of selling shares.

Hanjin Group and Korean Air Chairman Cho Yang-ho died on April 8 at age of 70. Cho was known to have directly taken care of the conglomerate's managerial issues until recently. Attention is being drawn to what impacts his sudden death will have on the management of Hanjin Group. Here is more.

[Pkg]

Hanjin Group is the unrivaled leader in Korea's air service and transportation industries. It is also the 14th largest conglomerate in the nation. Cho Yang-ho's sudden passing naturally raised concerns about managerial complications that could follow. To dispel such concerns, Hanjin immediately went into emergency management mode. Key decisions will be made in meetings of CEOs and top executives. According to the firm, there are no immediate problems with the Cho family's managerial control, since Seok Tae-soo, a close aide to the late chairman, was elected the head of Hanjin KAL for his second term at a shareholders' meeting held last month. Hanjin KAL is the holding company of the business group. However, observers predict a bumpy road ahead for the late chair's heir Cho Won-tae to take the management rights of Korean Air and become its president. There are also forecasts that the Chos could be involved in a conflict over management rights while securing funds to pay inheritance tax. The family holds a 29 percent share in Hanjin KAL. But their stake could drop to some 20 percent if they sell part of it to pay inheritance tax. Their position as the largest shareholder could be threatened, as the stakes of KCGI and the National Pension Service will exceed 20 percent when added up. KCGI and the National Pension played a major role behind the late chairman's ouster from Korean Air's directors' board last month. This is why industry insiders are predicting that Cho Won-tae and other family members will focus on defending management rights by paying inheritance tax with their own funds and loans instead of selling shares.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- Hanjin Group Challenges

-

- 입력 2019-04-09 15:08:31

- 수정2019-04-09 15:28:15

[Anchor Lead]

Hanjin Group and Korean Air Chairman Cho Yang-ho died on April 8 at age of 70. Cho was known to have directly taken care of the conglomerate's managerial issues until recently. Attention is being drawn to what impacts his sudden death will have on the management of Hanjin Group. Here is more.

[Pkg]

Hanjin Group is the unrivaled leader in Korea's air service and transportation industries. It is also the 14th largest conglomerate in the nation. Cho Yang-ho's sudden passing naturally raised concerns about managerial complications that could follow. To dispel such concerns, Hanjin immediately went into emergency management mode. Key decisions will be made in meetings of CEOs and top executives. According to the firm, there are no immediate problems with the Cho family's managerial control, since Seok Tae-soo, a close aide to the late chairman, was elected the head of Hanjin KAL for his second term at a shareholders' meeting held last month. Hanjin KAL is the holding company of the business group. However, observers predict a bumpy road ahead for the late chair's heir Cho Won-tae to take the management rights of Korean Air and become its president. There are also forecasts that the Chos could be involved in a conflict over management rights while securing funds to pay inheritance tax. The family holds a 29 percent share in Hanjin KAL. But their stake could drop to some 20 percent if they sell part of it to pay inheritance tax. Their position as the largest shareholder could be threatened, as the stakes of KCGI and the National Pension Service will exceed 20 percent when added up. KCGI and the National Pension played a major role behind the late chairman's ouster from Korean Air's directors' board last month. This is why industry insiders are predicting that Cho Won-tae and other family members will focus on defending management rights by paying inheritance tax with their own funds and loans instead of selling shares.

Hanjin Group and Korean Air Chairman Cho Yang-ho died on April 8 at age of 70. Cho was known to have directly taken care of the conglomerate's managerial issues until recently. Attention is being drawn to what impacts his sudden death will have on the management of Hanjin Group. Here is more.

[Pkg]

Hanjin Group is the unrivaled leader in Korea's air service and transportation industries. It is also the 14th largest conglomerate in the nation. Cho Yang-ho's sudden passing naturally raised concerns about managerial complications that could follow. To dispel such concerns, Hanjin immediately went into emergency management mode. Key decisions will be made in meetings of CEOs and top executives. According to the firm, there are no immediate problems with the Cho family's managerial control, since Seok Tae-soo, a close aide to the late chairman, was elected the head of Hanjin KAL for his second term at a shareholders' meeting held last month. Hanjin KAL is the holding company of the business group. However, observers predict a bumpy road ahead for the late chair's heir Cho Won-tae to take the management rights of Korean Air and become its president. There are also forecasts that the Chos could be involved in a conflict over management rights while securing funds to pay inheritance tax. The family holds a 29 percent share in Hanjin KAL. But their stake could drop to some 20 percent if they sell part of it to pay inheritance tax. Their position as the largest shareholder could be threatened, as the stakes of KCGI and the National Pension Service will exceed 20 percent when added up. KCGI and the National Pension played a major role behind the late chairman's ouster from Korean Air's directors' board last month. This is why industry insiders are predicting that Cho Won-tae and other family members will focus on defending management rights by paying inheritance tax with their own funds and loans instead of selling shares.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[headline]](https://news.kbs.co.kr/data/news/2019/04/09/4176600_10.jpg)

이 기사에 대한 의견을 남겨주세요.