BOK TO PURCHASE UNLIMITED AMOUNT OF BONDS

입력 2020.03.27 (15:15)

수정 2020.03.27 (16:46)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

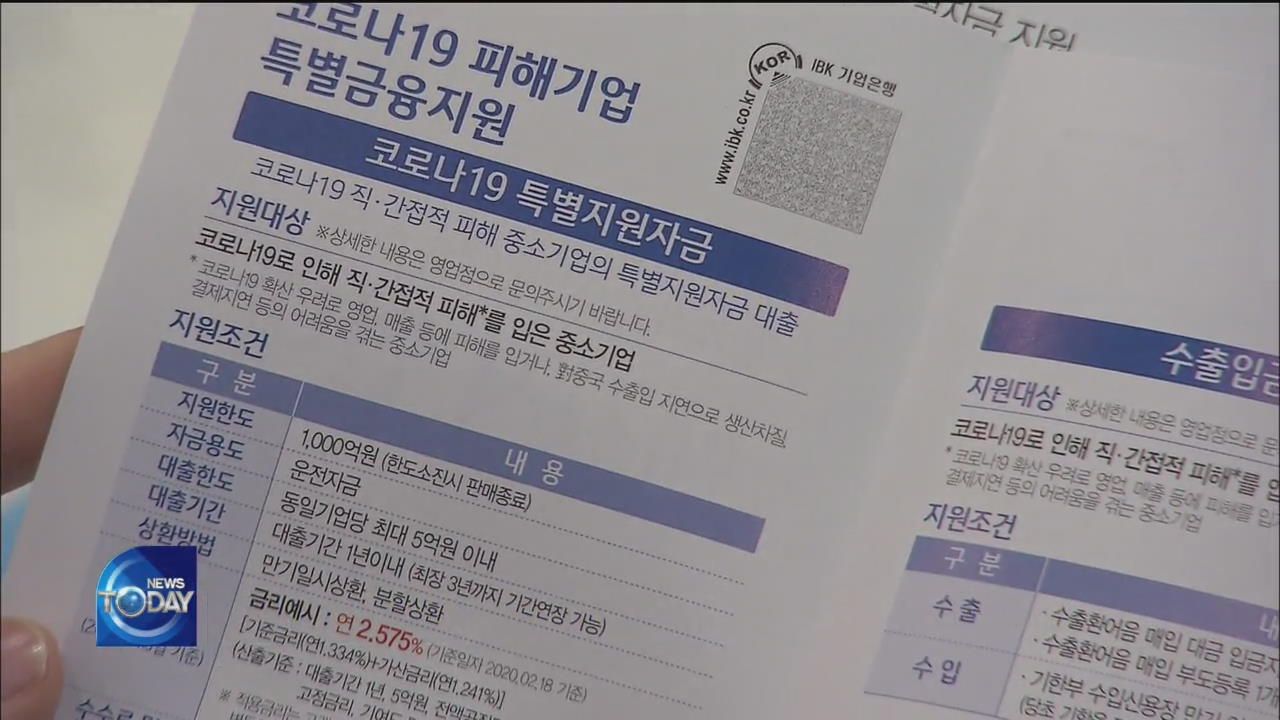

The Bank of Korea has decided to provide much needed liquidity to the financial market by purchasing an unlimited amount of bonds for the next three months, starting next week. The BOK's unlimited quantitative easing measure, the first one in the bank's history, aims to minimize financial uncertainties caused by the ongoing COVID-19 pandemic.

[Pkg]

The latest stimulus measure in South Korea is designed to have the central bank buy up an unlimited amount of repurchase agreements or "repos" from financial firms. The BOK will supply the market with liquidity by freely purchasing bonds once every week for three months at an annual interest rate of up to 0.85%. This is in fact quantitative easing, a measure Bank of Korea has not implemented even during the 1998 or the 2008 financial crisis.

[Soundbite] YOON MYUN-SHIK(SENIOR DEPUTY GOVERNOR, BANK OF KOREA) : "We will meet all of the market demand. If you ask us if this is in fact quantitative easing, we cannot deny it."

The BOK is taking this unprecedented measure to support the government's 100-trillion-won-plus stimulus package for private citizens, financial firms, and businesses. The funds released into the market by the Central Bank's bond purchases will allow financial firms to put that money back into securities and bonds market, which will ultimately flow into corporations and stock markets. The BOK will end up providing indirect assistance to private businesses.

[Soundbite] YOON YEO-SAM(MERITZ SECURITIES) : "The financial firms' liquidity will be restored to help struggling businesses pay back loans and improve overall corporate environment."

Eleven more securities firms have been made eligible to sell a wider variety of bonds to the Bank of Korea.

[Soundbite] CHO YOUNG-MOO(LG ECONOMIC RESEARCH INSTITUTE) : "Similar to the European Central Bank, Korea needs to consider measures that ease financial soundness regulations for financial firms and apply flexible accounting criteria for bad loans."

Meanwhile, Deputy Prime Minister Hong Nam-ki presided over a meeting to discuss direct financial relief plans for conglomerates.

The Bank of Korea has decided to provide much needed liquidity to the financial market by purchasing an unlimited amount of bonds for the next three months, starting next week. The BOK's unlimited quantitative easing measure, the first one in the bank's history, aims to minimize financial uncertainties caused by the ongoing COVID-19 pandemic.

[Pkg]

The latest stimulus measure in South Korea is designed to have the central bank buy up an unlimited amount of repurchase agreements or "repos" from financial firms. The BOK will supply the market with liquidity by freely purchasing bonds once every week for three months at an annual interest rate of up to 0.85%. This is in fact quantitative easing, a measure Bank of Korea has not implemented even during the 1998 or the 2008 financial crisis.

[Soundbite] YOON MYUN-SHIK(SENIOR DEPUTY GOVERNOR, BANK OF KOREA) : "We will meet all of the market demand. If you ask us if this is in fact quantitative easing, we cannot deny it."

The BOK is taking this unprecedented measure to support the government's 100-trillion-won-plus stimulus package for private citizens, financial firms, and businesses. The funds released into the market by the Central Bank's bond purchases will allow financial firms to put that money back into securities and bonds market, which will ultimately flow into corporations and stock markets. The BOK will end up providing indirect assistance to private businesses.

[Soundbite] YOON YEO-SAM(MERITZ SECURITIES) : "The financial firms' liquidity will be restored to help struggling businesses pay back loans and improve overall corporate environment."

Eleven more securities firms have been made eligible to sell a wider variety of bonds to the Bank of Korea.

[Soundbite] CHO YOUNG-MOO(LG ECONOMIC RESEARCH INSTITUTE) : "Similar to the European Central Bank, Korea needs to consider measures that ease financial soundness regulations for financial firms and apply flexible accounting criteria for bad loans."

Meanwhile, Deputy Prime Minister Hong Nam-ki presided over a meeting to discuss direct financial relief plans for conglomerates.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- BOK TO PURCHASE UNLIMITED AMOUNT OF BONDS

-

- 입력 2020-03-27 15:16:21

- 수정2020-03-27 16:46:32

[Anchor Lead]

The Bank of Korea has decided to provide much needed liquidity to the financial market by purchasing an unlimited amount of bonds for the next three months, starting next week. The BOK's unlimited quantitative easing measure, the first one in the bank's history, aims to minimize financial uncertainties caused by the ongoing COVID-19 pandemic.

[Pkg]

The latest stimulus measure in South Korea is designed to have the central bank buy up an unlimited amount of repurchase agreements or "repos" from financial firms. The BOK will supply the market with liquidity by freely purchasing bonds once every week for three months at an annual interest rate of up to 0.85%. This is in fact quantitative easing, a measure Bank of Korea has not implemented even during the 1998 or the 2008 financial crisis.

[Soundbite] YOON MYUN-SHIK(SENIOR DEPUTY GOVERNOR, BANK OF KOREA) : "We will meet all of the market demand. If you ask us if this is in fact quantitative easing, we cannot deny it."

The BOK is taking this unprecedented measure to support the government's 100-trillion-won-plus stimulus package for private citizens, financial firms, and businesses. The funds released into the market by the Central Bank's bond purchases will allow financial firms to put that money back into securities and bonds market, which will ultimately flow into corporations and stock markets. The BOK will end up providing indirect assistance to private businesses.

[Soundbite] YOON YEO-SAM(MERITZ SECURITIES) : "The financial firms' liquidity will be restored to help struggling businesses pay back loans and improve overall corporate environment."

Eleven more securities firms have been made eligible to sell a wider variety of bonds to the Bank of Korea.

[Soundbite] CHO YOUNG-MOO(LG ECONOMIC RESEARCH INSTITUTE) : "Similar to the European Central Bank, Korea needs to consider measures that ease financial soundness regulations for financial firms and apply flexible accounting criteria for bad loans."

Meanwhile, Deputy Prime Minister Hong Nam-ki presided over a meeting to discuss direct financial relief plans for conglomerates.

The Bank of Korea has decided to provide much needed liquidity to the financial market by purchasing an unlimited amount of bonds for the next three months, starting next week. The BOK's unlimited quantitative easing measure, the first one in the bank's history, aims to minimize financial uncertainties caused by the ongoing COVID-19 pandemic.

[Pkg]

The latest stimulus measure in South Korea is designed to have the central bank buy up an unlimited amount of repurchase agreements or "repos" from financial firms. The BOK will supply the market with liquidity by freely purchasing bonds once every week for three months at an annual interest rate of up to 0.85%. This is in fact quantitative easing, a measure Bank of Korea has not implemented even during the 1998 or the 2008 financial crisis.

[Soundbite] YOON MYUN-SHIK(SENIOR DEPUTY GOVERNOR, BANK OF KOREA) : "We will meet all of the market demand. If you ask us if this is in fact quantitative easing, we cannot deny it."

The BOK is taking this unprecedented measure to support the government's 100-trillion-won-plus stimulus package for private citizens, financial firms, and businesses. The funds released into the market by the Central Bank's bond purchases will allow financial firms to put that money back into securities and bonds market, which will ultimately flow into corporations and stock markets. The BOK will end up providing indirect assistance to private businesses.

[Soundbite] YOON YEO-SAM(MERITZ SECURITIES) : "The financial firms' liquidity will be restored to help struggling businesses pay back loans and improve overall corporate environment."

Eleven more securities firms have been made eligible to sell a wider variety of bonds to the Bank of Korea.

[Soundbite] CHO YOUNG-MOO(LG ECONOMIC RESEARCH INSTITUTE) : "Similar to the European Central Bank, Korea needs to consider measures that ease financial soundness regulations for financial firms and apply flexible accounting criteria for bad loans."

Meanwhile, Deputy Prime Minister Hong Nam-ki presided over a meeting to discuss direct financial relief plans for conglomerates.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.