BOK MENTIONS BUBBLE IN ASSET MARKETS

입력 2021.06.23 (15:04)

수정 2021.06.23 (16:47)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The Bank of Korea says the bubble in asset markets, including real estate and stocks, is similar to that of the 1997 Asian financial crisis. A report issued by the BOK says if the Korean economy receives internal or external shocks, house prices could plunge.

[Pkg]

Last week apartment prices in Seoul recorded the highest weekly surge in one and a half years. Despite weekly housing supply plans announced by the government, the skyrocketing house prices show no signs of abating. The Bank of Korea says property prices have also soared in terms of absolute value. House prices in other countries have also surged in terms of the house price-to-income ratio. However in Korea, the housing cost burden is especially heavy when compared to other OECD nations. That's because people's incomes have remained largely the same. The BOK says apartment prices in Seoul are over-valued. They have skyrocketed compared to the residents' incomes, surpassing the ten-year long-run average. The BOK is warning that if the Korean economy receives internal or external shocks, house prices could nosedive. The central bank says asset prices in the nation including real estate are similar to those recorded during the 1997 Asian financial crisis and slightly lower than during the 2007 global financial crunch. In other words, a flood of liquidity in the asset market has resulted in the growing price bubble.

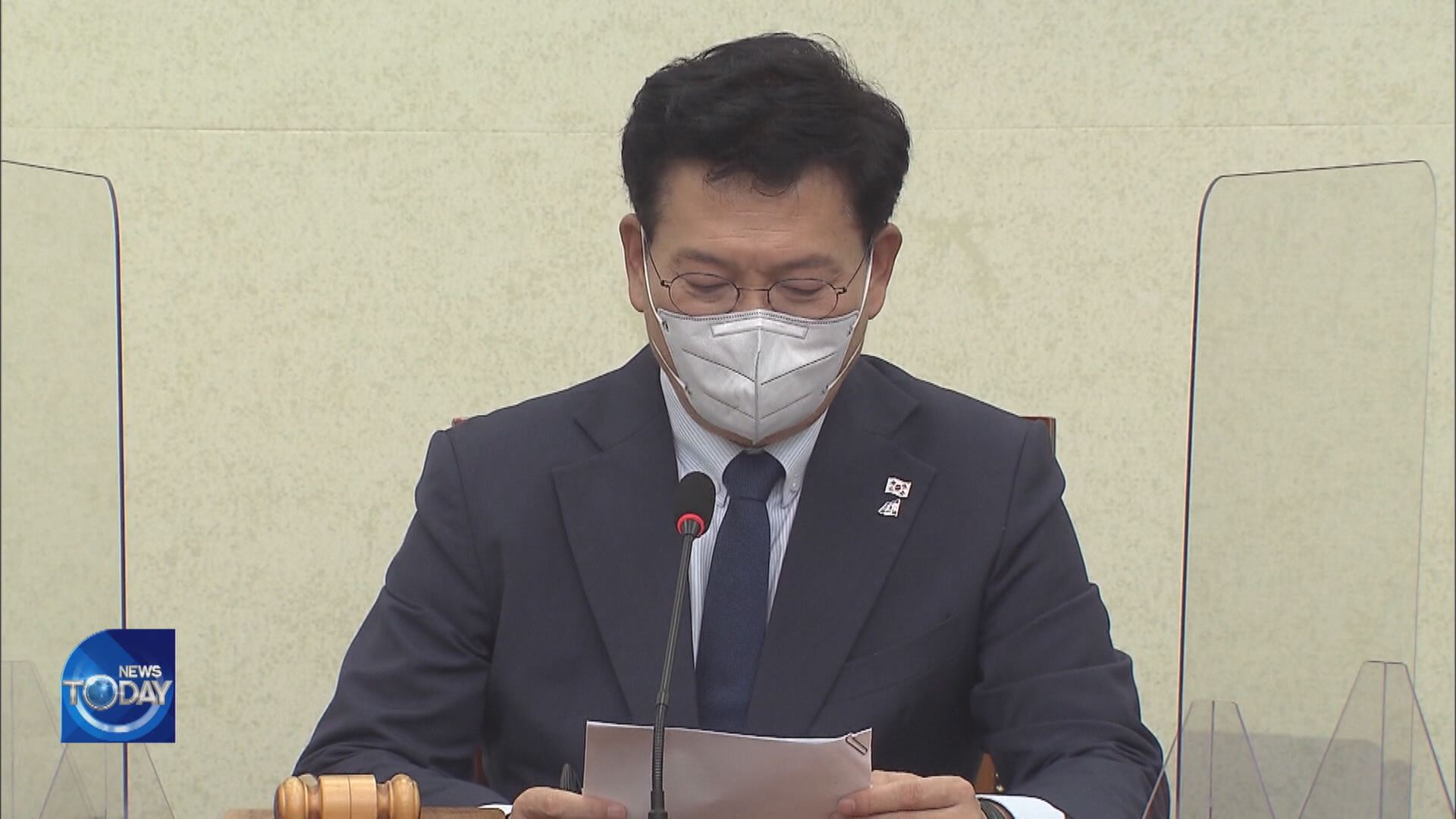

[Soundbite] Park Jong-seok(Bank of Korea) : "Prices in the real estate market continue to spike. I can say cautiously that the financial vulnerability index will likely remain high for the time being."

The BOK also predicts the cryptocurrency market to remain volatile for some time.

The Bank of Korea says the bubble in asset markets, including real estate and stocks, is similar to that of the 1997 Asian financial crisis. A report issued by the BOK says if the Korean economy receives internal or external shocks, house prices could plunge.

[Pkg]

Last week apartment prices in Seoul recorded the highest weekly surge in one and a half years. Despite weekly housing supply plans announced by the government, the skyrocketing house prices show no signs of abating. The Bank of Korea says property prices have also soared in terms of absolute value. House prices in other countries have also surged in terms of the house price-to-income ratio. However in Korea, the housing cost burden is especially heavy when compared to other OECD nations. That's because people's incomes have remained largely the same. The BOK says apartment prices in Seoul are over-valued. They have skyrocketed compared to the residents' incomes, surpassing the ten-year long-run average. The BOK is warning that if the Korean economy receives internal or external shocks, house prices could nosedive. The central bank says asset prices in the nation including real estate are similar to those recorded during the 1997 Asian financial crisis and slightly lower than during the 2007 global financial crunch. In other words, a flood of liquidity in the asset market has resulted in the growing price bubble.

[Soundbite] Park Jong-seok(Bank of Korea) : "Prices in the real estate market continue to spike. I can say cautiously that the financial vulnerability index will likely remain high for the time being."

The BOK also predicts the cryptocurrency market to remain volatile for some time.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- BOK MENTIONS BUBBLE IN ASSET MARKETS

-

- 입력 2021-06-23 15:04:07

- 수정2021-06-23 16:47:04

[Anchor Lead]

The Bank of Korea says the bubble in asset markets, including real estate and stocks, is similar to that of the 1997 Asian financial crisis. A report issued by the BOK says if the Korean economy receives internal or external shocks, house prices could plunge.

[Pkg]

Last week apartment prices in Seoul recorded the highest weekly surge in one and a half years. Despite weekly housing supply plans announced by the government, the skyrocketing house prices show no signs of abating. The Bank of Korea says property prices have also soared in terms of absolute value. House prices in other countries have also surged in terms of the house price-to-income ratio. However in Korea, the housing cost burden is especially heavy when compared to other OECD nations. That's because people's incomes have remained largely the same. The BOK says apartment prices in Seoul are over-valued. They have skyrocketed compared to the residents' incomes, surpassing the ten-year long-run average. The BOK is warning that if the Korean economy receives internal or external shocks, house prices could nosedive. The central bank says asset prices in the nation including real estate are similar to those recorded during the 1997 Asian financial crisis and slightly lower than during the 2007 global financial crunch. In other words, a flood of liquidity in the asset market has resulted in the growing price bubble.

[Soundbite] Park Jong-seok(Bank of Korea) : "Prices in the real estate market continue to spike. I can say cautiously that the financial vulnerability index will likely remain high for the time being."

The BOK also predicts the cryptocurrency market to remain volatile for some time.

The Bank of Korea says the bubble in asset markets, including real estate and stocks, is similar to that of the 1997 Asian financial crisis. A report issued by the BOK says if the Korean economy receives internal or external shocks, house prices could plunge.

[Pkg]

Last week apartment prices in Seoul recorded the highest weekly surge in one and a half years. Despite weekly housing supply plans announced by the government, the skyrocketing house prices show no signs of abating. The Bank of Korea says property prices have also soared in terms of absolute value. House prices in other countries have also surged in terms of the house price-to-income ratio. However in Korea, the housing cost burden is especially heavy when compared to other OECD nations. That's because people's incomes have remained largely the same. The BOK says apartment prices in Seoul are over-valued. They have skyrocketed compared to the residents' incomes, surpassing the ten-year long-run average. The BOK is warning that if the Korean economy receives internal or external shocks, house prices could nosedive. The central bank says asset prices in the nation including real estate are similar to those recorded during the 1997 Asian financial crisis and slightly lower than during the 2007 global financial crunch. In other words, a flood of liquidity in the asset market has resulted in the growing price bubble.

[Soundbite] Park Jong-seok(Bank of Korea) : "Prices in the real estate market continue to spike. I can say cautiously that the financial vulnerability index will likely remain high for the time being."

The BOK also predicts the cryptocurrency market to remain volatile for some time.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.