CAUTIONS AGAINST STOCK INVESTMENTS

입력 2021.08.30 (15:11)

수정 2021.08.30 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

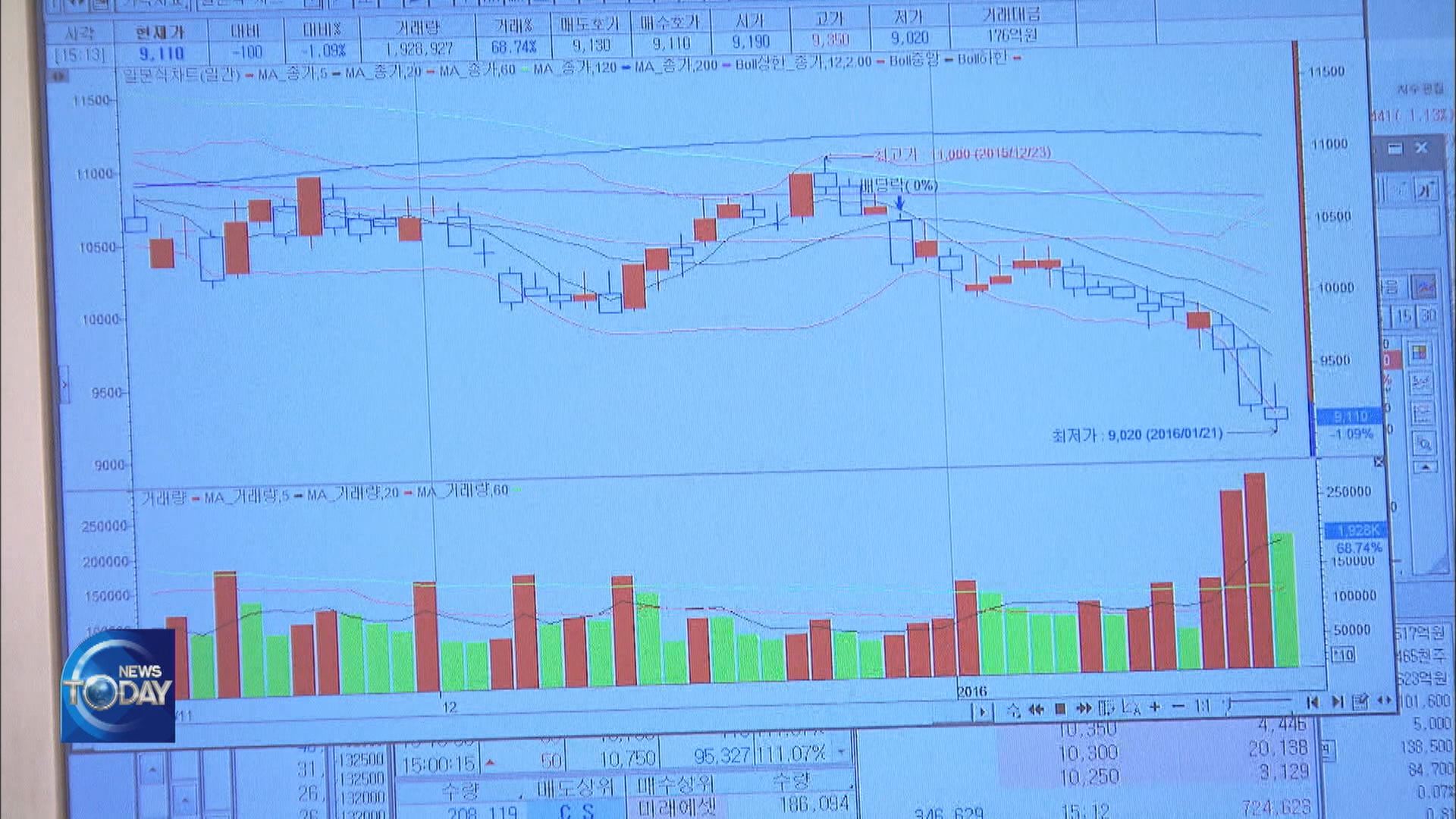

Initial public offerings are the buzzword among retail stock investors in Korea. There have been some companies that hit the ceiling twice on the day of their IPOs since last year, prompting many individuals to take out loans for subscription deposits. But experts warn that investors should be more careful when the stock market is so volatile.

[Pkg]

PlayerUnknown's Battlegrounds is an online multiplayer shooter that 100 users can play at the same time. It is Krafton’s flagship game with morethan a billion downloads. But its debut on the Korean stock market didn’t live up to expectations. Its first-day stock price fell 9% than its public offering price.

[Soundbite] Lee Jae-sun(Senior Researcher, Hana Financial Investment) : "It was one of the overrated companies, so it didn’t perform as well as the market expected."

IPO subscription is popular these days with only one out of 1,300 investors being able to purchase related stocks. The popularity is driven by the likelihood of so-called“ddasang” or a company debuting at double the IPO price and hitting the daily ceiling. Last year SK Bio-Pharm and Kakao Games achieved such a feat, coining the word “ddasang.” 23 companies have done the same so far this year. But the last two years were rather an anomaly, because in previous years five companies at best hit “ddasang” annually. In the second half of this year, some highly anticipated companies, such as Krafton and Lotte Rental, saw their stock prices tumble below the IPO prices immediately after they went public.

[Soundbite] (IPO Investor(VOICE MODIFIED)) : "I borrowed as much as KRW 200 million. I can’t get an IPO stock without investing a lot of money."

Experts warn that IPOs are very risky since public expectations prematurely fuel their projected prices.

[Soundbite] Lee Seok-hoon(Researcher, Korea Capital Market Institute) : "Because an IPO company is highly appraised, its market volatility is twice as great. When the market is uncertain, IPO investment is that much risky."

Experts advise investors to be more careful as the stock market has been more volatile recently.

Initial public offerings are the buzzword among retail stock investors in Korea. There have been some companies that hit the ceiling twice on the day of their IPOs since last year, prompting many individuals to take out loans for subscription deposits. But experts warn that investors should be more careful when the stock market is so volatile.

[Pkg]

PlayerUnknown's Battlegrounds is an online multiplayer shooter that 100 users can play at the same time. It is Krafton’s flagship game with morethan a billion downloads. But its debut on the Korean stock market didn’t live up to expectations. Its first-day stock price fell 9% than its public offering price.

[Soundbite] Lee Jae-sun(Senior Researcher, Hana Financial Investment) : "It was one of the overrated companies, so it didn’t perform as well as the market expected."

IPO subscription is popular these days with only one out of 1,300 investors being able to purchase related stocks. The popularity is driven by the likelihood of so-called“ddasang” or a company debuting at double the IPO price and hitting the daily ceiling. Last year SK Bio-Pharm and Kakao Games achieved such a feat, coining the word “ddasang.” 23 companies have done the same so far this year. But the last two years were rather an anomaly, because in previous years five companies at best hit “ddasang” annually. In the second half of this year, some highly anticipated companies, such as Krafton and Lotte Rental, saw their stock prices tumble below the IPO prices immediately after they went public.

[Soundbite] (IPO Investor(VOICE MODIFIED)) : "I borrowed as much as KRW 200 million. I can’t get an IPO stock without investing a lot of money."

Experts warn that IPOs are very risky since public expectations prematurely fuel their projected prices.

[Soundbite] Lee Seok-hoon(Researcher, Korea Capital Market Institute) : "Because an IPO company is highly appraised, its market volatility is twice as great. When the market is uncertain, IPO investment is that much risky."

Experts advise investors to be more careful as the stock market has been more volatile recently.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- CAUTIONS AGAINST STOCK INVESTMENTS

-

- 입력 2021-08-30 15:11:47

- 수정2021-08-30 16:45:07

[Anchor Lead]

Initial public offerings are the buzzword among retail stock investors in Korea. There have been some companies that hit the ceiling twice on the day of their IPOs since last year, prompting many individuals to take out loans for subscription deposits. But experts warn that investors should be more careful when the stock market is so volatile.

[Pkg]

PlayerUnknown's Battlegrounds is an online multiplayer shooter that 100 users can play at the same time. It is Krafton’s flagship game with morethan a billion downloads. But its debut on the Korean stock market didn’t live up to expectations. Its first-day stock price fell 9% than its public offering price.

[Soundbite] Lee Jae-sun(Senior Researcher, Hana Financial Investment) : "It was one of the overrated companies, so it didn’t perform as well as the market expected."

IPO subscription is popular these days with only one out of 1,300 investors being able to purchase related stocks. The popularity is driven by the likelihood of so-called“ddasang” or a company debuting at double the IPO price and hitting the daily ceiling. Last year SK Bio-Pharm and Kakao Games achieved such a feat, coining the word “ddasang.” 23 companies have done the same so far this year. But the last two years were rather an anomaly, because in previous years five companies at best hit “ddasang” annually. In the second half of this year, some highly anticipated companies, such as Krafton and Lotte Rental, saw their stock prices tumble below the IPO prices immediately after they went public.

[Soundbite] (IPO Investor(VOICE MODIFIED)) : "I borrowed as much as KRW 200 million. I can’t get an IPO stock without investing a lot of money."

Experts warn that IPOs are very risky since public expectations prematurely fuel their projected prices.

[Soundbite] Lee Seok-hoon(Researcher, Korea Capital Market Institute) : "Because an IPO company is highly appraised, its market volatility is twice as great. When the market is uncertain, IPO investment is that much risky."

Experts advise investors to be more careful as the stock market has been more volatile recently.

Initial public offerings are the buzzword among retail stock investors in Korea. There have been some companies that hit the ceiling twice on the day of their IPOs since last year, prompting many individuals to take out loans for subscription deposits. But experts warn that investors should be more careful when the stock market is so volatile.

[Pkg]

PlayerUnknown's Battlegrounds is an online multiplayer shooter that 100 users can play at the same time. It is Krafton’s flagship game with morethan a billion downloads. But its debut on the Korean stock market didn’t live up to expectations. Its first-day stock price fell 9% than its public offering price.

[Soundbite] Lee Jae-sun(Senior Researcher, Hana Financial Investment) : "It was one of the overrated companies, so it didn’t perform as well as the market expected."

IPO subscription is popular these days with only one out of 1,300 investors being able to purchase related stocks. The popularity is driven by the likelihood of so-called“ddasang” or a company debuting at double the IPO price and hitting the daily ceiling. Last year SK Bio-Pharm and Kakao Games achieved such a feat, coining the word “ddasang.” 23 companies have done the same so far this year. But the last two years were rather an anomaly, because in previous years five companies at best hit “ddasang” annually. In the second half of this year, some highly anticipated companies, such as Krafton and Lotte Rental, saw their stock prices tumble below the IPO prices immediately after they went public.

[Soundbite] (IPO Investor(VOICE MODIFIED)) : "I borrowed as much as KRW 200 million. I can’t get an IPO stock without investing a lot of money."

Experts warn that IPOs are very risky since public expectations prematurely fuel their projected prices.

[Soundbite] Lee Seok-hoon(Researcher, Korea Capital Market Institute) : "Because an IPO company is highly appraised, its market volatility is twice as great. When the market is uncertain, IPO investment is that much risky."

Experts advise investors to be more careful as the stock market has been more volatile recently.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.