KAKAO CORPORATION UNDER INVESTIGATION

입력 2021.09.14 (15:04)

수정 2021.09.14 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

There are growing calls for regulation against the reckless expansion of internet giants, such as Kakao Corporation. The Fair Trade Commission has launched an investigation into the messaging giant Kakao and its founder and chairman Kim Beom-su on charges of violating the separation of industrial and financial capital.

[Pkg]

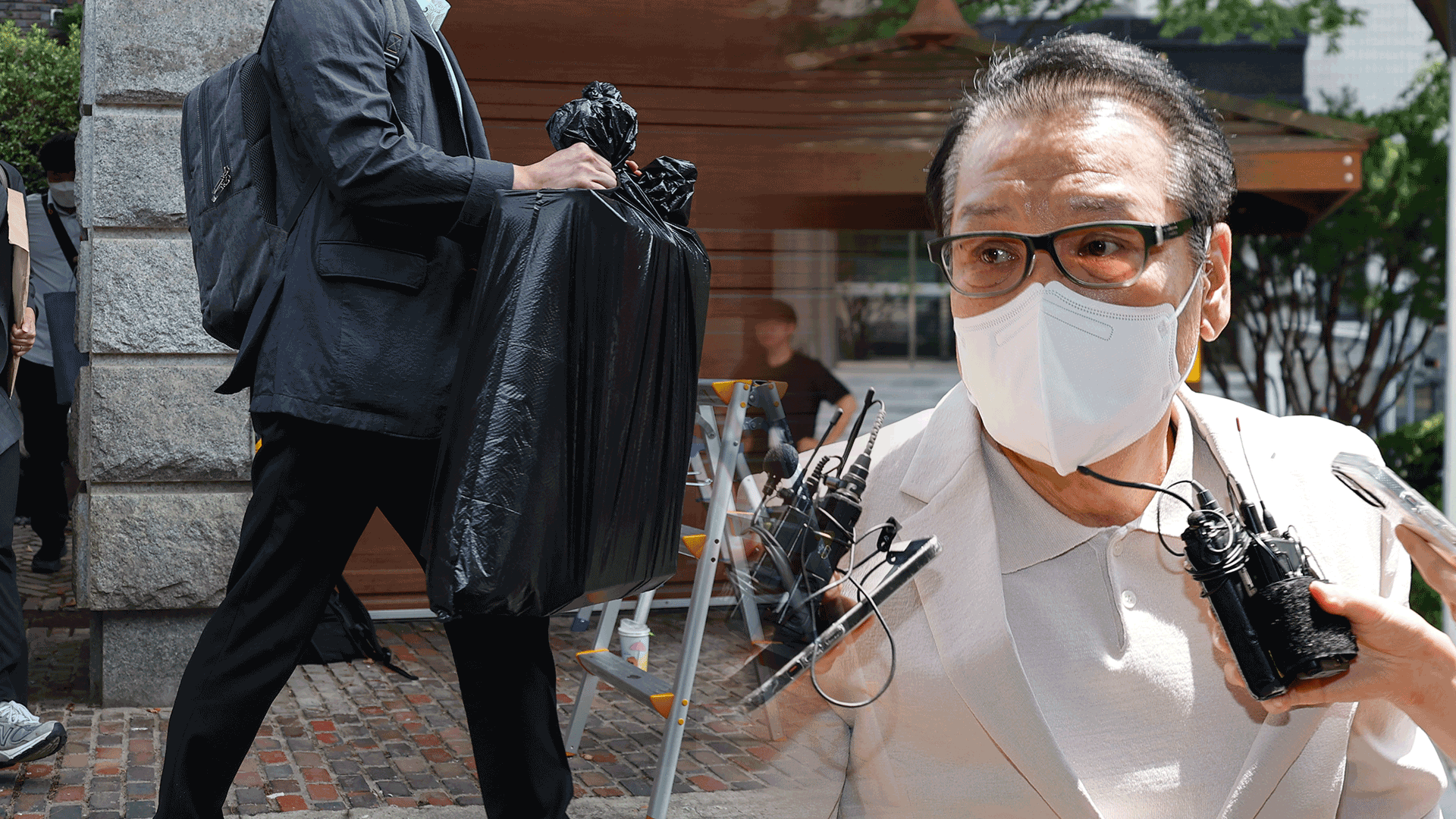

This is a building in Seoul's Samseong-dong area that is home to a number of Kakao affiliates. On the building's 15th floor is a private company called K Cube Holdings, which Kakao chairman Kim Beom-su holds a 100% stake in. As the firm holds nearly 11% of Kakao shares, it is the de facto holding company of Kakao Group. The Fair Trade Commission last week conducted an onsite inspection into K Cube Holdings.

[Soundbite] Kim Tak-heung(CEO, K Cube Holdings) : "It's difficult to say at the moment because that's the reason for the probe."

This is from the firm's disclosed information. It says that when the firm was founded in 2007, it started out as a management consulting firm that falls in the services sector. But last year, it changed to a financial business. K Cube was initially established as a software developer and supplier, but as corporate investment grew, it became a financial investment firm.

[Soundbite] Kim Tak-heung(CEO, K Cube Holdings) : "Sales are too small if earnings from interest and dividends are categorized as non-operating income. We made the change because that portion takes up the largest amount."

In other words, this means K Cube Holdings, a financial firm, has held control over Kakao, a non-financial firm. The FTC sees this as a violation of the separation of industrial and financial capital, thus why it is investigating the matter. The country's current fair trade law restricts financial and insurance subsidiaries of corporate groups from owning stakes in non-finance affiliates and exercising voting rights.

[Soundbite] Lee Chang-min(Prof., Hanyang Univ.) : "Risks of non-finance sectors can spill over into finance. The same can happen with K Cube Holdings."

The FTC is also known to have found circumstantial evidence pointing to Kakao's failure to properly file reports on share holdings belonging to Kim's relatives. After concluding the probe, the FTC is expected to decide whether to slap sanctions on Kakao and K Cube Holdings as early as the end of the year.

There are growing calls for regulation against the reckless expansion of internet giants, such as Kakao Corporation. The Fair Trade Commission has launched an investigation into the messaging giant Kakao and its founder and chairman Kim Beom-su on charges of violating the separation of industrial and financial capital.

[Pkg]

This is a building in Seoul's Samseong-dong area that is home to a number of Kakao affiliates. On the building's 15th floor is a private company called K Cube Holdings, which Kakao chairman Kim Beom-su holds a 100% stake in. As the firm holds nearly 11% of Kakao shares, it is the de facto holding company of Kakao Group. The Fair Trade Commission last week conducted an onsite inspection into K Cube Holdings.

[Soundbite] Kim Tak-heung(CEO, K Cube Holdings) : "It's difficult to say at the moment because that's the reason for the probe."

This is from the firm's disclosed information. It says that when the firm was founded in 2007, it started out as a management consulting firm that falls in the services sector. But last year, it changed to a financial business. K Cube was initially established as a software developer and supplier, but as corporate investment grew, it became a financial investment firm.

[Soundbite] Kim Tak-heung(CEO, K Cube Holdings) : "Sales are too small if earnings from interest and dividends are categorized as non-operating income. We made the change because that portion takes up the largest amount."

In other words, this means K Cube Holdings, a financial firm, has held control over Kakao, a non-financial firm. The FTC sees this as a violation of the separation of industrial and financial capital, thus why it is investigating the matter. The country's current fair trade law restricts financial and insurance subsidiaries of corporate groups from owning stakes in non-finance affiliates and exercising voting rights.

[Soundbite] Lee Chang-min(Prof., Hanyang Univ.) : "Risks of non-finance sectors can spill over into finance. The same can happen with K Cube Holdings."

The FTC is also known to have found circumstantial evidence pointing to Kakao's failure to properly file reports on share holdings belonging to Kim's relatives. After concluding the probe, the FTC is expected to decide whether to slap sanctions on Kakao and K Cube Holdings as early as the end of the year.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- KAKAO CORPORATION UNDER INVESTIGATION

-

- 입력 2021-09-14 15:04:17

- 수정2021-09-14 16:45:19

[Anchor Lead]

There are growing calls for regulation against the reckless expansion of internet giants, such as Kakao Corporation. The Fair Trade Commission has launched an investigation into the messaging giant Kakao and its founder and chairman Kim Beom-su on charges of violating the separation of industrial and financial capital.

[Pkg]

This is a building in Seoul's Samseong-dong area that is home to a number of Kakao affiliates. On the building's 15th floor is a private company called K Cube Holdings, which Kakao chairman Kim Beom-su holds a 100% stake in. As the firm holds nearly 11% of Kakao shares, it is the de facto holding company of Kakao Group. The Fair Trade Commission last week conducted an onsite inspection into K Cube Holdings.

[Soundbite] Kim Tak-heung(CEO, K Cube Holdings) : "It's difficult to say at the moment because that's the reason for the probe."

This is from the firm's disclosed information. It says that when the firm was founded in 2007, it started out as a management consulting firm that falls in the services sector. But last year, it changed to a financial business. K Cube was initially established as a software developer and supplier, but as corporate investment grew, it became a financial investment firm.

[Soundbite] Kim Tak-heung(CEO, K Cube Holdings) : "Sales are too small if earnings from interest and dividends are categorized as non-operating income. We made the change because that portion takes up the largest amount."

In other words, this means K Cube Holdings, a financial firm, has held control over Kakao, a non-financial firm. The FTC sees this as a violation of the separation of industrial and financial capital, thus why it is investigating the matter. The country's current fair trade law restricts financial and insurance subsidiaries of corporate groups from owning stakes in non-finance affiliates and exercising voting rights.

[Soundbite] Lee Chang-min(Prof., Hanyang Univ.) : "Risks of non-finance sectors can spill over into finance. The same can happen with K Cube Holdings."

The FTC is also known to have found circumstantial evidence pointing to Kakao's failure to properly file reports on share holdings belonging to Kim's relatives. After concluding the probe, the FTC is expected to decide whether to slap sanctions on Kakao and K Cube Holdings as early as the end of the year.

There are growing calls for regulation against the reckless expansion of internet giants, such as Kakao Corporation. The Fair Trade Commission has launched an investigation into the messaging giant Kakao and its founder and chairman Kim Beom-su on charges of violating the separation of industrial and financial capital.

[Pkg]

This is a building in Seoul's Samseong-dong area that is home to a number of Kakao affiliates. On the building's 15th floor is a private company called K Cube Holdings, which Kakao chairman Kim Beom-su holds a 100% stake in. As the firm holds nearly 11% of Kakao shares, it is the de facto holding company of Kakao Group. The Fair Trade Commission last week conducted an onsite inspection into K Cube Holdings.

[Soundbite] Kim Tak-heung(CEO, K Cube Holdings) : "It's difficult to say at the moment because that's the reason for the probe."

This is from the firm's disclosed information. It says that when the firm was founded in 2007, it started out as a management consulting firm that falls in the services sector. But last year, it changed to a financial business. K Cube was initially established as a software developer and supplier, but as corporate investment grew, it became a financial investment firm.

[Soundbite] Kim Tak-heung(CEO, K Cube Holdings) : "Sales are too small if earnings from interest and dividends are categorized as non-operating income. We made the change because that portion takes up the largest amount."

In other words, this means K Cube Holdings, a financial firm, has held control over Kakao, a non-financial firm. The FTC sees this as a violation of the separation of industrial and financial capital, thus why it is investigating the matter. The country's current fair trade law restricts financial and insurance subsidiaries of corporate groups from owning stakes in non-finance affiliates and exercising voting rights.

[Soundbite] Lee Chang-min(Prof., Hanyang Univ.) : "Risks of non-finance sectors can spill over into finance. The same can happen with K Cube Holdings."

The FTC is also known to have found circumstantial evidence pointing to Kakao's failure to properly file reports on share holdings belonging to Kim's relatives. After concluding the probe, the FTC is expected to decide whether to slap sanctions on Kakao and K Cube Holdings as early as the end of the year.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.