CONSUMER PRICE AFFECTS THE VULNERABLE

입력 2021.11.03 (15:09)

수정 2021.11.03 (16:46)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

Last month consumer prices rose more than 3 percent for the first time since 2012. Low-income earners are the most vulnerable group when consumer prices surge.

[Pkg]

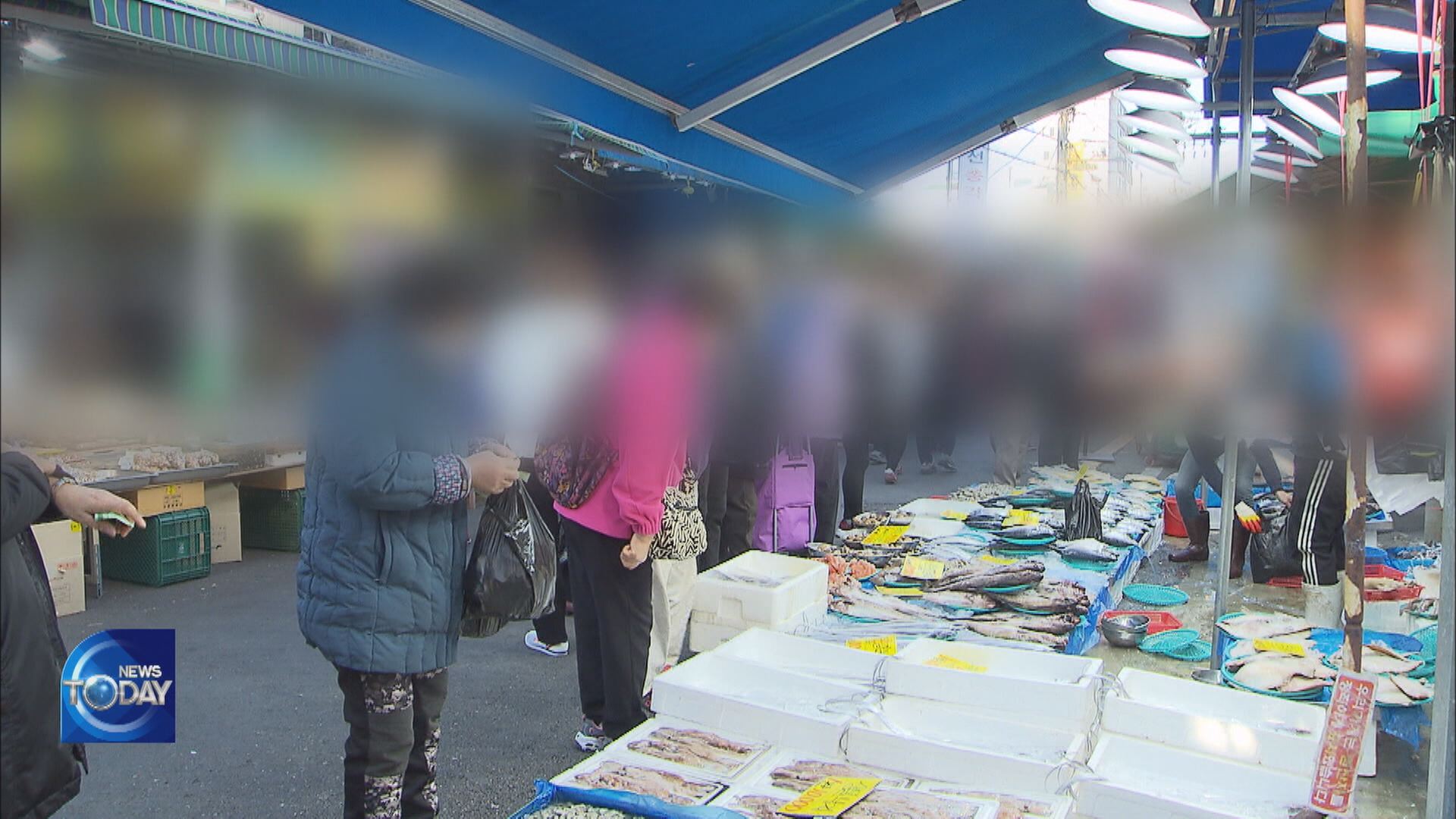

Two hundred servings of packed launches are being prepared for residents of poor neighborhoods. Each meal consists of three side dishes, rice and a pork cutlet, and costs 2,900 won. Organizers have been struggling recently because of the rising prices of food ingredients.

[Soundbite] Choi Eun-hwa(Director, Welfare Organization(Saramin)) : "We buy affordable ingredients at a market right before cooking. Prices are higher these days."

To those who struggle to make ends meet, inflation is a major concern.

[Soundbite] (Low-income resident) : "I eat what they bring me. When there's nothing to eat, I starve. I try to save as much as possible."

[Soundbite] (Low-income resident) : "I don't cook because it costs money. I just get by as I can."

Although consumer prices have risen more than 3 percent, the consumer price index for living necessities has spiked even more. Items that are purchased frequently and account for a large share of consumers' spending are now even more burdensome to buy. Such items include food. Low-income earners usually bear the brunt of high inflation, as they mostly spend their money on food. Compared to the pre-pandemic era, people in the lowest income bracket perceived inflation to be 3.6 percent, nearly one percentage point higher than high-income earners.

[Soundbite] Joo Won(Hyundai Economic Research Inst.) : "Low-income earners have seen their incomes shrink significantly. Prices of daily necessities have surged, making them more vulnerable in terms of spending quantitatively and qualitatively."

Analysts say inflation will likely continue to intensify for the time being due to policies promoting domestic consumption in time for the gradual return to normal life.

Last month consumer prices rose more than 3 percent for the first time since 2012. Low-income earners are the most vulnerable group when consumer prices surge.

[Pkg]

Two hundred servings of packed launches are being prepared for residents of poor neighborhoods. Each meal consists of three side dishes, rice and a pork cutlet, and costs 2,900 won. Organizers have been struggling recently because of the rising prices of food ingredients.

[Soundbite] Choi Eun-hwa(Director, Welfare Organization(Saramin)) : "We buy affordable ingredients at a market right before cooking. Prices are higher these days."

To those who struggle to make ends meet, inflation is a major concern.

[Soundbite] (Low-income resident) : "I eat what they bring me. When there's nothing to eat, I starve. I try to save as much as possible."

[Soundbite] (Low-income resident) : "I don't cook because it costs money. I just get by as I can."

Although consumer prices have risen more than 3 percent, the consumer price index for living necessities has spiked even more. Items that are purchased frequently and account for a large share of consumers' spending are now even more burdensome to buy. Such items include food. Low-income earners usually bear the brunt of high inflation, as they mostly spend their money on food. Compared to the pre-pandemic era, people in the lowest income bracket perceived inflation to be 3.6 percent, nearly one percentage point higher than high-income earners.

[Soundbite] Joo Won(Hyundai Economic Research Inst.) : "Low-income earners have seen their incomes shrink significantly. Prices of daily necessities have surged, making them more vulnerable in terms of spending quantitatively and qualitatively."

Analysts say inflation will likely continue to intensify for the time being due to policies promoting domestic consumption in time for the gradual return to normal life.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- CONSUMER PRICE AFFECTS THE VULNERABLE

-

- 입력 2021-11-03 15:09:27

- 수정2021-11-03 16:46:30

[Anchor Lead]

Last month consumer prices rose more than 3 percent for the first time since 2012. Low-income earners are the most vulnerable group when consumer prices surge.

[Pkg]

Two hundred servings of packed launches are being prepared for residents of poor neighborhoods. Each meal consists of three side dishes, rice and a pork cutlet, and costs 2,900 won. Organizers have been struggling recently because of the rising prices of food ingredients.

[Soundbite] Choi Eun-hwa(Director, Welfare Organization(Saramin)) : "We buy affordable ingredients at a market right before cooking. Prices are higher these days."

To those who struggle to make ends meet, inflation is a major concern.

[Soundbite] (Low-income resident) : "I eat what they bring me. When there's nothing to eat, I starve. I try to save as much as possible."

[Soundbite] (Low-income resident) : "I don't cook because it costs money. I just get by as I can."

Although consumer prices have risen more than 3 percent, the consumer price index for living necessities has spiked even more. Items that are purchased frequently and account for a large share of consumers' spending are now even more burdensome to buy. Such items include food. Low-income earners usually bear the brunt of high inflation, as they mostly spend their money on food. Compared to the pre-pandemic era, people in the lowest income bracket perceived inflation to be 3.6 percent, nearly one percentage point higher than high-income earners.

[Soundbite] Joo Won(Hyundai Economic Research Inst.) : "Low-income earners have seen their incomes shrink significantly. Prices of daily necessities have surged, making them more vulnerable in terms of spending quantitatively and qualitatively."

Analysts say inflation will likely continue to intensify for the time being due to policies promoting domestic consumption in time for the gradual return to normal life.

Last month consumer prices rose more than 3 percent for the first time since 2012. Low-income earners are the most vulnerable group when consumer prices surge.

[Pkg]

Two hundred servings of packed launches are being prepared for residents of poor neighborhoods. Each meal consists of three side dishes, rice and a pork cutlet, and costs 2,900 won. Organizers have been struggling recently because of the rising prices of food ingredients.

[Soundbite] Choi Eun-hwa(Director, Welfare Organization(Saramin)) : "We buy affordable ingredients at a market right before cooking. Prices are higher these days."

To those who struggle to make ends meet, inflation is a major concern.

[Soundbite] (Low-income resident) : "I eat what they bring me. When there's nothing to eat, I starve. I try to save as much as possible."

[Soundbite] (Low-income resident) : "I don't cook because it costs money. I just get by as I can."

Although consumer prices have risen more than 3 percent, the consumer price index for living necessities has spiked even more. Items that are purchased frequently and account for a large share of consumers' spending are now even more burdensome to buy. Such items include food. Low-income earners usually bear the brunt of high inflation, as they mostly spend their money on food. Compared to the pre-pandemic era, people in the lowest income bracket perceived inflation to be 3.6 percent, nearly one percentage point higher than high-income earners.

[Soundbite] Joo Won(Hyundai Economic Research Inst.) : "Low-income earners have seen their incomes shrink significantly. Prices of daily necessities have surged, making them more vulnerable in terms of spending quantitatively and qualitatively."

Analysts say inflation will likely continue to intensify for the time being due to policies promoting domestic consumption in time for the gradual return to normal life.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] “윤석열·김용현 등 공모해 군사상 이익 해쳐”…외환죄 대신 일반이적죄 적용](/data/layer/904/2025/07/20250714_3VTJV3.jpg)

이 기사에 대한 의견을 남겨주세요.