FINE AGAINST SK GROUP CHAIR

입력 2021.12.23 (15:12)

수정 2021.12.23 (16:46)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The Fair Trade Commission has concluded that SK Group Chairman Chey Tae-won snatched a chance from SK Inc. to purchase a greater stake in the process of its takeover of Siltron. This is said to be the first case that the antitrust watchdog punished a major shareholder for exploiting a chance that should have gone to an affiliate.

[Pkg]

In an effort to bolster its semiconductor material business, SK purchased a 51 percent stake in Siltron in January, 2017. Three months later, the conglomerate additionally purchased a 19.6 percent stake at a 30 percent discount. At the time, SK internally decided that Siltron’s corporate value would further increase. But the remaining stake of 29.4 percent went to SK Group Chair Chey Tae-won, not SK Inc. The Fair Trade Commission took note of how Chey acquired the stake. The FTC believed SK had given up the profitable business opportunity to the chairman without any plausible reason and eventually helped him make undue gains. The value of the stake Chey purchased is believed to have increased by nearly 200 billion won in three years. The Commission concluded that SK violated commercial law by waiving the chance to buy the stake in question without the board of directors’ approval.

[Soundbite] Yook Sung-kwon(FTC) : "The profits should have gone to SK Inc. But Chair Chey illegally took advantage of the chance and gained the profits without the company’s consent and paying appropriate prices."

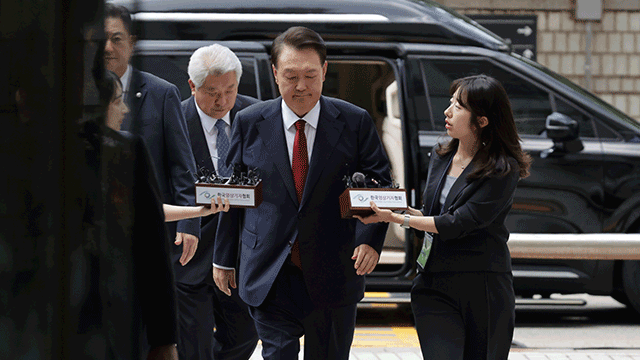

The antitrust watchdog slapped fines of 800 million won each on SK Inc. and Chey Tae-won. The company actively tried to dispel doubts regarding the 2017 deal. On his part, Chey attended a session by the FTC and answered questions about the allegations. Following the commission’s decision, SK said it is deeply disappointing to see the allegations established with no facts legally proven.

The Fair Trade Commission has concluded that SK Group Chairman Chey Tae-won snatched a chance from SK Inc. to purchase a greater stake in the process of its takeover of Siltron. This is said to be the first case that the antitrust watchdog punished a major shareholder for exploiting a chance that should have gone to an affiliate.

[Pkg]

In an effort to bolster its semiconductor material business, SK purchased a 51 percent stake in Siltron in January, 2017. Three months later, the conglomerate additionally purchased a 19.6 percent stake at a 30 percent discount. At the time, SK internally decided that Siltron’s corporate value would further increase. But the remaining stake of 29.4 percent went to SK Group Chair Chey Tae-won, not SK Inc. The Fair Trade Commission took note of how Chey acquired the stake. The FTC believed SK had given up the profitable business opportunity to the chairman without any plausible reason and eventually helped him make undue gains. The value of the stake Chey purchased is believed to have increased by nearly 200 billion won in three years. The Commission concluded that SK violated commercial law by waiving the chance to buy the stake in question without the board of directors’ approval.

[Soundbite] Yook Sung-kwon(FTC) : "The profits should have gone to SK Inc. But Chair Chey illegally took advantage of the chance and gained the profits without the company’s consent and paying appropriate prices."

The antitrust watchdog slapped fines of 800 million won each on SK Inc. and Chey Tae-won. The company actively tried to dispel doubts regarding the 2017 deal. On his part, Chey attended a session by the FTC and answered questions about the allegations. Following the commission’s decision, SK said it is deeply disappointing to see the allegations established with no facts legally proven.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- FINE AGAINST SK GROUP CHAIR

-

- 입력 2021-12-23 15:12:59

- 수정2021-12-23 16:46:34

[Anchor Lead]

The Fair Trade Commission has concluded that SK Group Chairman Chey Tae-won snatched a chance from SK Inc. to purchase a greater stake in the process of its takeover of Siltron. This is said to be the first case that the antitrust watchdog punished a major shareholder for exploiting a chance that should have gone to an affiliate.

[Pkg]

In an effort to bolster its semiconductor material business, SK purchased a 51 percent stake in Siltron in January, 2017. Three months later, the conglomerate additionally purchased a 19.6 percent stake at a 30 percent discount. At the time, SK internally decided that Siltron’s corporate value would further increase. But the remaining stake of 29.4 percent went to SK Group Chair Chey Tae-won, not SK Inc. The Fair Trade Commission took note of how Chey acquired the stake. The FTC believed SK had given up the profitable business opportunity to the chairman without any plausible reason and eventually helped him make undue gains. The value of the stake Chey purchased is believed to have increased by nearly 200 billion won in three years. The Commission concluded that SK violated commercial law by waiving the chance to buy the stake in question without the board of directors’ approval.

[Soundbite] Yook Sung-kwon(FTC) : "The profits should have gone to SK Inc. But Chair Chey illegally took advantage of the chance and gained the profits without the company’s consent and paying appropriate prices."

The antitrust watchdog slapped fines of 800 million won each on SK Inc. and Chey Tae-won. The company actively tried to dispel doubts regarding the 2017 deal. On his part, Chey attended a session by the FTC and answered questions about the allegations. Following the commission’s decision, SK said it is deeply disappointing to see the allegations established with no facts legally proven.

The Fair Trade Commission has concluded that SK Group Chairman Chey Tae-won snatched a chance from SK Inc. to purchase a greater stake in the process of its takeover of Siltron. This is said to be the first case that the antitrust watchdog punished a major shareholder for exploiting a chance that should have gone to an affiliate.

[Pkg]

In an effort to bolster its semiconductor material business, SK purchased a 51 percent stake in Siltron in January, 2017. Three months later, the conglomerate additionally purchased a 19.6 percent stake at a 30 percent discount. At the time, SK internally decided that Siltron’s corporate value would further increase. But the remaining stake of 29.4 percent went to SK Group Chair Chey Tae-won, not SK Inc. The Fair Trade Commission took note of how Chey acquired the stake. The FTC believed SK had given up the profitable business opportunity to the chairman without any plausible reason and eventually helped him make undue gains. The value of the stake Chey purchased is believed to have increased by nearly 200 billion won in three years. The Commission concluded that SK violated commercial law by waiving the chance to buy the stake in question without the board of directors’ approval.

[Soundbite] Yook Sung-kwon(FTC) : "The profits should have gone to SK Inc. But Chair Chey illegally took advantage of the chance and gained the profits without the company’s consent and paying appropriate prices."

The antitrust watchdog slapped fines of 800 million won each on SK Inc. and Chey Tae-won. The company actively tried to dispel doubts regarding the 2017 deal. On his part, Chey attended a session by the FTC and answered questions about the allegations. Following the commission’s decision, SK said it is deeply disappointing to see the allegations established with no facts legally proven.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.