DETAILS OF GOVT'S ECONOMIC POLICIES

입력 2022.06.17 (15:20)

수정 2022.06.17 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The government released yesterday its blueprint for economic policies, which entails tax reductions and deregulation to bring about economic growth led by the private sector.

[Pkg]

An “Out of Order” sign is attached on an equipment in a university lab. The same signs are posted on other equipment too. Most of the equipment in the center were donated some 20 years ago, making them too outdated for use.

[Soundbite] Kim Sung-jae(Dir., SNU Inter-University Semiconductor Research Center) : "The prices of semiconductor equipment are quite high, which is why we can’t purchase one when we need it. This is also why we need large investments."

Korea has the world’s second largest share in the semiconductor market. But unlike the solid standing in memory semiconductors, the country’s share in system semiconductors stands at a mere 3%. The government aims to lessen corporate burden for such key industries and ultimately achieve economic growth by nurturing talent and carrying out corporate innovations.

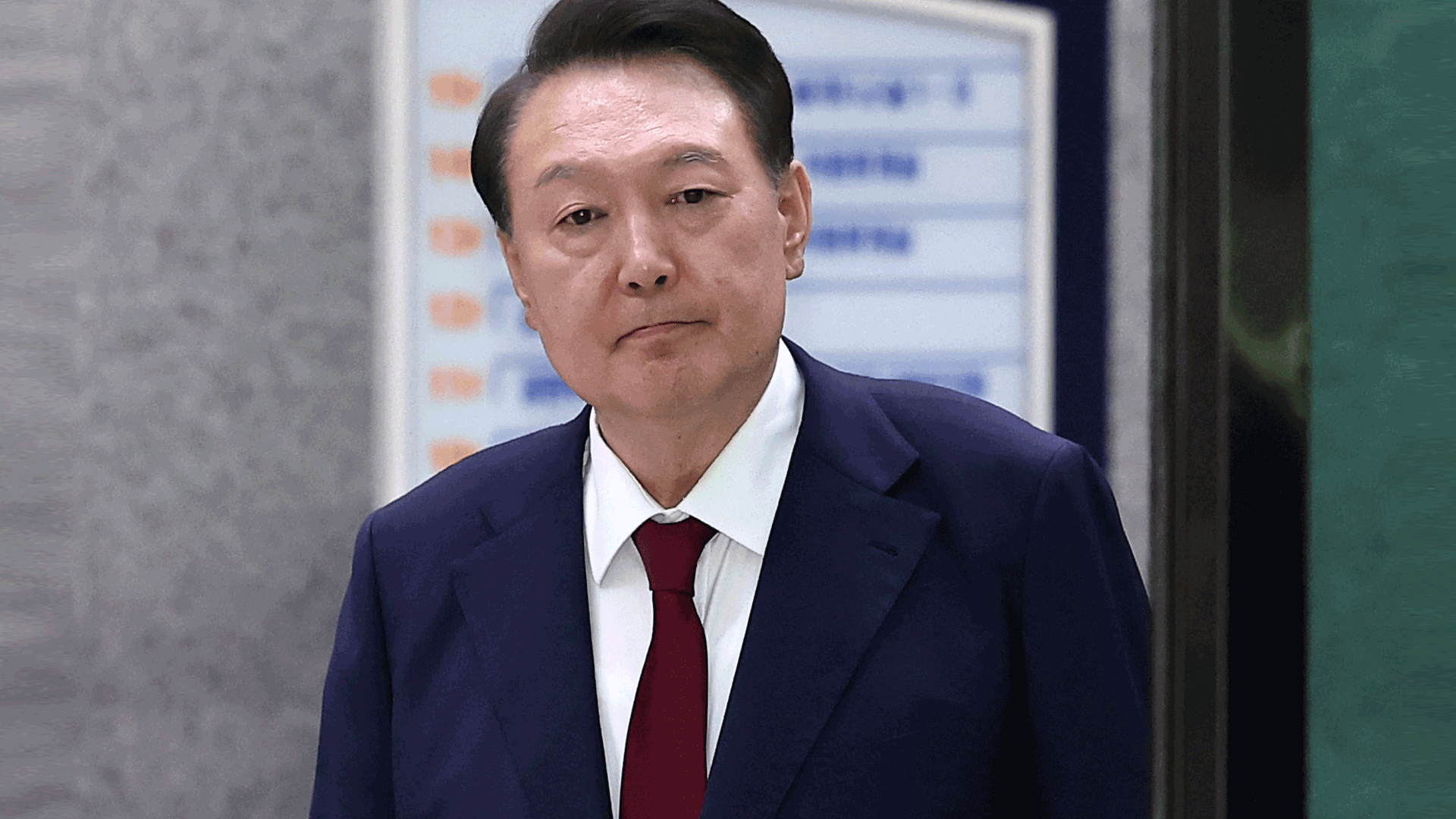

[Soundbite] Yoon Suk-yeol(President) : "The gov't must do all it can to assist the semiconductor and other strategic industries’ R&D programs and manpower training."

First, taxes will be lowered. The corporate tax ceiling of 25% will be lowered to 22% and four tax brackets will be simplified. The tax deduction rate for large corporations’ facility investments will be expanded and more tax benefits will be given to those key industries that return to Korean soil from abroad. Also, when small or medium businesses are passed down in families, their tax burden will be lightened by allowing them to defer their inheritance tax payment. The government is also eager to adopt a regulation reform program, which would include a system that requires one new regulation to be countered with the abolition of twice as many existing rules.

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will establish an economic regulation reform task force to focus on on-site difficulties, environment, health and medical services, location, and deregulation in the new industries."

The government plans to table the tax law revision bills at the National Assembly next month.

The government released yesterday its blueprint for economic policies, which entails tax reductions and deregulation to bring about economic growth led by the private sector.

[Pkg]

An “Out of Order” sign is attached on an equipment in a university lab. The same signs are posted on other equipment too. Most of the equipment in the center were donated some 20 years ago, making them too outdated for use.

[Soundbite] Kim Sung-jae(Dir., SNU Inter-University Semiconductor Research Center) : "The prices of semiconductor equipment are quite high, which is why we can’t purchase one when we need it. This is also why we need large investments."

Korea has the world’s second largest share in the semiconductor market. But unlike the solid standing in memory semiconductors, the country’s share in system semiconductors stands at a mere 3%. The government aims to lessen corporate burden for such key industries and ultimately achieve economic growth by nurturing talent and carrying out corporate innovations.

[Soundbite] Yoon Suk-yeol(President) : "The gov't must do all it can to assist the semiconductor and other strategic industries’ R&D programs and manpower training."

First, taxes will be lowered. The corporate tax ceiling of 25% will be lowered to 22% and four tax brackets will be simplified. The tax deduction rate for large corporations’ facility investments will be expanded and more tax benefits will be given to those key industries that return to Korean soil from abroad. Also, when small or medium businesses are passed down in families, their tax burden will be lightened by allowing them to defer their inheritance tax payment. The government is also eager to adopt a regulation reform program, which would include a system that requires one new regulation to be countered with the abolition of twice as many existing rules.

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will establish an economic regulation reform task force to focus on on-site difficulties, environment, health and medical services, location, and deregulation in the new industries."

The government plans to table the tax law revision bills at the National Assembly next month.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- DETAILS OF GOVT'S ECONOMIC POLICIES

-

- 입력 2022-06-17 15:20:26

- 수정2022-06-17 16:45:47

[Anchor Lead]

The government released yesterday its blueprint for economic policies, which entails tax reductions and deregulation to bring about economic growth led by the private sector.

[Pkg]

An “Out of Order” sign is attached on an equipment in a university lab. The same signs are posted on other equipment too. Most of the equipment in the center were donated some 20 years ago, making them too outdated for use.

[Soundbite] Kim Sung-jae(Dir., SNU Inter-University Semiconductor Research Center) : "The prices of semiconductor equipment are quite high, which is why we can’t purchase one when we need it. This is also why we need large investments."

Korea has the world’s second largest share in the semiconductor market. But unlike the solid standing in memory semiconductors, the country’s share in system semiconductors stands at a mere 3%. The government aims to lessen corporate burden for such key industries and ultimately achieve economic growth by nurturing talent and carrying out corporate innovations.

[Soundbite] Yoon Suk-yeol(President) : "The gov't must do all it can to assist the semiconductor and other strategic industries’ R&D programs and manpower training."

First, taxes will be lowered. The corporate tax ceiling of 25% will be lowered to 22% and four tax brackets will be simplified. The tax deduction rate for large corporations’ facility investments will be expanded and more tax benefits will be given to those key industries that return to Korean soil from abroad. Also, when small or medium businesses are passed down in families, their tax burden will be lightened by allowing them to defer their inheritance tax payment. The government is also eager to adopt a regulation reform program, which would include a system that requires one new regulation to be countered with the abolition of twice as many existing rules.

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will establish an economic regulation reform task force to focus on on-site difficulties, environment, health and medical services, location, and deregulation in the new industries."

The government plans to table the tax law revision bills at the National Assembly next month.

The government released yesterday its blueprint for economic policies, which entails tax reductions and deregulation to bring about economic growth led by the private sector.

[Pkg]

An “Out of Order” sign is attached on an equipment in a university lab. The same signs are posted on other equipment too. Most of the equipment in the center were donated some 20 years ago, making them too outdated for use.

[Soundbite] Kim Sung-jae(Dir., SNU Inter-University Semiconductor Research Center) : "The prices of semiconductor equipment are quite high, which is why we can’t purchase one when we need it. This is also why we need large investments."

Korea has the world’s second largest share in the semiconductor market. But unlike the solid standing in memory semiconductors, the country’s share in system semiconductors stands at a mere 3%. The government aims to lessen corporate burden for such key industries and ultimately achieve economic growth by nurturing talent and carrying out corporate innovations.

[Soundbite] Yoon Suk-yeol(President) : "The gov't must do all it can to assist the semiconductor and other strategic industries’ R&D programs and manpower training."

First, taxes will be lowered. The corporate tax ceiling of 25% will be lowered to 22% and four tax brackets will be simplified. The tax deduction rate for large corporations’ facility investments will be expanded and more tax benefits will be given to those key industries that return to Korean soil from abroad. Also, when small or medium businesses are passed down in families, their tax burden will be lightened by allowing them to defer their inheritance tax payment. The government is also eager to adopt a regulation reform program, which would include a system that requires one new regulation to be countered with the abolition of twice as many existing rules.

[Soundbite] Choo Kyung-ho(Deputy Prime Minister for Economy) : "The gov't will establish an economic regulation reform task force to focus on on-site difficulties, environment, health and medical services, location, and deregulation in the new industries."

The government plans to table the tax law revision bills at the National Assembly next month.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] 윤석열 정부, ‘대통령실 공사비 미지급’ 피소](/data/news/2025/06/30/20250630_8MRvHk.png)

이 기사에 대한 의견을 남겨주세요.