S. KOREAN CHIP FIRMS AFFECTED BY U.S. LAW

입력 2022.08.11 (15:13)

수정 2022.08.11 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

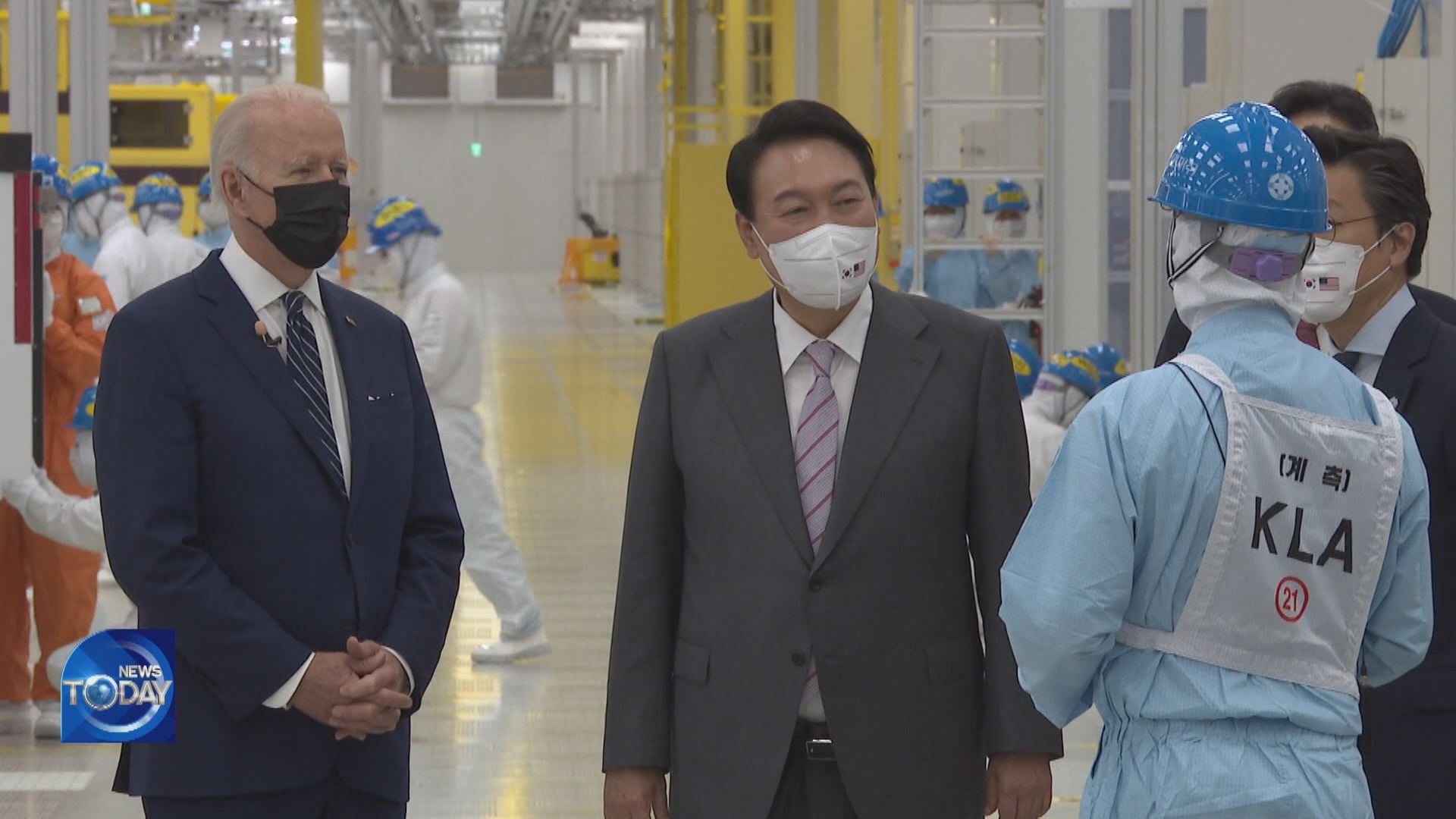

U.S. President Joe Biden has signed the the CHIPS and Science Act into law to provide benefits to semiconductor makers that invest in the U.S. market. But pundits say the law challenges China because one of its stipulations restricts investments in China. Korean chip businesses with a presence in the U.S. and China are now trying to figure out which side they should stick to.

[Pkg]

Samsung Electronics, which is building a chip factory in Texas, is set to receive tax breaks amounting to 1.3 trillion won from the state government over 20 years. With the signing of the CHIPS and Science Act, the conglomerate is expected to receive even greater benefits.

[Soundbite] Greg Abbott(Governor of State of Texas (Nov. 2021))

SK Hynix, which also plans to build a memory chip facility in America, will likely be eligible for the new benefits as well. But the new law could turn out to be a burden to Korean businesses. If they receive the benefits, their investments in China will be partially restricted in the next decade. New investments in system chips technology that's more advanced than 28 nanometers are banned. When it comes to memory chips, special guidelines will be devised by the U.S. secretary of commerce. Depending on the guidelines set, expanding chip production facilities in China could be difficult for Samsung and SK in the future. Moreover, Washington is looking to restrict exports of semiconductor equipment to China. Korean firms could have difficulties bringing manufacturing equipment from the states to China, where they produce electronic chips.

[Soundbite] Kyung Hee-kwon(Korea Institute for Industrial Economics & Trade) : "The Korean gov’t should ask for Washington’s understanding in terms of bringing new chip manufacturing equipment to memory factories in China."

If the Korean government decides to join the so-called CHIP4 alliance led by the U.S., it could trigger opposition from Beijing. With the chip row intensifying between the U.S. and China, South Korean chip makers are trying to figure out where they stand on the matter.

U.S. President Joe Biden has signed the the CHIPS and Science Act into law to provide benefits to semiconductor makers that invest in the U.S. market. But pundits say the law challenges China because one of its stipulations restricts investments in China. Korean chip businesses with a presence in the U.S. and China are now trying to figure out which side they should stick to.

[Pkg]

Samsung Electronics, which is building a chip factory in Texas, is set to receive tax breaks amounting to 1.3 trillion won from the state government over 20 years. With the signing of the CHIPS and Science Act, the conglomerate is expected to receive even greater benefits.

[Soundbite] Greg Abbott(Governor of State of Texas (Nov. 2021))

SK Hynix, which also plans to build a memory chip facility in America, will likely be eligible for the new benefits as well. But the new law could turn out to be a burden to Korean businesses. If they receive the benefits, their investments in China will be partially restricted in the next decade. New investments in system chips technology that's more advanced than 28 nanometers are banned. When it comes to memory chips, special guidelines will be devised by the U.S. secretary of commerce. Depending on the guidelines set, expanding chip production facilities in China could be difficult for Samsung and SK in the future. Moreover, Washington is looking to restrict exports of semiconductor equipment to China. Korean firms could have difficulties bringing manufacturing equipment from the states to China, where they produce electronic chips.

[Soundbite] Kyung Hee-kwon(Korea Institute for Industrial Economics & Trade) : "The Korean gov’t should ask for Washington’s understanding in terms of bringing new chip manufacturing equipment to memory factories in China."

If the Korean government decides to join the so-called CHIP4 alliance led by the U.S., it could trigger opposition from Beijing. With the chip row intensifying between the U.S. and China, South Korean chip makers are trying to figure out where they stand on the matter.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- S. KOREAN CHIP FIRMS AFFECTED BY U.S. LAW

-

- 입력 2022-08-11 15:13:32

- 수정2022-08-11 16:45:25

[Anchor Lead]

U.S. President Joe Biden has signed the the CHIPS and Science Act into law to provide benefits to semiconductor makers that invest in the U.S. market. But pundits say the law challenges China because one of its stipulations restricts investments in China. Korean chip businesses with a presence in the U.S. and China are now trying to figure out which side they should stick to.

[Pkg]

Samsung Electronics, which is building a chip factory in Texas, is set to receive tax breaks amounting to 1.3 trillion won from the state government over 20 years. With the signing of the CHIPS and Science Act, the conglomerate is expected to receive even greater benefits.

[Soundbite] Greg Abbott(Governor of State of Texas (Nov. 2021))

SK Hynix, which also plans to build a memory chip facility in America, will likely be eligible for the new benefits as well. But the new law could turn out to be a burden to Korean businesses. If they receive the benefits, their investments in China will be partially restricted in the next decade. New investments in system chips technology that's more advanced than 28 nanometers are banned. When it comes to memory chips, special guidelines will be devised by the U.S. secretary of commerce. Depending on the guidelines set, expanding chip production facilities in China could be difficult for Samsung and SK in the future. Moreover, Washington is looking to restrict exports of semiconductor equipment to China. Korean firms could have difficulties bringing manufacturing equipment from the states to China, where they produce electronic chips.

[Soundbite] Kyung Hee-kwon(Korea Institute for Industrial Economics & Trade) : "The Korean gov’t should ask for Washington’s understanding in terms of bringing new chip manufacturing equipment to memory factories in China."

If the Korean government decides to join the so-called CHIP4 alliance led by the U.S., it could trigger opposition from Beijing. With the chip row intensifying between the U.S. and China, South Korean chip makers are trying to figure out where they stand on the matter.

U.S. President Joe Biden has signed the the CHIPS and Science Act into law to provide benefits to semiconductor makers that invest in the U.S. market. But pundits say the law challenges China because one of its stipulations restricts investments in China. Korean chip businesses with a presence in the U.S. and China are now trying to figure out which side they should stick to.

[Pkg]

Samsung Electronics, which is building a chip factory in Texas, is set to receive tax breaks amounting to 1.3 trillion won from the state government over 20 years. With the signing of the CHIPS and Science Act, the conglomerate is expected to receive even greater benefits.

[Soundbite] Greg Abbott(Governor of State of Texas (Nov. 2021))

SK Hynix, which also plans to build a memory chip facility in America, will likely be eligible for the new benefits as well. But the new law could turn out to be a burden to Korean businesses. If they receive the benefits, their investments in China will be partially restricted in the next decade. New investments in system chips technology that's more advanced than 28 nanometers are banned. When it comes to memory chips, special guidelines will be devised by the U.S. secretary of commerce. Depending on the guidelines set, expanding chip production facilities in China could be difficult for Samsung and SK in the future. Moreover, Washington is looking to restrict exports of semiconductor equipment to China. Korean firms could have difficulties bringing manufacturing equipment from the states to China, where they produce electronic chips.

[Soundbite] Kyung Hee-kwon(Korea Institute for Industrial Economics & Trade) : "The Korean gov’t should ask for Washington’s understanding in terms of bringing new chip manufacturing equipment to memory factories in China."

If the Korean government decides to join the so-called CHIP4 alliance led by the U.S., it could trigger opposition from Beijing. With the chip row intensifying between the U.S. and China, South Korean chip makers are trying to figure out where they stand on the matter.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.