4% EXPECTED INFLATION NOTCHED IN FEB.

입력 2023.02.22 (15:10)

수정 2023.02.22 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

The expected inflation rate, which represents consumers' price perception of the year head, surged for two straight months, meaning that the public believes consumer prices will further increase. This is due to the surge in public utility fees like gas and electricity. Attention is now drawn to what kind of decision the central bank will make in regards to the key rate at tomorrow's Monetary Policy Committee meeting.

[Pkg]

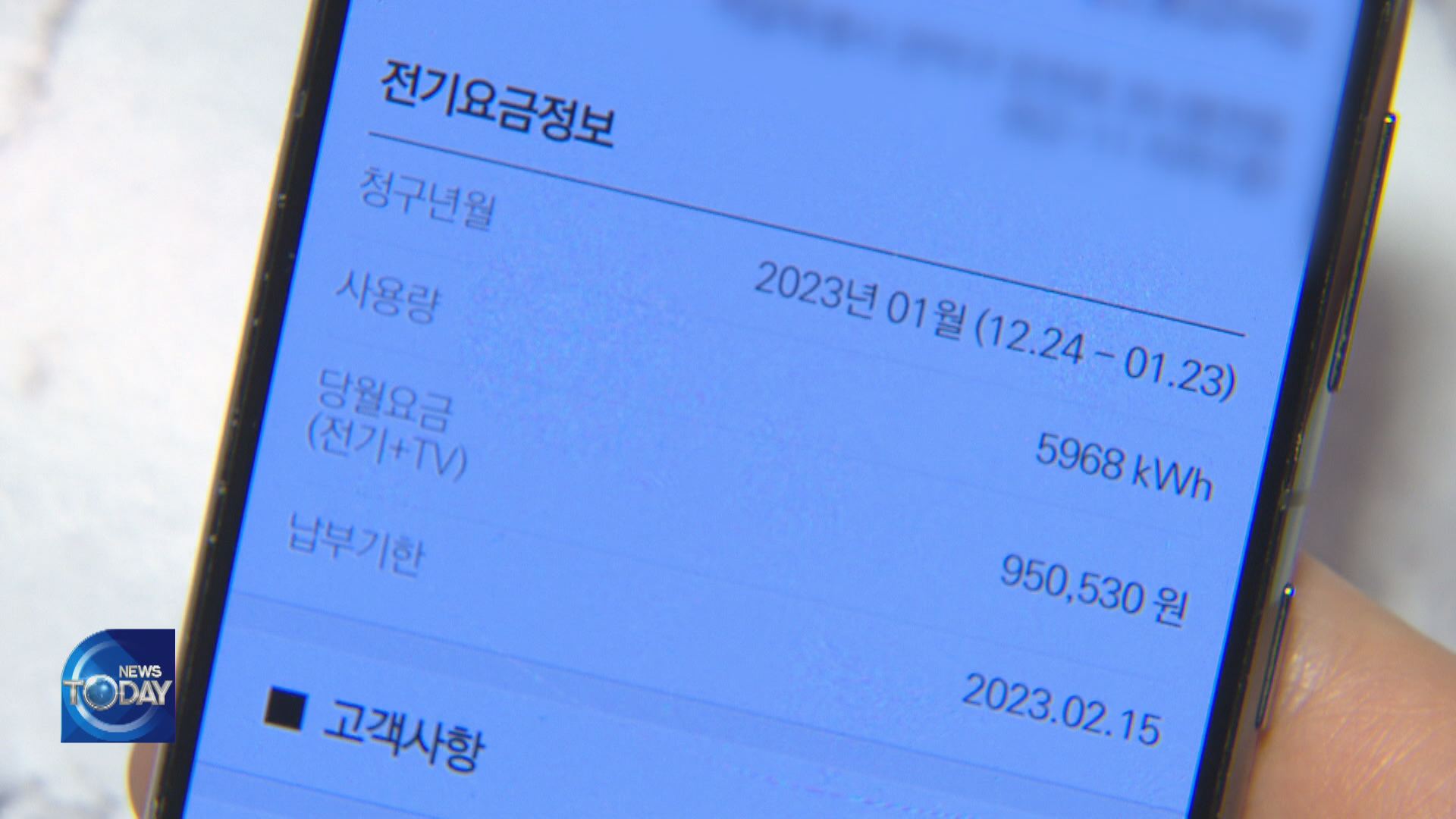

This household's city gas bill surpassed 320-thousand won in January. It's over 100-thousand won more than last year, even though a similar amount of heating was used.

[Soundbite] Kim Min-young(Seoul resident) : "I was shocked to see the first digit change. I know someone who chooses to turn on the heating only 3-4 hours a day."

The consumer price index for last month shows city gas fees surged more than 36 percent, while electricity fees rose nearly 30 percent. Because of rapidly rising public utility fees, the expected inflation rate, which indicates consumers' price perception of the year ahead, recorded 4 percent this month. The rate has surged for two straight months, meaning consumers believe that prices will rise further. The government mentioning the need to adjust the speed of energy price increases on Feb. 15 also reflects the current trend.

[Soundbite] Cho Young-moo(LG Business Research) : "When prices are expected to rise further, demands for wage raises or increases in the prices of products and services will likely follow."

However, the market believes the Bank of Korea will likely freeze the key rate at its Monetary Policy Committee meeting slated for Thursday. That's because exports have been declining this year and concerns over economic recession are growing. Even the government has officially recognized that the economy is in a slump. However, the BOK, which prioritizes price stabilization, cannot ignore inflation rate exceeding 5% and the possibility of an additional rate hike in the U.S. The nation's central bank is in a dilemma after raising the key rate seven consecutive times.

The expected inflation rate, which represents consumers' price perception of the year head, surged for two straight months, meaning that the public believes consumer prices will further increase. This is due to the surge in public utility fees like gas and electricity. Attention is now drawn to what kind of decision the central bank will make in regards to the key rate at tomorrow's Monetary Policy Committee meeting.

[Pkg]

This household's city gas bill surpassed 320-thousand won in January. It's over 100-thousand won more than last year, even though a similar amount of heating was used.

[Soundbite] Kim Min-young(Seoul resident) : "I was shocked to see the first digit change. I know someone who chooses to turn on the heating only 3-4 hours a day."

The consumer price index for last month shows city gas fees surged more than 36 percent, while electricity fees rose nearly 30 percent. Because of rapidly rising public utility fees, the expected inflation rate, which indicates consumers' price perception of the year ahead, recorded 4 percent this month. The rate has surged for two straight months, meaning consumers believe that prices will rise further. The government mentioning the need to adjust the speed of energy price increases on Feb. 15 also reflects the current trend.

[Soundbite] Cho Young-moo(LG Business Research) : "When prices are expected to rise further, demands for wage raises or increases in the prices of products and services will likely follow."

However, the market believes the Bank of Korea will likely freeze the key rate at its Monetary Policy Committee meeting slated for Thursday. That's because exports have been declining this year and concerns over economic recession are growing. Even the government has officially recognized that the economy is in a slump. However, the BOK, which prioritizes price stabilization, cannot ignore inflation rate exceeding 5% and the possibility of an additional rate hike in the U.S. The nation's central bank is in a dilemma after raising the key rate seven consecutive times.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- 4% EXPECTED INFLATION NOTCHED IN FEB.

-

- 입력 2023-02-22 15:10:35

- 수정2023-02-22 16:45:02

[Anchor Lead]

The expected inflation rate, which represents consumers' price perception of the year head, surged for two straight months, meaning that the public believes consumer prices will further increase. This is due to the surge in public utility fees like gas and electricity. Attention is now drawn to what kind of decision the central bank will make in regards to the key rate at tomorrow's Monetary Policy Committee meeting.

[Pkg]

This household's city gas bill surpassed 320-thousand won in January. It's over 100-thousand won more than last year, even though a similar amount of heating was used.

[Soundbite] Kim Min-young(Seoul resident) : "I was shocked to see the first digit change. I know someone who chooses to turn on the heating only 3-4 hours a day."

The consumer price index for last month shows city gas fees surged more than 36 percent, while electricity fees rose nearly 30 percent. Because of rapidly rising public utility fees, the expected inflation rate, which indicates consumers' price perception of the year ahead, recorded 4 percent this month. The rate has surged for two straight months, meaning consumers believe that prices will rise further. The government mentioning the need to adjust the speed of energy price increases on Feb. 15 also reflects the current trend.

[Soundbite] Cho Young-moo(LG Business Research) : "When prices are expected to rise further, demands for wage raises or increases in the prices of products and services will likely follow."

However, the market believes the Bank of Korea will likely freeze the key rate at its Monetary Policy Committee meeting slated for Thursday. That's because exports have been declining this year and concerns over economic recession are growing. Even the government has officially recognized that the economy is in a slump. However, the BOK, which prioritizes price stabilization, cannot ignore inflation rate exceeding 5% and the possibility of an additional rate hike in the U.S. The nation's central bank is in a dilemma after raising the key rate seven consecutive times.

The expected inflation rate, which represents consumers' price perception of the year head, surged for two straight months, meaning that the public believes consumer prices will further increase. This is due to the surge in public utility fees like gas and electricity. Attention is now drawn to what kind of decision the central bank will make in regards to the key rate at tomorrow's Monetary Policy Committee meeting.

[Pkg]

This household's city gas bill surpassed 320-thousand won in January. It's over 100-thousand won more than last year, even though a similar amount of heating was used.

[Soundbite] Kim Min-young(Seoul resident) : "I was shocked to see the first digit change. I know someone who chooses to turn on the heating only 3-4 hours a day."

The consumer price index for last month shows city gas fees surged more than 36 percent, while electricity fees rose nearly 30 percent. Because of rapidly rising public utility fees, the expected inflation rate, which indicates consumers' price perception of the year ahead, recorded 4 percent this month. The rate has surged for two straight months, meaning consumers believe that prices will rise further. The government mentioning the need to adjust the speed of energy price increases on Feb. 15 also reflects the current trend.

[Soundbite] Cho Young-moo(LG Business Research) : "When prices are expected to rise further, demands for wage raises or increases in the prices of products and services will likely follow."

However, the market believes the Bank of Korea will likely freeze the key rate at its Monetary Policy Committee meeting slated for Thursday. That's because exports have been declining this year and concerns over economic recession are growing. Even the government has officially recognized that the economy is in a slump. However, the BOK, which prioritizes price stabilization, cannot ignore inflation rate exceeding 5% and the possibility of an additional rate hike in the U.S. The nation's central bank is in a dilemma after raising the key rate seven consecutive times.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[HEADLINE]](https://news.kbs.co.kr/data/news/title_image/newsmp4/news_today/2023/02/22/10_7611202.jpeg)

![[속보] 국회, 김민석 총리 임명동의안 가결…국민의힘 표결 불참](/data/layer/904/2025/07/20250703_GUK05j.jpg)

이 기사에 대한 의견을 남겨주세요.