ECONOMIC MISERY INDEX HITS RECORD HIGH

입력 2023.02.24 (15:09)

수정 2023.02.24 (16:45)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor Lead]

Amid high inflation, it was found that household spending of the lower income bracket increased in the fourth quarter last year, but after taking into account the current inflation rate, it could be seen that their actual spending had decreased by 5 percent. In other words, it's become more difficult for them to make ends meet with high inflation, not to mention soaring energy bills during the cold winter.

[Pkg]

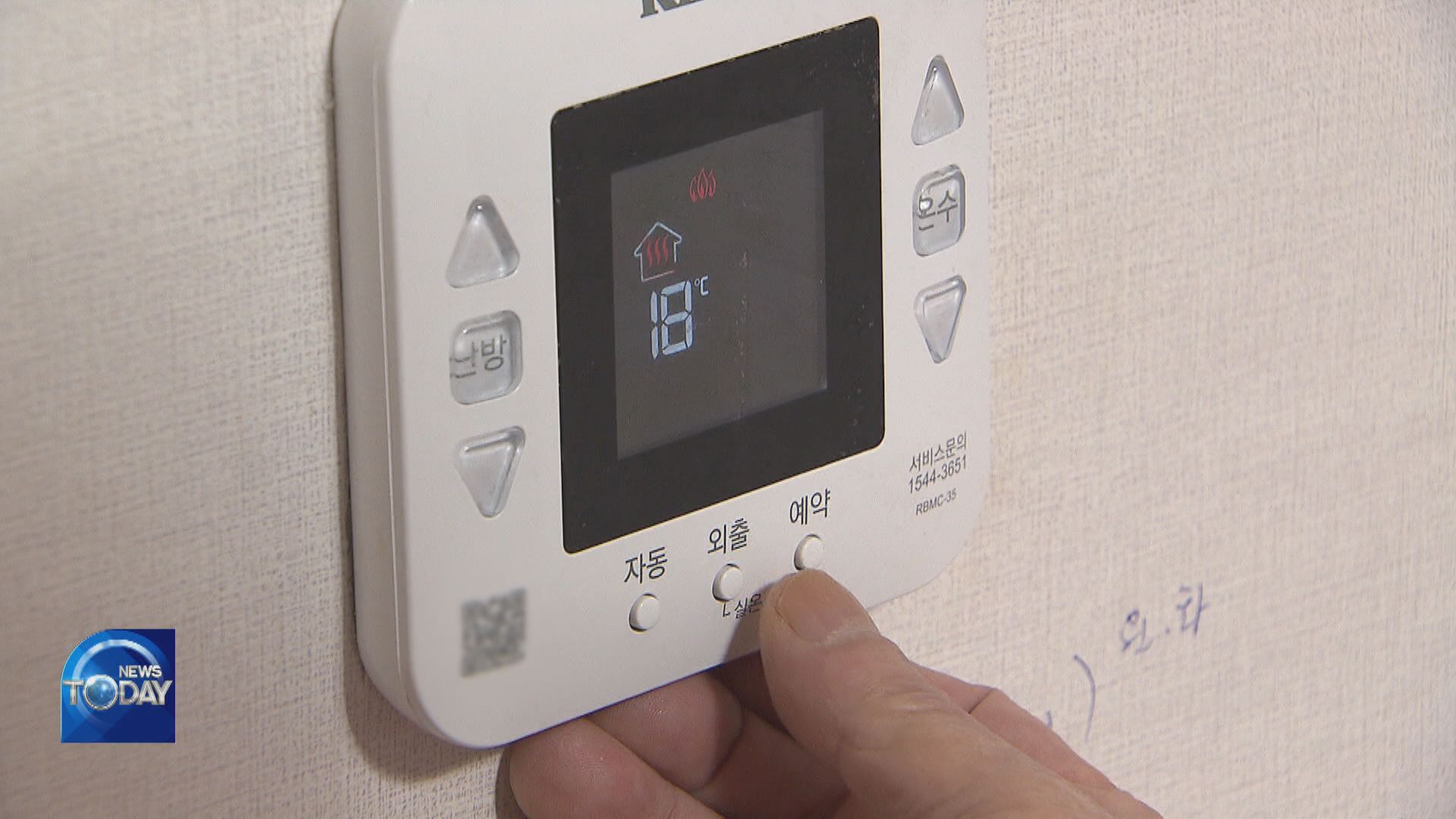

The only monthly income of this man in his 50s is a 600-thousand-won basic living subsidy. He uses an electric mat and puts on layers of clothing to stay warm while saving energy fees. But despite efforts to minimize spending, his gas bill for January tripled from a year ago to 30-thousand won.

[Soundbite] (Recipient of basic living subsidies(VOICE MODIFIED)) : "I only turn on the heating in the morning for 30 minutes to take a shower, even when it’s very cold."

The cost of food is also burdensome. Even the prices of processed foods such as instant noodles have surged.

[Soundbite] (Recipient of basic living subsidies (VOICE MODIFIED)) : "I often end up eating only once a day. I tend to binge-eat at 6 p.m. I drink some instant coffee when I feel hungry."

Statistics show people in the bottom 20-percent income bracket spent more on food in the fourth quarter of last year. However, taking into account the current inflation rate, their actual spending decreased by 5 percent. In other words, people spend more, but their diets are worse. Spending on fuel during the same period surged more than 20 percent on-year due to the rapidly rising electricity and gas fees. This is especially tough for low-income earners, because spending on gas and electricity is essential for them.

[Soundbite] Joo Won(Hyundai Research Institute) : "The higher the income, the more money is spent on education or leisure and less on other things. But low-income earners cannot afford that consumption pattern."

All households including high-income earners saw their incomes go down for the second consecutive quarter due to inflation. Spending increased about 6 percent as a result of soaring prices, but actual expenditures only rose by 0.6 percent. Given additional hikes in public utility fees, households' burden will only continue to grow, and employment remains far from stable, which explains why the economic misery index surged to an all-time high last month.

Amid high inflation, it was found that household spending of the lower income bracket increased in the fourth quarter last year, but after taking into account the current inflation rate, it could be seen that their actual spending had decreased by 5 percent. In other words, it's become more difficult for them to make ends meet with high inflation, not to mention soaring energy bills during the cold winter.

[Pkg]

The only monthly income of this man in his 50s is a 600-thousand-won basic living subsidy. He uses an electric mat and puts on layers of clothing to stay warm while saving energy fees. But despite efforts to minimize spending, his gas bill for January tripled from a year ago to 30-thousand won.

[Soundbite] (Recipient of basic living subsidies(VOICE MODIFIED)) : "I only turn on the heating in the morning for 30 minutes to take a shower, even when it’s very cold."

The cost of food is also burdensome. Even the prices of processed foods such as instant noodles have surged.

[Soundbite] (Recipient of basic living subsidies (VOICE MODIFIED)) : "I often end up eating only once a day. I tend to binge-eat at 6 p.m. I drink some instant coffee when I feel hungry."

Statistics show people in the bottom 20-percent income bracket spent more on food in the fourth quarter of last year. However, taking into account the current inflation rate, their actual spending decreased by 5 percent. In other words, people spend more, but their diets are worse. Spending on fuel during the same period surged more than 20 percent on-year due to the rapidly rising electricity and gas fees. This is especially tough for low-income earners, because spending on gas and electricity is essential for them.

[Soundbite] Joo Won(Hyundai Research Institute) : "The higher the income, the more money is spent on education or leisure and less on other things. But low-income earners cannot afford that consumption pattern."

All households including high-income earners saw their incomes go down for the second consecutive quarter due to inflation. Spending increased about 6 percent as a result of soaring prices, but actual expenditures only rose by 0.6 percent. Given additional hikes in public utility fees, households' burden will only continue to grow, and employment remains far from stable, which explains why the economic misery index surged to an all-time high last month.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- ECONOMIC MISERY INDEX HITS RECORD HIGH

-

- 입력 2023-02-24 15:09:04

- 수정2023-02-24 16:45:30

[Anchor Lead]

Amid high inflation, it was found that household spending of the lower income bracket increased in the fourth quarter last year, but after taking into account the current inflation rate, it could be seen that their actual spending had decreased by 5 percent. In other words, it's become more difficult for them to make ends meet with high inflation, not to mention soaring energy bills during the cold winter.

[Pkg]

The only monthly income of this man in his 50s is a 600-thousand-won basic living subsidy. He uses an electric mat and puts on layers of clothing to stay warm while saving energy fees. But despite efforts to minimize spending, his gas bill for January tripled from a year ago to 30-thousand won.

[Soundbite] (Recipient of basic living subsidies(VOICE MODIFIED)) : "I only turn on the heating in the morning for 30 minutes to take a shower, even when it’s very cold."

The cost of food is also burdensome. Even the prices of processed foods such as instant noodles have surged.

[Soundbite] (Recipient of basic living subsidies (VOICE MODIFIED)) : "I often end up eating only once a day. I tend to binge-eat at 6 p.m. I drink some instant coffee when I feel hungry."

Statistics show people in the bottom 20-percent income bracket spent more on food in the fourth quarter of last year. However, taking into account the current inflation rate, their actual spending decreased by 5 percent. In other words, people spend more, but their diets are worse. Spending on fuel during the same period surged more than 20 percent on-year due to the rapidly rising electricity and gas fees. This is especially tough for low-income earners, because spending on gas and electricity is essential for them.

[Soundbite] Joo Won(Hyundai Research Institute) : "The higher the income, the more money is spent on education or leisure and less on other things. But low-income earners cannot afford that consumption pattern."

All households including high-income earners saw their incomes go down for the second consecutive quarter due to inflation. Spending increased about 6 percent as a result of soaring prices, but actual expenditures only rose by 0.6 percent. Given additional hikes in public utility fees, households' burden will only continue to grow, and employment remains far from stable, which explains why the economic misery index surged to an all-time high last month.

Amid high inflation, it was found that household spending of the lower income bracket increased in the fourth quarter last year, but after taking into account the current inflation rate, it could be seen that their actual spending had decreased by 5 percent. In other words, it's become more difficult for them to make ends meet with high inflation, not to mention soaring energy bills during the cold winter.

[Pkg]

The only monthly income of this man in his 50s is a 600-thousand-won basic living subsidy. He uses an electric mat and puts on layers of clothing to stay warm while saving energy fees. But despite efforts to minimize spending, his gas bill for January tripled from a year ago to 30-thousand won.

[Soundbite] (Recipient of basic living subsidies(VOICE MODIFIED)) : "I only turn on the heating in the morning for 30 minutes to take a shower, even when it’s very cold."

The cost of food is also burdensome. Even the prices of processed foods such as instant noodles have surged.

[Soundbite] (Recipient of basic living subsidies (VOICE MODIFIED)) : "I often end up eating only once a day. I tend to binge-eat at 6 p.m. I drink some instant coffee when I feel hungry."

Statistics show people in the bottom 20-percent income bracket spent more on food in the fourth quarter of last year. However, taking into account the current inflation rate, their actual spending decreased by 5 percent. In other words, people spend more, but their diets are worse. Spending on fuel during the same period surged more than 20 percent on-year due to the rapidly rising electricity and gas fees. This is especially tough for low-income earners, because spending on gas and electricity is essential for them.

[Soundbite] Joo Won(Hyundai Research Institute) : "The higher the income, the more money is spent on education or leisure and less on other things. But low-income earners cannot afford that consumption pattern."

All households including high-income earners saw their incomes go down for the second consecutive quarter due to inflation. Spending increased about 6 percent as a result of soaring prices, but actual expenditures only rose by 0.6 percent. Given additional hikes in public utility fees, households' burden will only continue to grow, and employment remains far from stable, which explains why the economic misery index surged to an all-time high last month.

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

이 기사에 대한 의견을 남겨주세요.