S. Korea to join key global government bond index starting 2025

입력 2024.10.10 (10:04)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

The FTSE Russell's World Government Bond Index includes 25 major countries such as the United States and Japan, and is referred to as the gathering of developed country bonds.

This morning (10.9), it was reported that South Korea will be included as the 26th country in the index.

The scale of international funds that move according to this index is $2.5 trillion, which is approximately 3,300 trillion won in our currency, and it is expected that up to 80 trillion won will be invested in Korea next year.

The government's efforts in foreign exchange market structural reform and maintaining sound finances have been recognized, and reporter Kim Jin-hwa will report on what effects this inclusion may bring.

[Report]

The UK's FTSE Russell, which manages the World Government Bond Index, began to pay attention to South Korea two years ago since it placed it in the organization's watch list.

However, despite efforts, there were many in the industry who believed that inclusion this year would be difficult.

This was due to the accessibility of the bond market.

In response, the government opened a consolidated government bond account in June of this year and extended the foreign exchange trading hours to 2 a.m. the next day, in line with the expectations of global investors.

Since the market size and national credit rating had already met the criteria, as the level of market accessibility improved, FTSE Russell explained that this was a positive development for inclusion.

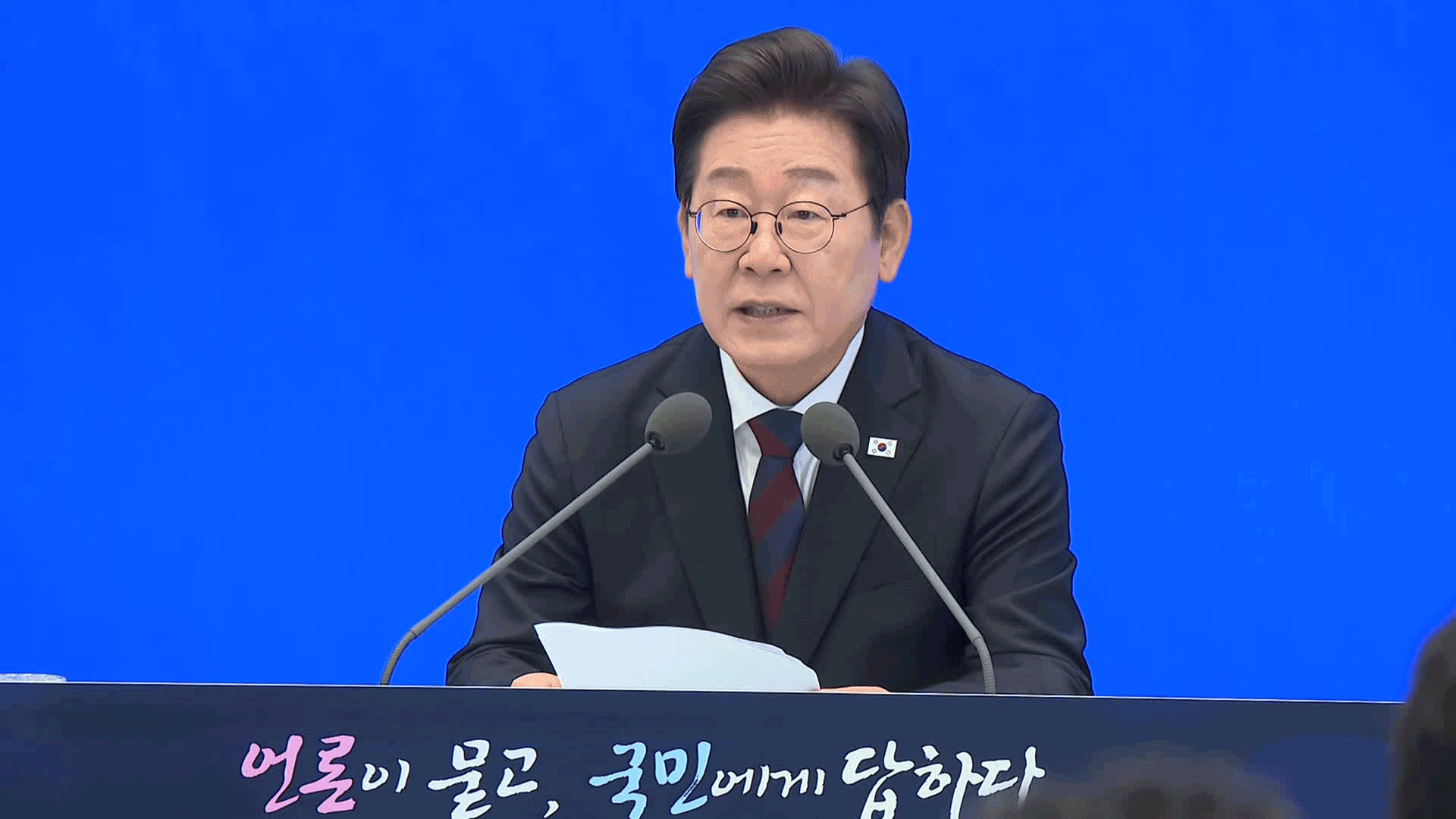

[Choi Sang-mok / Deputy Prime Minister and Minister of Economy and Finance: "This means that our government bond market has successfully received its fair value."]

It is expected to also provide relief in national financial management.

When the index is included in November next year, the funds expected to flow into the country are estimated to be between 60 to 80 trillion won.

This is comparable to the annual net issuance of government bonds.

With large-scale global funds entering, interest rates are expected to decrease, reducing the cost of financing for the government and businesses, and helping to stabilize the exchange rate.

[Hwang Se-woon / Research Fellow at the Korea Capital Market Institute: "This means that the cost incurred when the government borrows funds will decrease because interest rates are falling."]

Meanwhile, the prohibition of short selling in our stock market was pointed out as an issue in this evaluation.

This is KBS News, Kim Jin-hwa.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- S. Korea to join key global government bond index starting 2025

-

- 입력 2024-10-10 10:04:16

[Anchor]

The FTSE Russell's World Government Bond Index includes 25 major countries such as the United States and Japan, and is referred to as the gathering of developed country bonds.

This morning (10.9), it was reported that South Korea will be included as the 26th country in the index.

The scale of international funds that move according to this index is $2.5 trillion, which is approximately 3,300 trillion won in our currency, and it is expected that up to 80 trillion won will be invested in Korea next year.

The government's efforts in foreign exchange market structural reform and maintaining sound finances have been recognized, and reporter Kim Jin-hwa will report on what effects this inclusion may bring.

[Report]

The UK's FTSE Russell, which manages the World Government Bond Index, began to pay attention to South Korea two years ago since it placed it in the organization's watch list.

However, despite efforts, there were many in the industry who believed that inclusion this year would be difficult.

This was due to the accessibility of the bond market.

In response, the government opened a consolidated government bond account in June of this year and extended the foreign exchange trading hours to 2 a.m. the next day, in line with the expectations of global investors.

Since the market size and national credit rating had already met the criteria, as the level of market accessibility improved, FTSE Russell explained that this was a positive development for inclusion.

[Choi Sang-mok / Deputy Prime Minister and Minister of Economy and Finance: "This means that our government bond market has successfully received its fair value."]

It is expected to also provide relief in national financial management.

When the index is included in November next year, the funds expected to flow into the country are estimated to be between 60 to 80 trillion won.

This is comparable to the annual net issuance of government bonds.

With large-scale global funds entering, interest rates are expected to decrease, reducing the cost of financing for the government and businesses, and helping to stabilize the exchange rate.

[Hwang Se-woon / Research Fellow at the Korea Capital Market Institute: "This means that the cost incurred when the government borrows funds will decrease because interest rates are falling."]

Meanwhile, the prohibition of short selling in our stock market was pointed out as an issue in this evaluation.

This is KBS News, Kim Jin-hwa.

-

-

김진화 기자 evolution@kbs.co.kr

김진화 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] 김민석 총리, 취임 첫 일정으로 ‘송미령 반대’ 농민단체 농성장 방문](/data/news/2025/07/03/20250703_YUTdgQ.png)

![[단독] ‘스테로이드’부터 ‘임신중지약’까지…해외 의약품 불법 유통 11만 건](/data/news/2025/07/03/20250703_qpUU1y.png)

이 기사에 대한 의견을 남겨주세요.