NVIDIA's Jensen Huang requests six-month early delivery of HBM4 from SK Hynix

입력 2024.11.06 (00:31)

읽어주기 기능은 크롬기반의

브라우저에서만 사용하실 수 있습니다.

[Anchor]

NVIDIA, TSMC, and OpenAI...

Big tech companies leading the AI era have appeared at a forum hosted by SK Group.

SK is focusing on AI because it is the exclusive supplier of high-bandwidth memory, HBM, to NVIDIA.

SK has already announced plans to develop 5th generation 16-layer products, and NVIDIA's Jensen Huang personally requested Chairman Chey Tae-won to expedite the process.

Samsung Electronics, which has fallen behind in HBM, also held a private AI forum today (Nov.5).

Our reporter Kim Ji-sook analyzes the semiconductor market, which is being transformed by AI.

[Report]

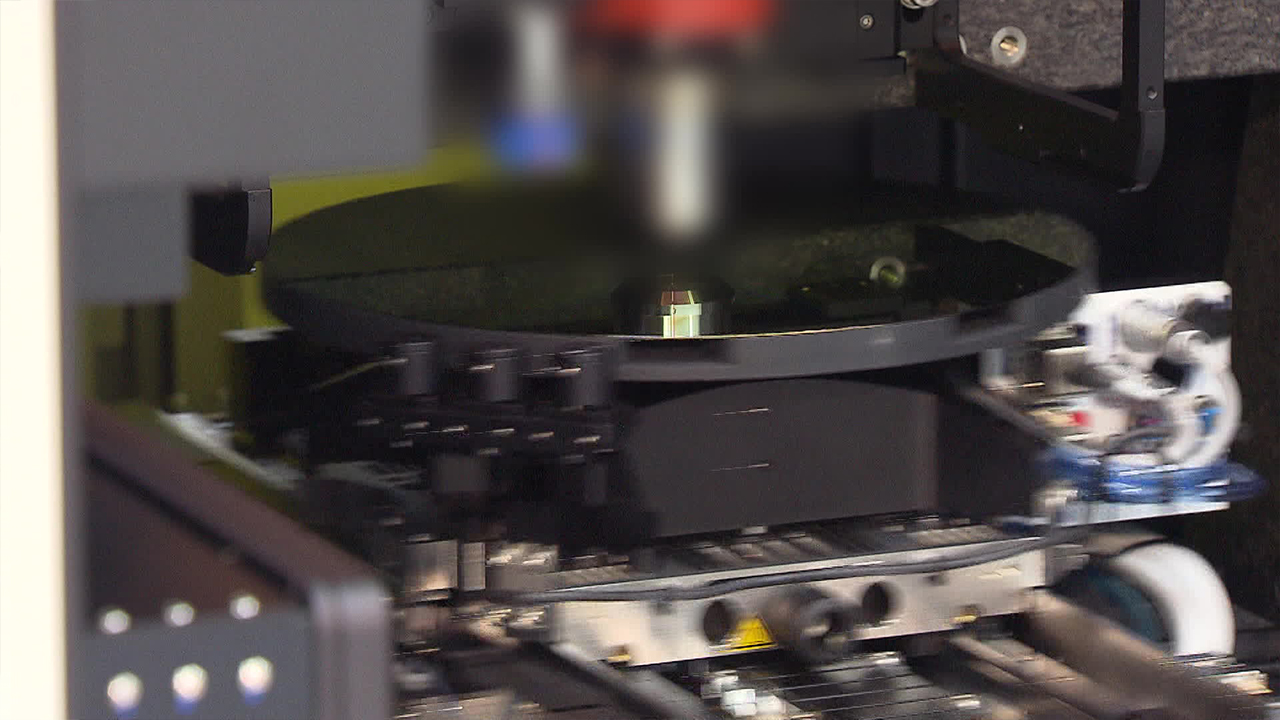

This is an equipment that measures whether the HBM DRAM circuits are well connected and stacked.

Development began two years ago, and this year it started supplying products to HBM manufacturing companies, with contracts already in place for next year's volume.

[Park Jin-seok/Executive Director of Semiconductor Equipment Manufacturer: "Last year, the revenue share was about 8%, but this year it is almost around 35%..."]

Originally, the equipment was produced for general use, but the production ratio has been increased to meet AI demand.

[Park Jin-seok/Executive Director of Semiconductor Equipment Manufacturer: "It's a race against time to quickly identify customer needs and rapidly develop solutions in response."]

The profitability of HBM, known as 'AI memory', is about five times that of general-purpose DRAM, and companies that quickly transitioned to HBM are generating significantly larger profits.

For instance, both SK Hynix and Samsung Electronics reported a 70% growth in HBM sales in the third quarter.

However, the difference in the proportion of HBM-related products directly translated into performance differences.

The situation in China has also impacted the market.

As the share of Chinese products in the low-cost general memory market increases, the position of Korean products is diminishing.

This has led to a greater demand for rapid transition and focus on high-value-added semiconductors.

[Kim Yang-pang/Specialist Researcher at the Korea Institute for Industrial Economics and Trade: "As other electronic products use large amounts of data, they will adopt HBM. Currently, NVIDIA holds 80-90% of the AI accelerator market, but that could change."]

SK Hynix has already sold out its volume for next year, while Samsung Electronics is targeting HBM mass production and delivery by next year.

With predictions that the growth rate of HBM demand next year will be double that of this year, competition to secure next-generation HBM is expected to intensify.

This is KBS News, Kim Ji-sook.

NVIDIA, TSMC, and OpenAI...

Big tech companies leading the AI era have appeared at a forum hosted by SK Group.

SK is focusing on AI because it is the exclusive supplier of high-bandwidth memory, HBM, to NVIDIA.

SK has already announced plans to develop 5th generation 16-layer products, and NVIDIA's Jensen Huang personally requested Chairman Chey Tae-won to expedite the process.

Samsung Electronics, which has fallen behind in HBM, also held a private AI forum today (Nov.5).

Our reporter Kim Ji-sook analyzes the semiconductor market, which is being transformed by AI.

[Report]

This is an equipment that measures whether the HBM DRAM circuits are well connected and stacked.

Development began two years ago, and this year it started supplying products to HBM manufacturing companies, with contracts already in place for next year's volume.

[Park Jin-seok/Executive Director of Semiconductor Equipment Manufacturer: "Last year, the revenue share was about 8%, but this year it is almost around 35%..."]

Originally, the equipment was produced for general use, but the production ratio has been increased to meet AI demand.

[Park Jin-seok/Executive Director of Semiconductor Equipment Manufacturer: "It's a race against time to quickly identify customer needs and rapidly develop solutions in response."]

The profitability of HBM, known as 'AI memory', is about five times that of general-purpose DRAM, and companies that quickly transitioned to HBM are generating significantly larger profits.

For instance, both SK Hynix and Samsung Electronics reported a 70% growth in HBM sales in the third quarter.

However, the difference in the proportion of HBM-related products directly translated into performance differences.

The situation in China has also impacted the market.

As the share of Chinese products in the low-cost general memory market increases, the position of Korean products is diminishing.

This has led to a greater demand for rapid transition and focus on high-value-added semiconductors.

[Kim Yang-pang/Specialist Researcher at the Korea Institute for Industrial Economics and Trade: "As other electronic products use large amounts of data, they will adopt HBM. Currently, NVIDIA holds 80-90% of the AI accelerator market, but that could change."]

SK Hynix has already sold out its volume for next year, while Samsung Electronics is targeting HBM mass production and delivery by next year.

With predictions that the growth rate of HBM demand next year will be double that of this year, competition to secure next-generation HBM is expected to intensify.

This is KBS News, Kim Ji-sook.

■ 제보하기

▷ 카카오톡 : 'KBS제보' 검색, 채널 추가

▷ 전화 : 02-781-1234, 4444

▷ 이메일 : kbs1234@kbs.co.kr

▷ 유튜브, 네이버, 카카오에서도 KBS뉴스를 구독해주세요!

- NVIDIA's Jensen Huang requests six-month early delivery of HBM4 from SK Hynix

-

- 입력 2024-11-06 00:31:39

[Anchor]

NVIDIA, TSMC, and OpenAI...

Big tech companies leading the AI era have appeared at a forum hosted by SK Group.

SK is focusing on AI because it is the exclusive supplier of high-bandwidth memory, HBM, to NVIDIA.

SK has already announced plans to develop 5th generation 16-layer products, and NVIDIA's Jensen Huang personally requested Chairman Chey Tae-won to expedite the process.

Samsung Electronics, which has fallen behind in HBM, also held a private AI forum today (Nov.5).

Our reporter Kim Ji-sook analyzes the semiconductor market, which is being transformed by AI.

[Report]

This is an equipment that measures whether the HBM DRAM circuits are well connected and stacked.

Development began two years ago, and this year it started supplying products to HBM manufacturing companies, with contracts already in place for next year's volume.

[Park Jin-seok/Executive Director of Semiconductor Equipment Manufacturer: "Last year, the revenue share was about 8%, but this year it is almost around 35%..."]

Originally, the equipment was produced for general use, but the production ratio has been increased to meet AI demand.

[Park Jin-seok/Executive Director of Semiconductor Equipment Manufacturer: "It's a race against time to quickly identify customer needs and rapidly develop solutions in response."]

The profitability of HBM, known as 'AI memory', is about five times that of general-purpose DRAM, and companies that quickly transitioned to HBM are generating significantly larger profits.

For instance, both SK Hynix and Samsung Electronics reported a 70% growth in HBM sales in the third quarter.

However, the difference in the proportion of HBM-related products directly translated into performance differences.

The situation in China has also impacted the market.

As the share of Chinese products in the low-cost general memory market increases, the position of Korean products is diminishing.

This has led to a greater demand for rapid transition and focus on high-value-added semiconductors.

[Kim Yang-pang/Specialist Researcher at the Korea Institute for Industrial Economics and Trade: "As other electronic products use large amounts of data, they will adopt HBM. Currently, NVIDIA holds 80-90% of the AI accelerator market, but that could change."]

SK Hynix has already sold out its volume for next year, while Samsung Electronics is targeting HBM mass production and delivery by next year.

With predictions that the growth rate of HBM demand next year will be double that of this year, competition to secure next-generation HBM is expected to intensify.

This is KBS News, Kim Ji-sook.

NVIDIA, TSMC, and OpenAI...

Big tech companies leading the AI era have appeared at a forum hosted by SK Group.

SK is focusing on AI because it is the exclusive supplier of high-bandwidth memory, HBM, to NVIDIA.

SK has already announced plans to develop 5th generation 16-layer products, and NVIDIA's Jensen Huang personally requested Chairman Chey Tae-won to expedite the process.

Samsung Electronics, which has fallen behind in HBM, also held a private AI forum today (Nov.5).

Our reporter Kim Ji-sook analyzes the semiconductor market, which is being transformed by AI.

[Report]

This is an equipment that measures whether the HBM DRAM circuits are well connected and stacked.

Development began two years ago, and this year it started supplying products to HBM manufacturing companies, with contracts already in place for next year's volume.

[Park Jin-seok/Executive Director of Semiconductor Equipment Manufacturer: "Last year, the revenue share was about 8%, but this year it is almost around 35%..."]

Originally, the equipment was produced for general use, but the production ratio has been increased to meet AI demand.

[Park Jin-seok/Executive Director of Semiconductor Equipment Manufacturer: "It's a race against time to quickly identify customer needs and rapidly develop solutions in response."]

The profitability of HBM, known as 'AI memory', is about five times that of general-purpose DRAM, and companies that quickly transitioned to HBM are generating significantly larger profits.

For instance, both SK Hynix and Samsung Electronics reported a 70% growth in HBM sales in the third quarter.

However, the difference in the proportion of HBM-related products directly translated into performance differences.

The situation in China has also impacted the market.

As the share of Chinese products in the low-cost general memory market increases, the position of Korean products is diminishing.

This has led to a greater demand for rapid transition and focus on high-value-added semiconductors.

[Kim Yang-pang/Specialist Researcher at the Korea Institute for Industrial Economics and Trade: "As other electronic products use large amounts of data, they will adopt HBM. Currently, NVIDIA holds 80-90% of the AI accelerator market, but that could change."]

SK Hynix has already sold out its volume for next year, while Samsung Electronics is targeting HBM mass production and delivery by next year.

With predictions that the growth rate of HBM demand next year will be double that of this year, competition to secure next-generation HBM is expected to intensify.

This is KBS News, Kim Ji-sook.

-

-

김지숙 기자 vox@kbs.co.kr

김지숙 기자의 기사 모음

-

이 기사가 좋으셨다면

-

좋아요

0

-

응원해요

0

-

후속 원해요

0

![[단독] “북한군 교전 사상자 등 분석 중…최대 15,000명 배치 예상”](/data/layer/904/2024/11/20241105_kMhCxv.jpg)

이 기사에 대한 의견을 남겨주세요.